Budgeting apps and spending trackers provide an overview of your income and expenses to help you stay on budget, meet your savings goals, and more. Several apps of this type are available in app stores, each with different features and various ways of helping users plan and stick to a budget.

Top Debt Relief Options

Budgeting Apps: Top Winners

Our research team has researched the best budgeting apps, narrowing them down to the following top contenders. We review them here to help you find your best option.

Best Budgeting Apps and Spending Trackers

Mint- Rocket Money

- YNAB

- Goodbudget

- Monarch Money

- PocketGuard

- EveryDollar

- Quicken Simplifi

- Honeydue

- Oportun

What Happened to Mint?

Mint was one of the first apps of its kind, allowing users to plan a budget and track their spending while growing their savings by meeting budgeting goals. Although Mint was acquired in 2020 by Credit Karma, it continued functioning as the Mint app that users knew and loved. However, as of January 1st, 2024, Mint became completely absorbed into Credit Karma, with the app transitioning into the Credit Karma app.

The Credit Karma app has some notable features for managing money, but it’s not necessarily a budgeting app like Mint once was. In fact, many of Mint’s most popular features specifically for budgeting and helping people spend less money are no longer available through the Credit Karma app. For these reasons, Mint is no longer on our list of the best budgeting apps.

Best Budgeting Apps

We narrowed down the best budgeting apps to the following options, which we chose because of their numerous features, pricing, ratings, and overall ability to help people with different types of personal budgets.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

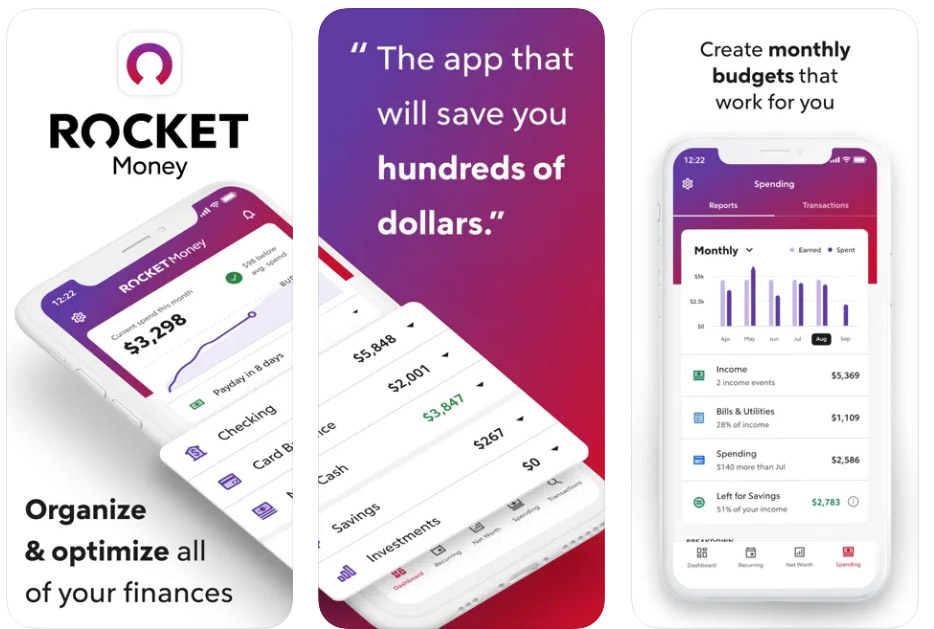

Rocket Money

Rocket Money is a money management app that lets you connect your financial accounts, keeping all your expenses and income in one place for easy tracking. The app also includes multiple money management features, like automatic savings, goal-setting, and bill negotiation.

Pros

- Automatic savings plans

- Pay-what-you-want model

- Can automatically cancel subscriptions and negotiate bills

- 7-day free trial

Cons

- Bill negotiation costs at least 30% of your money saved

- Limited free features

- Live chat with customer service is only guaranteed for Premium members

Highlights

Type of Personal Budget: Traditional budget

Best For: Managing subscriptions

Cost: $4-$12/month

Free Trial: Yes

Links to Accounts: Yes; Bank, investment, and credit card accounts

Apple App Store Rating: 4.2/5

Google Play Rating: 4.3/5

Why We Like Rocket Money

Not only does Rocket Money help you stay on budget, but it also actively looks for potential issues in your expenses – namely duplicate and unwanted subscriptions. By tracking your spending accounts, Rocket Money can identify these areas that can lead to unnecessary spending, alert you to the issue, and cancel subscriptions for you.

Pricing & Plans

Cost: $4-$12/month

Rocket Money connects to your checking, savings, investment, and credit card accounts to track your income and expenses and find ways for you to save money. Rocket Money can also negotiate some of your bills, like a subscription, internet, or cable bill, that you’d like to lower and help you get refunds for overdraft and late fees.

Rocket Money is free to download and get started with, but access to premium features, like creating multiple budgets, viewing your credit reports, and Cancellation Concierge, costs $4 to $12 per month. Rocket Money also charges between 30% and 60% of the money it helps you save by negotiating a lower bill. The good news is that you can choose how much you pay for Premium and for cancellations. If you can only afford $4 per month, you can pay that, for example.

Rocket Money does have a 7-day free trial for any new member who wants to test the app’s features.

Read the full Rocket Money review >>

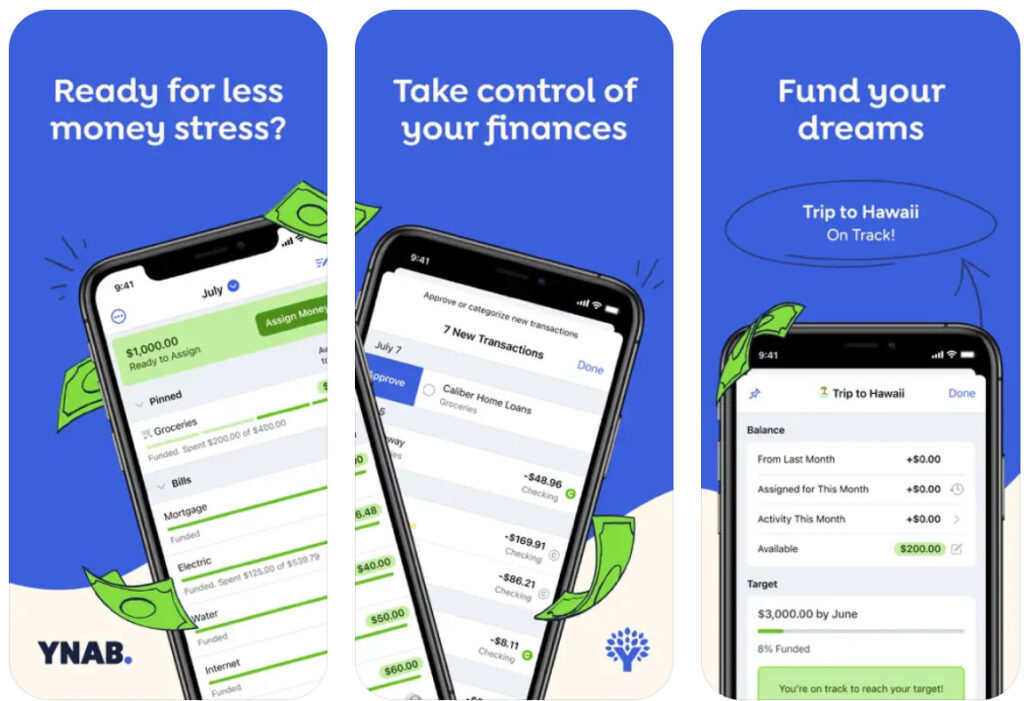

YNAB

Short for You Need a Budget, YNAB helps you find a place for every dollar you earn by using a zero-based budgeting system that divides your income into bills, savings, and more.

Pros

- Easy to customize your goals

- Connects to more than 100 financial institutions

- Up to six people can share one account

- Generous 34-day free trial

Cons

- Zero-based budgeting can feel restrictive for some

- No bill pay features

- Can’t track investment accounts

- No free version

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Accounting for every dollar

Cost: $14.99/month or $99/year

Free Trial: Yes

Links to Accounts: Yes; Bank accounts

Apple App Store Rating: 4.8/5

Google Play Rating: 4.7/5

Why We Like YNAB

YNAB has made its mark on the budgeting world because of its dedication to assigning every dollar a “job” using zero-based budgeting. By doing so, it helps you account for all your cash, giving your money a purpose beyond just paying bills.

Pricing & Plans

Cost: $14.99/month or $99/year

YNAB doesn’t offer a free version, but it does have a 34-day free trial to let you test it for more than a full month to ensure that it has what you need. If you decide to pay for the app, YNAB costs $14.99 per month or you can get a discount by paying annually for $99, saving more than $80 on a subscription. One subscription grants access to up to six people, allowing families and friends to budget together.

Once you connect your bank accounts to YNAB, the app tracks your income and transactions. You create goals for all of your cash, like paying bills, saving for a vacation, or moving money to a retirement fund. YNAB will then keep track of how close you are to your savings goals. And, if your income ever changes or you want to change your goals, you can do that easily via the app, and YNAB will help you adjust.

