In this post:

Founded in 1912, the Liberty Mutual Group is one of the longest-running insurance companies in the United States. In addition to its other insurance products, Liberty Mutual Home Insurance is specific to homeowners seeking coverage options for their homes, including dwelling insurance, liability coverage, and flood insurance.

Liberty Mutual Home Insurance crafts each homeowners insurance policy with care, taking into consideration area specifics, like economy and weather. In addition to traditional homeowners insurance, Liberty Mutual also offers protection for mobile homes and condos.

As one of the best homeowners insurance companies, competitors of Liberty Mutual include:

- Farmers Insurance

- American Family

- Progressive

- Amica

- Lemonade

- Allstate

- State Farm

- Erie Insurance

- USAA

Homeowners in every state and Washington D.C. can get personal property coverage, liability coverage, and other types of coverage through a Liberty Mutual homeowners insurance policy.

Liberty Mutual Home Insurance: Company Overview

Weighing the pros and cons of a potential insurance company is helpful when seeking the best homeowners insurance to protect your home and valuables. The Liberty Mutual Insurance Company has a lot of benefits for every homeowner, including several discounts to keep policies more affordable and a mobile app that makes it easy to check and manage your account, no matter where you are or what you’re doing.

Still, Liberty Mutual may not have coverage suitable for every homeowner and situation. Unfortunately, the website isn’t as detailed as some other companies, making it difficult to complete preliminary research before contacting the company for further details. Here’s a rundown of some of the top benefits and drawbacks of Liberty Mutual Insurance.

Pros

- Several discounts available to lower premiums

- Mobile app for convenient account access

- BBB-accredited since 1931 with A+ rating

- Simple and fast online claims

- Available in all states, including Washington D.C.

Cons

- Not a lot of coverage information available on the website

- Limited coverage options compared to some companies

- May deny coverage if you own certain dog breeds

Types of Coverage Available

A Liberty Mutual homeowners insurance policy can include multiple types of insurance coverage, including those your lender requires and additional coverages that offer an extra blanket of protection for your home and belongings.

You can get the following types of coverage for your policy through Liberty Mutual, depending on the coverage available where you live.

Home Hazard Insurance

Home hazard insurance is what Liberty Mutual Home Insurance refers to as dwelling coverage. Dwelling coverage is one of the most important types of coverage to have on your home, and it’s typically one that your mortgage lender will require you to have until you’ve paid off your loan. This coverage protects against property damage from incidents like vandalism, strong winds, or fire.

Your Liberty Mutual policy will name a specific amount for a replacement cost as part of its home hazard insurance, but you can increase this amount for additional coverage. This amount is how much the policy will pay up to if your home needs to be replaced due to damage. Porches and attached garages may be covered under the dwelling portion of your policy, but detached areas of the home, like a shed on your property, might need separate coverage.

Before Liberty Mutual reimburses a claim for home hazard insurance, you’ll need to pay a deductible. You can specify an amount you feel comfortable paying if you were to need a covered repair or replacement.

Personal Property Coverage

While dwelling insurance covers the actual structure of your home, personal property coverage from Liberty Mutual provides specific coverage for your personal belongings. You would be covered if your home is damaged in a covered loss, such as a hurricane, and you lost many of your personal belongings, like furniture, clothing, and appliances.

Your personal property insurance covers those belongings, allowing you to replace the items you lost. This insurance coverage can also protect your items if they are stolen.

Liberty Mutual will specify an amount of personal property coverage in your policy, which is usually a percentage of your dwelling coverage. However, you may be able to increase your coverage if you want more protection for your belongings.

Liability Coverage

Liability coverage typically comes standard on your insurance policy. This coverage protects you in the event that a person becomes injured on your property or your home causes damage to another person’s property. If you were sued due to this type of incident, your liability coverage would kick in, offering up to a specified monetary value to cover your losses.

This coverage can pay for the high costs of medical bills, legal costs, and even lost wages you might incur if you miss work for court hearings.

It’s important to note that a business run in your home may not have protections under liability coverage in your homeowners insurance policy. Instead, you may need a separate liability policy that solely protects your business operations.

Hurricane Coverage

Hurricane coverage comes standard with many Liberty Mutual Home Insurance policies. This coverage protects against property damage and loss of your personal property in the event of a hurricane, which is considered a covered loss. Typically, any repairs or replacements to your structure that need to be made as a result of a hurricane would be covered under home hazard insurance.

Your insurance policy may have a different deductible required for hurricane coverage to kick in than your dwelling deductible, but you can speak with your Liberty Mutual representative to adjust your deductible if necessary.

Wind and Hail Coverage

Similar to hurricane coverage, wind and hail coverage protects your home against these weather anomalies. This coverage comes standard with some Liberty Mutual homeowners insurance policies and may have a deductible separate from your dwelling coverage. Not only will this coverage help you repair or replace structural damage to your home caused by wind and hail, but it can also provide reimbursement for the cost of damaged belongings inside your home.

Additional Living Expenses Coverage

This coverage comes standard with Liberty Mutual policies to reimburse you for costs relating to living somewhere else while your home is repaired or rebuilt due to a covered loss. For instance, you can use your claim money from this coverage toward the price of a hotel stay as you wait for your home to become liveable again.

Additional Coverage from Liberty Mutual Home Insurance

Additional coverage options from Liberty Mutual Home Insurance do not typically come standard with home insurance policies, but they are available as optional coverage for policyholders in the United States. Adding these to your policy can help you protect your home and valuables even further than a standard homeowners insurance policy would.

Inflation Protection

Liberty Mutual’s inflation protection coverage helps you account for inflation each year by automatically adjusting your policy’s coverage limits based on current inflation rates. Although this may affect the premiums you pay, you also receive a discount each year when adjustments are made to help offset some of the costs of having this optional coverage on your policy.

Insurance Coverage for Valuables

High-value items in your home, like jewelry, electronics, and collections, may not have enough coverage under your standard homeowners policy to reimburse you for their loss should something happen to them in a named peril. However, insurance coverage for valuables can name each high-value item and its value in your policy, giving your items insurance coverage specific to their values.

If you’re unsure whether you should have insurance coverage for your valuables, speak with a Liberty Mutual representative, who can tell you the standard coverages for each type of item. From there, you can determine whether you’d have enough coverage for your valuables or should consider getting more.

Water Backup Coverage

Standard homeowners insurance policies typically have little to no insurance coverage for water damage caused by backed-up or broken pipes when the damage occurs because of failing to repair or maintain your plumbing system. However, you can add the optional water backup coverage to help protect against this type of problem. Water backup coverage can help protect against issues that arise from dishwashers or laundry units, backed-up sump pumps, and other problems that can cause water damage to your home.

Flood Insurance

Flood insurance may be required for your Liberty Mutual Home Insurance policy if you live in an area that’s prone to flooding. If this is the case, your representative will let you know when outlining your quote.

For others, flood insurance is optional coverage. Liberty Mutual works with the National Flood Insurance Program to write policies allowing up to $250,000 of flood protection for your home and up to $100,000 for your belongings.

Umbrella Insurance

Umbrella insurance is an insurance product from Liberty Mutual that covers both auto and property insurance. This protection can add additional coverage to your plans, offering an “umbrella” of protection. This coverage is highly customizable to give you the right amount of protection for what you want to cover. For example, you might use it for additional liability coverage or vandalism coverage. Umbrella insurance through Liberty Mutual is available for as much as $3 million of additional coverage.

Mobile Home and Condo Insurance

In addition to covering standard residential properties, Liberty Mutual offers special policies for other types of homes, like mobile homes and condos, which may require specific coverages and amounts that vary from traditional homeowners insurance. They still have the same protections you’d expect from homeowners insurance but with customizable coverage options for these types of homes.

