PocketGuard is one of several popular budgeting apps available for most mobile devices. It’s been around for over a decade and has helped thousands of customers save money each month and put more money toward their financial goals.

Like most budgeting apps, PocketGuard offers something a little different from its competitors in the way it monitors accounts for fraudulent activity, quickly alerting users so they can handle the situation with their banks. If you want a simple way to boost your accounts’ security, PocketGuard could be for you.

PocketGuard Overview

PocketGuard is a California-based fintech company founded in 2015. Its main offering is the PocketGuard app, which was designed to simplify budgeting and staying on top of financial transactions for the everyday person. To date, PocketGuard has helped its users save more than $40 million, collectively, on their bills.

Pros

- Customizable budgeting

- Fraud detection and alerts

- Personalized spending reports

Cons

- Transaction editing can be time-consuming

- Free version only allows one account sync

- Some users report issues with account disconnections

Highlights

Type of Personal Budget: Zero-based budgeting

Best For: Fraud detection

Cost: $12.99/month or $74.99/year

Free Trial: Yes

Links to Accounts: Yes; Bank and credit card accounts

Apple App Store Rating: 4.6/5

Google Play Rating: 3.8/5

PocketGuard routinely gets updates that cater to its users’ needs based on feedback gathered from user reviews, surveys, and discussions in the official PocketGuard Reddit community. Some in-the-works changes potentially coming to PocketGuard include editing multiple transactions at once, allowing shared collaborators on one PocketGuard account, and rolling over unused cash from a budget to the next month.

Why We Like PocketGuard

PocketGuard has all the bells and whistles that most of the best budgeting apps do:

- It tracks all your upcoming bills so you can see when your next bill is due.

- It sends you alerts when you spend a specific percentage of your budget to help you stay on top of how much you have left.

- It teaches you to spend less money using a zero-based budgeting system or two other popular budgeting methods.

- It helps you create a debt payoff plan so that you can be one step closer to financial freedom.

On top of those perks, PocketGuard has an excellent fraud detection system that consistently monitors your finances for potentially fraudulent transactions. Its real-time alerts make it possible for you to quickly take action and contact your bank if needed.

Who Is PocketGuard Best For?

PocketGuard is an app for people who want to experiment with different types of personal budgets to see which one fits their needs best. PocketGuard’s In My Pocket feature is its primary budgeting feature, which uses a zero-based budget system. However, users can also use the envelope budgeting system or a 50/30/20 budget to see which one they want to stick with, allowing for a good amount of control over how to manage their money.

PocketGuard also works well for people who have several financial accounts to monitor at once. You can connect an unlimited number of banks to the app and get updated transactions and fraud information in the app as they happen. No more visiting each bank account daily online – PocketGuard keeps all your accounts organized in the app.

Pricing & Plans

PocketGuard offers just one all-inclusive plan to keep things simple. It’s $12.99 per month but costs just $74.99 per year if you choose an annual subscription, saving about 50% compared to monthly pricing. You can subscribe through the PocketGuard website or the mobile app. If the latter, you’ll pay for and manage your subscription through the Apple App Store or Google Play.

| Feature | Details |

|---|---|

| Plan Options | Single all-inclusive plan |

| Monthly Price | $12.99/month |

| Annual Price | $74.99/year (saves about 50% compared to monthly) |

| Subscription Methods | PocketGuard website or mobile app |

| Included in Paid Plan | Monthly budgeting, debt payoff plan, financial reporting and insights, unlimited bank connections, financial transaction categorization, custom categories |

| Free Version Available | Yes, but with limited features |

| Note on Free Version | Full app features are not accessible without a paid subscription |

A paid PocketGuard plan gives you access to all features, including monthly budgeting, a debt payoff plan, financial reporting and insights, unlimited bank connections, financial transaction categorization, and custom categories.

You can sign up for PocketGuard without subscribing to access a limited free version, but you won’t be able to really get a feel for the app until you sign up.

How PocketGuard Works

Before downloading the app and signing up for PocketGuard, learn more about how it works. We tested it to give you the details.