YNAB also has numerous other features for money management, like debt calculators, live workshops, and visual reports.

Read the full YNAB review >>

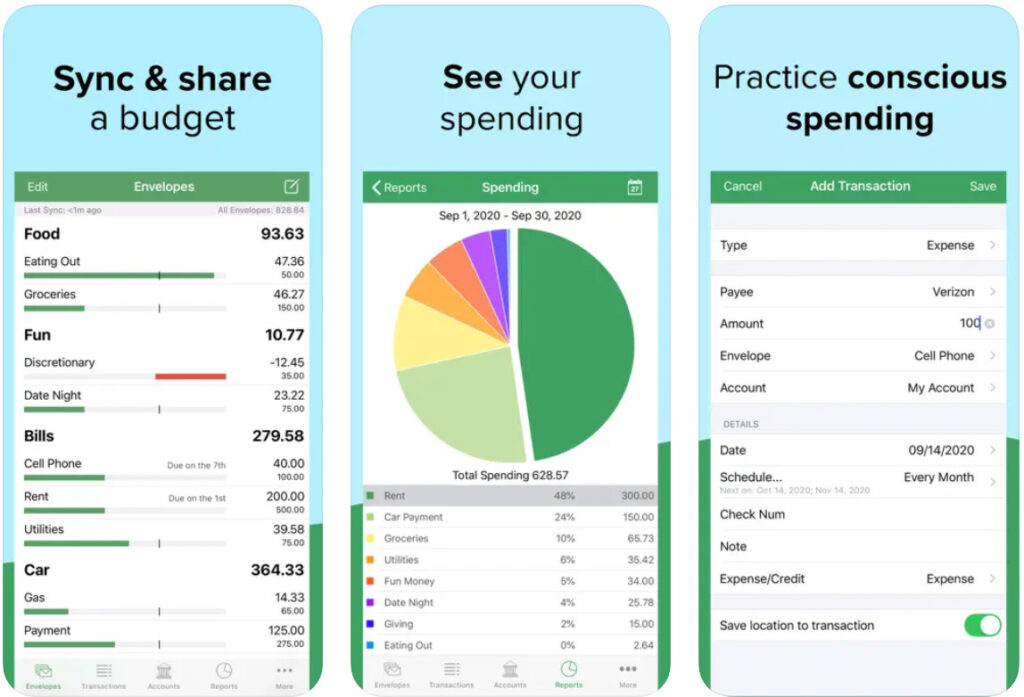

Goodbudget

Goodbudget is based on the envelope budgeting system, in which you place the money you’ve earned into envelopes for different purposes, like paying bills or saving for a car.

Pros

- Free version available

- Spending reports

- Numerous money management resources

- Sync and share capabilities for budgets

Cons

- No investing tools

- Limited financial reporting

- Bank connections are only available with premium version

Highlights

Type of Personal Budget: Envelope system

Best For: Manual budgeting

Cost: $0-$10/month

Free Trial: No

Links to Accounts: Yes; Bank accounts and credit cards

Apple App Store Rating: 4.6/5

Google Play Rating: 4.1/5

Why We Like Goodbudget

Goodbudget is a simplified version of a budgeting app, which is ideal for someone who just needs a little help organizing their budget. You can even share your budget with others, like your partner or friends, to help you stay on track with your savings goals.

Pricing & Plans

Cost: $0-$10/month

Goodbudget has a free version allowing up to 20 budgeting envelopes for you to divide your cash into. Free users can use the app on two devices and get one year of budgeting history. Or, opt for the premium plan for $10/month or $80/year, which gives you unlimited envelopes and accounts and allows you to sync the app to five devices.

Connecting a bank or credit card account is also only available for premium users, which lets you track your transactions and keep a closer eye on your finances. Otherwise, free users can manually add transactions and move their money to envelopes, similar to how the envelope budgeting system was intended to work, only with a little digital help.

