Cash advance apps have become a popular, convenient solution for those in need of quick financial relief. However, many of these apps require users to have steady paychecks and direct deposits, which can be a challenge for those without a traditional job.

Fortunately, there are still several unemployment cash advance apps that cater to freelancers, gig workers, and those in between jobs. These apps provide easy access to funds without strict employment requirements. In this review, we will discuss the top five apps that loan you money instantly without a job.

Apps That Loan Money Instantly Without a Job

| App Name | Cash Advance Amount | Fees | Payout Time | Bank Account Requirements | Key Features |

|---|---|---|---|---|---|

| Chime SpotMe | $20-$200 | None | Instant | Chime Checking Account required | Overdraft protection |

| Cleo | $20-$250 | $5.99-$14.99/month, additional fee for 24h disbursement | 3-4 business days | Bank account linked | AI-powered budgeting, No credit check |

| Vola | $30-$300 | $2.99-$28.99/month (optional) | Same-day | Bank account, balance of $150 | Spending analytics, Payment extensions |

| SoLo Funds | $20-$575 | None, optional tips and donations | Same-day (post-approval) | Bank account linked | Peer-to-peer lending, Set own terms |

| Gerald | $10-$215 | $9.99/month, $3.99 instant fee | 3-5 business days | Bank account, 3 months old | Mobile banking, Early paycheck access |

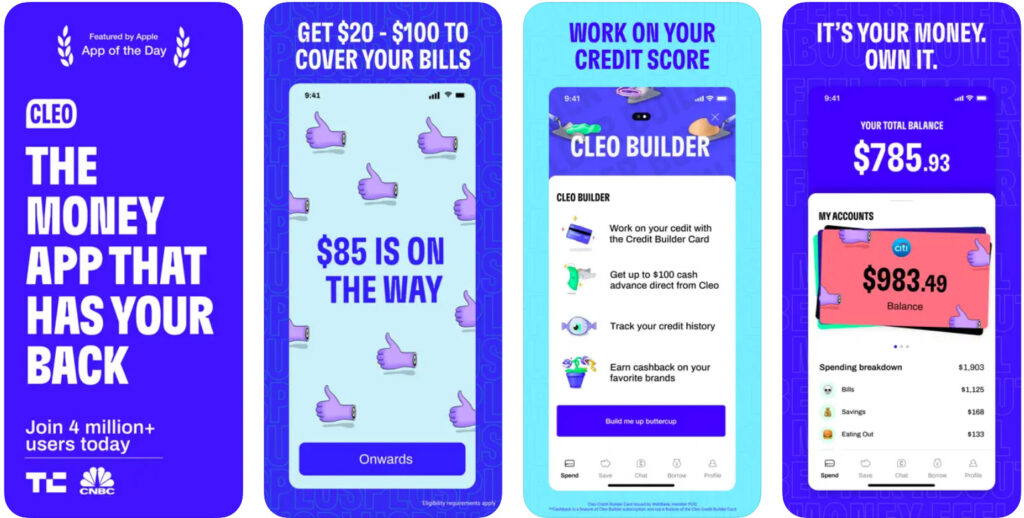

1. Cleo

Cleo is a cash advance app that is more accessible than others on the market. The app makes it easy for freelancers, gig workers, and unemployed individuals to get financial assistance when they're in a bind. It's one of the best options for getting a cash advance without a job.

Pros

- Freelancers and gig workers qualify

- No credit check

- No interest charged

Cons

- There is a monthly subscription cost

- Maximum advance limit is only $250

- Must pay extra to get funds instantly

Highlights

Cash Advance Amount: $20-$250

Payout Time: 3-4 business days

Fees: $5.99-$14.99/month (optional express transfer fee)

The app, which doubles as a snarky, AI-powered budgeting tool, offers interest-free cash advances with no credit check required. However, there is a monthly subscription fee of $5.99 per month for Cleo Plus to access cash advances.

There is also a Cleo Credit Builder membership that includes cash advances and a credit builder loan for $14.99 per month.

When you sign up for the Cleo app, you will need to link your bank account. Unlike most cash advance apps, Cleo does not require users to provide proof of employment. Instead, their complex, AI-assisted algorithm evaluates your bank account activity in order to determine eligibility.

Cleo's cash advance limits are on the low side, starting at around $20-$100. But, you can increase your limit up to $250 over time as you make timely repayments and receive consistent direct deposits. It can take up to 4 days for your cash advance to be deposited, but Cleo also has an instant transfer option that costs an extra fee.

