Apps Like Brigit

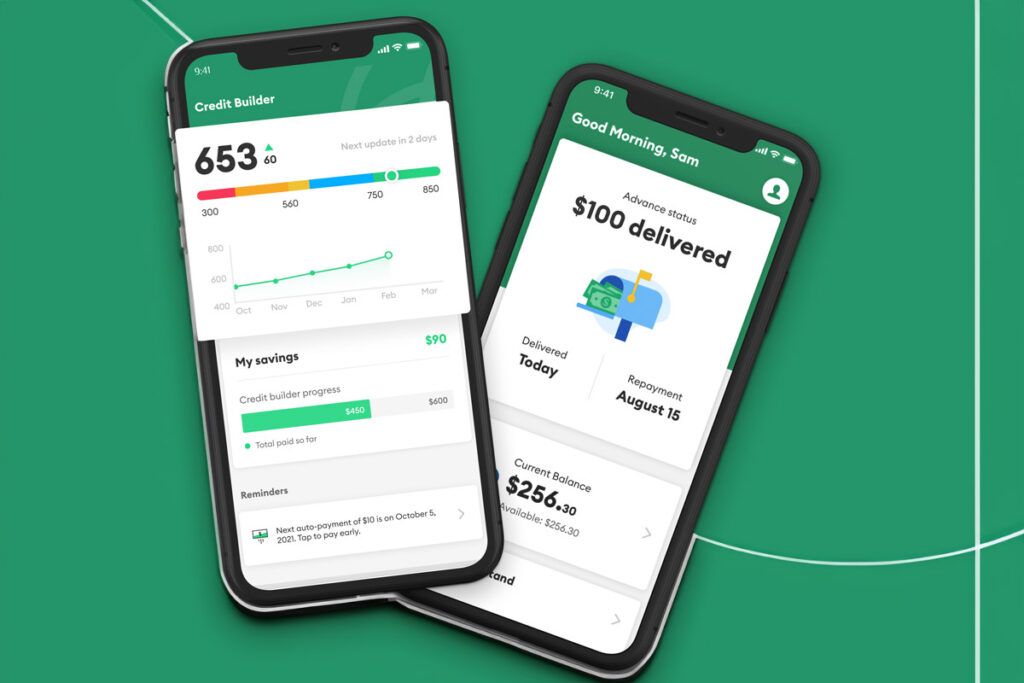

Sometimes you need to borrow cash to get you to your next paycheck. Thankfully, apps like Brigit are available to fill the gap. These apps provide quick cash in a pinch without the hassle of applying (and getting approved for) a traditional loan.

While Brigit is one of the best cash advance apps, it isn’t right for everyone. Many users complain about its expensive subscription requirements, while others find that their limits are too low to cover their needs. If you’re looking for a cash advance app with lower costs and higher limits, then you might want to check out one of these Brigit alternatives.

Apps Like Brigit

| App | Loan Amount | Fees | Deposit Speed |

| EarnIn | $100 to $750 | $3.99-$4.99 | Minutes |

| Dave | Up to $500 | $3-$25 | 5 minutes |

| Chime | Up to $500 | $2 | Minutes |

| Brigit | $50 - $250 | $0.99-3.99 | 20 minutes |

| MoneyLion | Up to $1,000 | $.49-$8.99 | Minutes |

| Cleo | Up to $250 | $3.99 | Same day |

| Possible Finance | Up to $500 | $15-20 | Minutes |

| Albert | Up to $250 | $4.99 | 10 minutes |

Keep scrolling to see the pros and cons of each app and find the right cash advance option for your needs.

Apps Like Brigit

1. Dave

👍

Pros

- High cash advance limit

- Option to extend repayment date

- No minimum account balances

👎

Cons

- Mandatory monthly subscription

- Higher income requirements

- High instant transfer fees

Loan Limit: $500

Fees: $3-$25 for instant transfer

Deposit Speed: 5 minutes

Dave offers a wide range of personal finance tools to help you manage your money. Its ExtraCash account allows you to borrow up to $500 in five minutes or less. While there are no credit checks or late fees, you do need to have a Dave membership, which costs $1 per month. You can pay back your cash advance by scheduling a pay-off date or by completing instant-pay surveys or side hustles through the Dave app.

Read the full Dave review >>

2. EarnIn

👍

Pros

- High cash advance limit

- No mandatory fees, interest, or credit checks

- Provides funds within minutes

- Free credit score monitoring

👎

Cons

- Can only borrow $100 per day

- Requires paycheck verification

- Not an option for gig workers

EarnIn is a cash advance app that offers up to $750 per pay period. Once you verify your paycheck, you can transfer up to $100 per day to your linked bank account. While there is no interest or mandatory fees, the app does ask for an optional tip in exchange for providing the funds. Once you receive your paycheck, any cash advances, tips, and applicable fees will be debited to your account.

Loan Limit: $750

Fees: $3.99-$4.99 for instant transfer

Deposit Speed: Minutes

Read the full EarnIn review >>

3. Cleo

👍

Pros

- No interest or credit checks

- Accepts freelancers and gig workers

- Includes money-management features

👎

Cons

- Small cash advance limit

- Monthly subscription required

- Must pay an extra fee for same-day transfers

Loan Amount: $250

Fees: $3.99 for instant transfer

Deposit Speed: Same day

Cleo is a personal finance app powered by a beloved AI bot. It offers budgeting tools, credit cards, and cash advances that help users manage their money to achieve their financial goals. Once you connect your bank account, Cleo will send you playful reminders to help you stay on track. And unlike other apps like Brigit, it also offers cash advances to self-employed/gig workers.

Read the full Cleo review >>

4. Klover

👍

Pros

- No subscription or membership fees

- Points program to earn rewards

- Basic budgeting tools and credit monitoring

👎

Cons

- High instant transfer funding fees

- Slower deposit speeds

- Small cash advance limits

Loan Limit: $200

Fees: $1.50-$20.78 for instant transfer

Deposit Speed: 3 business days

Klover is a cash advance app that allows users to borrow up to $200 with no credit checks or interest fees. Once you sign up and connect your bank account, you’ll gain access to their powerful budgeting and credit monitoring tools. Users can also earn points by completing surveys and watching ads, at which point they can trade them in for a larger advance or enter the app’s daily sweepstakes.

Read the full Klover review >>

5. Chime

👍

Pros

- More than 60,000 partner ATMs across the United States

- No fees or balance minimums

- Access your paychecks up to two days early

👎

Cons

- Chime checking account required for cash advance

- No physical banking locations

Loan Limit: $200

Fees: $2 for instant transfer

Deposit Speed: Minutes

Chimeoffers online checking accounts and entry-level credit cards designed to help you manage your finances easily. When you sign up, you qualify for up to $200 in overdraft protection with its SpotMe service. There are no monthly minimum or balance fees, and you can access your paycheck up to two days early when you add your Chime account to your employer’s direct deposit setup.

6. Possible Finance

👍

Pros

- On-time payments help build credit

- Installment repayment available

- High borrowing limits

- No credit checks

👎

Cons

- High interest rates and monthly fees

- Not available in every state

- Limited customer support

Loan Limit: $500

Fees: $15-$20 for every $100 borrowed

Deposit Speed: Minutes

Possible Finance has a wide range of borrowing options from cash advances to credit cards and short-term loans. It offers up to $500 cash advances with no penalty fees or credit checks, and you can pay in installments over time. Possible Finance reports payments to two out of three credit bureaus, so there is the opportunity to increase your credit score if your payments are on time.

7. Albert

👍

Pros

- Budgeting and credit monitoring tools included

- Personalized financial advice from Genius experts

- Cash back rewards when you use banking services

👎

Cons

- Monthly subscription required for cash advances

- Limited customer support

Loan Amount: $250

Fees: $4.99 for instant transfer

Deposit Speed: 10 minutes

Albert gives you the ability to manage your finances with a checking, savings, and investment accounts. They not only provide members with $250 in overdraft protection, but they also process direct deposits up to two days earlier than competitors—giving you access to your funds faster. They also offer budgeting tools and personalized financial advice, helping you make smart decisions to stay on top of your financial goals.

Read the full Albert review >>

8. MoneyLion

Related reading: Apps Like MoneyLion

👍

Pros

- High cash advance limits

- Self-employed/gig worker options

- Option to extend repayment

👎

Cons

- CFPB lawsuit in 2022

- Cash advances are limited to $100 per transaction

Loan Limit: $1,000

Fees: $0.49-$8.99 for instant transfer

Deposit Speed: Minutes

MoneyLion offers a variety of financial tools within its app, including cash advances, personal loans, mobile banking, credit monitoring, managed investing, and high-yield savings accounts. Its Instacash service provides users with up to $1,000 in cash advances. While some of these tools require a monthly subscription, Instacash is free, making it a convenient option for those who need cash quickly.

Read the full MoneyLion review >>

Which Brigit Alternative is Best?

Not every app like Brigit will meet your needs. It all depends on whether you’re looking for an app that focuses on overdraft protection, one that offers full-fledged financial services, or one that strikes a balance between the two. Those who have higher incomes will have more options available to them, while those who rely on gig work will be more limited.

Related reading: Apps That Loan You Money Instantly Without a Job

For most people, we recommend EarnIn for its high cash advance limit and quick access to cash. We also recommend Dave for its helpful side hustle resources and reasonable fees. Always read the terms and conditions carefully before signing up, and understand the fee structure and repayment terms before requesting an advance.

In order to decide which Brigit alternative meets your needs, carefully read the terms and conditions and make sure you fully understand the fees and repayment terms before borrowing money.

Other Ways to Get Quick Cash

Not everybody wants a cash advance, and that’s okay! Maybe you need more flexible payment terms, or maybe you don’t like the idea of borrowing money at all. In these cases, you’ll want to consider other options, such as:

- Side hustles or gig work

- Selling unused items around the house

- Personal loans

- Credit cards

- Borrowing from friends and family

Are Payday Loans a Good Idea?

While payday loans are a quick way to get cash, they also come with high interest rates that you have to repay in a short amount of time. If you can’t repay it, you need to apply for another payday loan, creating a cycle that can quickly spiral out of control. For these reasons, we cannot recommend payday loans, especially when there are better alternatives available.

Cash advances are different from payday loans. For one, they don’t typically charge interest. They also have flexible repayment terms that are linked to your paychecks. This makes the loan less risky and easier to manage.

Boost Your Budget with Brigit Alternatives

There are lots of apps like Brigit when it comes to getting a cash advance, each with unique advantages and features to help you manage your personal finances until payday. Depending on your job and financial situation, some Brigit alternatives will suit you better than others. It’s important to review each one carefully to make sure the repayment terms and fees meet your needs.

With the right financial tools and a little strategizing, bridging the gap until payday is entirely possible!

Continue reading: