Ownwell is an online provider that helps homeowners lower and monitor their property taxes. It works on behalf of its clients by protesting and appealing to your county tax assessor to reduce the assessed rate on your home, which lowers your property taxes. The company, formerly known as realAppeal, was founded in 2020 and is based in Austin, Texas.

Pros

- Only pay when you save money

- 86% of customers end up saving money on their property taxes

- Low risk to get started

Cons

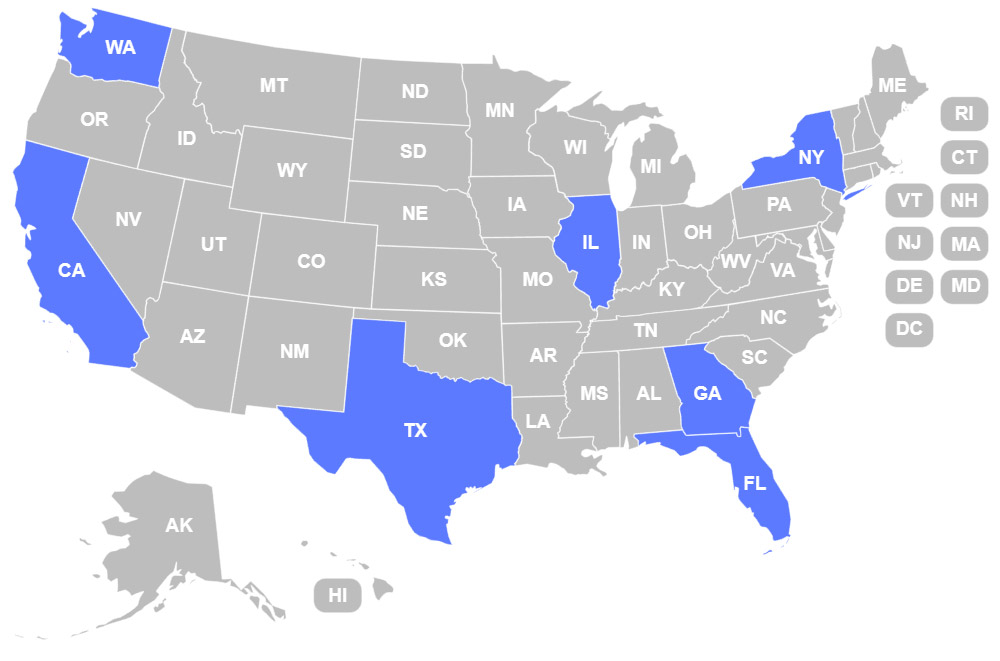

- Services only available in seven U.S. states

- No guarantee that you’ll save

- Potential to raise your assessed property value in Washington and Georgia

Services Offered: Property tax appeals, property tax exemptions, bill reduction, insurance rate monitoring.

Potential Savings: Helps you spend less money. An owner of a single-family home can save an average of $1,148 a year.

Fees: Ownwell only charges a fee if it’s able to save you money. The 25% to 35% contingency fee is calculated as a percentage of the amount you end up saving.

Available States: Texas, Illinois, Florida, Georgia, California, Washington, and New York, (note there may be some counties in these states that are not eligible).

Is Ownwell Legit?

Ownwell is a legit company with an A+ rating from the Better Business Bureau and countless positive reviews from customers. Because you only owe money to Ownwell if you end up saving money on your taxes, there’s little to no risk for signing up. That said, its services are only available in a handful of states and it doesn’t guarantee savings so won’t be effective for some homeowners.

How Does Ownwell’s Property Tax Savings Work?

