If you’re pinching pennies with a week to go until payday, downloading one of the best cash advance apps can help tide you over. These apps loan you money based on previous paychecks without the need for a credit check or lengthy approval process.

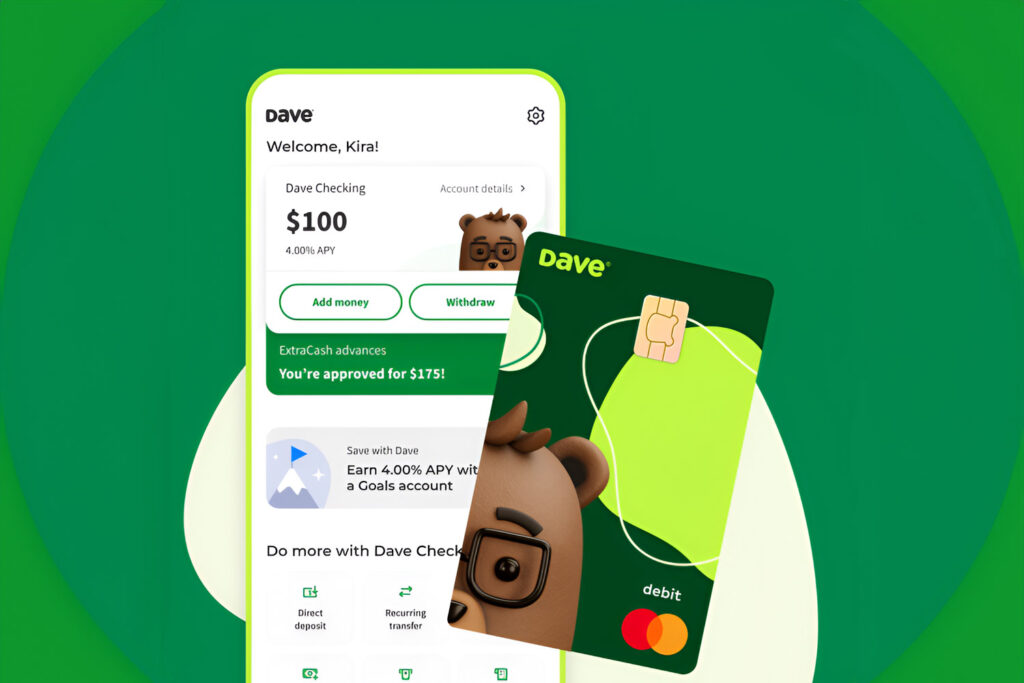

While Dave is one of the most popular apps in its category, it does have its drawbacks. Not everybody will meet the income requirements, and many people can’t afford to pay the instant transfer fees (in addition to its mandatory membership requirement).

Related reading: How To Get a Personal Loan

If you’re looking for a cash advance app that has lower fees and more flexible borrowing terms, consider one of these Dave alternatives:

Apps Like Dave

| App | Loan Limit | Fees | Deposit Speed |

|---|---|---|---|

| EarnIn | $750 | $3.99-$4.99 for instant transfer | Minutes |

| Klover | $200 | $1.50-$20.78 | 1-3 business days |

| Brigit | $250 | $0.99-$3.99 for instant transfer | 20 minutes |

| Possible Finance | $500 | $15-$20 for every $100 borrowed | Minutes |

| Chime | $200 | $2 for instant transfer | Minutes |

| Albert | $250 | $4.99 for instant transfer | 10 minutes |

| Cleo | $500 | $3.99 for instant transfer | Same day |

| MoneyLion | $1,000 | $0.49-$8.99 for instant transfer | Minutes |

Each app has its own perks and drawbacks. Read on to find out which one is the best fit for your financial needs.

Apps Like Dave

1. EarnIn

Pros

- High cash advance limit

- No interest or mandatory fees

- Provides funds within minutes

- Free credit score monitoring

Cons

- Can only borrow $100 per day

- Employment verification require

- Not an option for gig workers

EarnIn is a financial services app that provides cash advances in addition to its credit monitoring and calculator tools. It offers users up to $750 per pay period ($100 per day) with no interest or mandatory fees. While it does request a tip for its services, it is completely optional. All you have to do is validate your earnings with a work email address or by enabling GPS tracking.

2. Klover

Pros

- No subscription or membership fees

- Points program to earn rewards

- Basic budgeting tools and credit monitoring

Cons

- High instant transfer funding fees

- Slower deposit speeds

- Small cash advance limits

Klover is a cash advance app that offers up to $200 with no credit check. The app features budgeting tools that help you create a savings goal and monitor your credit.

While there are no mandatory fees or interest charges, there is a fee for instant cash deposits. After signing up, users can complete surveys and watch ads to access larger cash advances or use their points to enter Klover’s $100 daily sweepstakes.

3. Brigit

Pros

- Free extension on cash advance repayments

- Low instant transfer fees

- Subscription includes credit monitoring and budget tools

Cons

- Must sign up for a membership for cash advance

- Cash advance amount lower than most competitors

Brigit is a credit monitoring and budgeting app that provides cash advances to help members avoid overdraft fees. These cash advances range anywhere from $50 to $250.

The app schedules a payoff date when you initially request the advance, but this date can be extended if need be. You must be a subscriber to receive cash advances, but the membership comes with valuable tools that can help you manage your finances more effectively.

4. Possible Finance

Pros

- Ability to repay in installments

- On-time payments help build credit

- Works with people who have bad or no credit

Cons

- High interest rates and monthly fees

- No phone support

- Not available in every state

Possible Finance offers cash advances, credit cards, and short-term loans, giving borrowers multiple loan options to meet their financial needs. Their cash advances have a $500 limit with no credit checks or penalty fees, and borrowers can pay in installments over time. Possible Finance does report payments to the credit bureaus, so it’s a great opportunity to increase your score with responsible repayment.

5. Chime

Pros

- Access to paychecks up to two days early

- More than 60,000 partner ATMs across the United States

- No fees or balance minimums

Cons

- Chime checking account required for cash advance

- No physical banking locations

Chime is a financial services app that provides users with online banking, credit cards, and money management tools. Its SpotMe feature provides up to $200 in cash advances to protect its users from overdrafting. There are no monthly fees or minimum balances required, and you can access more than 60,000 ATMs at stores like Walgreens, CVS, and 7-Eleven. If you set up your Chime account with your employer’s direct deposit, you can access your paycheck up to two days early.

6. Albert

Pros

- Budgeting and credit monitoring tools included

- Financial experts available to offer personalized advice

- Cash back rewards when you use banking services

Cons

- Monthly subscription required for cash advances

- Limited customer support

- No mobile check deposits

The Albert app offers users banking, savings, and investment accounts. It provides up to $250 in overdraft protection, allowing users to earn cash back on gas, groceries, and delivery services.

It also features powerful money management tools, with everything from credit monitoring to personalized advice from financial experts. There are no minimum balance fees, and each Albert Cash and Albert Savings account is insured by the FDIC.

7. Cleo

Pros

- No interest or credit checks

- Accepts freelancers and gig workers

- Includes money management features

Cons

- Monthly subscription required

- Must pay an extra fee for same-day transfers

Cleo is a clever AI bot that helps you save money by sending you motivating reminders to stay on track. The app offers credit cards, budgeting tools, and cash advances with no credit checks to help users improve their financial health. It’s also one of the only Dave alternatives that works with gig workers and freelancers, providing flexible financial solutions to those with irregular income.

8. MoneyLion

Pros

- High borrowing limits

- Self-employed/gig worker options

- Ability to extend repayment dates

- Wide range of financial services

Cons

- CFPB lawsuit in 2022

- Cash advances are limited to $100 increments

MoneyLion is a financial app that offers mobile banking with rewards, automated investing, credit-building tools, and cash advances to help users stay on top of their finances.

Related reading: Apps Like MoneyLion

Users can borrow up to $1,000 in a matter of minutes with no credit check or mandatory fees. Some features will require a monthly subscription, but the app’s Instacash feature is free – giving you access to fast cash when you need it most.

Choosing Apps Like Dave

Different cash advance apps will appeal to different needs. Some just need an app to float a bit of cash in a pinch, while others want an all-inclusive financial management service. Those with high incomes will have more options, while those with less stable incomes will need more flexible solutions.

No matter which app you download, make sure you carefully review the terms and conditions before signing up or borrowing money. This includes the fee structure, repayment terms, and how the app can use your information. Doing your research can help you avoid unexpected costs and protect your privacy.

Other Fast Money Options to Consider

Cash advances aren’t always the best option. Maybe you need to borrow money long-term, or maybe you prefer a loan with more flexible repayment terms. In these situations, you might want to explore options, such as:

- Personal loans

- Get a credit card from Yendo based on the value of your car

- Side hustles

- Borrow money from friends and family

- Sell unused items around the house

- Sell your junk car for fast cash

The Best Ways To Make Money At Home.

Payday Loan vs Cash Advance

Payday loans have much higher interest rates and shorter repayment periods compared to cash advances. Their strict terms can quickly lead to a cycle of debt if not handled carefully. Because of this, we do not recommend taking out a payday loan.

Cash advances, on the other hand, are a great option when you’re in a financial pinch. They rarely charge interest, and the loan amount and repayment date are tied to your paycheck, which makes it much easier to manage. This flexibility can help you avoid the financial instability that payday loans often cause.

Fast Funds with Apps Like Dave

While Dave is one of the best cash advance apps on the market, it isn’t the only one. There are many Dave alternatives that may be a better fit for your needs. Pick two or three of the apps from the list above, and then review their repayment terms and conditions to make sure they fit your financial goals. With a little time and research, your personal finances will be back on track in no time.

Continue reading: