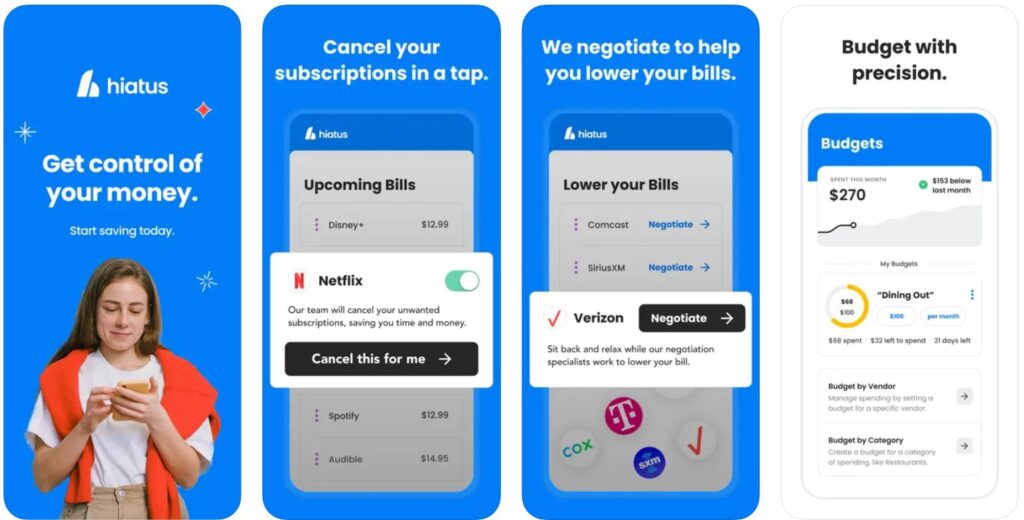

Do you want to get better about your spending and saving habits but aren’t sure where to start? Hiatus may be the budgeting app for you. The Hiatus budgeting app is all about simplicity, breaking down personal finances and net worth monitoring into manageable pieces. Using Hiatus, you can check in on your financial accounts, see your upcoming bills, manage subscriptions, and even have the Hiatus team negotiate your payments.

Keep reading to discover how Hiatus works and who it’s best for.

Hiatus Overview

Hiatus was established in 2016 as a small team dedicated to simplifying personal finances for the average person. The company now has a team of 30 working on its budgeting and financial management app and associated services and products at all times, including bill negotiation services and its partnership with AmONE to help people find personal loans for various needs.

Pros

- Actively negotiates better rates for services

- Identifies and cancels unused subscriptions

- Uses 256-bit encryption to safely connect bank accounts

Cons

- Users must pay fees to access premium features

- Only provides email support

- The interface can be confusing for some

Highlights

Type of Personal Budget: Goal-based

Best For: Improving financial habits and cash flow

Cost: $0-$21/month

Free Trial: No

Links to Accounts: Checking, savings, credit cards, and investment accounts

Apple App Store Rating: 4.2/5

Google Play Rating: 3.9/5

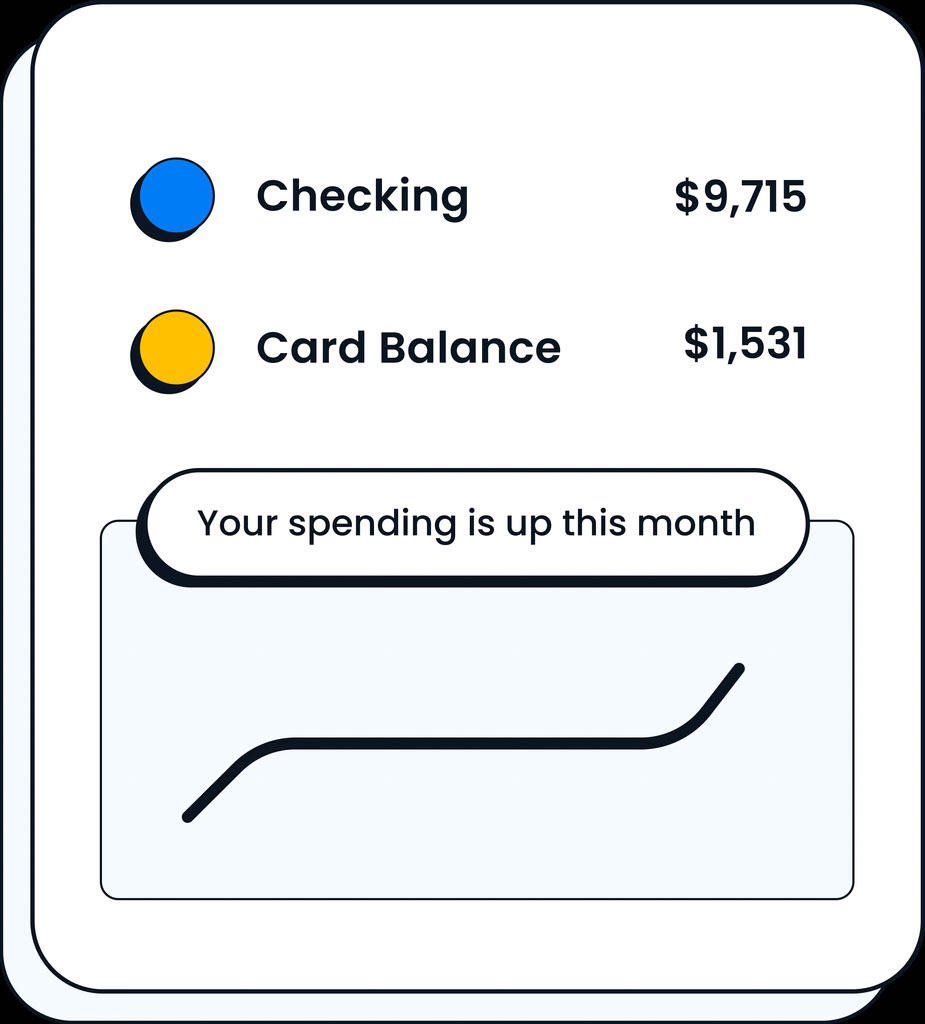

The Hiatus app is designed to be customer-focused with a clean and simple interface that makes it easy to stay on top of finances. The app connects to thousands of financial institutions so you can connect your checking, savings, credit card, and investment accounts in one place.

Why We Like Hiatus

While many budgeting apps focus on one or two key areas of personal financial management, like budgeting or making over bad spending habits, Hiatus covers a little bit of everything. This might overwhelm some users who are looking for an app that’s more pinpointed toward specific types of personal budgets or growing net worth, but if you want an all-in-one app for your finances, Hiatus may be for you.

At its most basic level, Hiatus tracks your spending and lets you create savings and budgeting goals to stay on track. But Hiatus also has net worth monitoring, subscription management, spending insights, and other helpful features to keep your finances on track. You can even get help from Hiatus’s bill negotiators to reduce some of your recurring bills, like your mobile or internet bills.

Who Is Hiatus Best For?

If you’re looking to get a handle on your financial habits and cash flow in general, Hiatus might be one of the best budgeting apps for you. The app provides a snapshot of your overall finances based on the financial accounts you connect while helping you create budgeting goals and stay on top of your upcoming bills.

Because everything is presented in one cohesive dashboard, you can use Hiatus to get quick updates to inform your next financial steps, like creating a new budget or canceling a subscription. But if you want to drill down your money habits further, you can click over to the Cash Flow or Spending Insights tabs to dive deeper into where your money has been going.

Pricing & Plans

| Feature | Free | Premium Monthly | Premium Yearly |

|---|---|---|---|

| Cost | $0 | $10/month | $48/year |

| Savings and Budgeting Goals | Yes | Yes | Yes |

| Net Worth Tracking | Yes | Yes | Yes |

| Upcoming Bills Dashboard | Yes | Yes | Yes |

| Subscription Cancellations | No | Yes | Yes |

| Bill Negotiations | No | Yes | Yes |

| Smart Budgeting | No | Yes | Yes |

| Rate Comparisons (Loans, Credit) | Yes | Yes | Yes |

| Savings Account Offers | Yes | Yes | Yes |

Hiatus is free with limited features. The free version gives you access to all the basics, like setting savings and budgeting goals, viewing your net worth, and seeing your upcoming bills in one spot on your dashboard.

If you want access to all features, including subscription cancellations, bill negotiations, and smart budgeting, you can opt into Premium while you set up your Hiatus account or at any time after.

Hiatus runs on a choose-your-own-payment system for Premium. The most affordable option is signing up for a year for $48, working out to just $4 per month. However, you can also choose to donate extra to Hiatus if you really love the service.

How Hiatus Works

Hiatus is one of the simplest budgeting apps to use, but it could be helpful to know what you can do with it and what to expect from the app before you download it. Or, to jump in right away, download Hiatus from the App Store or Google Play.

Net Worth and Money Management with Hiatus

After downloading Hiatus, the app prompts you to create a Hiatus account and connect your accounts. You can connect any financial account that Hiatus supports through Plaid.

If you want to get all the benefits of Hiatus, this is an important step. You can’t currently add transactions manually. You’ll need a connected bank account to take advantage of spending insights, net worth tracking, and budgeting based on your incoming cash and outgoing expenses.

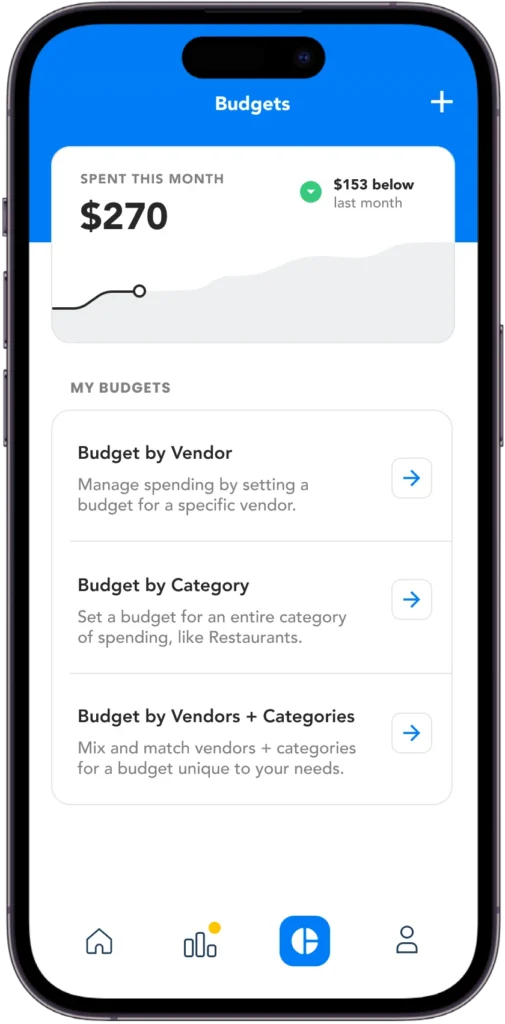

The primary goal of Hiatus is to help you spend less money. In addition to gathering data about your personal finances so you can see information from all of your accounts in one place, Hiatus offers custom budgeting using the goal-based budgeting method. You define your goals – you can set a budget for a specific vendor or category, or mix and match budgets for both. Set the amount you want to stay under for each separate budget.

Your Hiatus dashboard shows your upcoming bills, allowing you to quickly see when your next bills are due. If any bill is missing from Hiatus, you can add it to your account manually. If there’s a subscription showing in your Hiatus account that you no longer need, click the “Start a cancellation” button to get help from the Hiatus team. This feature is available for Premium members only.

Also for Premium members is the bill negotiation feature, which alerts you if Hiatus detects any bills that might be negotiable, like your cell phone bill. If you opt in, the team will work with the billing company to attempt to reduce your bill.