Read the full Cleo review >>

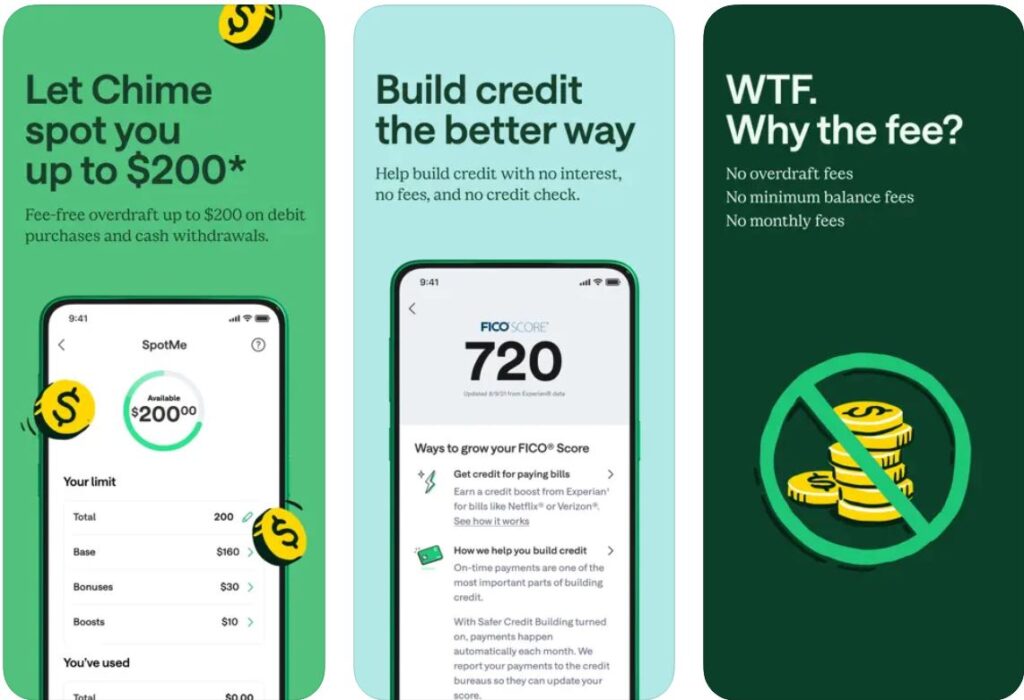

2. Chime SpotMe

Chime SpotMe is a useful feature that provides up to $200 in overdraft protection. Unlike traditional cash advance apps that give users money for any expense, SpotMe specifically covers overdrafts in your Chime Checking Account.

Pros

- No monthly fees

- Minimal income required to qualify

- Can get up to $200 in overdraft protection

Cons

- Requires a Chime checking account

- Limit starts at as little as $20

- Only covers debit card purchases and cash withdrawals

Highlights

Loan Amount: $20-$200

Payout Time: Instant

Fees: None

To take advantage of Chime SpotMe's benefits, you must have a Chime Checking Account or Credit Builder card and have received at least $200 in direct deposits over the last 34 days. Income from gig apps like Doordash or Uber and government benefits qualify, as long as the money was directly deposited into your checking account.

The best part about Chime SpotMe is that it's entirely free to use. When you first sign up, your SpotMe limit will be around $20. But, over time, the maximum can increase up to $200 as you build up history. You can also increase your limit each month by receiving up to four $5 “Boosts” from friends who also use the Chime app.

The downside to Chime SpotMe is that it only covers purchases made with your Chime debit card or cash withdrawals from your checking account. If you're not already a Chime user or need to borrow a larger amount, then you will probably want to consider other options.

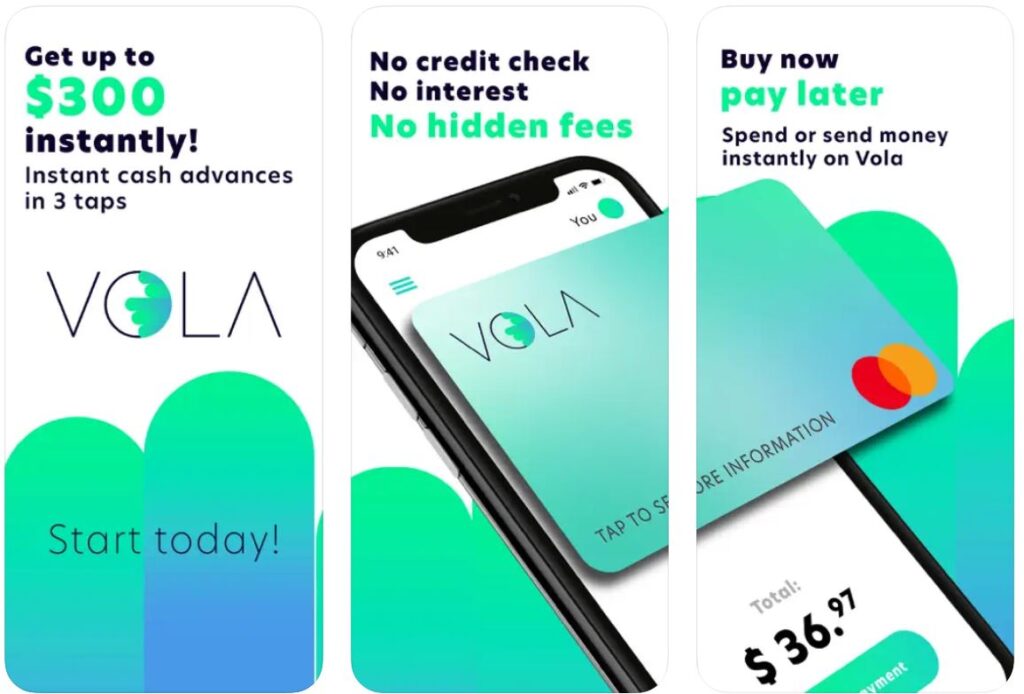

3. Vola Finance

Vola Finance is another one of the best cash advance apps without direct deposit requirements. To qualify, users must have an active bank account at least 3 months old with an average balance of $150 and proof of income. Unemployment benefits and money earned from gig work or freelancing count as valid sources of income.

Pros

- No interest charges or hidden fees

- Allows payment extensions up to 10 days

- Free same-day transfers within 5 hours

Cons

- Potentially expensive, unclear monthly subscription fees

- Requires bank account balance of $150

- Advances start at just $30

Highlights

Loan Amount: up to $30-$300

Payout Time: Same-day

Fees: Free Basic Membership, or Premium Membership of $2.99-$28.99/month

After being approved, your cash advance limit will start at around $30-$50. Vola will use your bank account activity to assign you a score between 0 and 100. The higher your score, the more you can borrow – up to $300.

In addition to cash advances, Vola has spending analytics and additional features designed to help you manage your finances. The app does not charge interest or any hidden fees, like tips or late charges. Basic Membership, which includes cash advances, is free.

However, if you want to take advantage of Vola's additional features, you must pay a Premium Membership monthly subscription ranging from $2.99-$28.99 per month.

