Erie Insurance was founded as the Erie Insurance Exchange in 1925. Located in Erie, Pennsylvania, the company began as an auto insurance company. After a few successful decades, Erie Insurance began offering coverage for homeowners. Today, the company offers multiple types of insurance, including life insurance, business insurance, and Medicare supplement insurance coverage.

Erie Home Insurance: Company Overview

Pros

- Replacement cost available as standard for most policies

- Extensive network of more than 13,000 insurance agents

- A+ BBB rating

- Average 20% multi-policy discount

Cons

- No online quoting system

- Available in a limited number of states

Erie Insurance has a strong reputation in the auto insurance industry but has not yet made as big of a wave with its home insurance – perhaps due to its limited availability within the United States. Still, a network of over 13,000 insurance agents stands ready to help potential customers find the right homeowner’s insurance with the Erie Insurance Group.

Customizable plans and excellent discounts, such as 20% off eligible multiple policies, may entice homeowners in Erie’s coverage areas.

As one of the best homeowners insurance companies, competitors of Erie Insurance include:

- Farmers Insurance

- Liberty Mutual

- American Family

- Progressive

- Amica

- Lemonade

- Allstate

- State Farm

- USAA

One significant drawback for many prospective customers is that Erie Insurance doesn’t offer online quotes. Instead, you’ll need to contact an agent to receive a home insurance quote.

Locations

Erie home insurance is currently offered in the following states:

- Illinois

- Indiana

- Kentucky

- Maryland

- New York

- North Carolina

- Ohio

- Pennsylvania

- Tennessee

- Virginia

- Washington, D.C.

- West Virginia

- Wisconsin

Types of Coverage Available

When determining whether Erie home insurance is the best insurance company for your needs, it’s a good idea to understand the following standard types of insurance and coverages it offers homeowners.

Standard Coverages

Erie homeowner’s insurance includes the typical coverage options you’d expect from home insurance as standard coverage in its plans. These include:

Dwelling Coverage

Dwelling coverage protects the structure of your home and attached structures, like a covered porch or attached garage, if a covered event damages your home. Fire, vandalism, and windstorms are examples of covered perils that dwelling coverage can protect against.

Erie offers full replacement cost coverage on your home, which pays all your home’s rebuilding costs for the actual cost at the time of repairs.

Liability Coverage

Liability coverage is standard from the best homeowner’s insurance companies like Erie. This important coverage helps you handle the costs of accidents that may occur on your property, such as someone falling and injuring themselves. Liability insurance can pay for both medical payments and legal fees associated with the accident.

Personal Property Coverage

Personal property insurance is for your personal belongings in your home, like cookware, electronics, clothing, furniture, and office supplies. This coverage can reimburse you for belongings that are damaged, stolen, or vandalized as the result of a covered peril on your policy. Usually, this coverage is about 50% of the dwelling coverage amount, but you may be able to ask for an increase in coverage to help insure more of your belongings.

Additional Coverages

To ensure that every homeowner gets the protection they want and need from their insurance policy, Erie home insurance offers several additional coverage options that don’t come standard but can be added to eligible policies.

Extended Water Coverage

Homeowners insurance typically doesn’t cover all water damage, depending on what causes it. Adding extended water coverage can provide extra protection in the event of sewer backups, drain problems, or storm surge overflows, protecting the structure of your home and personal property from water damage.

Extended Water Coverage also provides up to $10,000 of reimbursement money for proactively protecting a home against flooding before it happens.

Service Line Coverage

Service line coverage is specifically for the service lines, like power or sewer lines, that run underneath a home and are usually the homeowner’s responsibility to repair or maintain. Depending on the home insurance bundle you choose, this coverage allows up to $10,000 or $25,000 in protection for issues like animal-related damage, root intrusion, or corrosion.

Flood Insurance

Flood insurance from Erie home insurance is designed to protect your home’s structure and personal property from flood damage. In some areas, flood insurance may be required. However, other homeowners can opt to add it as an extra layer of protection. Erie’s flood insurance takes up to 30 days to go into effect, so it’s a good idea to add this coverage while signing up for your policy.

Personal Valuables Insurance

Your standard home insurance policy from Erie includes personal property coverage for your belongings, like furniture and appliances. Personal valuables insurance goes to greater lengths to protect your belongings by covering named valuables, like antiques and jewelry, with high values. Choose between naming items separately in your policy or including an entire collection with an estimated value.

ErieSecure Home Bundles

| Advantage | Plus | Select |

| ErieSecure Home policy | ErieSecure Home policy | ErieSecure Home policy |

| Increased limits on theft and lost valuables | Increased limits on theft and lost valuables | Increased limits on theft and lost valuables |

| Identity Recovery coverage | Identity Recovery coverage | Identity Recovery coverage |

| Higher limits for trailers and watercraft | Higher limits for trailers and watercraft | |

| Additional coverage for Siding and Roof Restoration | Additional coverage for Siding and Roof Restoration | |

| Up to $10,000 of underground service line protection | Up to $10,000 of underground service line protection | |

| Option to add Sewer or Drain Backup coverage | Option to add Sewer or Drain Backup coverage | |

| Even higher limits | ||

| Higher liability coverage for watercraft | ||

| Criminal Defense Cost Reimbursement coverage | ||

| Equipment Breakdown coverage |

ErieSecure Home Bundles are additional bundled coverages homeowners can add to their standard policies to expand protection for their home or personal belongings. Erie offers three plans with different levels of protection and pricing structures. Your exact price for these plans depends on the size of your home, your home’s location, and other factors.

Advantage

This base bundle is the most affordable of the three, with lower additional coverage amounts. With ErieSecure Advantage, you get additional protection against theft and lost valuables. Erie also includes identity protection in this plan to help you recover from fraudulent activity using your identity.

Plus

ErieSecure Plus includes everything from the Advantage bundle and adds up to $10,000 of coverage for underground sewer lines. It also includes higher limits for other items, like watercraft and your home’s siding. You can optionally add sewer or drain backup coverage to Plus.

Select

The Select bundle is the most comprehensive bundle of the three, offering everything included with Advantage and Plus. This plan also includes equipment breakdown coverage for homeowners with sewer or drain backup coverage. Additionally, Select includes extra liability coverage for watercraft that even covers the costs of a criminal defense attorney in the event of a legal dispute.

Pricing and Costs

According to our research from several sources, the average home insurance policy costs between $1,400 and $1,800 per year. However, this rate can vary significantly based on a home’s size, materials, and location. For instance, some states, like Oklahoma and Kansas, have much higher average rates than states like Utah and Hawaii.

Our research finds that Erie home insurance falls right in line with the average homeowner’s insurance rate, at about $1,400-$1,500 per year. However, the average cost of home insurance in many of the states Erie covers is generally a bit lower than this amount, making Erie a somewhat more expensive option compared to other home insurance companies.

To increase affordability, the company has multiple discounts to reduce the cost of a policy, like insuring a new home and bundling home insurance with car insurance from Erie.

Deductibles

Another way to decrease the amount you pay each year for home insurance with Erie is to customize your deductible. A deductible is the amount of money a homeowner is responsible for paying before Erie pays its share for a covered peril. For example, a $1,500 deductible would need to be paid by the homeowner before Erie pays the rest of the amount of repairs for water damage from a frozen pipe.

Deductibles typically range from $500 to $2,000. The higher the deductible, the more a homeowner pays for a claim. However, this higher amount can also decrease your premiums, sometimes by hundreds of dollars per year. Eligible homeowners using Erie home insurance can choose a deductible from $0 to $10,000.

Discounts

Erie home insurance drives customer satisfaction by giving eligible customers attractive discounts on their insurance policies. Perhaps the company’s most coveted discount is its multi-policy discount for homeowners who also have another insurance policy through the company, like Erie car insurance or life insurance. The average customer who bundles policies with Erie gets a discount of about 20% in total.

Other discounts from Erie include:

- Advanced quote discount: Offered to customers who get a quote for Erie home insurance within 7-60 days before their current homeowner’s insurance policy renews.

- Safety and security credit: This discount applies to policies when homeowners install new safety and security equipment, like fire alarms or security cameras.

Depending on your area and home specifics, you may qualify for additional discounts. Speak with an Erie insurance agent to determine whether any other discounts may apply to your policy.

How to Get a Quote

Erie home insurance works through a network of agents, so the best way to get a quote for home and property insurance is to locate your nearest agent’s office by using the location tool on the website. Currently, there’s no way to get a quote from Erie online.

If you have trouble finding an agency or you’d like assistance from Erie in doing so, you can call 1-800-458-0811 to speak with a representative and ask for a quote. Be sure to have information about your home available, such as its square footage and the year it was built.

How to File a Claim

Erie customers can go through their agencies to file claims against their homeowner’s insurance. The agent can help you work through the claims process, letting you know what you need to file the claim and keeping you updated along the way.

Customers can also contact Erie Insurance if they need any help with the claims process by calling 1-800-367-3743. This line is available 24/7. You can also contact this number or your Erie agency to track the status of your claim or update any information. Erie Insurance does not yet offer online claims submissions, but you can check your claim’s status in your online account.

Customer Service Contact Info

Erie provides several ways for customers to get in contact with someone if they need help figuring out their policy or understanding how to file a claim. First, you can subscribe to Erie’s newsletter to stay in the loop about changes or new services.

For specific questions or concerns, you can call Erie Insurance’s customer service line at 1-800-458-0811 or call your Erie agency. Customers can log into their online account for some information as well, like policy information, claims status, and billing history.

Erie also offers email support and live chat to assist customers. To access live chat, log into your Erie online account.

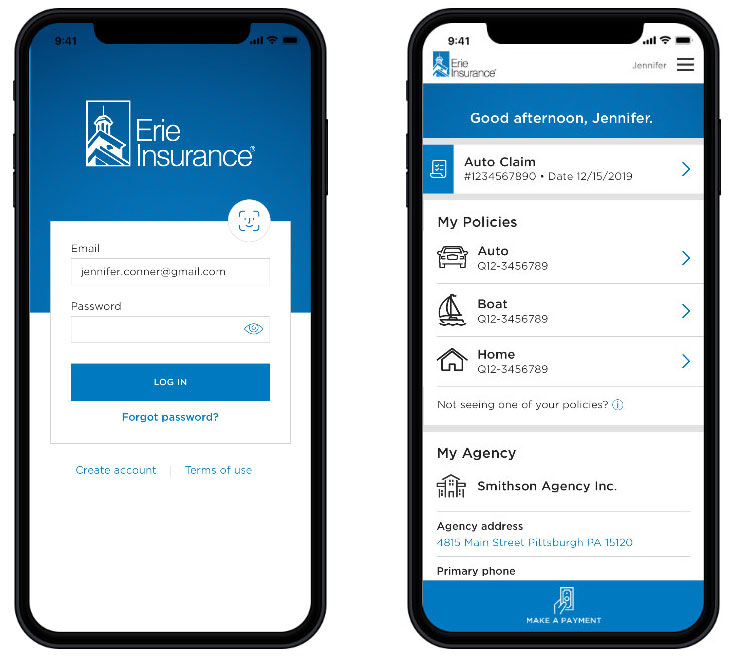

Erie Mobile App

Sometimes, it helps to have quick access to your home insurance coverage when you’re on the go.

The Erie Insurance Mobile App lets you view your policy and ID cards, billing history and upcoming payments, claims status, and more right from your mobile device. You’ll also see information about your agency in your mobile account for quick and convenient contact if needed.

The Erie Insurance Mobile App is available in the App Store and on Google Play.

Is Erie Homeowners Insurance Right for Me?

As you decide what the best homeowner’s insurance is for you, consider adding Erie home insurance to the loop. Erie Insurance has a longstanding positive reputation in the insurance industry, especially with its Erie auto coverage. Customers can also get personalized help from their Erie Insurance agency if they need to update coverages, have questions, or want to file a claim.

Erie’s mobile app provides quick access to policy information and claims status checks, even when you can’t get to a computer. Unfortunately, the lack of online quoting and claims filing can be a drawback for customers who prefer taking care of these processes themselves through convenient digital methods.

Another important consideration is whether Erie home insurance is available in your state. Currently, Erie only covers 13 states, including Illinois, Ohio, and Pennsylvania. This is rather limited compared to more national companies covering all or most states, like State Farm or Amica.

If Erie is available in your state, consider contacting an agent to compare quotes from other companies in your area.