Compare Rates with Hiatus

A unique feature of Hiatus is its rate comparisons for credit cards, personal loans, and auto insurance. You can browse rates for each directly through the Hiatus app by clicking on the relevant link at the top of the app. Hiatus works with partners like Savvy and AmOne to help you find the best rates for various financial products by answering just a few questions within the app.

Want to grow your money instead of spending it? Hiatus can help with that, too, with its current savings account offers. Click the “Grow your money” link at the top of the app to find savings account options with interest rates that will help you grow your savings.

These features are available to free and Premium Hiatus members at no extra cost.

How To Sign Up

Sign up for Hiatus by creating an account online or by downloading the app on Google Play or the App Store and following the prompts to create your account and connect your financial accounts to the app. Once you sign up, the app will also ask you whether you want to remain on the free plan or switch to the Premium plan and give you the option to choose how much you want to pay for Premium.

How To Contact Hiatus Support

If you run into any issues with the Hiatus app, use the Help section within the app by clicking on the gear icon in the upper right corner, followed by “Get Help.” Here, you can find answers to frequently asked questions or ask something more specific by using the automated chatbot in the “Contact Support” section. If you can’t find what you need, you can leave a message with the chatbot for the team to respond to when it’s available.

Support is also available via email at [email protected].

Hiatus also offers these support modes on its website:

How To Cancel Hiatus

Hiatus offers a full refund to eligible customers if you’re unsatisfied with your Premium subscription. Request a refund by using the in-app chatbot or by emailing [email protected]. Once you get your refund, your Premium account will be canceled, but it won’t affect your free Hiatus account.

To cancel your account and remove all personal and banking information, click the gear icon in the app to go to your settings. Then, click “More” > “Accounts” > “Deactivate Account”.

How Does Hiatus Compare?

Hiatus blends popular features from other budgeting apps to create an all-in-one financial management app that does a bunch of things well rather than focusing on just one or two primary features. For example, like Rocket Money, it helps find and cancel subscriptions you no longer need, and like Quicken Simplifi, Hiatus offers a clean, simple interface for managing your money without getting overwhelmed by complicated features.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

However, it’s missing some key features that other apps have, like collaborative tools from Monarch Money and Honeydue, and fraud detection offered by PocketGuard. Still, it’s a relatively inexpensive option if you decide to switch to Premium, which costs as little as $48 per year.

Is Hiatus Worth It?

If you’re looking for an affordable budgeting app that you can use to uncover spending insights, save toward custom goals, manage your subscriptions, and track your net worth, Hiatus probably won’t disappoint.

With a Premium account, you can let the team handle some of your finances by negotiating bills and canceling subscriptions you don’t want. Plus, you can get free offers for savings accounts, loans, and credit cards through Hiatus partners whenever you’re ready to open a new account.

Hiatus is a good choice for general monitoring of your finances and savings. But if you’re looking for detailed reporting to really dig into your spending, you might be better off with an app like YNAB or Goodbudget.

Can I trust the Hiatus app?

Yes. Hiatus is a legitimate app that uses Plaid – a trusted integration platform that connects bank accounts securely to apps and financial services—to gather your bank account information without you needing to give away any passwords and put your accounts at risk. Hiatus also offers a full refund if you’re not completely satisfied with how it works.

What is a Hiatus subscription?

Hiatus Premium is the app’s subscription service, which lets you manage your subscriptions and have Hiatus cancel the ones you no longer need. With a Premium account, you can also ask the team for help to negotiate your eligible bills, like your cell phone or internet bill. Hiatus Premium starts at $48 per year.

What subscriptions can Hiatus help me cancel?

Hiatus can attempt to cancel most subscriptions, including streaming TV services, music streaming services, or gaming services, such as Disney Plus or Amazon Music.

How does Hiatus bill negotiation work?

If Hiatus finds a bill of yours that it may be able to negotiate, the app will send you an alert. Then, you can decide whether to have the Hiatus team negotiate the bill on your behalf. Hiatus won’t change your plan unless there’s a better one available for a lower price; instead, it focuses only on reducing how much you pay for that service each month.