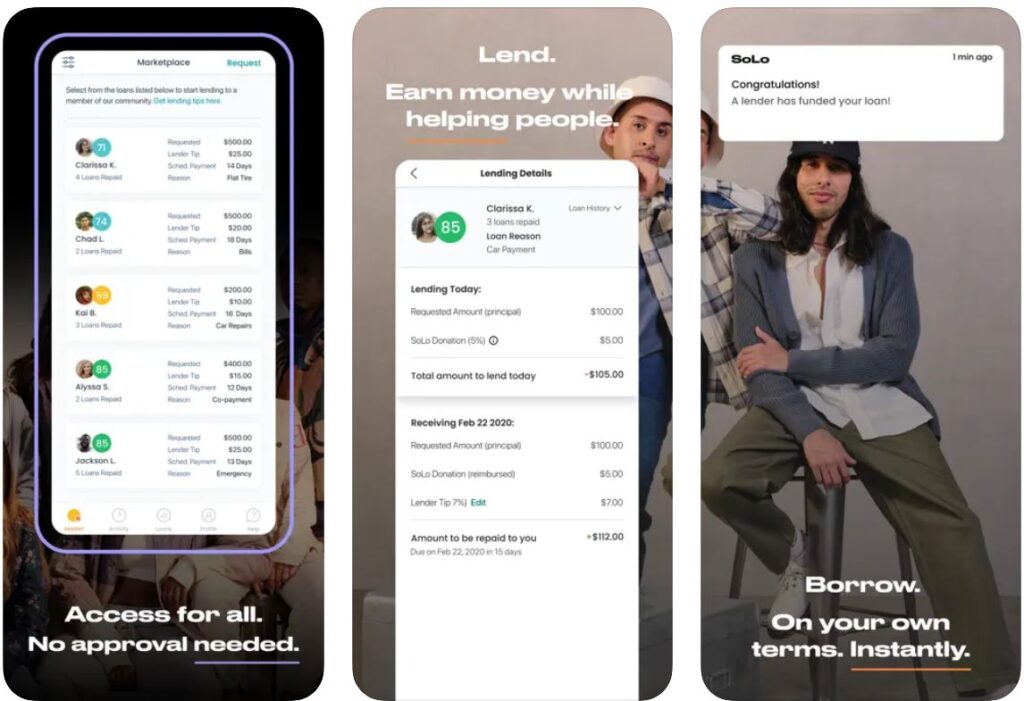

4. SoLo Funds

SoLo Funds is a loan app for unemployed people. It works by letting you borrow up to $575 from your peers.

Pros

- Free to use

- Can set your own terms

- Interest-free loans

Cons

- Charges late fees

- Loans only have a 55-60% chance of approval

- Loans can take up to 3 days to be approved

Highlights

Loan Amount: $20-$575

Payout Time: Same-day, once approved

Fees: Free, with optional tips and donations

Unlike many unemployment cash advance apps, SoLo Funds has no monthly membership fees. It's entirely free to use, and the loans are interest-free. However, you must repay your loan within 35 days based on the terms they set. Otherwise, there are late fees.

Users get a lot of control over their loans. You can choose your own loan amount and repayment date. However, since it is a peer-to-peer lender, it can take up to 3 days for someone to approve your loan, and approval is not guaranteed. If approved, funding can happen that same day.

SoLo Funds is available everywhere in the United States, except the state of California.

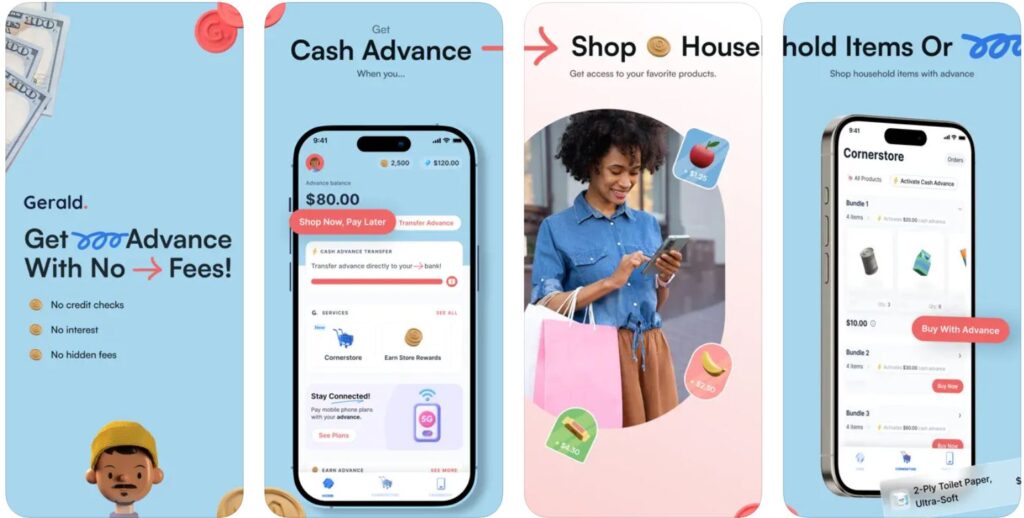

5. Gerald

Gerald is another app that lets you request a cash advance without a job. It also has mobile banking features, like a cash-back debit card, overdraft protection, a bill tracker, and a budget calculator. The app costs $9.99 per month.

With Gerald, you can borrow up to $215, with no credit check or interest charged. A unique feature that sets Gerald apart from other unemployment cash advance apps is that it offers early access to half of your paycheck, as long as you have already earned the money.

To qualify for a Gerald cash advance, you will need a bank account at least 3 months old with a positive balance. Additionally, your account should show regular deposits of at least $100 and demonstrate a pattern of having funds remaining after each payday.

Typically, when you first start out, your advance limit will be between $10-$80, which can go up over time. A standard transfer takes 3-5 days to get your funds. You can also pay an optional express fee to get your funds instantly.

Pros

- No credit check

- No interest charged

- Lets you receive half of your paycheck early

Cons

- Pricey monthly membership

- Small cash advances

- Extra charge for same-day transfers

Highlights

Loan Amount: $10-$215

Payout Time: 3-5 business days

Fees: $9.99/month (optional express transfer fee of $3.99)

What Are Some Alternatives to Cash Advance Apps?

If you don't meet the qualification requirements for a cash advance app or need to borrow a larger amount, there are still other ways to secure funds to help you through a financial rough patch. When emergencies strike, earning extra money is often the best solution. Here are some ideas to help you earn money quickly:

- Drive for ride-sharing apps like Uber or Lyft

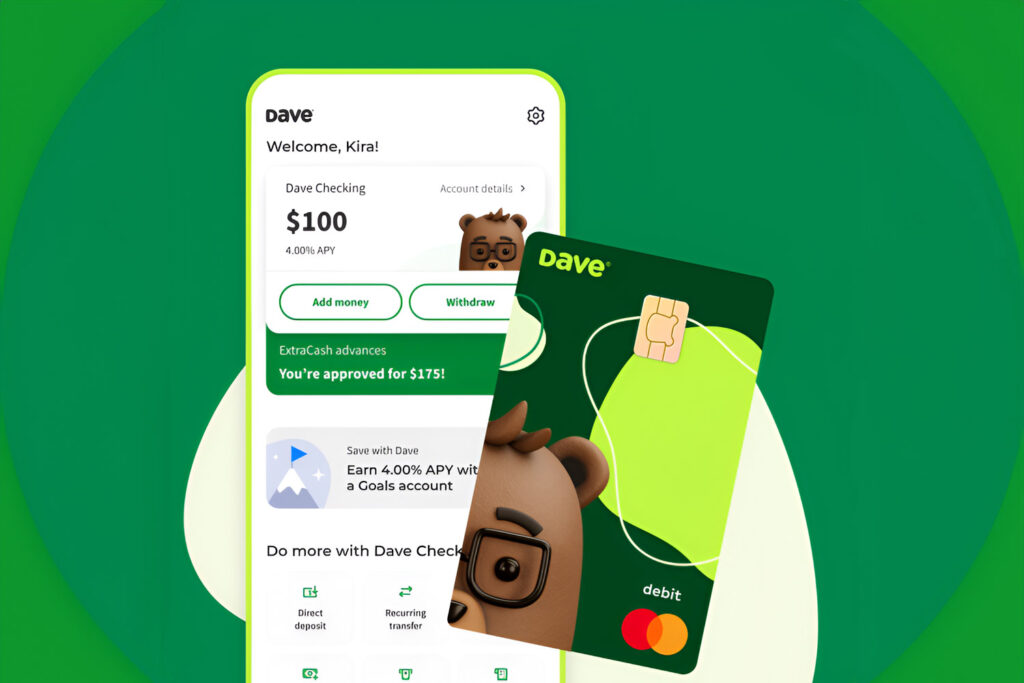

- Use better cash advance solutions like EarnIn and Dave

- Deliver food through a gig economy app like Uber Eats or DoorDash

- Get a credit card from Yendo based on the value of your car

- Start an online side hustle (ex. Dropshipping, freelancing, starting an Etsy shop, etc.)

- Begin babysitting, pet sitting, or house sitting

- Have a garage sell

- Sell items on eBay

Aside from earning income, there are also other ways to borrow money without traditional employment. A few other alternatives to using a cash advance app include:

- Apply for and use low-interest credit cards

- Apply for unemployment benefits

- Take out a personal loan

- Turn to friends and family

Another option is to take out a payday loan, but we strongly advise against it. Even though payday lenders often approve individuals without proof of employment, their terms are frequently incredibly predatory and can entangle you in a cycle of debt.

Lending Apps That Don't Require a Job

While there are numerous ways to make money if you're unemployed, not all of them are wise choices for your financial well-being. Some methods – like exploitative payday loans or taking on debt – may provide immediate relief but can lead to financial instability down the road. When considering borrowing money during periods of unemployment, weigh your options carefully to ensure long-term financial health.

Unemployment cash advance apps offer a superior alternative to long-term loans or accumulating debt. When money is tight, these apps can help you cover bills or unexpected expenses by letting you borrow a small amount instantly, usually with 0% interest and no impact on your credit score.

That said, none of these apps are designed to solve ongoing money issues or to serve as a substitute for a stable paycheck. It's important to use them responsibly and to ultimately work towards securing a steady source of income that eliminates the need for borrowing.