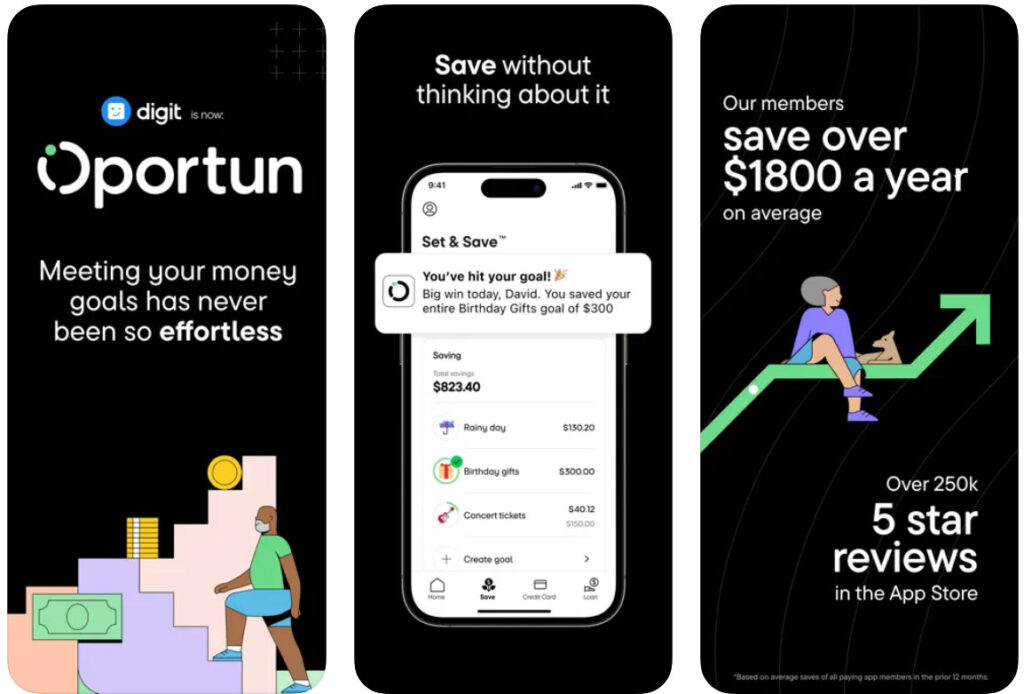

Oportun’s main services are personal loans and credit cards, but it also provides a mobile app for its loan and credit cardholders—and anyone else who wants to budget—to manage their finances on their phones or tablets. Formerly Digit, Oportun has become a popular budgeting app in its own right. Learn more about what it does well, how much it costs, and who can benefit from using it.

Oportun Overview

Oportun is a financial management company founded in 2006. The company acquired the personal finance and budgeting app Digit in 2021. Oportun is both a website and a mobile app, although the two are used for different purposes.

Pros

- Automated savings

- Set custom savings goals

- Customizable loan amounts up to $10,000

- Free for managing loans and credit cards

Cons

- Credit card limits cap at $1,000

- Automatic savings amounts can be difficult to predict

- Disconnection from bank accounts is a problem for some users

Highlights

Type of Personal Budget: Goal-based budgeting

Best For: People with loans

Cost: $0-$5/month

Free Trial: Yes

Links to Accounts: Yes; Bank, credit card, loan, and investment accounts

Apple App Store Rating: 4.7/5

Google Play Rating: 4.1/5

The Oportun website primarily services people who have an Oportun loan or credit card and provides web-based management of their accounts. The website also has handy resources for customers, like glossaries of financial terms and loan calculators.

The mobile app is an extension of the website with features more tailored to day-to-day budgeting. With the Oportun mobile app, users can manage any Oportun loans or credit cards, automate their savings, monitor investments, and track expenses and overall finances.

Why We Like Oportun

We appreciate when mobile apps genuinely make it easy for users to track their finances and spend less money, regardless of what types of personal budgets they like to use or whether they want to budget at all. Oportun does exactly that with its simplified, clean interface that lays all features and tools at your fingertips.

Oportun also offers a generous 30-day free trial to ensure it has what you need before buying a subscription, and even if you do decide to sign up, the monthly fee is relatively affordable for the peace of mind of getting a helping hand with your finances, loans, and credit cards.

Who Is Oportun Best For?

Oportun is best for anyone with a personal loan or credit card through Oportun. The app lets you manage your account wherever you are, so you can always view upcoming payments, balances, and more. Even if you don’t have a loan or credit card through Oportun, you can still use its financial management features, like viewing all bank or credit card accounts in one place or setting automatic savings goals.

Pricing & Plans

| Feature | Details |

|---|---|

| Free Trial | 30 days |

| Monthly Subscription | $5 per month |

| Annual Subscription | Not available |

| Included Services | Access to Oportun’s Set & Save feature for budgeting, tracking bills, and creating savings goals |

| Additional Benefits | Free access for one year to the service if you have an Oportun loan or credit card |

| Cost for Loan Management | Free on the website or app |

| Payment Method | Automatic debit from linked bank account each month |

| Cancellation | Subscription can be cancelled at any time |

Oportun does not have a free plan. However, there is a free 30-day trial for anyone who wants to test it before subscribing. After that, the app switches to a monthly subscription for $5 per month. There’s currently no annual subscription available.