Connecting Bank Accounts

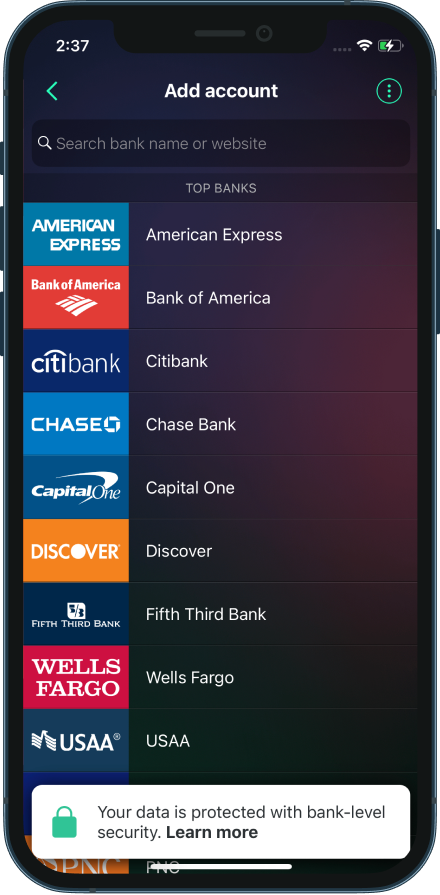

Once you sign up for PocketGuard, the app directs you to connect your bank accounts. Choose from the list of the most popular banks, or start typing your bank’s name in the search bar. Then, the app instructs you to connect to your bank securely so PocketGuard can begin showing you your transactions and income.

PocketGuard connects to more than 30,000 banks within the United States and Canada, so there’s a good chance your bank is there. You can connect checking and savings accounts and credit card accounts with PocketGuard. Once connected, make your way to your dashboard to view your transactions. It may take a few minutes to several hours for your transactions to populate.

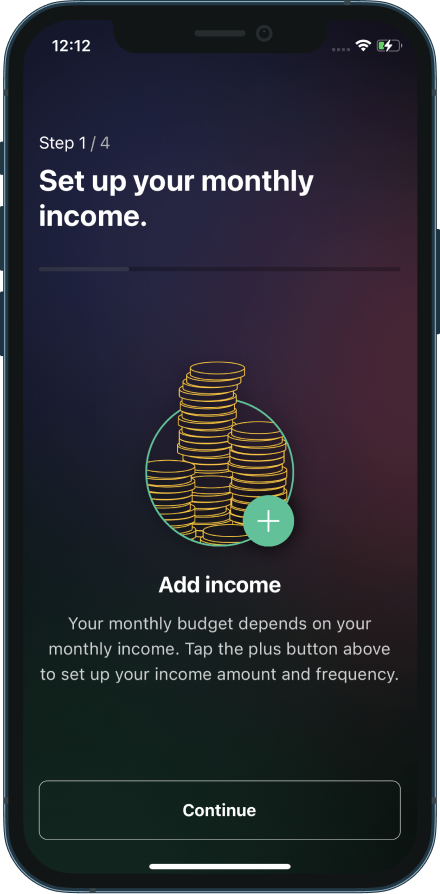

Setting Up Bills and Income

Now, you can begin setting up your bills and income information. PocketGuard does most of this automatically by scanning your financial accounts to pull in the information. If you see anything missing, though, you can add the information manually. PocketGuard will also ask you if you want to do this during the setup process.

Once you have your bills and income squared away, you’ll be able to view your bill payment tracker and spending insights, both of which give you an overview of your outgoing cash to help you stay on budget.