Read the full Goodbudget review >>

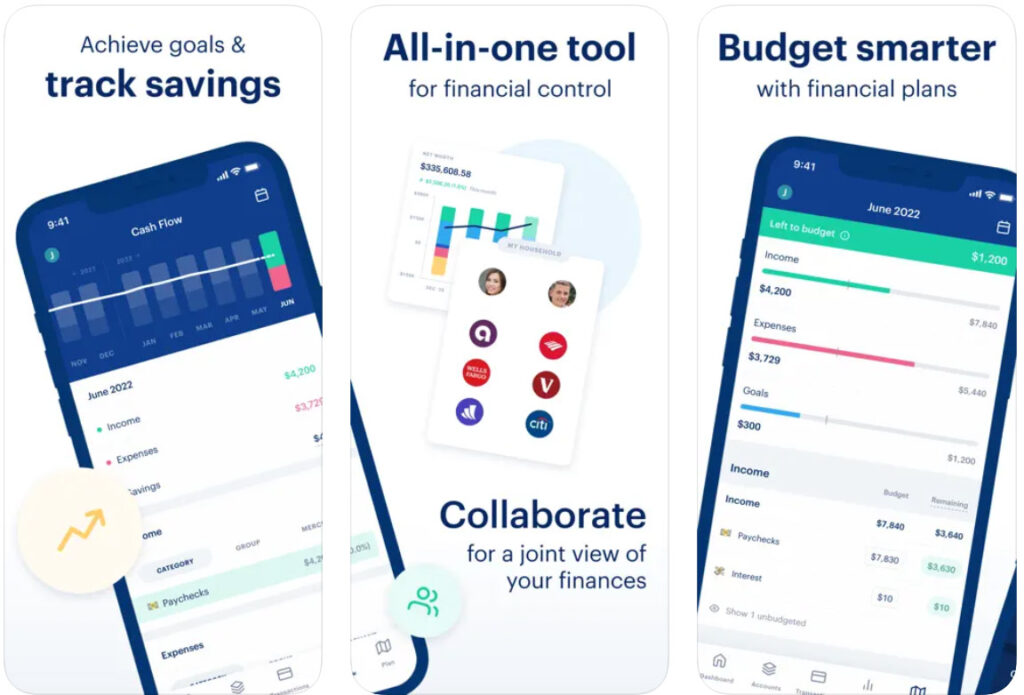

Monarch

Also known as Monarch Money, Monarch is one of the most comprehensive budgeting apps for anyone who wants to pinpoint where each dollar goes and plan for their future finances.

Pros

- Customizable dashboard

- Multi-user collaboration

- Investment tools to manage your whole portfolio

- Detailed calendar for bills and subscriptions

Cons

- Comes with a learning curve

- Short free trial

- Some users have reported issues with duplicate transactions

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Shareable budgeting

Cost: $14.99/month or $99.99/year

Free Trial: Yes

Links to Accounts: Yes; Bank accounts, loans, credit cards

Apple App Store Rating: 4.9/5

Google Play Rating: 4.7/5

Why We Like Monarch

Although several budgeting apps allow for sharing budgets with others, Monarch Money is specifically designed to play well with people who want to share their budgeting goals. Both parties get their own login information but can sync their accounts together to view joint reports and keep their budget on track.

Pricing & Plans

Cost: $14.99/month or $99.99/year

You can use a free version of Monarch, but it’s highly limited. The paid version costs $14.99/month or $99.99/year, which includes unlimited account syncs, investment and subscription tracking, custom categories and reports, and unlimited collaborators.

A 7-day free trial is available by default, and Monarch occasionally offers longer trials for up to 30 days.

After connecting your bank, credit card, and loan accounts to Monarch, the app organizes your financial transactions using AI to categorize them for easy viewing. You can then create custom categories to budget your cash flow, making space for everything from housing repairs to shopping trips. Monarch Money uses numerous visual charts and diagrams to help you stay on top of your finances and adjust your spending or savings goals, if necessary.

Sign up for Monarch Money today!

Read the full Monarch Money review >>

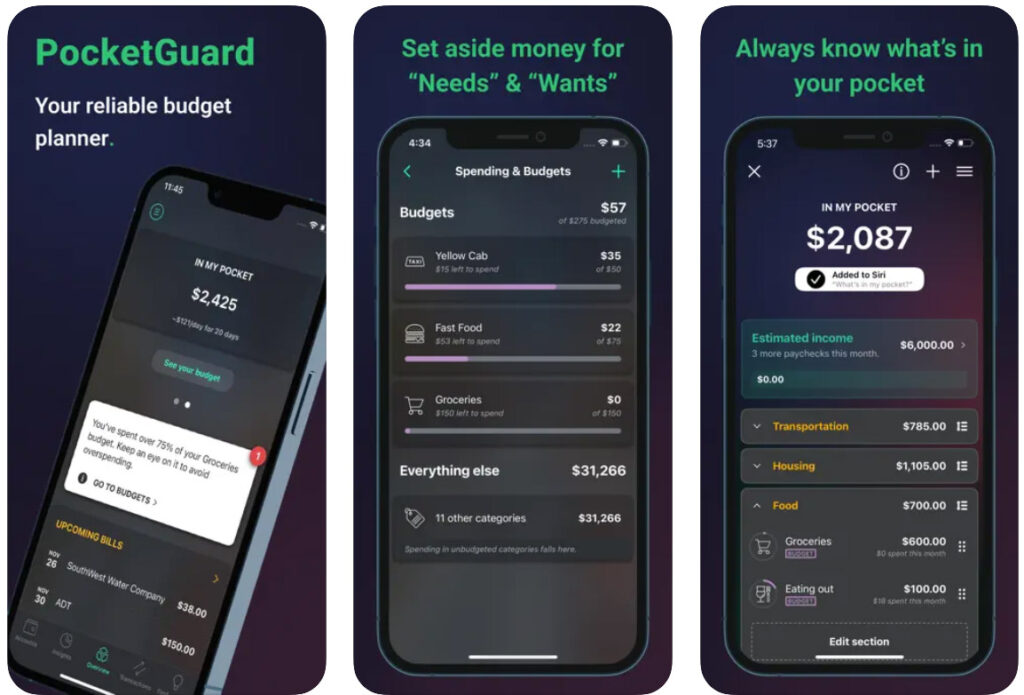

PocketGuard

PocketGuard is a money management and budgeting app that tracks income and expenses and helps you separate your money into savings goals.

Pros

- Customizable budgeting

- Fraud detection and alerts

- Personalized spending reports

Cons

- Transaction editing can be time-consuming

- Free version only allows one account sync

- Some users report issues with account disconnections

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Fraud detection

Cost: $12.99/month or $74.99/year

Free Trial: Yes

Links to Accounts: Yes; Bank and credit card accounts

Apple App Store Rating: 4.6/5

Google Play Rating: 3.8/5

Why We Like PocketGuard

In addition to the typical tracking and budgeting tools you’d expect to see in a budgeting app, PocketGuard also detects fraud. The app monitors suspicious activity happening in your accounts and alerts you and your financial institutions to protect you against potential fraud.

Pricing & Plans

Cost: $12.99/month or $74.99/year

PocketGuard has a limited free version, but to get the most out of PocketGuard, you’ll want its paid subscription, which costs $12.99/month or $74.99/year. This includes unlimited budget categories, visual pie charts, unlimited bank connections, and fraud monitoring.

Once you connect your accounts to PocketGuard, the app can start categorizing your transactions, and you can begin setting savings goals for your cash. You’ll also get access to the In My Pocket feature, which lets you quickly see how much money you have left to spend after you allocate your cash where it needs to go.

Need to get out of debt? PocketGuard also has a debt payoff plan feature where you can customize a plan to help you pay off a credit card, loan, or multiple debts.

Read the full PocketGuard review >>

EveryDollar

EveryDollar is made by Ramsey Solutions, the company spearheaded by financial guru Dave Ramsey. The budgeting app offers a simplified solution to tracking finances and staying on budget.

Pros

- User-friendly interface

- Available financial coaching

- Split transactions into different categories

- Sync between multiple users or devices

Cons

- No bank connections for free accounts

- Pricey monthly cost

- Some users note an issue with duplicate transactions appearing

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Financial coaching from experts

Cost: $17.99/month or $79.99/year

Free Trial: Yes

Links to Accounts: Yes; Bank accounts

Apple App Store Rating: 4.7/5

Google Play Rating: 3.5/5

Why We Like EveryDollar

Premium EveryDollar users can connect with financial experts to ask questions or get financial coaching to help them on their savings and credit-building journeys. Group financial coaching calls are available through the app to boost your financial literacy.

Pricing & Plans

Cost: $17.99/month or $79.99/year

EveryDollar has a free version with limited features, like creating a custom budget and syncing budgets between devices. However, you’ll need to enter all transactions for the app to consider manually.

With the premium version – which costs $17.99/month or $79.99/year – you’ll access bank connections to have the app find and categorize your transactions automatically. Premium also comes with custom savings goals, due date reminders for bills, group financial coaching calls, and custom reports.

You can try the premium version free for 14 days by signing up for the trial.

