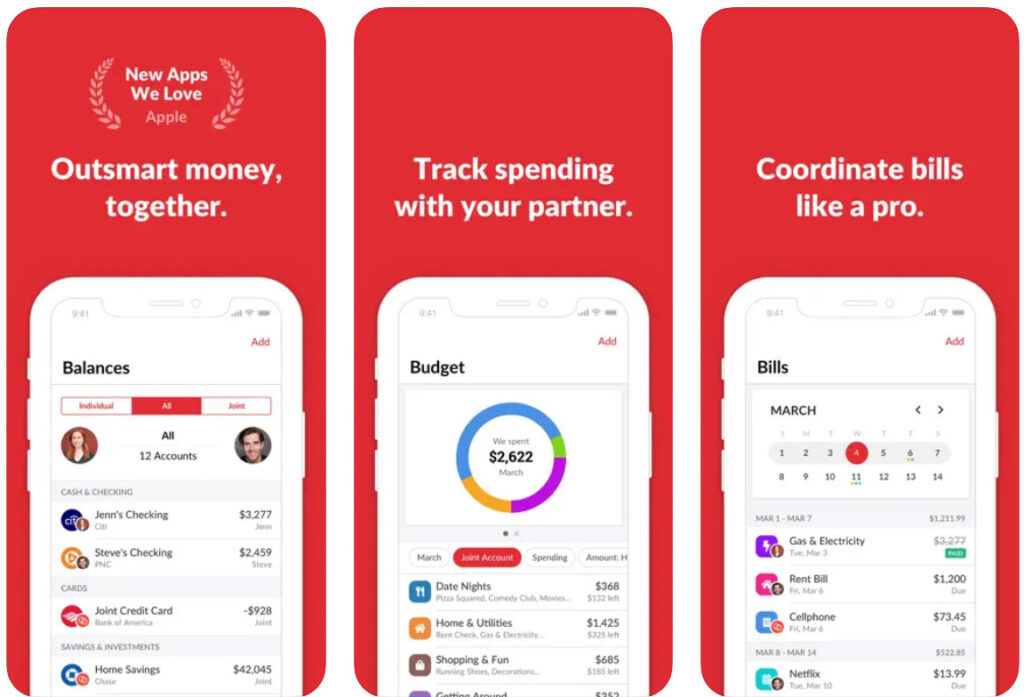

If you’re a fan of budgeting apps but haven’t had much luck finding one that lets you budget with another person, Honeydue might be the budgeting app for you. Honeydue was created with couples in mind, its name stemming from the phrase “honey-do list” that some couples use to describe their tasks or chores. However, it’s all about managing and tracking finances with a partner. We break down its features and how they work in this guide.

Honeydue Overview

Honeydue was founded in 2017 as WalletIQ, Inc., a San Francisco-based company providing educational resources to improve financial literacy. Soon after, the founders realized that having an app available to help people manage finances would be easier than using outdated methods like pen and paper or spreadsheets. Enter Honeydue, which digitizes budgeting in a way that’s more collaborative than many of its competitors.

Pros

- Supports connections to over 20,000 financial institutions

- Messaging and transaction sharing between couples

- Free to use

- Split and pay expenses with partners

Cons

- In-app advertising

- Does not include financial planning tools

- No tech support

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Couples who budget together

Cost: Free

Free Trial: No

Links to Accounts: Yes; Bank, credit card, loan, and investment accounts

Apple App Store Rating: 4.5/5

Google Play Rating: 3.6/5

Honeydue lets two people work together to achieve the common goals of budgeting and tracking their bills. They can add their financial accounts to the Honeydue app, allowing both parties to view transactions, monitor spending, get alerts for upcoming bills, and even chat with each other in-app about their finances.

Why We Like Honeydue

Honeydue is different from other budgeting apps. While many of them are designed for one person to track their finances and create savings goals, some do have the option of inviting one or a few other people to share an account. However, Honeydue is specifically designed for a person to work on finances with someone else, making it ideal for couples.

| Feature/Function | Description |

|---|---|

| Cost | Free |

| Financial Account Connection | Connects to 20,000+ institutions, supports checking, savings, mortgage, loan, and investment accounts |

| Transaction Tracking | Automatically categorizes transactions, supports manual edits and multiple categories |

| Bill Reminders | Sends alerts for upcoming bills |

| In-App Chat | Allows partners to communicate about finances |

| Privacy Options | Allows hiding specific transactions, offers bank-level encryption |

| Security | Uses bank-level 256-bit encryption for all data, connects to financial institutions using Plaid, a secure service |

Honeydue is also free, so it’s an affordable solution for budgeting together. Despite being one of the few free budgeting apps, it offers excellent features, like connecting to thousands of financial institutions, bill payment reminders, and financial education resources.

Who Is Honeydue Best For?

