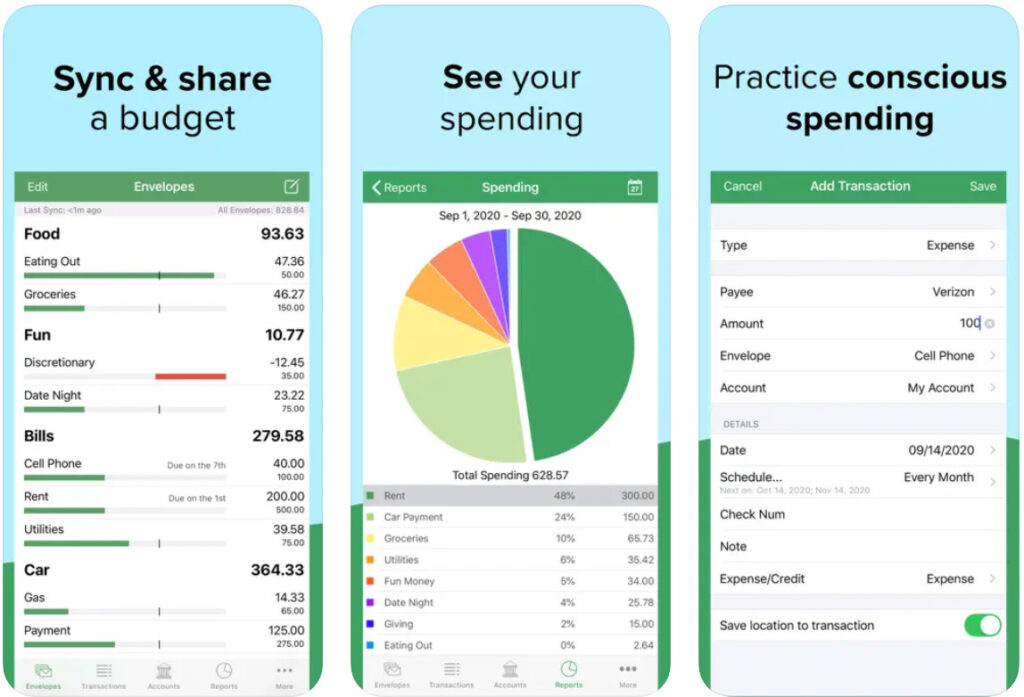

Thanks to budgeting apps like Goodbudget, you no longer need to stuff your cash into different envelopes marked for savings, groceries, bills, and more. Goodbudget digitizes the old envelope budgeting system, allowing you to move money between envelopes using your mobile device and even share your budget and savings goals with a friend or family.

Top Debt Relief Options

Goodbudget Overview

Goodbudget was founded in 2009 in San Francisco as an app that took the typical budgeting experience online with virtual budgeting envelopes. Since its start, Goodbudget has expanded its feature list, adding things like bank transaction syncing, shareable budgets, and multiple accounts.

Pros

- Free version available

- Spending reports

- Numerous money management resources

- Sync and share capabilities for budgets

Cons

- No investing tools

- Limited financial reporting

- Bank connections are only available with premium version

Highlights

Type of Personal Budget: Envelope system

Best For: Manual budgeting

Cost: $0-$10/month

Free Trial: No

Links to Accounts: Yes; Bank accounts and credit cards

Apple App Store Rating: 4.6/5

Google Play Rating: 4.1/5

Goodbudget follows a mission they’ve coined as “The Goodbudget Way.” This mission commits to helping users learn healthy financial habits so that they can pull themselves closer to a sound financial future. In addition to its budgeting app, Goodbudget aids this mission by providing financial resources covering topics like how to get out of debt, how to spend less money, smart ways to use a tax refund, and how to use your money charitably.

Why We Like Goodbudget

From the moment you pick up Goodbudget, you can start using it. There’s no learning curve, as everything is very straightforward, and the simplified interface makes it easy to navigate through each feature.

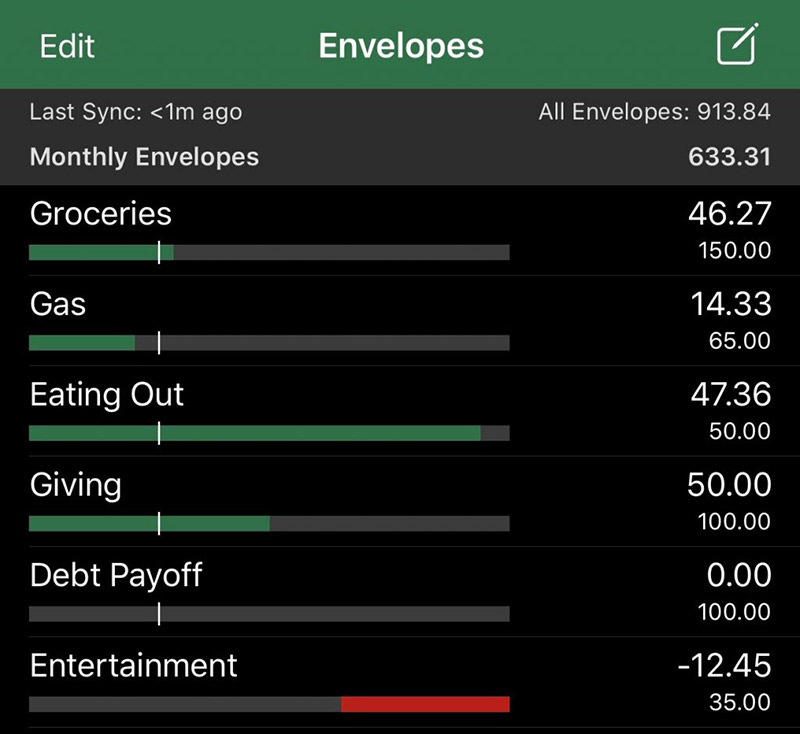

Because Goodbudget uses the envelope system of budgeting, it helps you create a plan for your cash rather than just tracking and monitoring your income and expenses. Move your money where you see fit, giving you a helpful visual of how much you can spend in each category.

We also love that Goodbudget has a free version that could work for most people without needing to pay for extra features. It offers up to 20 spending envelopes and access to the app on two devices.

Who Is Goodbudget Best For?

Goodbudget is an incredibly easy app to use, making it one of the best budgeting apps for people who aren’t super techie or don’t have much experience with using apps or budgeting. Budgeting is performed manually and nothing is automated.

The app uses the envelope budgeting system, which is one of the first and most simplified types of personal budgets to use. Anyone currently using envelopes to organize their money and set spending and saving goals should find it easy to switch to the digitized version Goodbudget offers.

Goodbudget is also helpful for people who want to budget together, like parents with their children or spouses. You can sync your financial accounts and budgeting goals into one Goodbudget account to keep multiple people on track.

Pricing & Plans

Goodbudget has a free version that gives users 20 budgeting envelopes, access to one account on two devices, debt tracking, community support, and up to one year of financial history.

| Feature | Free Version | Premium Version |

|---|---|---|

| Monthly Cost | Free | $10 |

| Annual Cost | Free | $80 (save $40 annually) |

| Budgeting Envelopes | 20 envelopes | Unlimited envelopes |

| Accounts Supported | Access to one account | Unlimited accounts |

| Device Access | Two devices | Up to five devices |

| Transaction Syncing | Manual entry required | Automated syncing |

| Debt Tracking | Included | Included |

| Financial History | Up to one year | Up to seven years |

| Support | Community support | Email and community support |

A free Goodbudget account can be a good option for someone looking to transition from a paper budget to a digital budget, although the free version doesn’t offer financial account syncing, so you’ll need to add transactions manually.

A paid subscription to Goodbudget costs $10 per month or $80 for an entire year, saving $40 when you subscribe annually. This bumps up your features by allowing automated transaction syncing, unlimited envelopes, and unlimited accounts on up to five devices. Premium users also get up to seven years of financial history and access to email support rather than just community support.

Although there’s no free trial, you can use the free account for as long as you want to decide if it’s right for you before stepping up to a Premium account.

How Goodbudget Works

Goodbudget’s philosophy is known as The Goodbudget Way, which is the idea that everyone should have a “Why” behind their desire to budget and see money as more than just dollars and cents. Goodbudget reminds its users that budgeting is a way of life and should help them develop a healthier relationship with money instead of making them stressed or anxious about spending.

Goodbudget uses the envelope budgeting system, which lets you split your income into different envelopes for separate goals. For example, one envelope might be for your grocery budget for the month, while another might cover gas, and another is for saving toward vacation. The purpose of the envelope system is to give all of your money a purpose while making it easy for you to see what needs to go where and how much you have available in each envelope to spend.

Once you download the Goodbudget app and sign in, you’ll set your budgeting period – weekly, monthly, or quarterly, for example – and begin creating envelopes. Goodbudget helps you create your envelope budgets based on your current income or your typical spending. In addition to regular envelopes, you’ll also get access to goal and annual envelopes. Goal envelopes are for one-time savings, like saving for a home, while annual envelopes are for things you want to save toward for the year, like your auto insurance premium. Goodbudget can remove a specified amount from your income to that auto insurance premium envelope every month to help you save toward that goal by its due date.

