When you think about TikTok, learning about personal finance probably isn't what comes to mind. But personal finance content is surprisingly popular on TikTok. In fact, the FinTok movement is helping millions of users – including Gen Zers – become more financially savvy.

Top Debt Relief Options

Some companies, like Oops Finance, have rode the FinTok wave and gone viral in the process.

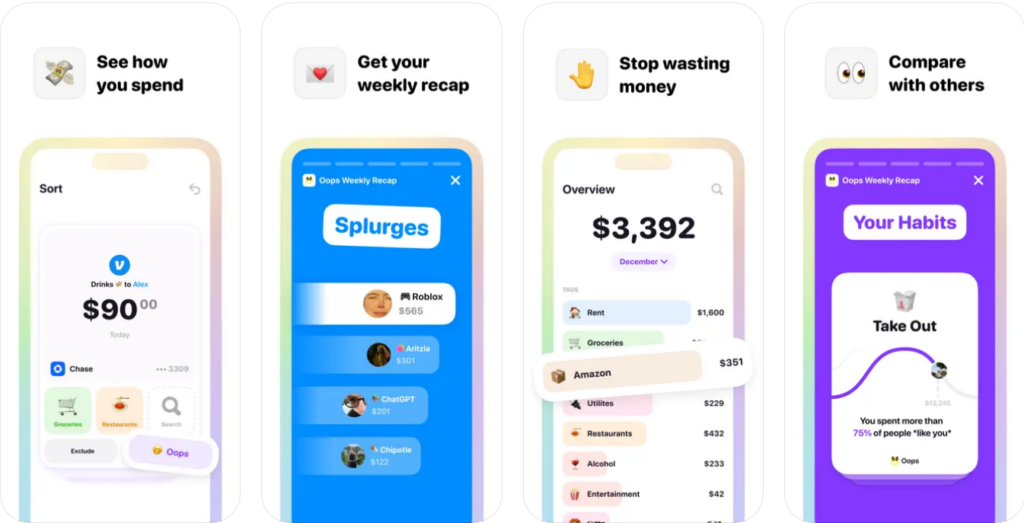

This iPhone budgeting app largely caters towards Gen Z consumers. Instead of confusing spreadsheets and in-depth budgeting tools, the app helps its users build financial awareness by simply “oopsing” purchases that they regret.

But is Oops a refreshing take on budgeting for young adults? Or is this app promoting a lifestyle that's actually doing more harm for Gen Z than good? Let's take a look.

What Is Oops Finance?

Oops is a new finance app that's available on the Apple app store. The company was founded by Anastasia Shaura, a Gen Z entrepreneur, and has since gained hundreds of thousands of downloads after gaining millions of views across TikTok.

Unlike traditional budgeting apps that often focus on in-depth reporting and data, Oops is much simpler.

All users have to do is link their bank accounts to the app and then view weekly recaps of their spending. If you spot a purchase you regret or one that might have been a tad reckless, you tap the “oops” button to mark the purchase as a mistake. Late-night DoorDash orders, Amazon shopping sprees, and a mild Starbucks addiction are all examples.

From there, Oops categorizes your spending categories, how much you spent on “oops” purchases, and even lets you compare your spending habits to similar app users.

On the surface, it's a fun, gamified way for Gen Z consumers and others to get a snapshot of their spending habits. Over time, this is how Oops aims to help people reduce their spending and become more financially aware.

Oops Financial Plans and Pricing

The Oops app is free to download. In-app purchases are available to upgrade the service and access additional budgeting features.

| Subscription Plan | Price |

|---|---|

| Oops App Download | Free |

| Oops Pro (app purchase) | $4.99 |

| Pro Monthly Subscription | $6.99 |

| Oops Pro Annual Subscription | $59.99 |

| Pro Weekly Subscription | $4.99 |

| First Time Connection | $3.99 |

| Basic Annual Subscription | $39.99 |

Good Financial Advice, Or One Big Marketing Ploy?

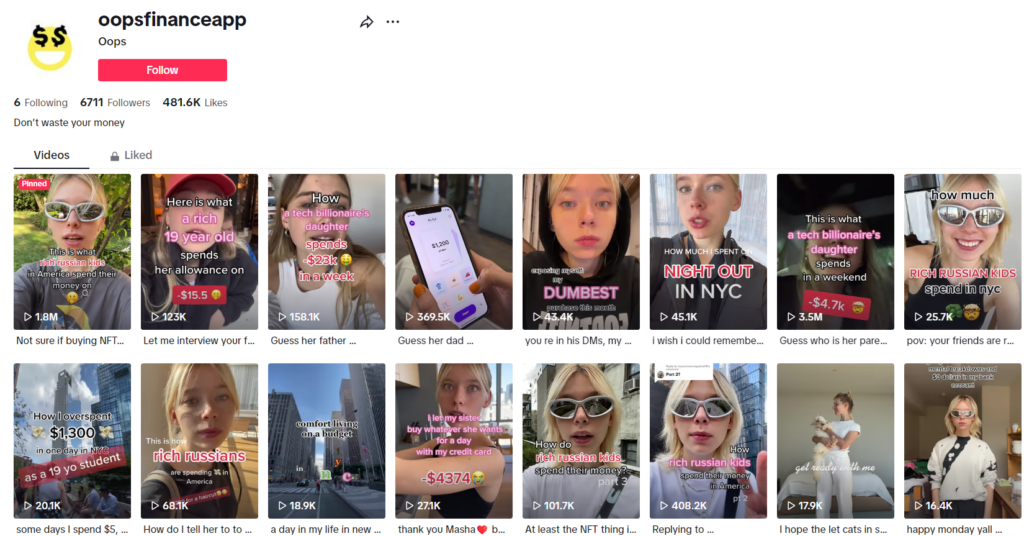

One of the most interesting aspects of Oops Finance's rapid growth is how the app markets itself via TikTok.