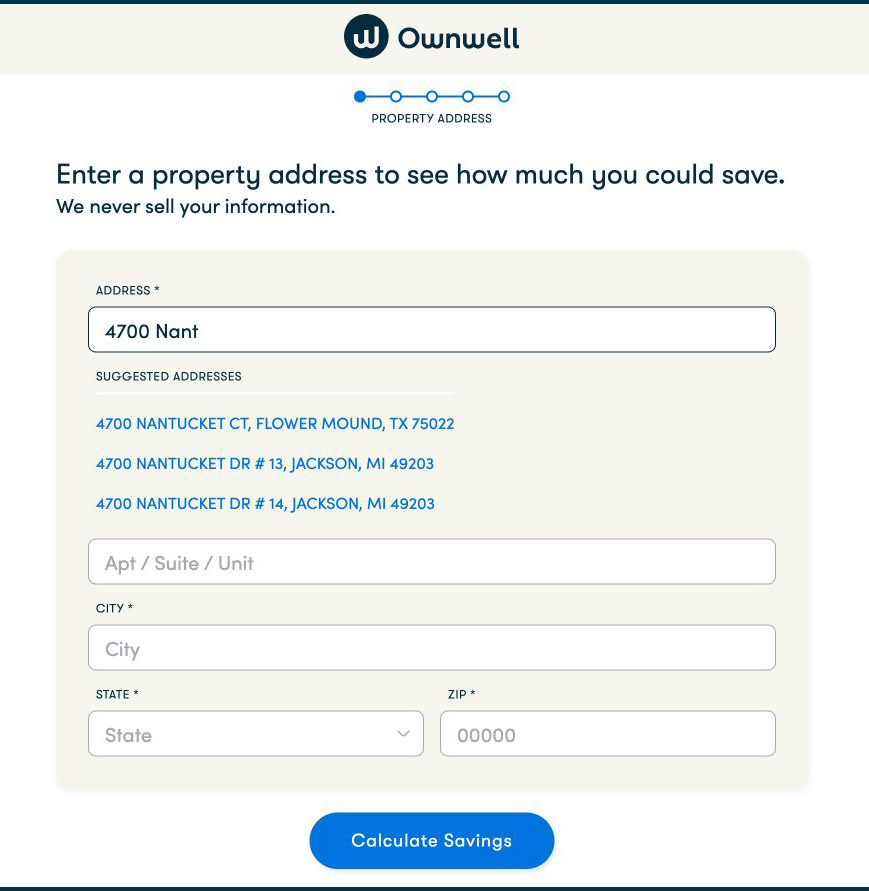

To get started with Ownwell, you’ll begin by entering your property address into its website to get an idea of your potential savings. Within a minute, you’ll see the average savings for homeowners in your area, and be prompted to enter your personal information and more details about your property.

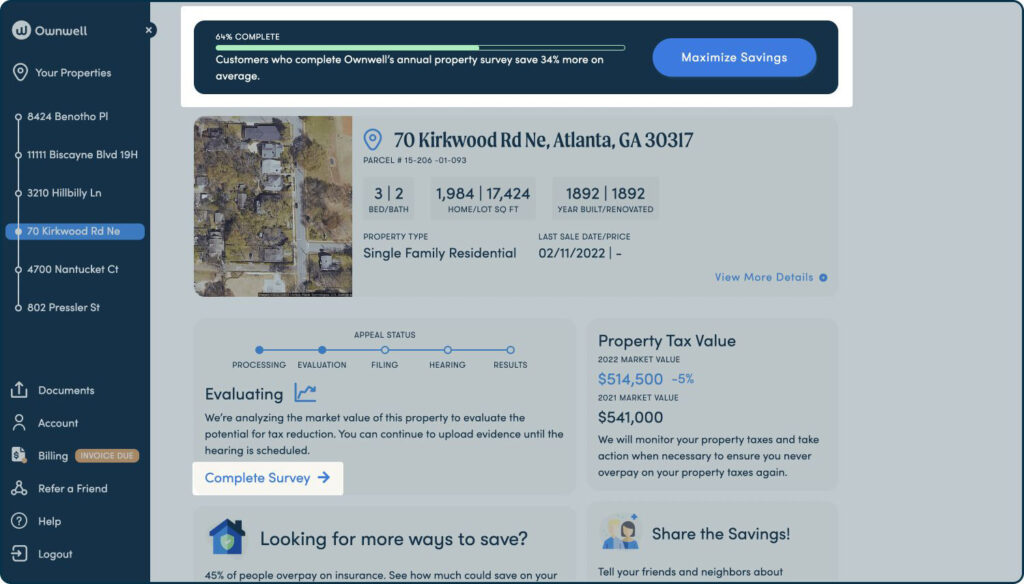

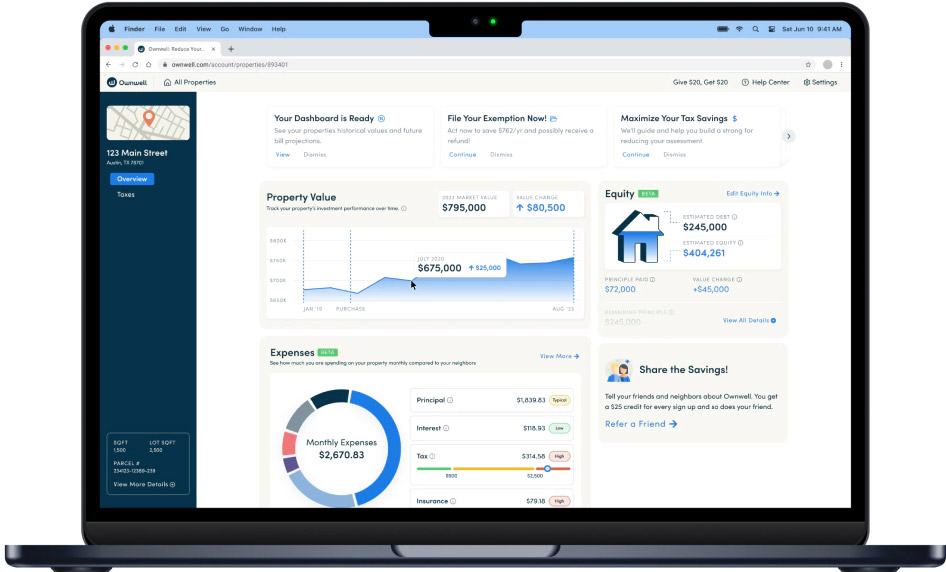

Once you authorize Ownwell to be your property tax agent, the company will take care of every step of the process for you including evaluating your property, filling out and submitting all applicable paperwork, and negotiating on your behalf to have your assessed home value and taxes reduced. If it turns out Ownwell can’t lower your taxes, you don't owe them anything. If your taxes can be reduced, you'll owe the company a contingency fee of 25% to 35% of the amount you saved.