Read the full EveryDollar review >>

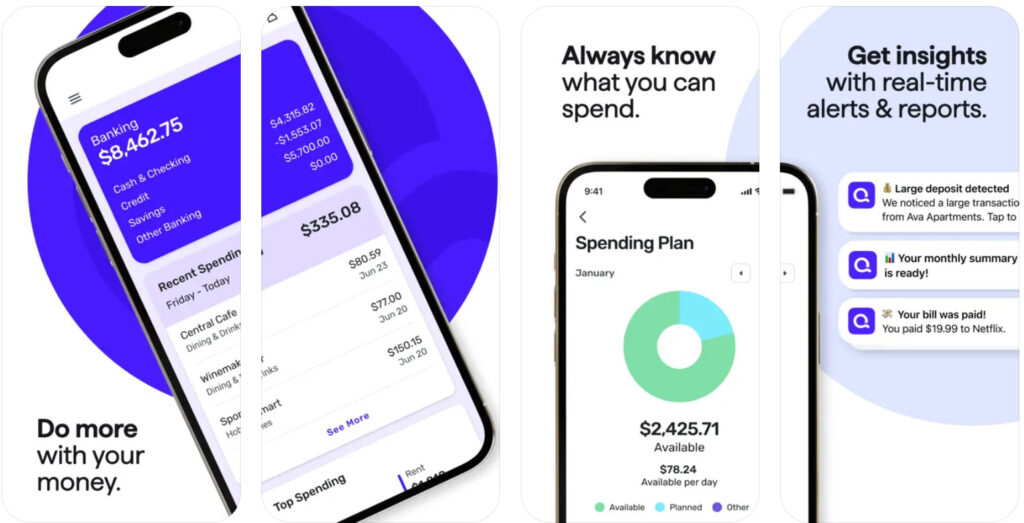

Quicken Simplifi

Made by personal finance software Quicken, Simplifi is a budgeting app that automates your budget and savings, lets you know how much you have left to spend, and provides insights about your overall financial picture.

Pros

- Helpful real-time alerts

- Clean and simple user interface

- Shareable accounts

- Bank-grade security

Cons

- No free version

- No monthly billing option

- Doesn’t offer credit score monitoring or alerts

Highlights

Type of Personal Budget: Multiple types of budgets are supported

Best For: Switching between budgeting systems

Cost: $3.99/month

Free Trial: No

Links to Accounts: Yes; Bank, credit card, and investment accounts.

Apple App Store Rating: 4.1/5

Google Play Rating: 4.7/5

Why We Like Quicken Simplifi

Quicken Simplifi works with whatever type of budget you like best, whether that’s a zero-based budgeting system or the pay-yourself-first method. When you set up a Simplifi spending plan, you have the power to split your money how you’d like to best meet your savings goals.

Pricing & Plans

Cost: $3.99/month

Quicken Simplifi doesn’t offer a free trial, but it does provide you with a 30-day money-back guarantee, allowing a full refund if you decide it’s not what you’re looking for. If you choose to buy a subscription, you’ll pay $3.99/month billed annually, making it $47.88/year. However, Simplifi frequently offers deals discounting a subscription to just $2/month or $24/year.

Quicken Simplifi provides typical budgeting tools you want to see from personal finance software, including automatic bank and transaction syncing, spending reports, custom savings goals, and custom transaction categories.

However, you can use Simplifi with any budgeting system you prefer. After syncing your accounts, the app creates a personalized spending plan for you, which you can customize to meet your financial goals. As you use it, you’ll get alerts when Simplifi notices unusual activity, you get close to a savings goal, or your spending money balance gets low.

Read the full Quicken Simplifi review >>

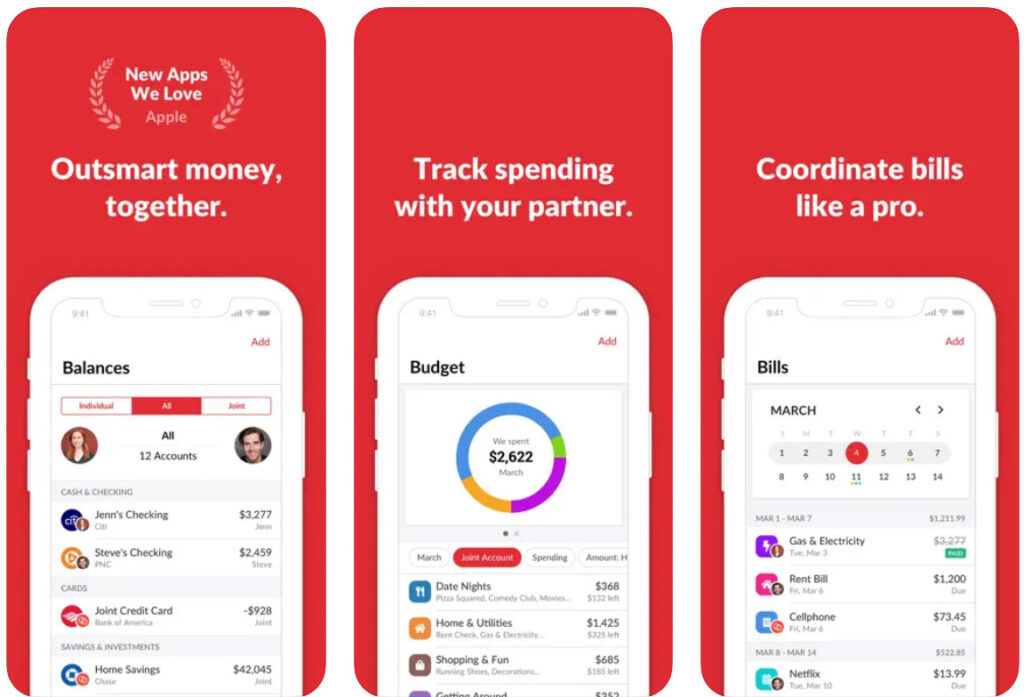

Honeydue

Honeydue gives couples a simple way to manage their finances together, pay each other their share of the bills, and ask about unexpected charges.

Pros

- Supports connections to over 20,000 financial institutions

- Messaging and transaction sharing between couples

- Free to use

- Split and pay expenses with partners

Cons

- In-app advertising

- Does not include financial planning tools

- No tech support

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Couples who budget together

Cost: Free

Free Trial: No

Links to Accounts: Yes; Bank, credit card, loan, and investment accounts

Apple App Store Rating: 4.5/5

Google Play Rating: 3.6/5

Why We Like Honeydue

Couples can collaborate on their finances inside Honeydue while tracking both individual and joint accounts in the app. Honeydue offers unique features, like text messaging and the ability to pay a partner for a portion of a bill, to help couples stay on the same page.

Pricing & Plans

Cost: Free

Honeydue is free to use with no hidden fees or subscriptions. However, users can choose to “tip” the app each month for as little as $0.99 as a thank-you for the service.

Once you connect your accounts to Honeydue, you and your partner can view transactions as they happen in real time, get alerts for bill due dates, and view balances on all connected accounts. Custom budgeting is also available for both of you to work on your savings goals together.

Honeydue also allows you to message one another with questions about transactions, split transactions with one another, and pay each other conveniently through the app.

Read the full Honeydue review >>

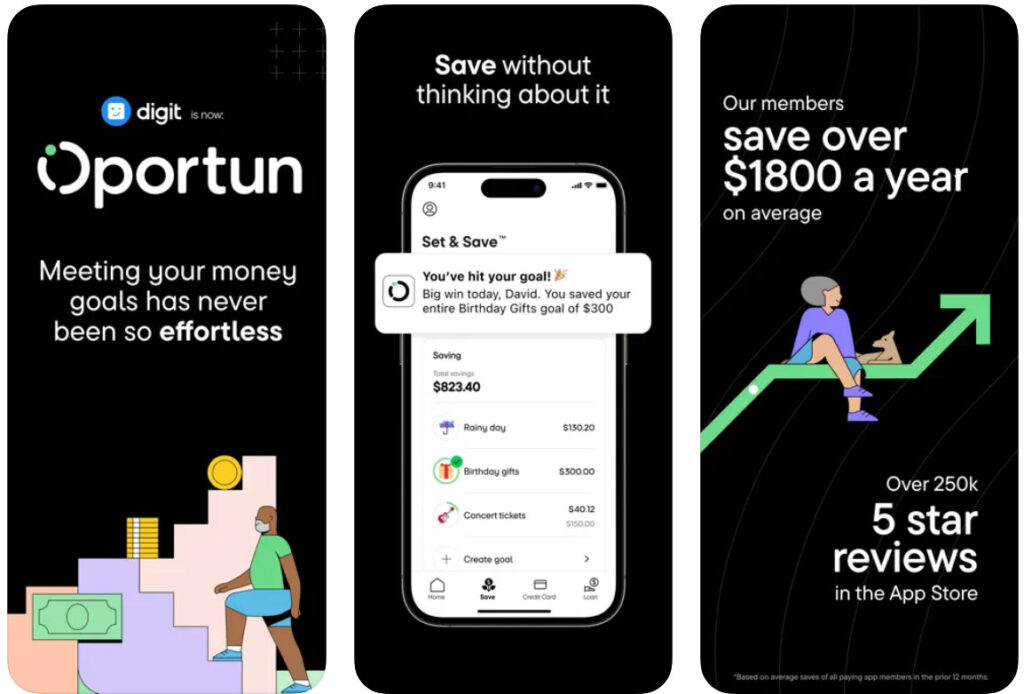

Oportun

Formerly Digit, Oportun is an app designed to help you save and invest your money, apply for personal loans, and build or repair your credit.

