In this post:

- Lemonade Pet Insurance - Company Overview

- Why We Like Lemonade Pet Insurance

- Lemonade Pet Insurance - How It Works

- Pet Insurance Plans and Coverage

- Optional Coverage plans

- How much does Lemonade Pet Insurance Cost?

- How To Get Started

- How To Submit a Claim

- How To Cancel

- Customer Service Contact Info

- Lemonade Mobile App

- Is Lemonade Pet Insurance Right for Me?

When accounting for the needs of everyone and everything in your household, you’ll quickly realize how fast expenses can pile up. Because of this, it’s only natural to look for ways to save money where you can and protect your savings from unexpected bills.

Get A FREE Pet Insurance Quote Now

One area that many people overlook when budgeting is how pet insurance can help them cover both predictable and unpredictable expenses for their cat or dog. But what does pet insurance cover? And is pet insurance worth it? The answer will be different for every pet owner, but it’s important to look at the facts yourself and then decide what kind of plan makes sense.

Read our Lemonade Pet Insurance review below to see if this may be a good option for you.

Lemonade Pet Insurance – Company Overview

Lemonade provides several types of insurance including car, life, renters, and homeowners insurance in both the United States and parts of Europe. The company has been in business since 2015 and has provided pet health insurance since 2020. Its US offices are based out of New York, NY, and it’s a fully licensed and regulated insurance company, meaning it both sells and underwrites all its own policies.

Pros

- Bundle discounts available for multiple pets and multi-policy holders

- Very competitive rates

- High annual coverage limit options

Cons

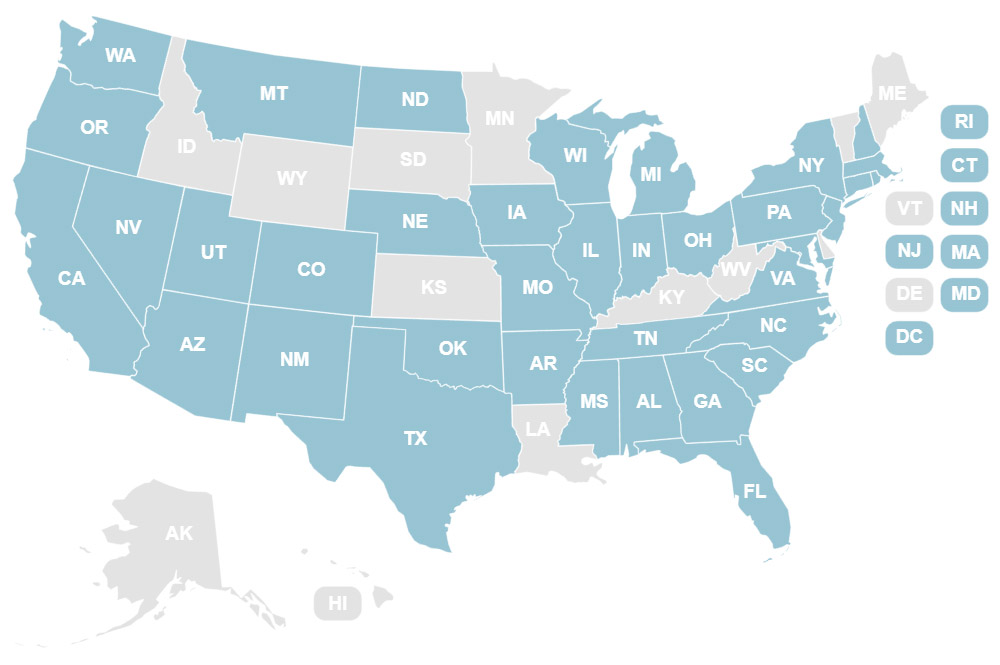

- Only available in 37 states

- Must provide medical records from a visit within the past 12 months to enroll

- Pets over the age of 14 are not eligible for enrollment

- Credit score and claims history can affect rates

- Does not cover prescription food

Option to Pay Vet Directly: No

App Support: Yes

Accident Waiting Period: 2 Days

Illness Waiting Period: 14 Days

Orthopedic Waiting Period: 6 Months

Vet Helpline Available: Yes (partnered with Chewy)

Multi-Pet Discount: Yes

Deductible Type: Annual

Where Is Lemonade Pet Insurance Available?

Pet insurance policies through Lemonade are currently only available in 37 states and Washington D.C., but the company is actively working on expanding coverage to those in Alaska, Delaware, Hawaii, Idaho, Kansas, Kentucky, Louisiana, Maine, Minnesota, South Dakota, Vermont, West Virginia, and Wyoming.

The company is also known for its commitment to charitable work in the form of the Lemonade Giveback program. The Giveback program works like this: when a customer signs up for a policy (any policy, not just pet insurance), they also choose a nonprofit they want to support. At the end of each policy term, the company tallies up any unclaimed money and gives up to 40% of it to that organization, keeping a flat fee to cover their expenses.

To date, Lemonade Insurance has given back over $8 million to charitable organizations under this program. It is also a Public Benefit Corporation and a Certified B Corp (the world’s only insurance company to hold these titles).

As one of the best pet insurance companies, competitors of Lemonade include:

- ASPCA Pet Health Insurance

- Embrace Pet Insurance

- Healthy Paws

- ManyPets

- Nationwide Pet Insurance

- Pet Assure

- Pets Best Insurance

- Prudent Pet

- Pumpkin Pet Insurance

- Spot

- Trupanion

Why We Like Lemonade Pet Insurance

There’s a lot to like about Lemonade Pet Insurance, even though it hasn’t been around for as long as many of its competitors. Customers will like the options they have for both basic accident and illness coverage as well as options to add on preventive care and stand-alone add-ons like dental illness, physical therapy, or vet visit fees. Its average prices are competitive if not lower than many of the bigger insurers and it offers lots of ways to save money on a pet insurance plan like its multi-pet and bundling discount for those who hold other types of insurance policies with the company.

Lemonade Pet Insurance – How It Works

Most pet insurance plans work in a similar way, in that they typically cover all diagnostic and treatment services your pet needs that result from an accident or injury. The pet’s owner is initially responsible for paying the vet bill for the recommended services, but can then submit a claim to be reimbursed according to the terms of their policy. All plans will be subject to a deductible, co-insurance percentage (also called a reimbursement percentage), and annual payout limit that we’ll cover more below.

Pet Insurance Plans and Coverage

The basic Lemonade insurance plan can be used for both cats and dogs and covers diagnostics, treatment, and medication for accidents and illnesses. For both cat and dog insurance, you can visit any licensed vet in the country (even if you’re traveling with your pet to a state that doesn’t currently offer Lemonade pet plans).

| Condition | Wait Time |

| Accidents | 2 days |

| Illnesses | 14 days |

| Orthopedic Conditions | 30 days |

| Cruciate Ligament Events | 6 months |

All plans are subject to a waiting period before you’ll be able to file a claim. For accidents, this is only two days, which is one of the shortest in the pet health insurance industry. For illnesses, the waiting period is 14 days, and for orthopedic conditions, you must wait 30 days. For cruciate ligament events, you must wait six months.

To start any coverage, you’ll first submit your pet’s medical records. These records must cover the last 12 and half months to determine a baseline health analysis of your pet and determine if they have a pre-existing condition that needs to be excluded from your coverage. This can be submitted after you sign up for a plan, but you will not be able to file any claims until it’s received.

| Covered | Not Covered |

|---|---|

| Hospitalization | Pre-existing conditions |

| Medication | Injuries during waiting period |

| Cancer Treatment | Bilateral conditions (if pre-existing) |

| Diagnostics | Alternative treatments like CBD |

| Emergency Care | Conditions from racing or fighting |

| Surgeries | Vet visit fees (without add-on) |

| Dental Accidents |

What’s Covered?

- Hospitalization

- Medication including allergy medications like Apoquel allergy pills and Cytopoint allergy injections

- Cancer treatment

- Diagnostics like x-rays, urinalysis, CT scans, blood work, MRIs, and ultrasounds

- Ingesting a foreign object or toxic foods

- Emergency care

- Surgeries

- Arthritis

- Vomiting

- Diarrhea

- Broken bones

- Sprains

- Diabetes

- Skin conditions

- Heart disease

- Dental accidents

What’s Not Covered?

- Pre-existing conditions

- Any illness or injury that happens during the mandatory waiting period

- Bi-lateral conditions like hip dysplasia, cherry eye, or cataracts (if pre-existing)

- Non-traditional or alternative treatments like CBD (though you will be eligible for some services like acupuncture, chiropractic care, or hydrotherapy with the physical therapy add-on)

- Services for conditions that began over 180 days ago

- Conditions that are preventable, such as injuries or illnesses from racing or fighting

- Vet visit fees unless you’ve added on this rider

Optional Coverage plans

In addition to its basic pet insurance plan, Lemonade offers three levels of optional preventative care coverage. None of these are subject to your annual deductible, meaning you can cash in on the benefits right away.

| Plan Type | Included Services |

|---|---|

| Preventative Care | Wellness exams, vaccinations, parasite tests |

| Preventative+ Care | Basic + heartworm/tick meds, dental cleaning |

| Puppy/Kitten Care | Extra exams, vaccinations, spay/neuter |

Preventative Care Package

Lemonade’s basic wellness plan can be added to any existing policy and provides reimbursement for the following services up to your plan’s limit:

- One annual wellness/physical exam

- One fecal or internal parasite test

- Three vital vaccinations (like rabies, FVRCP for cat insurance, or DAPP/DHPP for dogs)

- One preventive blood work

- One annual screening for parasites, heartworm, or FeLV/FIV Test

Preventative+ Care Package

The Preventative+ CarePackage includes everything the basic preventive package does as well as medications for heartworm or ticks and routine dental cleaning.

Puppy/Kitten Preventative Care Package

Anyone who’s had a new puppy or kitty in their house knows what kind of trouble they can get into and how much you can end up spending on vet care for these young animals. On average, puppies and kittens require more vaccinations, tests, and procedures than older animals which is why this coverage option can be so helpful for those with young furry friends.

This rider provides the following services:

- Two annual wellness/physical exams

- Two fecal or internal parasite tests

- Six vital vaccinations or boosters (like rabies, FVRCP for cat insurance, or DAPP/DHPP for dogs)

- One preventive blood work

- One annual screening for parasites, heartworm, or FeLV/FIV Test

- Spaying and neutering

- Flea, tick, and heartworm medication

- Microchipping

Others Add-ons

In addition to the preventive riders, Lemonade also offers five different add-ons you may be interested in as a pet parent considering your anticipated needs:

- Vet visit fees: None of Lemonade’s basic plans cover the cost of your visit or exam fee, and this add-on can help offset those expenses.

- Physical therapy: This can includevet-recommendedphysical therapy, acupuncture, and hydrotherapy.

- Dental illness: This rider can help with problems like gingivitis and periodontal disease if your pet needs procedures like tooth extractions or a root canal.

- Behavioral conditions: If your pet is experiencing anxiety or aggression, this will cover vet-recommended therapy and medications.

- End of life and remembrance: This benefit helps pay for euthanasia, cremation, or commemorative items to memorialize your pet.

How much does Lemonade Pet Insurance Cost?

| Pet Type | Average Monthly Premium |

|---|---|

| 3-Year-Old Mixed-Breed Dog | $39.28 |

| 3-Year-Old Domestic Shorthair Cat | $26.92 |

For a three-year-old mixed-breed dog, you’ll pay an average of $39.28/month, and for a three-year-old domestic shorthair cat, you’ll pay an average of $26.92/month.

That said, your actual costs will vary based on several different factors including your pet’s breed and age, your zip code (just as premiums for life insurance or health insurance are also affected by where you live), as well as your chosen deductible, coinsurance rate, and your annual limit.

| Factor | Impact on Cost |

|---|---|

| Deductible | $100, $250, $500 options |

| Reimbursement Rate | 70%, 80%, 90% choices |

| Annual Limit | Ranges from $5,000 to $100,000 |

| Discounts | Pay-in-full, multi-pet, bundling |

Most of these coverage options can be revised within 14 days of your policy start date, but if you wish to make a change after this time, you’ll have to wait until your renewal period.

- Deductible: Your basic deductible options with Lemonade are $100, $250, or $500. Before you can receive any payouts under your plan, the deductible must first be paid and this must be done each policy period. The higher your deductible, the lower your premium will be.

- Coinsurance/reimbursement rate: You will be able to choose from a 70%, 80%, or 90% reimbursement rate. This means you will be responsible for paying the remaining amount (for example, if you choose an 80% rate, you will have to pay the remaining 20% of your vet bill). Like your deductible, the higher the reimbursement rate you choose the higher your premium will be.

- Annual limit: Finally, all plans will have a cap on how much they will pay out each policy year. This can be anywhere from $5,000 to $100,000 a year. Although Lemonade doesn’t have an unlimited payout option, its $100,00 is one of the highest in the business. (For reference, companies like Figo Pet Insurance, Embrace Pet Insurance, and ASPCA Pet Health Insurance all offer unlimited caps).

Lemonade also offers a few discount options for policyholders:

- Pay-in-full discount of 5%

- Multi-pet discount of up to 5%

- Bundling discount of up to 10% for those with other Lemonade policies

How To Get Started

Lemonade is committed to providing most of its products and customer service digitally, which can streamline the process for pet parents looking for coverage. Because of this, it only allows new customers to sign up for a pet insurance policy either by using its mobile app or by going through the website using the online quote tool. Once you get a quote and want to sign up, simply enter your debit or credit card information and agree to the policy terms.

How To Submit a Claim

Most claims must be filed within 180 days of when treatment was received, though certain states may have shorter timelines (for instance in Texas you only have 90 days to file a claim). You will need to download Lemonade’s mobile app to submit a claim, but once you’ve done this the process is very straightforward. You will simply choose the policy you want, then click on “File A Claim” which will prompt you to include a picture of your paid invoice and receipt, your vet info, and a brief description of the services received. You may even be prompted to record a short video with this information. Once submitted, you’ll receive a confirmation email with your claims number and you’ll be able to track its progress through your app.

Lemonade uses AI to process most of its claims which means that many will be completed within minutes after they’re submitted. However, if more information is needed, the process will take longer. When you set up your account, you will need to enter banking information and all claims will be paid by direct deposit into your account.

How To Cancel

Cancellations can be made by contacting the company at [email protected], or via phone at 1-844-733-8666. The easiest and fastest way to cancel your plan is by using the company’s mobile app.

Customer Service Contact Info

Call Lemonade Customer Service at 1-844-733-8666 Monday to Friday, 9 am – 8 pm EST, or email [email protected].

Lemonade Mobile App

The highly-rated and easy-to-use Lemonade mobile app is available on the Apple App Store and Google Play. The app is the best way to file a claim or connect with the customer service team.

Is Lemonade Pet Insurance Right for Me?

The Lemonade Insurance Agency provides comprehensive coverage for pet insurance and is committed to the greater good on a company-wide level. This makes Lemonade an ideal choice for someone who prioritizes not just getting a good product but also supporting companies that reflect their overall values.

The company is also operated almost entirely digitally which can be a huge plus to those who are used to conducting most of their business online, but if you’re less comfortable doing this or with using an app to file claims, you may want to consider other options. Additionally, since it’s not yet available in every state, Lemonade may not be an option for you at this time.

Although Lemonade has only been a pet insurance provider for a few years, it has already racked up numerous positive reviews for its customer service and customizable coverage options. This could be the best pet insurance option for you if you’re able to take advantage of its multiple discount options and already low average prices.