If you happen to live in a county that Ownwell doesn’t service for property taxes, you may still be able to benefit from its insurance monitoring or bill reduction. The process for these services is similar to the property tax reduction in that you’ll be asked to enter some basic information about your bills or insurance coverage and the experts at Ownwell will review this and see where there may be opportunities to save you money.

There is no risk to you and you won’t owe any money upfront, only paying if and when they’re able to secure your savings.

Is Ownwell Worth It?

| Metric | Value |

|---|---|

| Success Rate (Customers Saving) | 86% |

| Average Savings (Per Home) | $1,148 |

Ownwell prides itself on its success rate, claiming that 86% of homeowners see a reduction in their property taxes once they sign up for the service. For many homeowners, even when the contingency fees are factored in, this service is still definitely worth it.

While it’s true that you can technically appeal your property tax assessment yourself, this can be a complicated and time-consuming process and if you don’t want to do the heavy lifting yourself, Ownwell is a great option because it poses little risk to you. The minimal fees are also likely less than what a tax attorney would charge for the same service.

One potential caveat to bring up is to residents of Georgia and Washington because of state-specific laws regarding property assessment. In these states, you run the risk of your taxes actually increasing if you submit an appeal and it’s found that the initial assessment undervalued your property. However, Ownwell says that in these cases it would first notify you ahead of time if they thought this might be the outcome and elect not to file on your behalf.

Ownwell Fees & Pricing

| Service Area | Savings Example | Contingency Fee Range | Fee Based on Savings Example |

|---|---|---|---|

| Property Tax Savings | $1,200 | 25% to 35% | $300 to $420 |

| Bill Reduction | $300 (annual) | 25% to 35% | $75 to $105 |

Ownwell only charges a fee when it’s able to save its customers money, so there’s virtually no risk for signing up and trying it out.

If you do end up saving money, whether on your property taxes or utility bills, Ownwell charges a contingency fee of 25% to 35%. For instance, if it was able to reduce your annual property tax bill from $4,500 to $3,200, you would see a savings of $1,200. From this, Ownwell could take 25% and you’d then owe them $300.

Other Ownwell Features

In addition to Ownwell’s property tax services, it also offers bill monitoring and reduction as well as insurance rate monitoring.

Bill Reduction

Ownwell works with customers to reduce monthly bills like internet, phone, cable, security system, and satellite radio subscriptions. You simply have to upload a recent bill and answer a few questions about your service. Then, Ownwell negotiates directly with your provider to try to lower your monthly charges. If Ownwell is unable to reduce your bill, you pay nothing. Ownwell will automatically try again in a couple of months when there may be new promotions or incentives available.

If Ownwell can save you money, your fee will be based on the duration of your newly reduced rate. For example, if Ownwell was able to save you $25 a month for an entire year, your savings would be $300 in total. You would then have to pay Ownwell 25% to 35% of this, equalling a $75 to $105 fee. In some instances, Ownwell will only be able to secure a one-time price reduction and if this is the case, you won’t have to pay anything in fees.

Need to save money fast? Learn how to save 10,000 in three months.

Insurance rate monitoring

Another service you can benefit from is insurance rate monitoring. Ownwell can save you money by tracking your home insurance coverage and rate to ensure you’re not overpaying. After answering a few basic questions about your coverage, Ownwell will shop around to see if they can get you a comparable policy for a lower premium.

Ownwell Reviews From Homeowners

Don't miss: 12 Proven Ways To Make Money From Home.

Who Can Sign Up?

Ownwell is only available in seven states: Texas, Illinois, Florida, Georgia, California, Washington, and New York.

If you do own a property in one of these states, whether as a residential homeowner or as an investor, you can sign up for Ownwell’s services by entering your property address for a preliminary review. If you decide to move forward with the protest and appeal, you’ll be asked to provide more details about yourself and the property so Ownwell’s tax experts can take a closer look at your case.

Is There Customer Service?

Yes, customers can contact Ownwell in a few different ways. On the company’s website, you can click in the lower right-hand corner to chat online with a representative, submit a request online, or you can call them directly at (512) 886-2282.

Final Thoughts

Although Ownwell is only available in a small group of states, the services that it offers can save homeowners real money. If you live in one of the eligible states, it’s worth the small amount of time it takes to enter your address to see how much you could be saving. Since there are no upfront charges, it’s essentially a win-win opportunity.

The only real downside is that the Ownwell property tax review is limitd to certain states. If you don’t happen to live in one of these areas, you’ll be on your own to protest and appeal your taxes. Additionally, homeowners in Georgia and Washington should take extra care to ensure their appeal doesn’t end up costing them more than they anticipated.

There are many ways for homeowners to cut costs, and saving on property tax is just one of them. You can also boost your savings by using the 50/30/20 budgeting rule each month, or by trying another type of personal budget. Another idea is to track your expenses using apps like Rocket Money or PocketGuard to stay on top of your spending.

Further reading: