Caring for household pets is a labor of love and also one that can cost you real money as the price of veterinary care continues to rise. Thankfully, pet owners now have many choices for pet insurance that can save them money and ensure pets get the care they need. In our ASPCA Pet Insurance review below we’ll cover everything you need to know about this company including the coverage options, estimated pricing, and how to sign up.

Get A FREE Pet Insurance Quote Now

Company Overview

Most people know the American Society for the Prevention of Cruelty to Animals (ASPCA) for their work running shelters, rescuing animals, and advocating for animal protection laws, but they may not know the organization also provides pet health insurance.

Pros

- Exam fees, microchip, prescription food, behavioral problems, and dental coverage included

- No medical history or exam required for enrollment

- Horse insurance available, in addition to dogs and cats

Cons

- Highest annual coverage available online is $10,000—you must call to ask about unlimited options

- Can take up to 30 days to receive reimbursement

- No weekend customer support

Option to Pay Vet Directly: No

App Support: Yes

Accident Waiting Period: 14 Days

Illness Waiting Period: 14 Days

Orthopedic Waiting Period: 14 Days

Vet Helpline Available: Yes

Multi-Pet Discount: Yes

Deductible Type: Annual

The ASPCA offers pet insurance through the PTZ Insurance Agency, Ltd., one of the oldest pet insurance providers in the country, but it wasn’t until 2006 that they introduced ASPCA Pet Health Insurance. Its plans are underwritten by either the Independence American Insurance Company or the United States Fire Insurance Company, and coverage is available in all 50 states plus the District of Columbia. In addition to cats and dogs, ASPCA Pet Insurance also provides some policy options for horses.

As one of the best pet insurance companies, competitors of ASPCA include:

- Embrace Pet Insurance

- Healthy Paws

- Lemonade Pet Insurance

- ManyPets

- Nationwide Pet Insurance

- Pet Assure

- Pets Best Insurance

- Prudent Pet

- Pumpkin Pet Insurance

- Spot

- Trupanion

Why We Chose ASPCA Pet Insurance

ASPCA Pet Health Insurance is a well-respected name in the industry and its policies allow you to see any licensed vet in the U.S. or Canada. It’s also very easy to obtain a quote online by entering basic information about your pet and then you can customize your plan to achieve a monthly premium you’re able to afford while also getting the necessary coverage.

Customers love being able to choose a reimbursement rate of 70%, 80%, or 90%, a deductible of $100, $250, or $500, and annual limit options from $2,500 to $10,000. Lastly, there are no upper age limits on enrollment and the standard policy covers many services including exam visits, alternative care, and hereditary conditions and policyholders gain access to The Vet Connection, a 24/7 telehealth line.

How Pet Insurance Works with ASPCA Pet Insurance

ASPCA offers two main choices for pet insurance with options to customize within each plan. For the most comprehensive coverage, pet parents should choose the Complete Coverage plan. For those who want some coverage, but may not be able to afford a full plan, there’s accident-only protection.

What’s Covered

Accident-related services covered under both the Complete Coverage and Accident-Only plans:

- Diagnostic tests like CT scans, MRIs, ultrasounds, and x-rays

- Stem cell therapy

- Alternative therapy like chiropractic, acupuncture, rehabilitative therapy, or hydrotherapy

- Medical supplies

- Tooth extractions

- Surgery

- Sutures

- Hospitalization

- Prescription pet food, but only to treat a covered condition

- Medications and intravenous (IV) fluids

- Laboratory tests

- Examinations

- Consultations

Illness-related services only covered by the Complete Coverage plan:

- Any of the services listed above that stem from illnesses

- Cancer treatment like radiation or chemotherapy

- Chronic conditions like diabetes

- Behavioral issues like excessive fur licking or destructive chewing, but only when provided through a licensed veterinarian or another certified animal behaviorist

- Arthritis

- Hypothyroidism

- Urinary tract infections (UTIs)

- Ear infections

- Digestive problems

- Hereditary conditions like heart disease or hip dysplasia, but only if they haven’t shown symptoms prior to starting your policy or within the 14-day waiting period.

What’s Not Covered

- Pre-existing conditions (any medical condition that occurred before your plan start date or during the mandatory waiting period. However, if the condition has been cured and has remained treatment-free for at least 180, it may be eligible for coverage. This doesn’t apply to ligament and knee conditions which are always considered a pre-existing condition.)

- Elective or cosmetic procedures like ear cropping, tail docking, or claw removal

- Anal gland expression

- Boarding breeding or pregnancy-related services

- Funeral services

- Experimental procedures

- Grooming and grooming supplies

- Prescription food for general health

- Training

- Dental cleanings that aren’t necessary to treat a covered illness

- Spaying and neutering

Plans

All of ASPCA’s plans are available to cats and dogs who are at least eight weeks old and there is no upper age limit for enrollment. Before any policy can begin, there’s a mandatory 14-day waiting period before you’ll be able to submit any claims.

Complete Coverage

The Complete Coverage option is available for both cats and dogs and insures them for accidents and illnesses. Complete Coverage also covers exam fees, which even some of the best pet insurance companies don’t do like Healthy Paws Pet Insurance or Spot Pet Insurance.

Accident Only

Accident Only coverage is ideal for pet owners who may need limited protection for their dog or cat, can’t afford a comprehensive plan, or know their pet is particularly accident-prone. This plan only covers veterinary services related to accidents and nothing related to illnesses. Examples of common accidents include swallowing a foreign object, broken bones, scrapes and cuts, bite wounds, fractured teeth, or accidental poisonings.

Wellness

In addition to standard coverage, many companies like ASPCA, Embrace Pet Insurance, and Hartville Pet Insurance offer plans to pay for expected, routine vet services. The ASPCA Preventive Coverage is an endorsement that’s added to an existing policy and works through a reimbursement model, covering a set number of routine services. Furthermore, there is no waiting period and you don’t need to meet a deductible before using the wellness coverage. There is a maximum annual payout per service.

Importantly, the preventive endorsement must be added to your policy when you first sign up or at your annual policy renewal date. There are two options for the wellness plan, Basic or Premium.

Basic Wellness

The Basic wellness option can be added for $9.95 a month and includes the following services:

- Annual wellness exam

- Dental cleaning

- Deworming

- Heartworm test (dog only)

- Fecal Test

- DHLPP Vaccine (dog only)

- Rabies or Lyme Vaccine (dog only)

- FVRCP Vaccine (cat only)

- Rabies or FIP Vaccine (cat only)

- FeLV Test (cat only)

Premium Wellness

The Premium preventive care package costs $24.95 a month. In addition to all the services listed above, the Premium wellness plan also includes:

- Spaying or neutering

- Health certificate

- Flea and heartworm prevention

- Blood test

- Urinalysis

- Bordetella Vaccine (dog only)

- FeLV Vaccine (cat only)

How Much Does It Cost?

ASPCA Pet Insurance makes it easy to get a quote quickly and easily online and provides some of the best pet insurance rates out there. For each policy, the factors that determine your monthly premium are your zip code, the breed and age of your pet, and your choices for deductible, reimbursement rate, and annual limit.

Deductible: Your deductible is the amount you must first pay before your policy will begin reimbursing. ASPCA Pet Insurance offers three options: $100, $250, and $500.

Reimbursement rate: After you’ve met your deductible, your plan will then reimburse you for any covered service up to a certain percentage, either 70%, 80%, or 90%.

Annual limit: Finally, each policy only pays out up to a set annual limit for covered services which can be $2,500, $5,000, $7,500, or $10,000.

For the estimates below, we obtained a quote for a three-year-old medium-sized, mixed-breed dog, and a three-year-old domestic shorthair cat living in Portland, Oregon. The plans were both calculated using an 80% reimbursement rate, a $5,000 maximum annual payout, and a $250 deductible.

| Complete Coverage | Accident-Only | Add Preventative | |

| Dog | $42.16/month | $31.79/month | $9.95/month for Basic, $24.95/month for premium |

| Cat | $22.84/month | $17.10/month | $9.95/month for Basic, $24.95/month for premium |

How To Sign Up

The easiest way to sign up for a pet insurance plan from the ASPCA is by going to the company’s website, clicking on the blue “Free Quote” button, and providing information about you and your pet. You can then review your options and adjust your coverage level until you reach your desired monthly premium. You’ll then be prompted to continue to enroll where you can start a policy with your credit card information.

