Quicken Simplifi Review - Is It Worth Paying for in 2025?

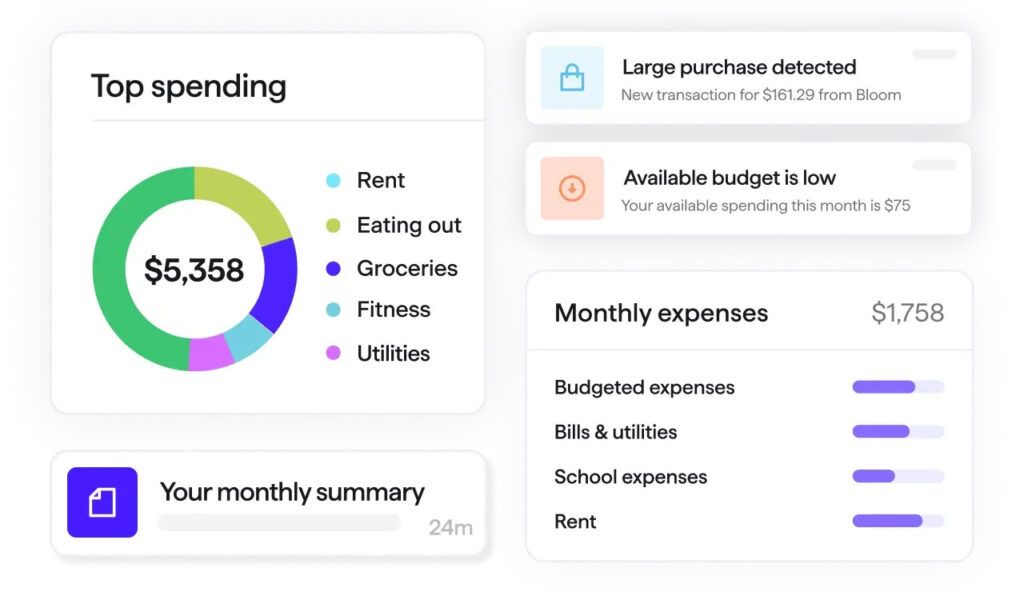

Nothing makes budgeting and managing your income and expenses easier than having all your financial information organized in an easy-to-use mobile app. Fortunately, that’s precisely what Quicken Simplifi was made to do. Created by Quicken, a household name in the financial world for about 40 years, Quicken Simplifi lets users track their net worth, get alerts when they make progress toward their debt and savings goals, and stay on top of how much they have left to spend each month.

Learn how Quicken Simplifi works, who it’s best for, and whether it’s worth a monthly or annual subscription.

Quicken Simplifi Overview

Quicken has been a well-known name in the financial industry for a few decades now. People and businesses alike have trusted the brand to manage their finances through easy-to-use accounting tools that make spreadsheet tracking a thing of the past.

👍

Pros

- Helpful real-time alerts

- Clean and simple user interface

- Shareable accounts

- Bank-grade security

👎

Cons

- No free version

- No monthly billing option

- Doesn’t offer credit score monitoring or alerts

Highlights

Type of Personal Budget: Multiple types of budgets are supported

Best For: Switching between budgeting systems

Cost: $3.99/month

Free Trial: No

Links to Accounts: Yes; Bank, credit card, and investment accounts.

Apple App Store Rating: 4.1/5

Google Play Rating: 4.7/5

In 2020, Quicken introduced its mobile app, Simplifi, which was built to help people who want a more mobile way to stay on top of their finances. Through the app, users can view their pay, see their progress toward goals like paying off debt or paying down a mortgage, oversee their investments, and create a budget to help them save for their future or present goals.

To date, Quicken has helped more than 20 million customers through its app and other accounting tools.

Why We Like Quicken Simplifi

As its name suggests, Quicken Simplifi is designed to make financial management as simple as possible. The app is clean and easy to understand how to use, even if you’re not someone who uses mobile apps regularly. And if you’re currently using outdated spreadsheets to track your spending, income, and investments, you’ll find that making the switch to Quicken Simplifi is easy, manageable, and incredibly time-saving.

Something we love most about Quicken Simplifi is that it’s highly customizable to fit the various types of personal budgets you want to use. You’re not stuck with envelope budgeting or using a zero-based budgeting system if that’s not what works for you. Learn to spend less money by budgeting how you see fit using Quicken Simplifi’s custom budgeting tools.

Who Is Quicken Simplifi Best For?

Quicken Simplifi is best for budgeters of all levels who want an affordable budgeting app. Quicken Simplifi is one of the cheapest around and offers some of the best customization tools that allow you to save and track your spending based on your unique needs.

There’s something for everyone with Quicken Simplifi, whether you’re completely new to budgeting to consider yourself an expert. Start small with basic budgeting tools and, as you feel more comfortable saving, use the app to grow your investments, pay down debt, and get steps closer to financial freedom. Quicken Simplifi sends you real-time alerts and insights based on your current spending, income, and goals to help you learn about your finances wherever you happen to be on your financial path.

Quicken Simplifi Pricing & Plans

| Annual Plan | Monthly Plan | |

|---|---|---|

| Cost | $47.88 ($3.99/mo) | $5.99/mo |

| Money-back Guarantee | 30 days | None |

| Free Trial | None | None |

Quicken Simplifi costs just $3.99 per month when billed annually, its default option, which comes to $47.88 per year. The app often has deals for those purchasing an annual plan for the first time, like offering a subscription for $35.88, the equivalent of $2.99 per month. You can also opt for a monthly plan for $5.99 per month if you’d like to try it out for one or two months first.

Although Quicken Simplifi does not have a free version or trial, it does offer a 30-day money-back guarantee for annual plan subscribers. If you’re not fully satisfied with the app, you can request a cancellation and refund within your first 30 days.

A Quicken Simplifi subscription comes with all features at one price point rather than tiered plans, so you’ll get everything from bank connections to savings goals and expense tracking.

How Quicken Simplifi Works

You can expect Quicken Simplifi to work similarly to classic Quicken but in a more mobile, simplified app version. Like Quicken, you can monitor your expenses, set budgets, and easily see how much you have left to spend for the month. However, it lacks a few more advanced personal finance tools that Quicken has, like built-in tax reporting and investment tools. Here’s an overview of Quicken Simplifi’s features and functions.

Bank Connections

Quicken Simplifi lets you connect your bank accounts to the app, which then automatically syncs your transactions with your Quicken Simplifi account so you can track your spending and follow a budget. Connections are one-way processes, so although you’ll need to use your bank account login to connect your account to Quicken Simplifi, the app can’t access your bank account in any way.

After connecting an account, Quicken Simplifi continuously updates your transactions and balances as the system receives information about them from your bank. In most cases, you should see the past 90 days of transactions available in your Quicken Simplifi account once a connection is made.

Budgeting and Savings Goals

Quicken Simplifi uses a spending plan system created by you, so you can budget any way that works for you. Your Spending Plan shows you how much money you have left to spend based on your income and transactions. You can decide how to adjust your Spending Plan to work for your budget and savings goals.

The system takes into account your planned spending, which will become more accurate the longer you use the app and any other spending you’ve already completed with your transactions.

The dollar amount left over is what you can use toward your own savings goals, which you can create in the Goals menu of the app.

Transaction Customization

When Quicken Simplifi syncs transactions from your bank to your account, it attempts to categorize the transactions automatically. However, this technology isn’t usually 100% accurate in any finance app, so Simplifi lets users customize their transactions. This is also a helpful feature if you want to make your own transaction categories to align with your expense-tracking goals.

To do this, simply find the transaction you want to edit and click “View Transaction.” Then, you can update the category with a pre-selected or custom category and save your changes. Expenses like this should start to sort into the same category.

Alerts and Reporting

Quicken Simplifi’s Report section helps you drill down specific financial information you want to learn more about. You can use numerous filters to find the exact information you need, whether you want to see all of your expenses in a particular spending category for the past month or look at incoming cash for a specific date range. Several preset reports visually highlight some of the most common information users look for, like the Net Income Report and Monthly Summary.

How To Sign Up for Quicken Simplifi

Visit the Quicken Simplifi website and click the “Buy Simplifi” button to sign up. Enter your name and email address, and tap the button to complete your sign-up. You can also download the app from the App Store or Google Play and follow the instructions in the app to sign up on your mobile device.

How To Contact Quicken Simplifi Support

Quicken Simplifi offers several points of contact if you have a question or problem with the app.

First, you can locate the help center from within the app. This has answers to numerous frequently asked questions about using the app and its features, so you may find the answer to your question there. You can also use the app to request a callback from a support agent or begin a live chat using the Simplifi app.

Quicken Simplifi also offers support through X (formerly Twitter), Facebook, and Simpli’s own online community. You can browse the community without an account, but you’ll need to register an account to post or reply to threads.

How To Cancel Quicken Simplifi

Cancel your Quicken Simplifi subscription at any time by visiting the Quicken Simplifi website, logging in, and going to your account settings to find your subscription information.

If you signed up through your phone instead of directly through Quicken Simplifi, you’ll need to visit the settings for Google Play or the App Store on your device. Find your subscription and click the link to cancel it.

Quicken Simplifi gives full refunds for annual plans when they’re canceled within the first 30 days of subscribing but doesn’t offer refunds on monthly subscriptions.

How Does Quicken Simplifi Compare?

Compared to other budgeting apps, Quicken Simplifi is one of the friendliest on your budget at under $50 per year. It also has one of the simplest, cleanest interfaces, making it easy to pick up and start using, even if you’re not super familiar with how budgeting apps work.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

Unlike several other budgeting apps, Quicken Simplifi doesn’t cater to just one type of budget. You have full control to make whatever type of budget you’d like using the savings tools and transaction organizing features within the app.

Is Quicken Simplifi Worth It?

Quicken Simplifi is one of the best budgeting apps for simplicity. This app was designed to be beginner-friendly, and it certainly fits the bill.

With customizable transactions, detailed reports, and easy-to-create savings goals, Quicken Simplifi is a good choice for budgeters looking for the most basic way to manage their finances digitally. Its low price tag for monthly or annual subscriptions is an added bonus, making it worthwhile to try out and make sure it’s a good fit.

What’s the difference between Simplifi and regular Quicken?

Quicken Classic is Quicken’s desktop software that helps you manage your finances and budget using a computer. Simplifi is a more mobile version of Quicken Classic, allowing you to sync your bank transactions, view reports, create spending goals, and more, right from your mobile device or on the web.

What is the difference between Simplifi and Mint?

Since Mint is no longer available, many users have switched to Simplifi to continue their mobile-based budgeting. Simplifi has features similar to Mint, like automatic bank transaction syncing, transaction categorization, and spending goals.

Does Simplifi have a free version?

No, Quicken Simplifi doesn’t have a free version. However, it often has deals available for new users to try the app for a lower price per month or year. Plus, annual subscribers can get a full refund within their first 30 days if they try the app and decide it’s not the best fit.

What account types does Quicken Simplifi support?

Quicken Simplifi supports most types of financial accounts, including checking and savings accounts, credit card accounts, and investment accounts, such as retirement and brokerage accounts. You can also track your real estate, vehicle, and personal loans with Quicken Simplifi.

Can I track my bills on Quicken Simplifi?

Yes, Quicken Simplifi has a Bill Connect feature for tracking your recurring bills. Use the connect feature to connect to your biller’s system to track everything from your energy bills to credit card bills.