A quick glance at Oops' page shows several videos with over 100,000 views. Here are some of their thumbnail titles:

- “This is what rich Russian kids in America spend money on.”

- “How a tech billionaire's daughter spends -$23k in a week.”

- “How much rich Russian kids spend in NYC.”

- “I let my sister buy whatever she wants for a day with my credit card.”

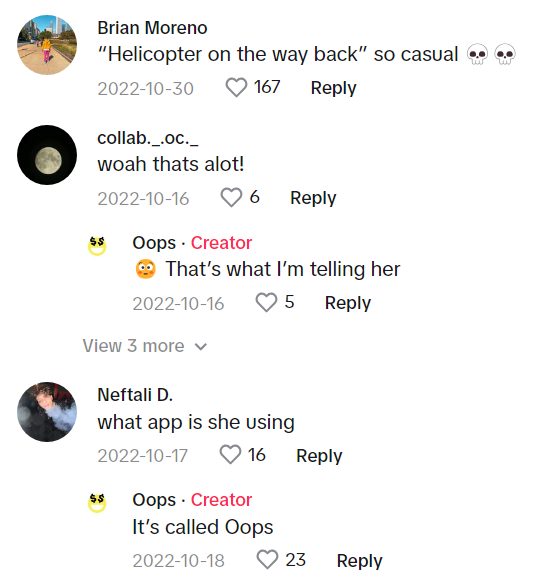

If you take the time to watch some of these TikToks – like this one – the trend behind the videos becomes clear: Oops features hyper-rich Gen Zers showcasing their reckless spending.

Multi-thousand dollar clothing bills. Hundreds of dollars spent on Uber, DoorDash, and dining out. Even a $3,000+ helicopter ride to the Hamptons make an appearance in some of Oops' videos. And all of the videos involve using the Oops app to scroll through this lavish transaction history.

The result?

People want to know which app these rich kids are using and where to get it.

This is an example of brands creating what looks like user-generated content to attract virality. And for Oops, the strategy is working.

But as some other content creators point out, this marketing tactic isn't exactly transparent or even helpful to young consumers.

Fake Riches & Deceptive Influencers

“These rich kids are lying to you.”

That's the title of a YouTube video from Swell Entertainment, a channel with over 400,000 subscribers that's run by a woman named Amanda.

In her 25+ minute video, Amanda takes a deep dive into Oops' rise on TikTok. After analyzing several of their most viral videos, she explains how Oops “might be using rich kids to lie to you.”

The basis of her argument is pretty simple: Oops Finance doesn't necessarily make it obvious that its promoting its own app within these TikTok videos. Plus, there's no way to know if these “rich kids” are being paid by Oops or are even employed by the company…And there's no way to tell if they're even rich, either.

Granted, many videos are posted from Oops' official TikTok account, so one could argue a disclosure isn't as necessary. But other TikTok videos featuring Oops are posted by creators without any kind of disclosure.

Considering that the FTC requires social media influencers to disclose their relationships to brands they promote, this could be seen as quite the gray area.

Legalities aside, the notion of promoting financial education to a largely Gen Z audience with blatant showcases of overspending is curious.

After all, Gen Z have the lowest salaries nationwide on average. It's a generation that are navigating student loans, entering the job market, rising housing costs, and more challenges. To teach them how to budget with displays of reckless spending is, perhaps, quite out of touch.

My Take On Oops' Viral Marketing & Gen Z Budgeting

Whatever Oops' marketing team is doing, it's working. The app has thousands of downloads and over 2,000 ratings. Plus, it's added monetization since users can now upgrade to Oops Gold to unlock unlimited transaction refreshes, so the company is theoretically making money.

However, it's worth asking if this style of marketing is going too far; particularly for young consumers. And it's also worth asking if the mission to simplify personal finance sometimes does more harm than good.

Is simply “oopsing” your unwise purchases really a path to getting your spending on track? And should we market to Gen Z by using unrealistic influencers who spend exorbitant amounts of money on frivolous things?

I'm not so sure.

Learning how to create a personal budget doesn't have to be rocket science. But it should involve an actual understanding of your finances, where your money goes, and why it goes there.

If tapping “oops” a couple times a day gets your spending under control, by all means, download the app. But if you want to take more control over your finances, there are better alternatives.

For me, an Excel spreadsheet and checking my bank statements each week gets the job done. There's also more robust budgeting tools out there, like YNAB, PocketGuard, Rocket Money, and countless others you can try.

I think everyone has the power to take charge of their finances and to learn how to budget. This includes Gen Zers, so please, don't be afraid of learning the basics and taking a deeper dive into your finances. If you just brush your spending under the rug, you might be making a financial “oops” that lasts a lifetime.

Note: This is an opinion piece from our Editor, Tom Blake. If you have comments or questions, get in touch via our Contact Page or with Tom on LinkedIn.