Navy Federal Credit Union offers a variety of home loan options to its members, including conventional, VA, FHA, and jumbo loans. They also offer special programs for first-time homebuyers, military members, and those looking to refinance their current mortgage. Navy Federal provides competitive interest rates, low down payments, and flexible terms to help its members achieve their dream of homeownership.

Navy Federal Credit Union Overview

Navy Federal Credit Union has been in the financial business since 1933, starting as a small group and transforming into a large credit union that helps people in all military branches, including the National Guard, Coast Guard, Air Force, and Marine Corps. The credit union allows active duty and veteran service members to join, as well as immediate family members, like children or siblings. Civilian employees are also able to join. Navy Federal has locations in 31 states and in 10 countries outside of the United States to help members access their accounts even when overseas.

Pros

- Wide variety of 0% down loan options

- Custom loan options for military members that have exhausted VA loan benefits

- Services all 50 states

- Offers rate match guarantee

- More than 350 brick-and-mortar locations across the United States

Cons

- No FHA or USDA Loans

- Membership is limited to current military members, veterans, family members, and certain federal employees

Types of Loans: VA Loans, Military Choice Loans, Conventional Loans, Homebuyers Choice Loans, Refinance Loans

Minimum Down Payment: $0

Minimum Credit Score: 620

When considering the types of banks you can use to get a mortgage, you might wonder if a credit union is right for you. Credit unions are similar to banks in the services they provide. However, the credit union’s members have a stake in the company and, therefore, get benefits like reduced interest rates and discounts for programs, memberships, and tickets. Navy Federal Credit Union is one of the best mortgage lenders for its military-focused benefits, like transitioning resources and reduced-rate military loans.

Why We Like Navy Federal Credit Union

As a credit union, Navy Federal Credit Union is very customer-focused. The changes and updates the company makes are designed to benefit its members. As one of the largest credit unions for active duty and retired service members in the United States, Navy Federal Credit Union can offer Navy Federal mortgage products at lower-than-average interest rates. It also offers other products, like a checking account or Navy Federal credit card, with perks for members.

Navy Federal Credit Union's competitors include:

- Freedom Mortgage

- Fairway Independent Mortgage Corporation

- Rocket Mortgage

- Better Mortgage

- Veterans United Home Loans

- Bank of America

- New American Funding

Members can get peace of mind knowing that money in their Navy Federal account is protected, too. The National Credit Union Administration (NCUA) insures each savings account up to $250,000 and receives regular auditing from the notable accounting and auditing firm, PricewaterhouseCoopers LLP, to ensure compliance.

Home Loans

A Navy Federal member can access several types of home loans, including conventional mortgages and VA loans for military members.

Military Choice Loans

Military Choice loans from Navy Federal Credit Union are for people who would usually be eligible for VA loans but may have already used the maximum amount allowed to buy a home previously. Therefore, only service members, veterans, and other eligible military members can get them.

The company offers this Navy Federal mortgage option to eligible service members to help them get many of the same benefits they’d have with a traditional VA loan without the backing of the VA. These loans come with a fixed interest rate for a steadier annual percentage yield, no private mortgage insurance, and flexible options with no down payments necessary. Sellers can also pay up to 6% of the purchase price to assist with closing costs.

Navy Federal provides 16 to 30-year terms for these loans. Although the best rates for these loans typically come with credit scores of 700 or higher, people with lower credit scores may still qualify. Navy Federal considers a homebuyer’s banking history with the federal credit union when determining their eligibility for any loan.

Refinance Loans

Navy Federal helps homeowners refinance their loans for a better interest rate and lower monthly payments. Refinancing can also help homeowners take advantage of the equity they’ve built up in their homes, allowing them to cash out that equity and use it toward home repairs, debt consolidation, or other large purchases.

Homebuyers can refinance their Navy Federal mortgage or a mortgage from another lender. To refinance with the credit union, homebuyers should have about 20% equity built up in their homes and meet similar credit score and debt-to-income ratio requirements as they had when they got their original mortgage.

In addition to traditional refinance loans, Navy Federal also offers VA loan refinancing. Homebuyers who became eligible for a VA loan after buying their homes can refinance into a VA loan, while current VA loan recipients can refinance with a VA Streamline loan, also known as IRRRL. An IRRRL loan provides lower-than-average interest rates for refinancing and allows homebuyers to switch from a fixed to an adjustable interest rate or vice versa. They also are designed for a faster refinancing process than traditional refinances.

VA Loans

Navy Federal offers VA loans for military members, including active duty and veteran service members. The credit union works with the VA to furnish the loan, although the VA outlines the immediate qualifying factors.

VA loans come with several benefits that traditional loans don’t, like no private mortgage insurance requirements, lower interest rates, and low to no down payments. Overall, these benefits can result in lower monthly payments for the loan. Eligible service members and veterans can also receive help paying their closing costs, as VA loans can include closing costs in the mortgage. Navy Federal can also negotiate with sellers to pay some or all of the closing costs associated with the loan.

To qualify for a VA loan, borrowers need to receive a Certificate of Eligibility (COE) from the VA that proves that they’re eligible for this loan type. In addition to meeting service requirements, a person getting a VA loan typically needs a minimum credit score of 580 and a debt-to-income ratio no higher than 41%.

Homebuyers Choice Loans

Navy Federal’s Homebuyers Choice loans are unique options for homebuyers who may not have the money needed to put down on a conventional loan. These loans do not require any down payment or private mortgage insurance, making them an affordable alternative for first-time homebuyers.

Something important to note is that, due to there not being a down payment and being easier to get than other loans, the Homebuyers Choice loan has a higher interest rate than conventional mortgages. However, homebuyers with credit scores of at least 700 may qualify for lower rates than those with lower credit scores. Navy Federal also likes to see homebuyers with consistent employment histories and low debt-to-income ratios of about 40% or lower.

Homebuyers can choose terms between 10 and 30 years to help them fit their mortgage into their current financial goals and their future goals for their homes.

Conventional Mortgage Loans

Navy Federal Credit Union members who are family of a military member but do not personally qualify for a VA loan may choose a conventional mortgage loan through Navy Federal.

A conventional loan can have either an adjustable annual percentage rate or a fixed interest rate. An adjustable rate loan has an interest rate that varies after a few years, while a fixed interest rate loan remains the same throughout the loan. Typically, people who do not expect to be in their home longer than a few years might choose an adjustable rate mortgage. Your Navy Federal loan officer can help you determine which option might be best for your personal loan and housing goals.

Conventional loans require a down payment, usually 20% or more of the purchase price. However, a member can put down a lower down payment and opt to pay private mortgage insurance instead. Private mortgage insurance is a monthly payment that offers the lender a bit more financial protection when furnishing your loan.

Navy Federal has conventional loans for 15 or 30 years, with 15-year loans usually providing lower interest rates. These loans typically require a minimum 620 credit score, but Navy Federal also considers other factors, like your income and debt-to-income ratio, when determining your eligibility for a conventional mortgage.

Jumbo Loans

A Navy Federal jumbo loan is reserved for homebuyers who are buying homes above the purchasing limits of a conventional loan, also known as conforming loan limits. These limits vary by geographical area but are most often set to $726,200 for a single-unit home. Since these loans are for larger amounts than traditional loans, they typically come with stricter requirements.

While homebuyers may be able to get a conventional loan with a 620 credit score, jumbo loans may require closer to a 700 credit score and a lower debt-to-income ratio to qualify.

Navy Federal Credit Union offers jumbo loans in terms from 10 to 30 years. Unlike most jumbo loans, homebuyers can get these loans with a minimum of a 5% down payment with no private mortgage insurance required.

How To Apply for a Navy Federal Mortgage

Homebuyers interested in working with Navy Federal Credit Union to apply for a home loan should start the process with a preapproval. However, Navy Federal only offers preapprovals to members of its credit union, so be sure to apply for membership.

You can complete a preapproval entirely online in just a few minutes. With a mortgage preapproval in hand, you can begin shopping for your home and have proof to sellers that you’re a serious buyer with buying power.

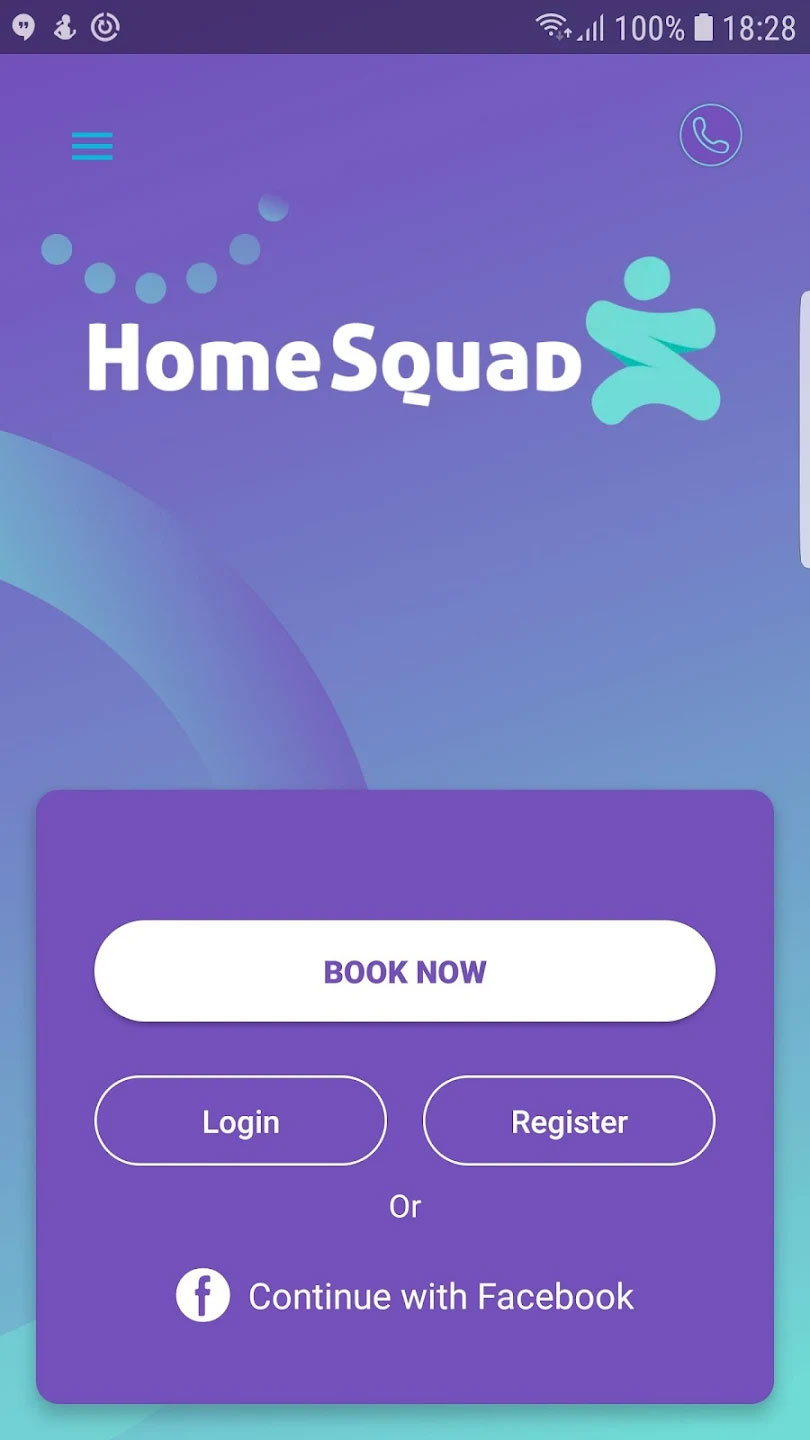

The HomeSquad app is a free tool to help you manage every part of your Navy Federal mortgage, including preapproval, document uploads, and document signing. The app is available on mobile or desktop, so you can check the status of your mortgage application at any time once you apply. HomeSquad also alerts you when you have any tasks to complete for the mortgage process, like sending a new verification or viewing a new document.

How To Contact Navy Federal Credit Union

Navy Federal Credit Union offers 24/7 customer service for current customers and potential customers who have questions. Call the always-open phone line at 888-842-6328.

You can also stop into a local Navy Federal branch, reach out on Facebook or Twitter, or mail correspondence.

The mailing address is:

Navy Federal

P.O. Box 3000

Merrifield, VA 22119-3000

Navy Federal credit union members can also sign into their online accounts to send a secure message or chat with a representative. Your online account also features several self-help features to manage your account, whether you want to complete a balance transfer, activate a debit card, monitor your checking account, or complete other online banking and mortgage tasks.

After the Loan Closes

Once you’ve been approved for a loan and it’s gone through the underwriting process, Navy Federal Credit Union will let you know that it’s time to move into closing. The closing process finalizes your Navy Federal mortgage, allowing you to take ownership of your new home. About three days before you move into closing, you’ll get more details from Navy Federal regarding an estimate of your closing costs and how to schedule your closing appointment.

After closing, the home is yours, and it’s time to make your first mortgage payment. You can do this by signing into your online banking account and paying a one-time payment or signing up for autopay. Navy Federal Credit Union also allows flexible payment methods, like bi-weekly payments rather than monthly payments, to help you budget for your mortgage.

What is RealtyPlus?

Anyone looking for a Navy Federal mortgage can use RealtyPlus, a service that helps you get a realtor as you search for your new home. You’ll also be eligible for up to $9,000 in cash back when you close on the home that your agent helps you find.

Is Navy Federal Credit Union Right for Me?

We hope our Navy Federal Credit Union review helps you learn more about your options and determine your best mortgage pathway. Navy Federal Credit Union offers several benefits to its members, including exclusive discounts and an easy-to-use online banking system to manage not just your mortgage but also your checking and savings account through the credit union. You can even get preapproved online within minutes if you’re already a credit union member.

Still, there are numerous mortgage loan servicers to choose from, whether you want a conventional loan or are eligible for a VA loan. Therefore, we recommend comparing a Navy Federal mortgage and its benefits to mortgage loans from other lenders before making a final choice. Most lenders are easy to contact and readily available to answer any questions you have, allowing you to get the information you need for an informed decision.