How To File a Claim

When you submit a claim, you’ll fill out a form that includes your contact information, a description of the treatment received, and a copy of your itemized invoice and payment receipt. This form can be filled out either by you or someone from your veterinary office, and it must be submitted within 270 days of the date of treatment. In some cases, you may be asked to submit further documentation of previous treatment or a company representative may contact your vet directly.

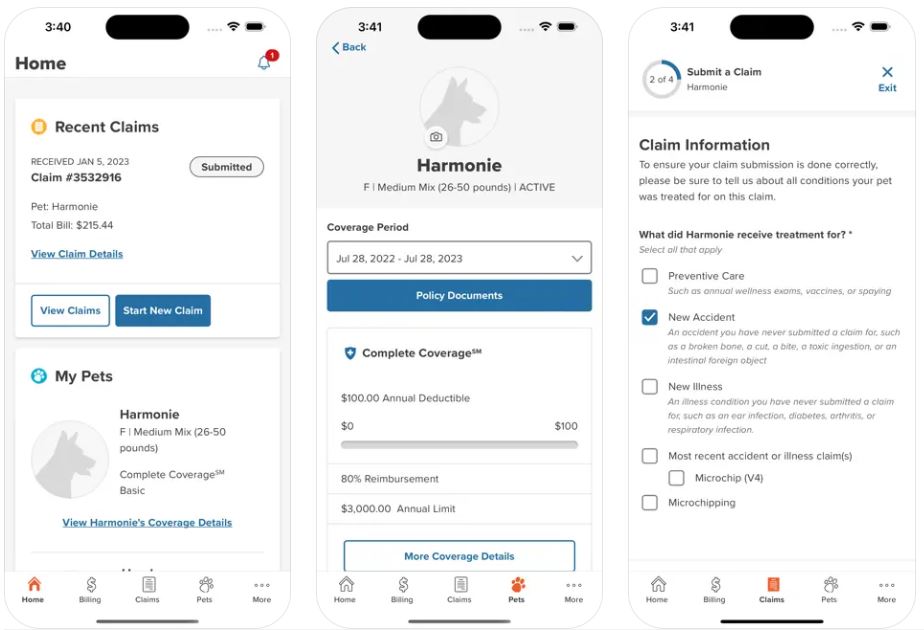

Claims can be made by logging into your Member Center account where you can access the details of your policy and, or by using the company’s mobile app. You can also fax claims to (866) 888-2495.

After your claim has been processed, you’ll be reimbursed according to the terms of your policy by the payment method chosen in your account, either by direct deposit or by sending a check in the mail. In some instances, ASPCA Pet Insurance can pay your vet directly, but this will be determined on a case-by-case basis.

Contact Information

You can contact the Customer Satisfaction team by calling (866) 204-6764, or the Sales team at (888) 716-1203, Monday through Friday from 8:00 am to 8:00 pm EST. You can also email the company at [email protected], or log into your member portal either through the website or your mobile app to ask questions about your policy.

How To Cancel ASPCA Pet Insurance

Any cancellations made within the first 30 days of your policy will be refunded in full as long as you haven’t filed any claims and no reimbursements have been made to your account. Cancellation requests can be made by phone, or can be emailed to [email protected] and need to include the reason for canceling and the date you want your policy to end. In many cases, you will be refunded for any premium payments you’ve made past this date.

Mobile App

The ASPCA Pet Health Insurance app lets you manage your policy, submit claims and track their progress, pay bills, add a picture of your pet to your account, and connect to 24/7 veterinary advice through the company’s telehealth service, The Vet Connection. Download the app from Google Play or the Apple App Store.

Is ASPCA Pet Insurance Right for Me?

ASPCA is widely known in the pet insurance provider industry for providing outstanding coverage and customers like it because of the options to customize, the low overall costs, the relatively short waiting periods, and the breadth of coverage (including alternative therapies, dental work, and exam fees). If you’re a pet parent looking to provide affordable veterinary care for your furry friends, ASPCA may be the best pet insurance company for you.

However, if you know you’ll need a lot of medical care for your cat or dog, keep in mind that there’s no option for an unlimited annual payout. In that case, you may want to consider an unlimited coverage plan from Pets Best or Embrace Pet Insurance.