Next, you’ll link your accounts for automatic bank syncing if you have a premium account. Click the link to add a new account in the app, and the setup wizard will walk you through connecting your bank account. If you have a free account, you’ll need to manually enter how much is in your account and your expenses. In the app, look for the notepad icon in the upper right corner of the screen to manually enter and edit your transactions.

Goodbudget lets free users have one account viewable on up to two devices, so partners can log into the same account to view their income and budgets. Premium users access unlimited accounts on up to five devices, making it easier to sync and share budgets with one another. Once your budget is set up through Goodbudget, it will automatically update and sync to your partner’s connected account, keeping you both on track if one person adds or removes money from any envelope.

Because Goodbudget is about more than just budgeting, the app also offers several financial resources for its free and paid members, including free articles, financial courses, and information about various budgeting goals. There’s also an online help center and user-contributed forums if you ever get stuck or want to chat with others about budgeting with Goodbudget.

How To Sign Up for Goodbudget

To begin your journey with Goodbudget, sign up on the website. Enter the email and password you want to use for your account, and choose whether you want a free or premium account. Then, click the button to complete your sign-up. If you choose a premium account, the website will direct you to the payment area to pay for your subscription.

You can also sign up for Goodbudget by downloading the app and clicking the sign-up button.

How To Contact Tech Support

Goodbudget tech support is available via email at [email protected]. This is the best method to use when you need personalized support for an issue with the app or your account.

If your question is more general, you can visit the help center to read support guides and articles about using Goodbudget and navigating through each feature. Or, post a question on the online discussion board to get help from other Goodbudget users. You can read questions and responses without being logged in, but you’ll need to sign into your account to post a question or reply.

How To Cancel Goodbudget

Goodbudget offers a full refund for anyone who purchased a subscription and decides the app isn’t right for them, but you need to request your refund within 30 days of starting your subscription. To cancel, log into your account on the website or app, visit your account page, and choose the cancel option.

How Does Goodbudget Compare?

Goodbudget’s free version is an excellent perk for someone looking for simplified budgeting and doesn’t mind inputting their transactions manually. However, like most budgeting apps, you’ll need to pay for the full version to get access to convenient automatic transaction syncing that makes budgeting apps worth their while.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

Goodbudget offers lots of financial resources that other budgeting apps don’t, which could make it a good option for beginning budgeters and people just starting out on their personal finance journey.

Is Goodbudget Worth It?

If you’re already using the traditional version of the envelope budgeting system and you want a way to move that system online in a more digital-friendly way, Goodbudget could be the answer. It’s also free to try, so you can get to know the app and how it works before jumping into a subscription. Plus, you can get a full refund of a premium subscription if you determine that the app doesn’t meet your needs after paying. Therefore, there’s nothing to lose if you try Goodbudget.

Is the Goodbudget app free?

The Goodbudget app has a completely free version that you can start with after downloading the app. The free version offers multiple budgeting envelopes for you to manage your money and savings goals, but you’ll need to enter your financial transactions manually. If you upgrade to the premium version, you’ll get more envelopes and automatic bank syncing for added convenience.

Can I track investments on Goodbudget?

No, Goodbudget does not allow you to connect your investment accounts for tracking. Instead, Goodbudget focuses on your regular income and expenses, creating a simpler budgeting app for beginners.

How do I group envelopes in Goodbudget?

Grouping envelopes in Goodbudget helps you see your total spending and progress in a specific category filled with subcategories, such as a Food envelope that includes money envelopes for dining out, groceries, and work lunches. Edit your envelope groups by navigating to the envelope editing screen from the website or app and selecting “Group.” Select the envelopes you’d like to group.

What does “Device limit reached” mean in the Goodbudget app?

If you get an error message saying “Device limit reached” in the Goodbudget app, it means that you’ve used the maximum number of devices for your account. Free accounts can access their account from two devices, while premium accounts can access the app from up to five different devices. If you plan to use Goodbudget on multiple devices, it may be best to upgrade to a premium account.

Why aren’t my transactions showing in my Goodbudget account?

After linking a bank account to Goodbudget, the app will start showing all new transactions you make on that account. However, it sometimes takes a day or two to sync new transactions. Contact Goodbudget’s customer support team if you still haven’t seen your new transactions after 2-3 days.