Cleo is a unique financial app that offers cash advances up to $250, along with a suite of other features, including a snarky AI assistant that adds a fun twist to the user experience. While Cleo is a better solution than traditional payday loans, its monthly membership fee may be a significant drawback for some users.

If you need some quick cash, Cleo is not your only option. To help you find the best fit for your needs, we've compiled a list of the best cash advance apps like Cleo. Although these Cleo alternatives may lack a sarcastic AI assistant, many offer more cost-effective services and higher cash advance limits.

Apps Like Cleo

1. EarnIn

Like Cleo, EarnIn is an app that lets you borrow against your upcoming paycheck without a credit check or any interest charged. Its main advantage is that it offers high cash advance limits up to $750 each pay period.

Pros

- No mandatory fees

- High cash advance limits

- Low Fast-Advance fee

Cons

- Does not accept all forms of income

- $100 daily limit

Loan Amount: Up to $750 per pay period

Fees: Optional tips up to $13, $3.99-$4.99 Fast-Advance fee

Deposit Speed: 1-3 business days

App Store Rating: 4.7/5 stars

Google Play Rating: 4.6/5 stars

Daily advances are capped at $100, and EarnIn has stricter income requirements than Cleo. To be eligible, you must be employed with a minimum income of $320.

EarnIn charges no mandatory fees, operating on a pay-as-you-will pricing structure with optional tips. Standard transfers take one to three business days, but EarnIn users can also pay an extra $3.99-$4.99 fast advance fee to get their funds within minutes.

Read the full EarnIn review >>

2. Chime

Chime is a well-known FinTech company that offers two features designed to help you get access to quick funds. First, there's Chime SpotMe, which provides fee-free overdraft protection up to $200. Then, there's Chime MyPay, a new cash advance feature that lets you borrow up to $500 each pay period. Chime has just begun rolling out its MyPay feature, so it might not be available to you just yet.

Pros

- No monthly fees

- Minimal income requirements

- Up to $200 overdraft protection

Cons

- Must be a Chime customer

- Advances can be as little as $20

Loan Amount: Up to $500 per pay period

Fees: $2 Fast Advance

Deposit Speed: 1-3 business days

App Store Rating: 4.8/5 stars

Google Play Rating: 4.7/5 stars

Typically, Chime MyPay transfers take one to three business days. Same-day funding is available for a small fee of $2.

There is no monthly fee for either of these features; however, you must have a Chime checking account and receive at least $200 per month in direct deposits. Chime customers can also enjoy other benefits, including early access to paychecks and a credit-building tool.

Get started with Chime!

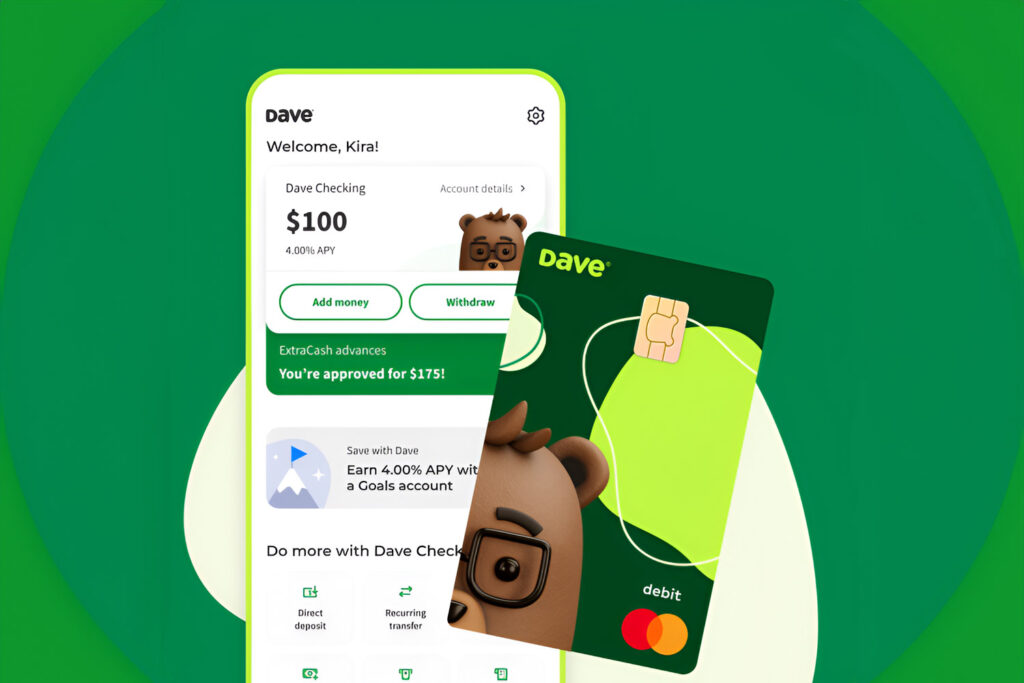

3. Dave

Dave is another cash advance app that offers up to $500 per pay period, doubling Cleo's $250 limit. There are no hidden fees, interest charges, or credit checks required. The app just requires you to pay a low monthly membership fee of $1.

Pros

- Large cash advances

- Easy repayment terms

- Includes budgeting and side hustle finder tool

Cons

- Requires monthly subscription

- High same-day transfer fee

Loan Amount: Up to $500 per pay period

Fees: $1 monthly membership, $3-$25 Fast Advance, optional tip up to 25% of advance amount

Deposit Speed: 1-3 business days

App Store Rating: 4.8/5 stars

Google Play Rating: 4.4/5 stars

Along with access to cash advances, Dave's monthly subscription also includes budgeting tools and a side hustle finder. Standard transfers are free and take one to three business days. Same-day transfers are available for an additional fee, which can be high depending on the amount of your advance.

Read the full Dave review >>

4. Brigit

Brigit is a financial app specifically designed to help people with poor credit scores. Its Instant Cash feature lets users borrow up to $250 each pay period, providing a useful financial buffer when needed. It can take one to three business days to receive a Brigit cash advance, but you can expedite the transfer by paying a fast advance fee ranging from $0.99 to $3.99.

Pros

- Includes budgeting tools

- Can help you build your credit

- Offers discounts for Brigit Premium members

Cons

- Expensive monthly subscription

- Relatively low cash advance limit

- Must be active for 60 days on Brigit before you can request an advance

Loan Amount: Up to $250

Fees: $8.99 or $14.99 monthly subscription, $0.99-$3.99 Fast Advance

Deposit Speed: 1-3 business days

App Store Rating: 4.8/5 stars

Google Play Rating: 4.7/5 stars

To access Instant Cash, you must subscribe to the Brigit Plus plan for $8.99 per month. Along with cash advances, this subscription also includes extra features like identity theft protection, credit score monitoring, a side hustle finder, and tools to help you save more money. If you want help building your credit, a Brigit Premium plan is also available for $14.99 per month.

Read the full Brigit review >>

5. Albert

Albert is an all-in-one financial app offering cash advances up to $250 each pay period. To access cash advances and most of the app's other features, you must subscribe to Albert Genius for $14.99 per month. Albert cash advances can take two to three business days to reach your bank account unless you pay an express transfer fee of $4.99.

Pros

- All-in-one financial app

- Can connect with financial experts

- Includes 30-day free trial

Cons

- Low cash advance limit

- Requires monthly subscription

Loan Amount: Up to $250 per pay period

Fees: $14.99 monthly subscription, $4.99 Fast Advance

Deposit Speed: 2-3 business days

App Store Rating: 4.6/5 stars

Google Play Rating: 4.2/5 stars

Along with cash advances, a Genius subscription provides access to real financial experts, or “Geniuses,” who can offer personalized advice. It also includes additional features designed to help you save money and grow your wealth, such as budgeting and investing tools, a cash account, and recurring savings.

Read the full Albert review >>

6. Possible Finance

Possible Finance is different from other apps like Cleo. Instead of offering cash advances, the app provides small, short-term personal loans up to $500, designed for people with poor or no credit. Unlike Cleo and most cash advance apps, Possible Finance reports your activity to two of the three major credit bureaus to help you build your credit. However, missing payments could have adverse effects.

Pros

- Can help build your credit

- No late fees

- Long repayment terms

Cons

- High fees

- Not available in every state

Loan Amount: up to $500

Fees: $15-$20 per every $100 borrowed, or 25% of the loan amount (varies by state)

Deposit Speed: 1-2 business days

App Store Rating: 4.8/5 stars

Google Play Rating: 4.0/5 stars

Repayment terms are longer than cash advance apps or payday loans, allowing up to 2 months. While there are no late fees, Possible Finance loans are costly. Fees range from $15 to $20 per $100 borrowed or up to $15% of the loan, depending on your state.

Get started with Possible Finance!

Read the full Possible Finance review >>

7. MoneyLion

MoneyLion is a digital banking app. Its InstaCash feature offers up to $500 in cash advances, and users with a MoneyRoar account can boost this limit up to $1,000.

Pros

- Includes banking and investing features

- RoarMoney customers can increase limit to $1,000

- Optional credit-building tool

Cons

- Best for MoneyLion customers

- Fast Advance fees can be expensive

Loan Amount: Up to $500 per pay period (or $1000 with a MoneyRoar account)

Fees: Optional tips, $0.49-$8.99 Fast Advance, Optional $19.99 monthly Credit Builder membership

Deposit Speed: 1-5 business days

App Store Rating: 4.7/5 stars

Google Play Rating: 4.5/5 stars

There are no mandatory monthly fees to use MoneyLion Instacash, but there are optional tips. Express transfer fees vary between $0.49 and $8.99, depending on the amount of the advance. Users can also pay an optional $19.99 monthly membership fee to access credit building features.

Read the full MoneyLion review >>

8. Empower

Empower provides cash advances ranging from $10 to $300 per pay period, with an average advance amount of $145. Like other Cleo alternatives, the app also offers additional financial features like budgeting assistance, automatic savings, and credit-building tools.

Pros

- Most advances delivered within one business day

- Includes budgeting assistance and credit-building tool

- 14-day free trial

Cons

- Cash advance limit can start low

- Charges monthly membership

Loan Amount: up to $300 per pay period

Fees: $8 monthly subscription, $1-$8 Fast Advance

Deposit Speed: 1-5 business days

App Store Ratings: 4.8/5 stars

Google Play Rating: 4.2/5 stars

Users are required to pay a $8 monthly membership fee. Typically, standard transfers take less than one business day but can take up to five days, depending on your bank. You can also request an instant advance by paying an extra fee between $1-$8.

Read the full Empower review >>

9. FloatMe

FloatMe is a cash advance app with a modest limit of $100. Most users start with a $10-$20 cash advance limit that can increase over time as they make timely repayments. Along with cash advances, which the app calls “floats,” FloatMe also offers personal finance management services, an automatic savings tool, and overdraft alerts.

The FloatMe app is expensive for what you get. It costs $3.99 per month, plus an Instant Float fee of $3-$7 if you don't want to wait the standard one to three business days to get your funds.

Loan Amount: up to $100 per pay period

Fees: $3.99 monthly membership, $3-$7 Fast Advance fees

Deposit Speed: 1-3 business days

App Store Rating: 4.8/5 stars

Google Play Rating: 4.4/5 stars

Read the full Floatme review >>

Final Thoughts

If you're strapped for cash, there are a variety of apps like Cleo on the market that can be used to help cover unexpected bills or emergency expenses. While these Cleo alternatives share some similarities, each one has distinct features, fees, and eligibility requirements.

Before signing up for any app, it's important to weigh the pros and cons to determine which is the best match for you. Overall, Cleo is a great option, especially if you enjoy interacting with the app's witty AI assistant or if you're a gig worker. But, other apps like Cleo might provide greater value with larger cash advances or lower membership fees.