Albert is an all-in-one money app designed to help you bank, save, and invest. And one of its most popular features is its cash advance/overdraft coverage service, which lets you borrow up to $250.

In our Albert review, we'll dive into the app's cash advance offering along with its other features to help you decide if it's right for you.

Albert: App Overview

Albert is a popular financial management tool and cash advance app that helps you budget, save, and invest. It provides a cash account, automated savings, cash advances, and investment options.

Pros

- Offers interest-free cash advances with no credit check

- All-in-one financial app

- Albert Genius subscribers can connect with financial experts

- Has a 30-day free trial

Cons

- Small cash advance limit

- No free version of the app

- Most features, including cash advances, require Genius subscription

Cash Advance Limits: up to $250

Fees: Basic Albert subscription of $9.99/mo, Genius subscription of $14.99/mo

Credit Score Requirements: None

Is Albert Legit?

Yes, Albert is a legit all-in-one financial app that can help you budget and begin investing. It also has a has a 4.6 out of 5 star rating across 177K reviews on the iOS app store, and a 4.2 out of 5 star rating out of nearly 95K reviews on the Android app store.

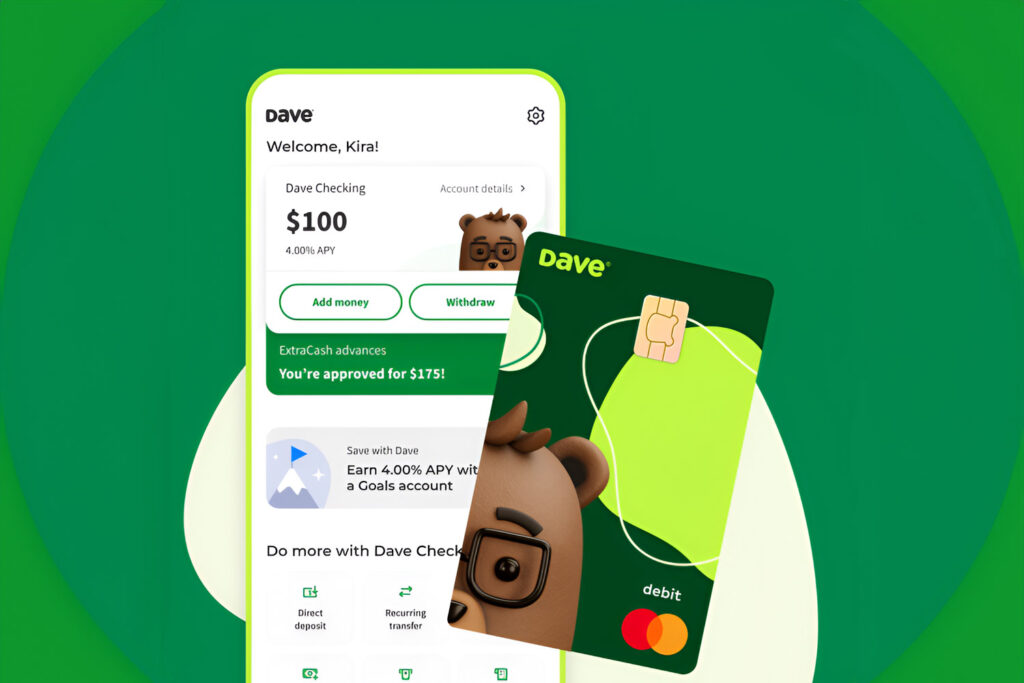

We like Albert if you want a single app to learn budgeting and investing basics. But if you're just looking for cash advances, solutions like EarnIn and Dave are better apps.

What Does Albert Offer?

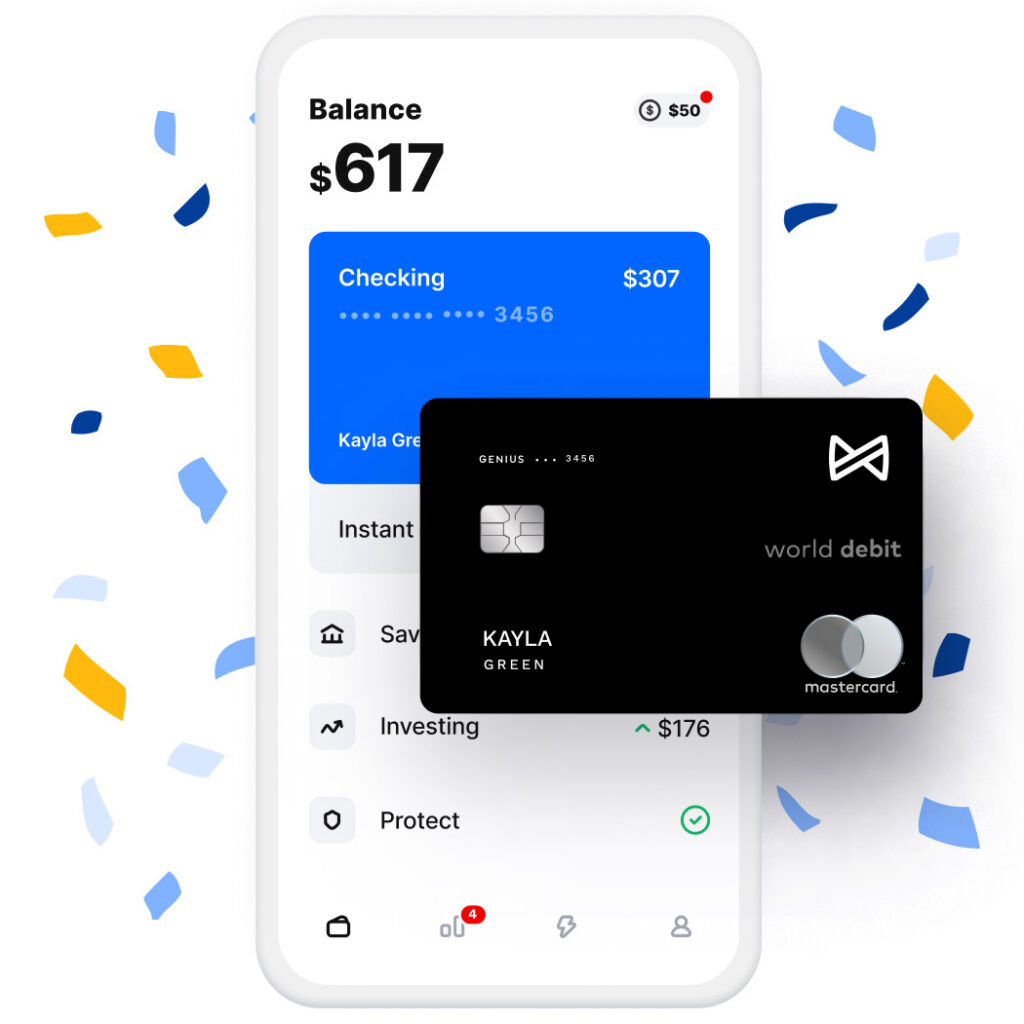

Albert is a one-stop shop for all financial needs. Along with cash advances, the app provides several features to help users bank, budget, save, and grow their wealth over time. These offerings include a cash account, recurring savings, a personalized investment portfolio, and budgeting tools.

| Feature | Basic Subscription ($9.99/mo) | Genius Subscription ($14.99/mo) |

|---|---|---|

| Cash Advances | ❌ | ✅ |

| Budgeting Tools | ✅ | ✅ |

| Investment Options | ❌ | ✅ |

| Automated Savings | ❌ | ✅ |

| Financial Expert Access | ❌ | ✅ |

| Early Paycheck Access | ❌ | ✅ |

| Cash-Back Debit Card | ❌ | ✅ |

| ATM Withdrawals | ❌ | ✅ |

| Identity Protection | ❌ | ✅ |

| Credit Monitoring | ❌ | ✅ |

| Bill Negotiation | ✅ | ✅ |

Albert Instant Cash Advance

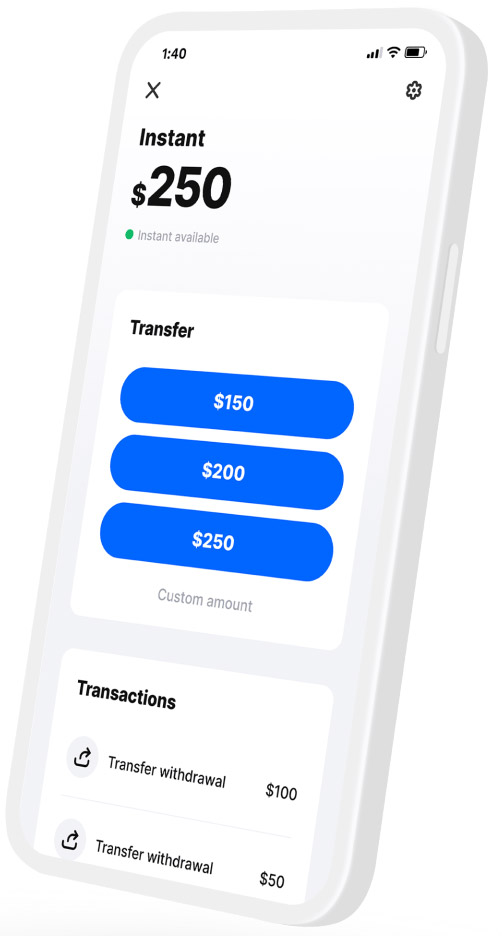

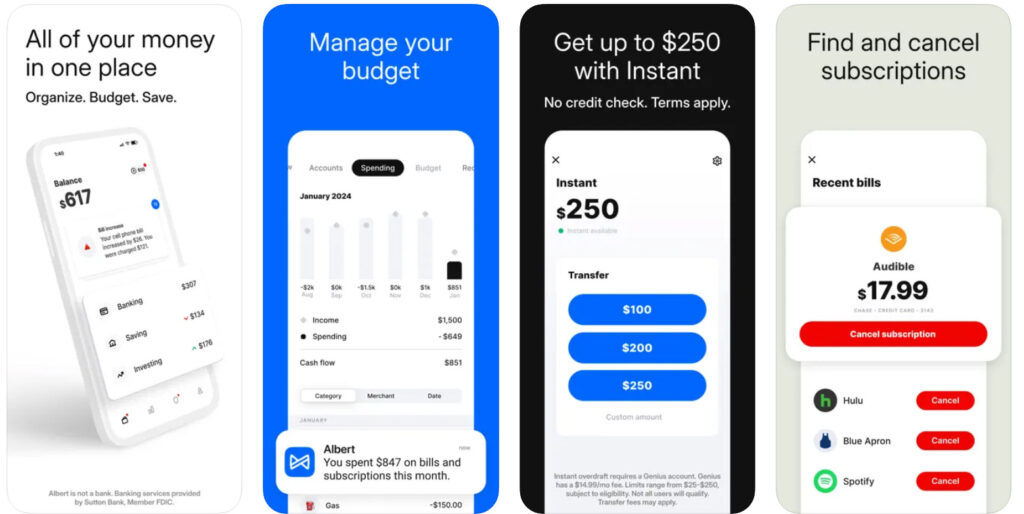

Albert is best known for its Instant Cash Advance feature. Users can borrow up to $25-$250 per pay period, with no interest or credit check. The average Albert cash advance limit is $95.

There aren't any late or overdraft fees – however, an Albert cash advance is not free. To access Albert Instant Cash Advance, users must pay for a monthly Genius subscription. We'll cover this a bit later in our Albert review.

Despite its name, receiving an Albert cash advance takes 2-3 business days. It is not “instant” unless you pay an extra express transfer fee. And we prefer apps like Dave and EarnIn to Albert when it comes to cash advances.

Albert Cash

Albert Cash is a mobile bank account provided through Albert's partner, Sutton Bank. This is the main account that Albert members use to access all of the app's financial services. It also requires a Genius subscription.

| Benefit | Description |

|---|---|

| Debit Card | Cash-back rewards |

| Early Paycheck Access | Up to 2 days early |

| No Minimum Funding Requirements | None |

| FDIC Insurance | Up to $250,000 through Sutton Bank |

| No-Fee ATM Withdrawals | Over 55,000 AllPoint ATMs |

Some benefits of Albert Cash include a debit card with cash-back rewards and up to 2 days early paycheck access. There are no minimum funding requirements, but there is a monthly Genius account maintenance fee.

All accounts are FDIC-insured up to $250,000. Members also get access to no-fee cash withdrawals at over 55,000 AllPoint ATMs.

Albert Saving

Albert Saving is a recurring savings feature only available to Genius subscribers. It analyzes income, spending habits, and bills to help members set aside small amounts of savings each week.

| Feature | Description |

|---|---|

| Automated Savings | Analyzes income and spending, saves small amounts |

| Savings Goals | Users set goals like college fund, down payment |

| Savings Account Yield | 0.25% APY |

| Investment Options | Individual stocks, ETFs, personalized portfolios |

| Auto-Invest Feature | Automatic investments on a set schedule |

Members set savings goals, like a college fund or saving up for a down payment, and the app automatically saves money for them each week to help achieve these goals. Additionally, users can earn annual cash bonuses on their savings. Right now, an Albert savings account yields 0.25% APY.

Alternatively, you can turn off the automatic savings feature if you want to manually transfer savings.

These saving tools are useful if you want an all-in-one app to tackle your finances. But we also suggest checking out Rocket Money or YNAB if you're mostly interested in budgeting tools.

Albert Investing

Genius subscribers also get access to Albert's investment features. It's designed for beginners who want to learn the ropes of investing.

You can get started building your portfolio for as little as $1. There are no trading fees, and you can either choose individual stocks and ETFs on your own or let an Albert Genius create a customized portfolio based on your goals, timeframe, and risk tolerance.

To help users maintain consistency, Albert offers an auto-invest feature that can be toggled on or off. This feature allows for automatic investments on a weekly, biweekly, or monthly schedule.

How To Earn Money With Your Home.

Budgeting Tools

The Albert app comes with a suite of tools to help users stay on track. Albert's home screen gives users an overview of how they're doing by displaying things like bills, categorized expenses, and savings and investment progress. The app also sends users alerts for bill increases, unusual purchases, and fees.

One unique feature that the Albert app offers is bill negotiation, through their partner Billshark. This service can lead to potentially lower monthly bills, including internet, phone, and cable TV. On average, Albert helps lower users' bills by $250 each year.

The app can also monitor your monthly subscriptions. If it detects unused subscriptions, the app can help you easily cancel.

The Best Ways To Save More Money At Home.

Albert Genius Cost & Features

Albert's basic subscription costs $9.99 per month and includes basic functions, like budget and spending insights. But to get access to the app's most popular features, including cash advances, users must subscribe to Genius.

| Subscription Plan | Monthly Cost | Yearly Cost (Monthly Equivalent) | Features |

|---|---|---|---|

| Basic | $9.99 | N/A | Budgeting tools, spending insights |

| Genius | $14.99 | $12.49 | Cash advances, overdraft coverage, cash-back debit card, fee-free ATM withdrawals, recurring savings, investment features, financial expert access |

Alber Genius costs $14.99 per month billed monthly, or $12.49 per month billed yearly. It unlocks cash advances/overdraft coverage, a cash-back debit card with fee-free ATM withdrawals, recurring savings, and investment features. It also includes financial expert access.

You can text or video chat with a team of expert financial advisors to get answers to all sorts of money-related questions. For example, you can ask:

- Should I buy or lease a car?

- How do I create a budget?

- Should I invest my extra cash or use it to pay off debt?

- How can I improve my credit score?

In addition to these features, Genius subscribers get Albert Protect, a 24/7 monitoring service to catch and alert users to potential threats or fraud, such as suspicious transactions or bill increases. It also includes identity protection and credit monitoring.

Albert Cash Advance Requirements

Although Albert doesn't run a credit check to determine eligibility for their Instant Cash features, this does not mean that everyone qualifies. And, even if you do qualify for an Albert cash advance, you may not be eligible to receive the full amount.

Albert takes into account many factors to determine eligibility and cash advance limits. These include:

- Having an active bank account without a negative balance and at least 2 months old

- Lengthy transaction history

- Receiving consistent direct deposits from the same source with funds still accessible 24 hours after payday

Depending on such factors, cash advance limits for eligible members range from $25-$250, with the average being $95. Albert frequently reviews accounts, so, over time, your eligibility status and limits may change. Users who set up direct deposits with Albert Cash can also potentially raise their cash advance limit.

How Does The Albert App Work?

It's easy to get started with the Albert app. To find out if you are eligible and request an Albert cash advance, follow these steps:

- Download and register for Albert. The Albert app can be downloaded from the Apple App or Google Play store. Once downloaded, you will need to sign up for an account. The app will ask you a few questions about your financial situation, needs, and goals in order to create a personalized experience.

- Connect your bank account. Next, you will need to link your bank account with Albert. This is necessary for Albert to review your activity to determine cash advance eligibility, and for the app to deposit and withdraw funds.

- Sign up for Genius. You will need a Genius membership to access Albert's Instant Cash Advance feature. There is a 30-day free trial. After this period, you will be charged a monthly subscription fee.

- Set up direct deposits with your Albert Cash account. The “Smart Money transfers” option must be turned on in order to receive a cash advance.

- Find out if you are eligible for an Albert cash advance. From the home screen of the app, click on “Instant.” Then, follow the on-screen prompts. If you are approved for Instant Cash, then you can opt in from here.

- Request an Albert cash advance. Confirm the amount you would like to request. Your funds will be deposited to your bank account in 2-3 business days; or, you can pay extra for same-day funding.

- Pay it back. On your next payday, Albert will automatically settle your balance by withdrawing the amount you borrowed from your account.

Who Is Albert Best For?

Albert is best for people who want a convenient way to organize all of their finances in one place. It's a nice all-in-one money app that can help you get an aggregated view of your finances. The app also has a decent Instant Cash Advance feature that can be used in a pinch to tide you over until your next payday.

That said, it's important to note that apps offering a broad range of features often don't excel at any single thing, and this is true for many of Albert's offerings. For instance, its investing and savings accounts aren't as competitive or robust as those from traditional banks or brokers.

Albert is also not an end-all solution for those constantly living paycheck to paycheck. While the app can help you find places to save money, give you a small cash boost, and even potentially cut your bills down a little, it's not designed to solve ongoing money issues.

Other Albert App Reviews From Customers

Overall, Albert has positive reviews online. The financial services app has a 4.5 out of 5 star rating across over 3.3K reviews on Trustpilot, and a 3.66 out of 5 star rating on Better Business Bureau out of nearly 1K reviews.

| Platform | Rating | Number of Reviews |

|---|---|---|

| iOS App Store | 4.6 / 5 | 177,000 |

| Android App Store | 4.2 / 5 | 95,000 |

| Trustpilot | 4.5 / 5 | 3,300 |

| BBB | 3.7 / 5 | 1,00 |

Many customers are pleased with the app's versatile functions, often highlighting the Genius subscription as a great value given its numerous features. Users specifically praise the convenience and speed of cash advances. Additionally, customers are generally satisfied with the helpfulness and friendliness of customer service.

However, some reviews mention difficulties in reaching customer service and canceling memberships.

Is There Customer Service?

Albert offers 24/7 customer service. You can contact Albert customer service through the app or by sending a text message to (639-37) for the fastest response time, which is generally within 2 minutes.

Alternatively, you can also email [email protected]. Or, you can call (844) 891-9309 to hear support options or leave a voicemail.

Is Albert Worth It?

So, does Albert work? Is it all it claims to be, and should you sign up?

The answer depends on what you're looking for.

Albert is kind of like the Swiss Army knife of financial apps, offering a consolidated solution for all your financial needs. If you need a quick pick-me-up to cover some emergency expenses or to hold you over until your next paycheck, Albert's Instant Cash Advance feature is a great way to borrow money, interest-free.

The app can also help you save, invest, and spend money. It's one of the best cash advance apps for anyone who wants the extra features that Albert offers. It's also a good choice for those who want to keep things simple and have all of their financial tools in one convenient app.

But if all you need is cash advances, Albert probably isn't the app for you. Other cash advance apps, like EarnIn, Cleo, and Dave, offer much higher limits and don't charge you a $14.99 monthly subscription fee to access them.

Is the Albert app safe?

Yes, the Albert app uses bank-level security measures to keep users' money and information safe. Albert does not store personal banking details, and all Cash account money is insured by the FDIC up to $250,000 through Sutton Bank.

Albert investments are SIPC-insured up to $500,000. Just keep in mind that this does not protect your investments from losing value.

Does the Albert app impact my credit score?

No, using Albert will not impact your credit score. Albert does not use hard or soft credit checks to determine users' eligibility, and they do not report to any of the three major credit bureaus.