Pricing and Costs

Like other homeowners insurance policies, a Liberty Mutual Home Insurance policy will vary between customers across the United States. Several factors go into determining your premium, including the amount of your dwelling coverage and liability coverage, the size of your home, and any mandatory coverages for your state or local area.

$1,000 to $1,500 per year

Generally, the average homeowner will pay between $1,000 to $1,500 per year with Liberty Mutual Home Insurance. If you add additional coverage options, like inflation protection or flood insurance, your premium may fall on the other side. However, if you qualify for certain discounts or increase your deductible, you could see a lower premium.

State homeowners insurance also varies significantly, so it’s a good idea to look at some average costs for your state based on home price ranges. The National Association of Insurance Commissioners (NAIC) outlines this data in a 2020 report, making it easy to compare your state’s average costs with others. For example, Texas, Alabama, and Florida tend to have some of the highest home insurance premiums, while Nevada, Idaho, and Pennsylvania premiums are comparably on the lower end of the spectrum.

Home Insurance Deductibles

A home insurance deductible is the amount of money you’ll pay for a claim before Liberty Mutual begins paying its portion. Many homeowners have deductibles ranging from $500 to $2,000. A deductible of $500 for a claim on a repair costing $5,000 means that you’ll need to pay $500 before Liberty Mutual pays the remaining amount of $4,500. If your deductible is $2,000, you’ll pay $2,000 before the company pays $3,000.

Deductibles don’t apply to all types of home insurance coverage from Liberty Mutual, such as personal liability coverage and insurance for additional living expenses.

Lowering your deductible amount typically increases your premium because Liberty Mutual will be responsible for more money for a claim than you will be. Similarly, raising your deductible can lower your premium. When you get a quote from Liberty Mutual, you can estimate how much a deductible change will affect your policy’s premium.

Discounts

Liberty Mutual features several discounts for homeowners to save on their home insurance. Like many other homeowners insurance companies, Liberty Mutual provides some standard discounts, like savings for having multiple policies with Liberty Mutual, reduced payments for enrolling in auto-pay, and a discount for having a paperless account.

Homeowners can also get discounts for being claims-free with their previous insurance carrier for at least five years. And, once they switch over to a Liberty Mutual policy, remaining claims-free for at least three years could yield more savings.

Liberty Mutual gives homeowners savings for things related to their homes, too, like having a new roof installed. Discounts are also available for a newly purchased home or having substantial repairs or renovations done on the home.

Additionally, quoting and switching over to Liberty Mutual before a current homeowner’s insurance policy expires can lead to a discount on the homeowner’s Liberty Mutual policy.

Be sure to call customer service to speak with a Liberty Mutual representative when finalizing your quote to ensure you get all the discounts on your policy for which you’re eligible.

How To Get a Quote

Getting a quote from Liberty Mutual can help you quickly compare its premium prices with those from other companies so that you can find the best homeowners insurance for your needs. To get a quote from Liberty Mutual, call 844-411-9591, and a representative will walk you through the process.

You can also get a quote on your own via the website by navigating to the ‘Shop Insurance’ link and clicking ‘Home.’ Enter your zip code on the information page, and click the ‘Get my price’ button to navigate the online quote system.

How To File a Claim

Liberty Mutual has a dedicated claims center on its website that you can visit by clicking the ‘Claims’ link at the top of the page. After logging into your account, you can file a claim and track the status of a current claim. Alternatively, call 800-225-2467 if you’d prefer a Liberty Mutual representative to assist you with the claims process.