Pros

- Automated savings

- Set custom savings goals

- Customizable loan amounts up to $10,000

- Free for managing loans and credit cards

Cons

- Credit card limits cap at $1,000

- Automatic savings amounts can be difficult to predict

- Disconnection from bank accounts is a problem for some users

Highlights

Type of Personal Budget: Goal-based budgeting

Best For: People with loans

Cost: $0-$5/month

Free Trial: Yes

Links to Accounts: Yes; Bank, credit card, loan, and investment accounts

Apple App Store Rating: 4.7/5

Google Play Rating: 4.1/5

Why We Like Oportun

Oportun is mostly an app designed for people who have an Oportun loan or credit card, but it also has additional tools to keep you on track with your budget and savings goals. Set your own savings goals, like a vacation or paying off a vehicle, and Oportun will help you meet them by tracking your income, learning how much you can afford to put towards savings, and automatically transferring your money over.

Pricing & Plans

Cost: $0-$5/month

First and foremost, Oportun is a money management app for your Oportun loans or credit cards. Use the app to view your balances, make payments, or set up autopay. The app is free when you use it for only these features, and you can apply for loans or credit cards directly through the app.

If you want to add automated savings features, you’ll pay $5/month. This lets you create custom savings goals and have Oportun move amounts you can afford over to savings, sometimes multiple times a week, getting you closer and closer to reaching your financial goals.

Read the full Oportun review >>

Hiatus

Founded in 2016, the goal of Hiatus is to simplify your personal finance management. The app lets you to monitor your net worth, manage subscriptions, and negotiate bills. It connects to various financial accounts, including checking, savings, credit cards, and investments.

Pros

- Actively negotiates better rates for services

- Identifies and cancels unused subscriptions

- Uses 256-bit encryption to safely connect bank accounts

Cons

- Users must pay fees to access premium features

- Only provides email support

- The interface can be confusing for some

Highlights

Type of Personal Budget: Goal-based

Best For: Improving financial habits and cash flow

Cost: $0-$21/month

Free Trial: No

Links to Accounts: Checking, savings, credit cards, and investment accounts

Apple App Store Rating: 4.2/5

Google Play Rating: 3.9/5

Why We Like Hiatus

Hiatus simplifies budgeting by providing a clear view of your finances. You can link your financial accounts to the app, track spending, set savings goals, and monitor net worth. The app also helps manage subscriptions and negotiates bills to reduce expenses.

Pricing & Plans

Hiatus offers both free and premium plans:

- Free Plan: Includes basic features like savings goals, budgeting, and net worth tracking.

- Premium Plan: Costs $10/month or $48/year. It includes additional features like subscription cancellations, bill negotiations, smart budgeting, and rate comparisons for loans and credit cards.

Hiatus is designed to help users spend less and save more money by providing a comprehensive view of their financial health.

Read the full Hiatus review >>

How To Choose the Best Budgeting App

If you’re having trouble comparing the best budgeting apps to find the right one for you, here are a few things to consider.

First, read reviews on the functionality of the app itself. Is it easy to navigate, find the tools you want to use, and keep your accounts connected? You want to make sure it’s reliable and secure, especially if you end up paying for it.

Next, compare costs. Most budgeting apps are more affordable when you buy them annually rather than monthly, so consider how much you might save by opting for an annual plan. Also, use a free trial if it’s available to make sure the app has all the features you need before buying it.

Finally, if you plan to share your budget with others, look for apps that offer syncing between devices and other users. This is a good idea if you want to budget with a partner or family member.

Are budgeting apps safe?

The best budgeting apps are safe to use. Look for apps with 256-bit encryption, which is also known as bank-grade encryption, to protect your financial accounts, passwords, and personal information.

Do budgeting apps really work?

When you remember to use them as part of your daily financial management process, budgeting apps work well. The best budgeting apps help you track your income and expenses and save for custom goals through easy-to-use tools and automation.

What is the best free budgeting app?

Although several budgeting apps have free trials, not many of them are entirely free. If you don’t want to pay for an app, try Honeydue, which lets you choose an amount to pay each month ($0 is an option), or Goodbudget, which has a free version for basic savings.

What is a safe budgeting app?

A safe budgeting app has 256-bit encryption to protect your accounts and information. All apps on our list, including Rocket Money, Everydollar, and PocketGuard, offer this level of encryption.

What is the best budgeting app without linking a bank account?

Most budgeting apps don’t require you to link your accounts, allowing you to enter your transactions manually. Goodbudget and EveryDollar are good examples of budgeting apps that don’t require account linking.