Honeydue is one of the best budgeting apps for couples, whether you’re married, living together, or planning finances together before committing further. The app makes it easy for two people to view spending in shared accounts while still allowing separate account logins, make select transactions private, and collaborate on budgeting goals.

Honeydue can also work well for any two people who are working toward common financial goals, such as roommates, a parent and young adult or teenage child, or an elder and their caretaker.

Pricing & Plans

Honeydue is one of the few completely free budgeting apps on the market. And it’s not just free for a limited time or with limited features encouraging you to upgrade. It’s actually free, and there’s no paid subscription available. Instead of charging for premium features, Honeydue makes money through in-app ads, similar to many mobile app games. You’re never required to click on the ads, but just allowing them to play when you’re using Honeydue helps the team make money and continue developing the app.

With that said, you can choose to donate to Honeydue if you love the app and want to support its creators. Simply use the tipping feature within the app to donate any amount you choose. That amount will recur, similar to a subscription, but you can cancel it at any time through your App Store or Google Play account.

How Honeydue Works

Honeydue primarily focuses on zero-based budgeting, but it’s customizable, so you and your collaboration partner can use different types of personal budgets to align with your financial goals and help you spend less money.

Let’s walk through Honeydue’s main features so you can learn how it works.

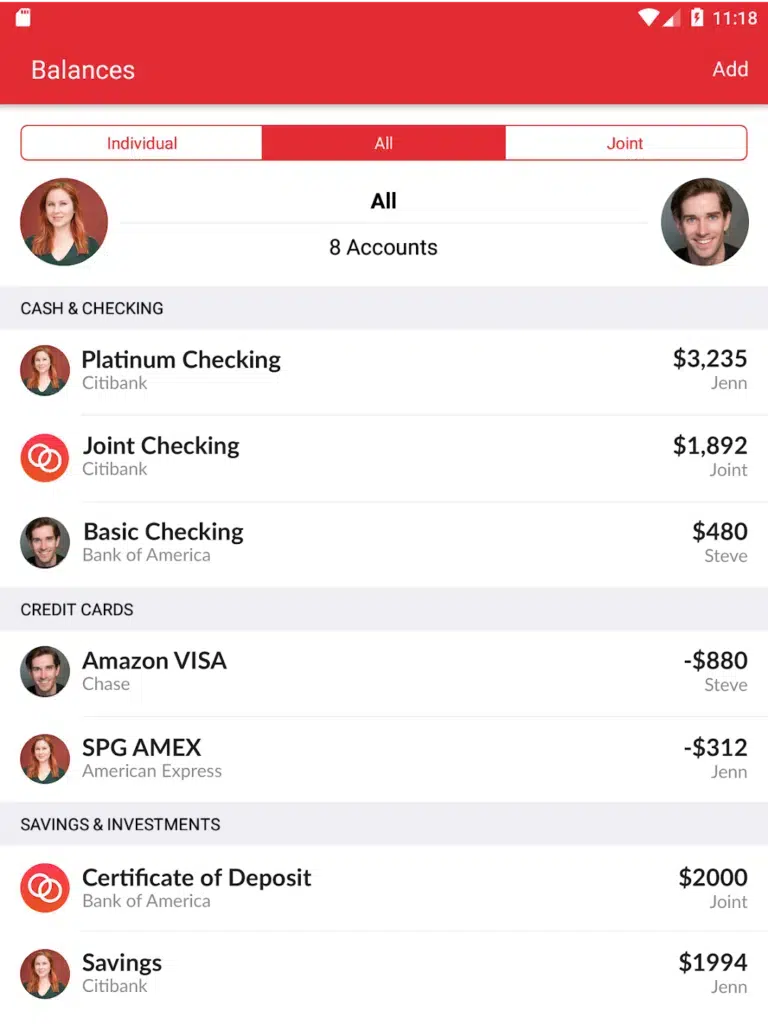

Connecting Financial Accounts in Honeydue

Honeydue connects to more than 20,000 financial institutions in the United States and four other countries, so there’s a good chance your bank is supported. In addition to checking and savings accounts, you can connect your mortgage, loan, and investment accounts to Honeydue to give you an accurate overview of your finances and net worth.

You can choose whether to connect to your bank automatically or manually. Automatic connections allow Honeydue to sync your transactions from your bank to your Honeydue account, while manual connections don’t require you to input your sign-in credentials, but you’ll need to update transactions manually.

Sometimes, Honeydue may ask you to reauthorize a bank account. This can happen when the app loses connection with your bank. You should simply be able to tap the reauthorization link and enter your credentials to relink your account.

Tracking Spending and Bills in Honeydue

After connecting your accounts, Honeydue begins syncing your transactions so you can track your spending. Honeydue automatically categorizes transactions as they come in, placing them in relevant categories like groceries or entertainment. However, you can manually edit categories to track spending in any way you’d like. Honeydue even supports adding transactions to multiple categories.

The app also keeps you updated on your bills with bill reminders. Get alerts when a bill is due soon so you and your partner can plan for the upcoming deduction. Once you pay a bill from a connected account, it will be categorized as spending and be included in your monthly spending and savings goals.

Collaborating in Honeydue

One of the most unique features of Honeydue is its collaboration features right inside the app. You and your partner can text each other in Honeydue, which can be a convenient way to chat strictly about finances and bills, keeping those conversations separate from your regular texts.

Honeydue also lets you highlight a specific transaction to chat about with your partner. For example, if you notice a charge you weren’t expecting, you can share information about it in the chat to ask your partner if they recognize the charge.

Privacy and Security in Honeydue

Honeydue offers security for all users of the app through its data management and privacy features.

All data in Honeydue is encrypted with bank-level security, including your account password, financial information, and banking credentials.

You can also keep some things private from your account partner, which you can edit from the app’s settings. For example, users can choose to share balances and transactions or share balances only. There’s also an option to hide select transactions from your partner, which can be helpful if you buy a gift you want to surprise them with, for example.

How To Sign Up for Honeydue

Start by downloading the Honeydue app from the Apple App Store or Google Play, then click the button to create a new account. Or, if you’ve received an invitation to join Honeydue from a referring member, click the link to accept your invitation on the main screen of the app.

Then, enter your email address and follow the instructions to activate your account using a code in the email Honeydue sends you. Next, fill out your information to finish creating your account. Be sure to choose a secure password that’s difficult for someone else to guess.

How To Contact Honeydue Support

Honeydue’s customer support is available via email at [email protected]. You can also find the Help section of the app and click the “Message Us” link to send a message to the support team. Expect a response in about one business day. The support team can help you with anything from setting up your account to making recurring donations to understanding the app’s features.

How To Cancel Honeydue

Cancel your Honeydue account at any time using the app’s account settings. Go there by clicking on your profile image, followed by “Options” and “Edit Profile.” Once there, look for the link to delete your account. If you’re the main account holder with Honeydue, note that your partner will also lose access to any shared information in your account after canceling.

How Does Honeydue Compare?

Honeydue is more of a financial tracking app than one for creating a budget and savings goals. Although you can use it to help you stick with a budget and determine how much you have left for savings, Honeydue is ultimately for keeping you and your partner both on track with upcoming bills and your spending in shared accounts.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

In that regard, it’s one of the only budgeting apps uniquely designed to share with a partner. Others, like YNAB, allow you to invite people to your account, but Honeydue’s sole purpose is to help two people work together for a common goal of tracking their finances.

Is Honeydue Worth It?

As a free app, Honeydue is worth a try, especially if you’re looking for a budgeting app that makes collaborating with your partner as simple as possible. With its in-app chat feature and tools designed to help you work together, Honeydue is a top choice for partners who want to be on the same page about money and don’t want to add a new subscription to their expenses.

Is there any cost for using Honeydue?

No, Honeydue is completely free. Honeydue makes money from placing advertisements within the mobile app rather than charging a subscription fee. However, users can choose to donate to Honeydue on a recurring basis by setting up a donation subscription from within the app.

Is it safe to connect a bank account to Honeydue?

Yes. Honeydue allows connections to over 20,000 financial institutions using Plaid, a secure service that offers encrypted connections between apps and bank accounts. Plaid uses 256-bit encryption to keep your data secure, including your account numbers and login credentials, like usernames and passwords. By connecting your accounts with Plaid, neither Plaid nor Honeydue can access your bank transactions or personal information.

How does Honeydue make money?

Honeydue places ads in the app, therefore making money from partnering with advertisers. The more Honeydue users engage with in-app advertisements, the more Honeydue can make from its partnerships. Honeydue also earns money through donations, which users can set up on a recurring basis through the app.

What are the disadvantages of the Honeydue app?

Although Honeydue does financial tracking really well, it lacks in helping users create and manage savings goals. Users can view their transactions and spending in the app, but Honeydue currently doesn’t offer envelope budgeting or other features for users to move leftover cash toward savings goals or to track their savings goals.

How do I make transactions private in Honeydue?

Partners who use Honeydue together can make select transactions private in the app by opening a transaction, tapping on the options, and visiting the “Edit Details” section. Then, find the visibility setting to toggle the transaction from visible to not visible to a partner.

Can you manually add transactions in Honeydue?

Yes, Honeydue supports manual and automatic transactions in the app. If you’d rather not connect your bank accounts to Honeydue, you can still add transactions manually to track your spending with a partner. To do that, manually add an account to Honeydue from the menu. Then, tap on the link to add transactions. Honeydue tracks all manual transactions with your spending as usual.