Liberty Mutual Mobile App

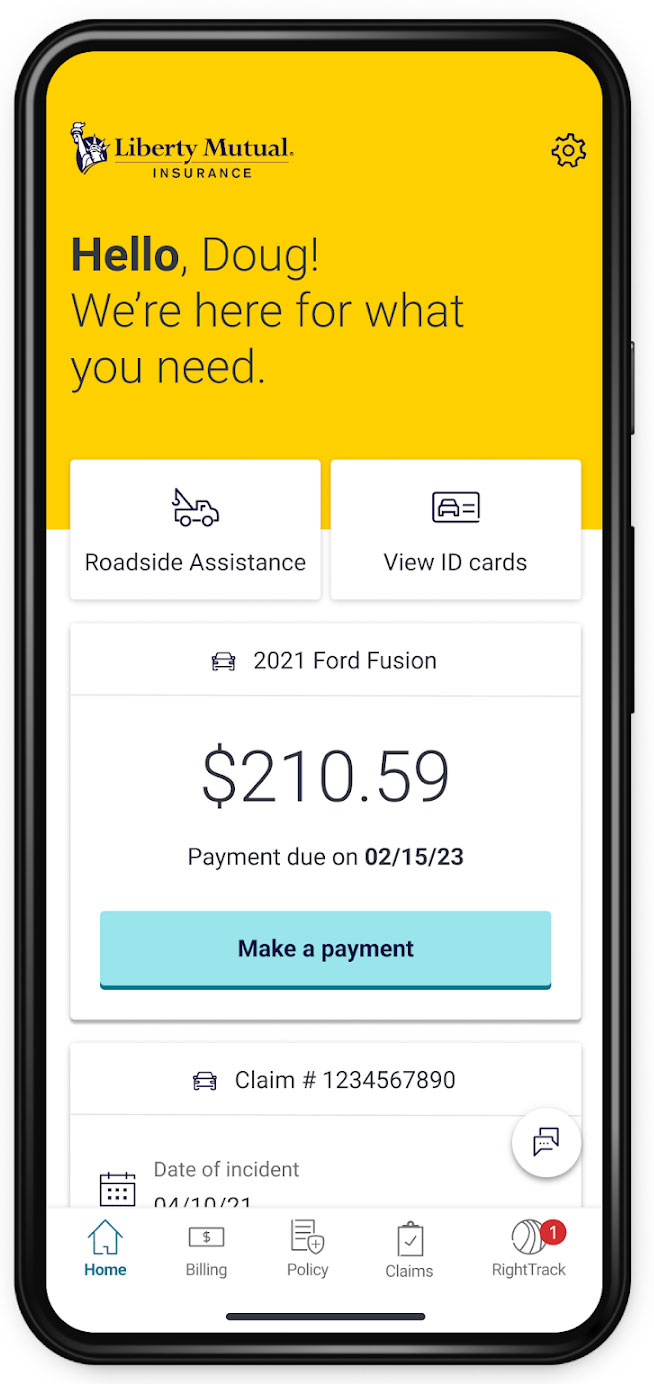

To make managing your homeowners insurance policy easy no matter where you are, Liberty Mutual offers a mobile app to customers. The app is available in Google Play and the App Store.

Using the app, you can pay your bill, track the status of a claim, or even file a new claim. The app also gives you digital access to your insurance policies and ID cards, so you don’t have to worry about bringing paper copies with you when you need them.

Is Liberty Mutual Homeowners Insurance Right for Me?

Overall, Liberty Mutual customers seem happy with their homeowners insurance through the company. As a well-known insurance provider, Liberty Mutual provides reliable coverage and excellent customer service to help customers work through a claim and make the most of their policy features.

Although pricing for Liberty Mutual homeowners insurance policies may run a bit higher than average for some homeowners, the company does offer excellent savings when you bundle other types of insurance, like your life insurance or car insurance policies. When you get a quote with Liberty Mutual for homeowners insurance, it might be worth your time also to get a quote for switching your other insurance policies to Liberty Mutual.

We also encourage you to compare your Liberty Mutual insurance quotes with quotes from other companies to help you determine the best path. Remember to make coverage limits the same when getting your quotes to have the most comparable pricing between companies. Also, consider the potential discounts you can have on your policy with each company and how changing your deductible might affect your premium.