It’s important to note that this subscription fee is for the Oportun app only, which gives you access to Oportun’s Set & Save feature for budgeting, tracking bills, and creating savings goals.

If you have an Oportun loan or credit card, you can get free access to this service for one full year after signing up. If you simply want to manage your loan or credit card on the website or app, it’s free to do so.

Once you sign up for a subscription, Oportun automatically debits your membership fee from your primary linked bank account each month until you cancel.

How Oportun Works

It helps to understand how Oportun works before jumping into a subscription. Below is an overview of the app’s features and how it ties everything together to help you budget and save. First, download the app on Google Play or the App Store and create an account to get started.

Managing Oportun Loans and Credit Cards

Oportun customers with loans and credit cards directly through Oportun can manage their accounts for free using the app. Oportun offers loans of up to $10,000 for personal use, like consolidating credit cards or bills or making repairs to their homes. It also has a Visa credit card with credit lines of up to $1,000, intended to help people build credit over time. Oportun’s credit card doesn’t require a credit history check to apply.

If you have either of these products, you can create an Oportun account to view your loan or credit card information, like balances and upcoming payments, on the website or app. You can also use the app to apply for an Oportun loan or credit card at your convenience.

Linking Financial Accounts

You don’t need to have an Oportun product to use the app. Many app users use it solely for budgeting and saving purposes. However, savings goals and spending tracking are only available with Oportun’s monthly subscription.

To start saving and tracking your spending, you’ll need to link your bank accounts. Your Oportun accounts are automatically loaded into the app if you log in with the same credentials. For other accounts, you’ll need to visit the app’s settings and find the link to connect to a new account. After following the instructions to connect a financial account, you’ll begin seeing your transactions automatically sync with Oportun.

Saving and Budgeting

Oportun’s savings feature is known as Set & Save, which lets you create savings goals and set an amount you’d like to save on a schedule of your choice. Then, Oportun automatically moves your money from your bank account toward the chosen savings goal according to your schedule, giving you a set-it-and-forget-it way to save.

Oportun also gives you a Rainy Day Fund as soon as you get your Set & Save account set up, but you’re free to create whatever savings goals you’d like. The app always shows you your spending balance, so you know how much you have left to work with each month.

Oportun Referrals

Want to tell someone else about Oportun? You can earn money by referring a friend. Each qualifying referral gives you and your referred person $5 each deposited into your linked bank accounts. Subscribers can earn up to $100 from Oportun referrals in a calendar year.

How To Sign Up for Oportun

Visit the Oportun website from your mobile device and click the “Get now” button to download the app. Once downloaded, the app will direct you to create an account to start using it. You can choose to purchase a subscription right away or enjoy a free 30-day trial.

If you’re already an Oportun customer, you can use your current login details to log into and use the Oportun app.

How To Contact Oportun Support

The help section of the Oportun website answers a lot of commonly asked questions about the app and Oportun services, so you may be able to get help with your questions here. If you need more assistance, you can use Oportun’s online ticketing system, email [email protected], or text (855) 642-2140.

How To Cancel Oportun

From the Oportun app, find your profile and account settings. Under the settings tab, find your subscription. Tap your subscription and click “Close my account.” Your account will still be accessible until its current term ends but you won’t be automatically charged again unless you decide to reopen your account. Your savings will also automatically return to your linked bank account within 1-5 business days.

How Does Oportun Compare?

Oportun is primarily an app for managing loans and credit cards from Oportun with the added benefit of tracking expenses and creating automatic savings plans. As a result, it’s not quite as robust as other best budgeting apps, as you can’t use it to view your net worth, share your account with a partner, or create an in-depth budget.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

Is Oportun Worth It?

If you already have a personal loan or credit card through Oportun, you may find the app’s account management and savings features helpful. At just $5 per month, the Set & Save feature lets you automatically save money without thinking about it while also offering some basic budgeting tools to keep you on track. Still, if you’re looking for a more all-in-one solution for budgeting, saving, and investment tracking, Oportun may not be the best choice.

How often does the Oportun app have updates?

The Oportun app typically has updates 2-3 times per month to improve features and provide bug fixes. You can view the app’s version history on its product page in the App Store or Google Play.

What happened to Oportun banking?

Oportun retired its direct℠ banking product to allocate more time and resources to its savings function. Previous banking users can convert their account to a Set & Save account to access Oportun’s automatic savings feature.

What is Oportun’s savings bonus?

Oportun offers a savings bonus for app users who use the automatic savings feature to save toward specific goals. The bonus provides 0.10% annually based on the average daily balance of the account and is paid quarterly. You can view when your next bonus will be paid in your account rewards section. Oportun can disable the bonus if you don’t want it on.

How do I update my personal information in Oportun?

Look for the “Profile & Settings” menu in the Oportun app and find “Contact information” under the “Settings” tab. Here, you can update your personal information, including your name, email address, and password. Click “Save” to save your new information.

Is the Oportun app available in other languages besides English?

Yes—Oportun is available in both English and Spanish. To switch between versions, visit the settings and locate the “General” tab, followed by “Language & Region.” Then, toggle the language you’d like to use.