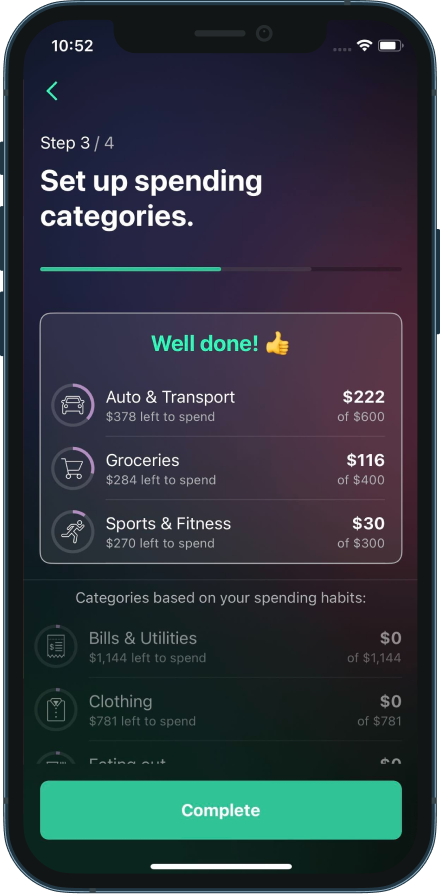

Setting Up Savings Goals, Spending Categories, and Budgets

Next, PocketGuard walks you through setting up everything it needs to know for you to budget how you want to, including choosing savings goals or grouping your goals into what PocketGuard calls spending categories. These are larger groups of different types of expenses, like transportation or entertainment, that include relevant spending, like gas or movie theater visits. PocketGuard also has a debt payoff plan feature that helps you decide how much to put toward debt each week or month until it’s gone.

After setting up these features, you can customize, add to, or delete them at any time as your savings or spending goals change.

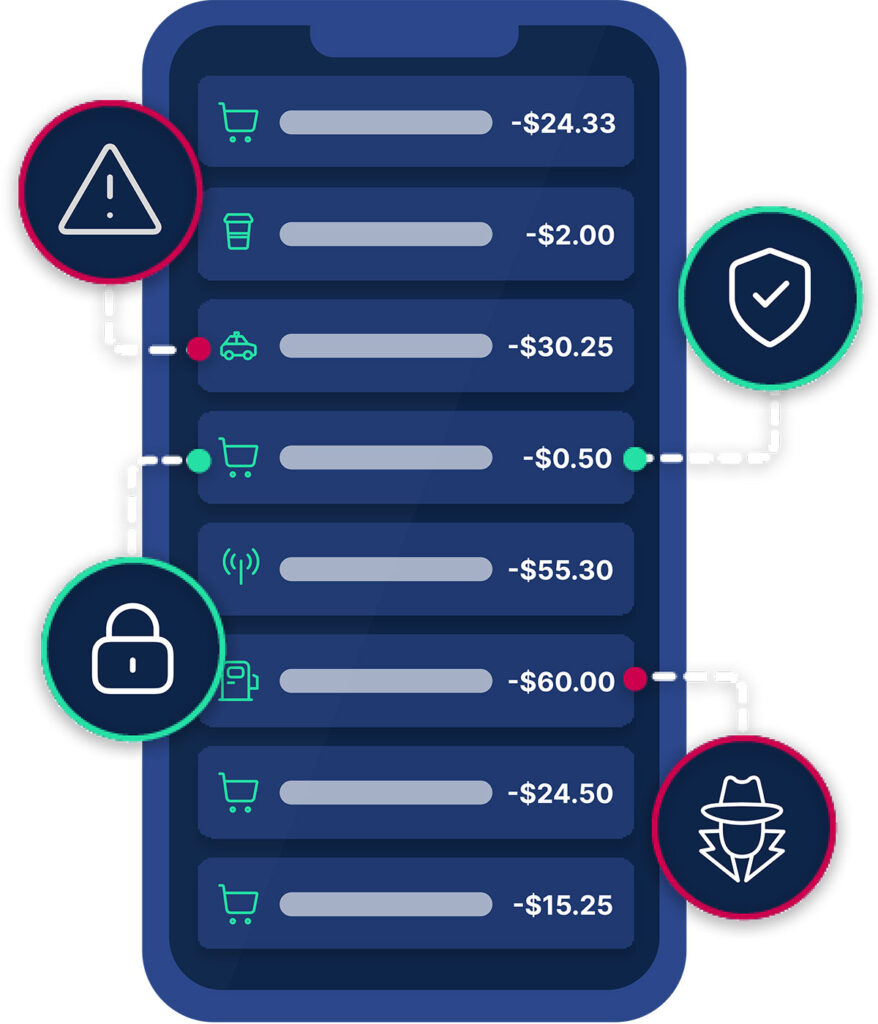

Monitoring for Fraud

With your account setup completed, PocketGuard can begin monitoring your connected accounts for fraud. This happens behind the scenes without you needing to trigger the feature. PocketGuard scans your accounts while its algorithm looks specifically for transactions that seem suspicious, like purchases from a store you don’t normally buy from or duplicate transactions using your debit card for the same amount.

You can also create a “Blacklist,” which is a high-priority list of transactions or activities that you want PocketGuard to keep an even closer eye on, alerting you when similar activity occurs again in your accounts.

How To Sign Up for PocketGuard

Sign up for PocketGuard on the website or download the mobile app to create an account when prompted. You can use your email address and a password to sign up or sign up using your Google or Apple credentials.

How To Contact PocketGuard Support

If you need help with billing, using a PocketGuard feature, setting up your account, or using the mobile app, PocketGuard support is available by emailing [email protected] or by using the help feature in the mobile app to send a message to the team.

PocketGuard also has a self-service section on its website to help you understand how to use the app and its many features. It may have the answer to your question inside, so it’s a good place to check before contacting customer support.

Finally, you can also use the PocketGuard subreddit to ask questions. You won’t always get an answer from the PocketGuard team, but other knowledgeable PocketGuard users are often quick to help.

How To Cancel PocketGuard

PocketGuard offers two methods to cancel your PocketGuard subscription: Cancel through the app or email [email protected] for assistance.

To cancel through your iOS or Android app, visit the appropriate app store and go to your subscriptions page. Find PocketGuard and look through the options to find the cancellation link. You can also modify your subscription to switch between annual and monthly payments.

How Does PocketGuard Compare?

PocketGuard’s free version is extremely limited, so you’ll likely need to purchase a premium account to enjoy its benefits. With that said, PocketGuard has a lot to offer in terms of budgeting and living debt-free with its savings and debt payoff features. It also can help tremendously with fraud monitoring, especially for those with multiple accounts to keep track of at once.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

Is PocketGuard Worth It?

If you want or need a lot of help with your budgeting, like insights as to where all your cash is going and a planner for paying off debt, then PocketGuard could be worth the cost of a subscription. Many users also think much of its value comes from its bill tracking and fraud monitoring features, which keep you updated with your finances in one convenient place whenever you want to check on them.

Can you trust PocketGuard?

PocketGuard uses bank-level encryption to secure all of your personal and financial data that makes its way to the app. This security also covers your bank connections, so you can feel safe connecting your accounts to the app. To keep your account secure, choose a hard-to-guess password. PocketGuard adds a layer of protection with a login PIN that you’ll set when setting up your account.

What are the downsides of PocketGuard?

PocketGuard has a free version, but it’s highly limited, so it doesn’t give you a good sense of what the app can do. There are also no manual options to add transactions, so you’ll need to connect your bank accounts to utilize the app’s features.

Does PocketGuard have a financial course?

Yes. PocketGuard offers a free financial course on its website that users can work through independently. The course covers several areas of financial literacy, including budgeting, managing finances, making better financial decisions, how to invest money correctly, and paying off debt.

Can two people use the same PocketGuard account?

Yes, two people can use the same PocketGuard account, but they’ll need to sign in with the same account username and password to access the account on different devices. Currently, PocketGuard does not offer separate logins for people to share the same account, although this is something that PocketGuard is considering adding to a future update.

Does PocketGuard show net worth?

Yes, PocketGuard can show net worth, although you may need to enter the balances of some accounts that you can’t connect to the app, like investment accounts, for this feature to display the most accurate net worth information.

How often does PocketGuard update?

PocketGuard updates your financial accounts daily to ensure that your transactions, income, payments, and more are as up-to-date as possible. However, this could be affected by how frequently your specific bank updates transactions. The PocketGuard app itself is usually updated every month or so for bug fixes and sometimes for new feature additions.