Hometap 2025 Review: Get Cash from a Home Equity Investment

If you’re a homeowner, there may come a time when you’ll want to tap into the equity you’ve built up in your home to pay for a large remodel, consolidate your debt, pay for college, or finance a business venture. Traditionally, this would be done by getting a home equity loan through your lender, but in recent years other options have become available.

One company at the forefront of these loan alternatives is called Hometap, and it offers consumers something called a home equity investment (HEI). In this article we’ll explain what an HEI is, how it differs from a traditional home equity loan, what homeowners it might be right for, and how Hometap can help you get one.

👉 Related reading: Best Cash Advance Apps in 2025

What Is Hometap?

Hometap is a financial tech company based in Boston, Massachusetts that was started in 2017. The founders of Hometap wanted to provide homeowners with a new way to access the equity in their home if they weren’t able to get a loan through conventional channels. It does this through a financial product called a home equity investment, or HEI.

Highlights:

- Investment Limit: Up to 25% of your home’s value or a maximum of $600,000

- Investment Length: 10-year term, with options to buy back earlier

- Fees: 3.5% transaction fee owed to Hometap directly, plus third-party fees like appraisals, escrow, recording, etc. that are deducted from your investment amount

- Funding Timeline: Once you submit your application you may receive an offer in as few as three weeks. After signing the investment agreement, you should receive your money within four to seven business days.

- Home Equity Requirements: Minimum of 25% equity

- Credit Requirements: Minimum FICO score of 500

An HEI allows homeowners to access instant cash from their home equity, but it’s not a loan. Rather, it’s a legally-binding agreement where Hometap gives the homeowner a lump sum of money based on a percentage of their equity, and in return the homeowner then owes Hometap a share of their home’s future value.

This means the homeowner can access cash fast without adding to their monthly payments or taking on any new debt. The investment period for an HEI is typically 10 years, and after this time the homeowner must pay Hometap a percentage of their home’s value, although there are other options for pre-payment.

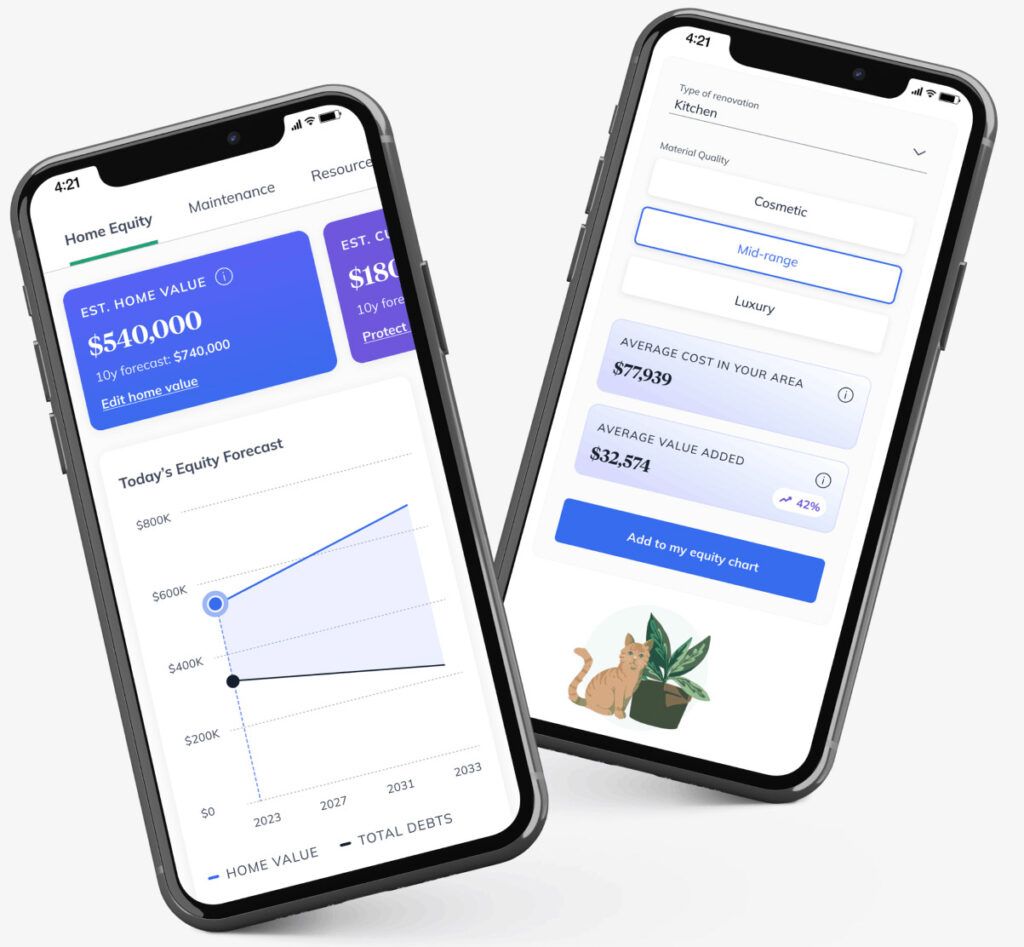

Consumers have many positive things to say about Hometap, and the company consistently receives five-star reviews. Its customers love the easy application process, the flexibility they have for repayment, and having access to the Home Equity Dashboard, an online portal that provides tools and resources for homeowners to better understand how they can make home equity work for them.

👉 Related reading: 33 Proven Ways To Save Money At Home

Is Hometap Legit?

Hometap is a legitimate business that’s invested in thousands of homeowners across the country. The company currently has a rating of 4.9 stars on Trustpilot from over 3,600 reviews and a B+ rating from the Better Business Bureau (BBB), and it’s also won awards for its exemplary customer service.

| Platform | Rating | Number of reviews |

| Trustpilot | 4.9 stars | 3,641 |

| BBB | 4.29 stars | 68 |

The vast majority of Hometap’s customers have positive things to say about their experience. Customer reviews often talk about the easy application process, and the customer service team that’s quick to respond, patient, and answers all questions that come up. They also remark on the professionalism and expertise of the company representatives.

Is Hometap Worth It?

A home equity investment from Hometap can be a good choice for many types of homeowners, and for these people, it is definitely worth it. This is especially true for those who’ve accumulated over 25% equity in their homes and those who for whatever reason can’t qualify for refinancing their home loan or for a home equity loan through a traditional lender.

However, there are others who may not be the ideal candidate for Hometap’s product. For instance, if you’re a newer homeowner and haven’t had a chance to build up a lot of equity, or if you’re able to secure more favorable terms with another lender, you may decide that an HEI isn’t the best use of your money.

👉 Related reading: Unlock Home Equity Review

How Does Hometap Work?

https://www.youtube.com/watch?v=MRKfdXOK590

Hometap strives to make the user experience as streamlined as possible, and a large part of this process is done completely digitally. Below we’ll walk you through the whole process from start to finish.

Getting Started with Your Investment

The initial process for getting a home equity investment with Hometap can be done entirely online. You’ll first start by creating an account and completing an investment inquiry. To do this, you’ll need to provide some basic personal information and details about your home, your finances, and your goals. This first step will help the experts at Hometap decide whether you’d be a good candidate for an investment.

If you pre-qualify, you’ll receive an investment estimate which will include the potential terms and amount you could be eligible for based on your finances and property details. At this time, you also have the opportunity to schedule a call with an investment manager to learn more about your estimate and get all your questions answered.

If you decide to move forward, you’ll then fill out an official application online which takes approximately 20 minutes to complete. Note that after your application has been submitted, you may be asked to upload financial documents and provide additional information. This is also the time that Hometap would schedule an appraisal of your home, although this won’t be required for all applicants. Depending on the value of your home and the amount you’d like to receive, a digital or in-person appraisal may be required before your application can be finalized.

Once all these steps are complete and Hometap receives the appraisal, you’ll be sent your final documents and asked to schedule a time for signing.

Settling Your Investment

A typical HEI term with Hometap is 10 years. After this time has elapsed, you’ll either have to sell your home or buy out the investment.

You can also choose to sell your property or buy out Hometap’s investment before the effective period is up. When you settle up early, the share of your home’s value that you’ll have to pay changes depending on how many years have gone by and the original amount you received. For example, if you received an initial investment that was equal to 10% of your home’s value, you would owe the following when it came time to settle up:

- From zero to three years: 15%

- From four to six years: 17.8%

- From seven to 10 years: 20%

If you decide to keep your home and buy Hometap out, you may be required to pay for another appraisal to determine the fair market value of your home. In the above scenario, if your home value decreased, you would only owe 15% (or the lowest pricing tier).

How Much Does Hometap Charge?

Hometap makes its money by charging a flat transaction fee of 3.5% of the investment amount, and this is taken right off the top of your payout. There are also additional fees that you would normally see connected to a home equity loan such as escrow charges, appraisals, filing and recording fees, title charges, notary, etc. These are all payable by the homeowner but can be taken directly out of the funds you’re paid so you won’t have any out-of-pocket expenses.

Hometap is committed to transparency in all its practices, and these fees will all be laid out for you when you receive your investment estimate so there are no surprises. You may also encounter some fees at the end of your term when settling the investment like an updated appraisal, but these will vary from one homeowner to the next.

👉 Related reading: 12 Proven Ways To Make Money From Home

Hometap vs Unlock vs Traditional Home Equity Loans

Two of the most popular fintech companies involved in home equity sharing are Hometap and Unlock, and we’ll compare the similarities and differences of them below. You can also learn more by reading our Unlock review.

Hometap vs Unlock Comparison

| Service Feature | Hometap | Unlock |

|---|---|---|

| Transaction Fees | 3.5% | 4.9% |

| Investment Range | $15,000 - $600,000 | $30,000 - $500,000 |

| Minimum Credit Score | 500 | 500 |

| Partial Buyout Option | No | Yes |

| Minimum Equity Requirement | 25% minimum | 20% minimum |

| Term Length | 10 years | 10 years |

Both of these companies offer homeowners a way to access money based on the equity in their homes, though Hometap calls these “home equity investments,” while Unlock calls them “home equity agreements (HEAs).” In general, the two companies have a lot in common, though it’s worth comparing and contrasting them so you can make an educated decision if you choose to start working with one over the other.

👉 Related reading: Truss Financial Group: Non-Traditional Home Loans

Both companies have favorable ratings from their customers and both offer investments in 10-year terms for homeowners who have a minimum credit score of 500. However, there are a few differences that consumers should take note of. For one, Hometap’s transaction fees are lower than Unlock’s (3.5% compared with 4.9%, respectively), and Hometap can offer investments as low as $15,000 and as high as $600,000, while Unlock isn’t able to offer less than $30,000 and only goes up to $500,000.

That said, Unlock does offer its customers the option of a partial buyout which lets you gradually gain your investment back over time, while Hometap requires payments in full every time. Additionally, Unlock’s HEAs allow homeowners with a loan-to-value (LTV) ratio of 80/20 to qualify, whereas Hometap requires at least a 75/25 LTV.

In general, home equity investments are a practical alternative to more traditional funding sources like a home equity loan, HELOC, or cash-out refinance, though the differences between these options aren’t always fully understood by consumers:

| Hometap HEI | Home Equity Loan | HELOC | Cash-Out Refinance | |

|---|---|---|---|---|

| Features | No monthly payments, no debt added | Lump sum payment, fixed monthly payments | Revolving credit line, payments on utilized amount | New mortgage, lump sum payment, single monthly payment |

| Monthly Payments | None | Yes | Yes, on utilized amount | Yes |

| Debt Implications | No new debt | Adds debt | Depends on usage | Adds debt |

| Equity Requirements | 25% minimum | 15%-20% minimum | 15%-20% minimum | 15%-20% minimum |

| Credit Requirements | 500 minimum FICO | Good to excellent | Good to excellent | Good to excellent |

| Maximum Term | 10 years | 10-30 years | Typically 10 years | 15-30 years |

| Investment/Funding Cap | $600,000 or 25% home value | Based on equity | Based on equity | Based on equity |

| Fees | 3.5% transaction fee + other fees | Varies | Varies | Varies, includes closing costs |

Home Equity Investment/Agreement

This is not the same as a loan, and homeowners won’t have to take on any additional debt or have to make a new monthly payment. Instead, Hometap and Unlock make an investment based on the equity of the home, and after the effective term ends, the homeowner owes them a percentage of the home’s new value.

Home Equity Loan

One of the most straightforward loans for homeowners who’ve accumulated enough equity in their homes (typically 15% to 20%), a home equity loan provides you with a lump sum payment which you’ll then have to make monthly payments with interest until the loan is paid back in full. This type of loan is sometimes called a second mortgage since you’ll now be making two separate monthly payments to your lender.

Home equity line of credit (HELOC)

Also based on the equity in your home, a HELOC gives homeowners access to a revolving line of credit that they can then use as much of or as little of as they’d like. With a HELOC, you only make payments on the amount that you’ve utilized, not your full credit limit.

Cash-Out Refinance

A cash-out refinance is an ideal option for those who are able to secure a lower interest rate than their current mortgage. With this option, you’ll get a new mortgage on your home for an amount higher than you need. The excess is then given to you as a lump sum payment, and you’ll only have one monthly payment. Because you have to apply and requalify for a mortgage, you’ll also be responsible for paying all the same closing costs that typically accompany a home purchase.

Who Can Use Hometap?

When applying, each prospective customer will be evaluated individually since there are several factors that Hometap looks for when considering eligibility. There are no hard and fast rules about who can qualify. That said, there are some general guidelines that you should be aware of.

- Type of home: Hometap can invest in single-family homes, multi-family homes, condos, vacation rentals, and manufactured homes.

- Credit score: Although Hometap can accept some homeowners with a credit score as low as 500, the company states most of its clients have scores of 600 or more.

- Home equity: You must have at least 25% equity in your home (or a 75/25 LTV)

- Investment amount: You can only receive up to 25% of your home’s value, but not to exceed $600,000

Who is Hometap Best For?

This product won’t be right for everyone. You should never agree to any financial agreement like this without thoroughly evaluating all your options and making sure this is a sound decision. Hometap may be a good option for you if you’re a homeowner who’s built up a considerable amount of equity in your home – and you can’t qualify for a traditional loan due to a poor credit score or insufficient income. It can also be a good choice for someone who needs cash right away but doesn’t want to add to their current debt or increase their monthly payments.

If you know you’re going to be selling your home within the next 10 years, you may find that the ultimate costs are comparable or even less than what they might be for a more traditional home equity loan.

On the other hand, if you are in a position to get a home equity loan or refinance with your lending institution, this may be a better option. Or, if you know you plan on staying in your home for over 10 years, a Hometap investment may not make sense for you since you’d have to come up with a lump sum to pay the company back at the end of your term, which usually means refinancing or working with personal loan lenders to secure the needed money.

👉 Related reading: Retirement Savings at Different Life Stages

Hometap Customer Service

The Hometap customer service team can be reached by calling (855) 223-3144, Monday through Friday from

9:00am to 5:00pm EST. You can also email the company at hello@hometap.com or chat online by clicking the blue chat icon in the bottom right-hand corner of the company’s website.

Is Hometap Worth Paying For?

Hometap is a reputable company that allows a homeowner to get a large amount of money fast based on the equity they’ve built up in their home. And, since it’s not a conventional loan, you won’t have to make monthly payments or add on to your existing debt. However, you will owe a lump sum payment after 10 years which means you either have to come up with the money or sell your house.

This could be a great opportunity for certain homeowners, but it won’t be right for everyone. Other options such as personal loans, home equity loans, or refinancing should be explored first and all your choices compared to ensure you’re getting the best deal.

Continue reading: