Where To Get the Best Personal Loan - 2025 Guide

When you need extra money to fund an emergency, make a large purchase, or consolidate debt, a personal loan can help you meet your financial needs. The best personal loans offer agreeable terms that work with your budget, like fair interest rates and little to no fees, which is why finding the right lender to fit the job is crucial.

Many borrowers turn to online lenders to find personal loans that fit their budgets and financial needs. Online lenders often have convenient application processes and make it easy to compare loan options right on their websites.

To help you compare, we’ve rounded up 9 of the best personal loan lenders and examined their pros and cons.

What Can a Personal Loan Be Used For?

Lenders generally let borrowers use personal loans in numerous ways, including:

- Weddings

- Travel

- Debt consolidation

- Medical bills

- Home improvement or repairs

- Vehicle repairs

- College expenses, like books or room and board

- Moving expenses

- Emergency funding

- Large purchases

Personal loans are typically one of the best options for getting cash fast when you don’t have the money to shell out for something. Their interest rates are usually much lower than the best cash advance apps or buy now, pay later loans offer, and some lenders allow you to borrow as much as $100,000.

However, most lenders have restrictions on using the money they lend you. For example, lenders may not let you use personal loan funds for a house down payment or to pay college tuition, as there are down payment loans and student loans for those purposes. Using a personal loan for business expenses is also against the rules, as you’ll typically need to apply for a business loan for that.

👉 Related reading: Hometap Review: Get Cash from a Home Equity Investment

9 Best Personal Loans for 2025

| Lender | BBB Rating | Loan Amounts | Estimated APR | Loan Terms | Origination Fees | Special Features | Best For |

|---|---|---|---|---|---|---|---|

| Best Egg | A+ | $2,000-$50,000 | 8.99%-35.99% | 36-60 months | 0.99%-9.99% | Reports to major credit bureaus, financial health tools | Borrowers with little to no credit |

| LendingClub | A+ | $1,000-$40,000 | 8.98%-35.99% | 24-60 months | Up to 8% | Multiple loan offers, no prepayment fees | Reviewing multiple loan offers |

| Happy Money | A+ | $5,000-$40,000 | 11.72%-17.99% | 2-5 years | Over 5% for some loans | Simple prequalification, low fixed rates | Credit card consolidation |

| SoFi | A+ | $5,000-$100,000 | 8.99%-29.49% | 2-7 years | None | No fees, 0.25% autopay discount | Large purchases, high loan amounts |

| Upstart | A+ | $1,000-$50,000 | 7.80%-35.99% | 3-5 years | Up to 12% | AI-driven approval, fast funding | Borrowers with low credit scores |

| Prosper | A- | $2,000-$50,000 | 8.99%-35.99% | 2-5 years | Up to 9.99% | Peer-to-peer lending, fast application process | Smaller loans, quick funding |

| LightStream | A | $5,000-$100,000 | 7.59%-25.99% | 2-20 years | None | Satisfaction guarantee, rate beat program | Large-purchase borrowers |

| Discover | A+ | $2,500-$40,000 | 7.99%-24.99% | 36-84 months | None | No fees, flexible payment dates | Long loan terms, low APRs |

| PenFed | A+ | $600-$50,000 | 8.99%-17.99% | 12-60 months | None | Credit union perks, financial assistance | Borrowers considering a credit union |

The following personal loan lenders are some of the highest rated for their ease of application, funding times, and loan terms.

1. Best Egg

Founded in 2014, Best Egg offers credit cards and unsecured and secured personal loans for people with all types of credit histories. The company focuses on helping everyone get the financial products that fit their needs, even if they have little to no credit or rough credit histories.

👍

Pros

- Reports to the three major credit bureaus

- Personal loans of up to $50,000

- Customer support available by phone, email, and live chat

👎

Cons

- Not available in Iowa, Vermont, West Virginia, the District of Columbia, or U.S. Territories

- Charges an origination fee of 0.99%-9.99% of the loan

- Loans aren’t available for less than one year

Highlights

Best For: Borrowers with little to no credit but good overall financial health

Loan Amounts: $2,000-$50,000

Estimated APR: 8.99%-35.99%

Loan Terms: 36-60 months

BBB Rating: A+

Why We Like Best Egg

Best Egg is as focused on financial health as it is on helping people borrow what they need. The company offers financial resources to borrowers, like a money management account with personalized financial insights, allowing them to visualize their current finances and make moves to grow their future wealth.

Best Egg also has flexible payment terms of 36-60 months with loans of up to $50,000, making it an excellent option for large purchases.

Who Is Best Egg Best For?

Best Egg attempts to help most people with their financial goals, even if they have less than stellar credit. Rather than focus on credit scores, Best Egg considers an applicant’s full financial profile, including their income, credit history, and mix of credit accounts, to determine whether it can help and what terms might work best for them.

2. LendingClub

LendingClub, founded in 2007, is a digital bank offering multiple financial products, including personal loans, high-yield savings accounts, and small business loans.

👍

Pros

- Connects to multiple investors to choose from several loan options

- No prepayment fees

- Fixed interest rates

👎

Cons

- Maximum loan amount of $40,000

- Origination fees of up to 8%

- No autopay discount

Highlights

Best For: Reviewing multiple loan offers

Loan Amounts: $1,000-$40,000

Estimated APR: 8.98%-35.99%

Loan Terms: 24-60 months

BBB Rating: A+

Why We Like LendingClub

LendingClub isn’t a typical online lender. Instead, think of it like a digital marketplace that connects borrowers to loan investors who offer to fund a personal loan. When you check your rate with LendingClub, the company reviews your information and compiles multiple loan offers based on what you’re looking for. You’re free to choose the most suitable one, whether you want the lowest monthly payment or the least amount of interest.

LendingClub caps personal loans at $40,000, so keep this in mind if you think you’ll need more funds.

Who Is LendingClub Best For?

LendingClub may be your best option if you’re in the shopping around phase for a personal loan and want to get an idea of what you might qualify for. You’ll typically get at least three or four offers from LendingClub when you check your rate online, each with different loan terms, interest rates, and monthly payments, making it easy to compare your choices without feeling boxed into one loan.

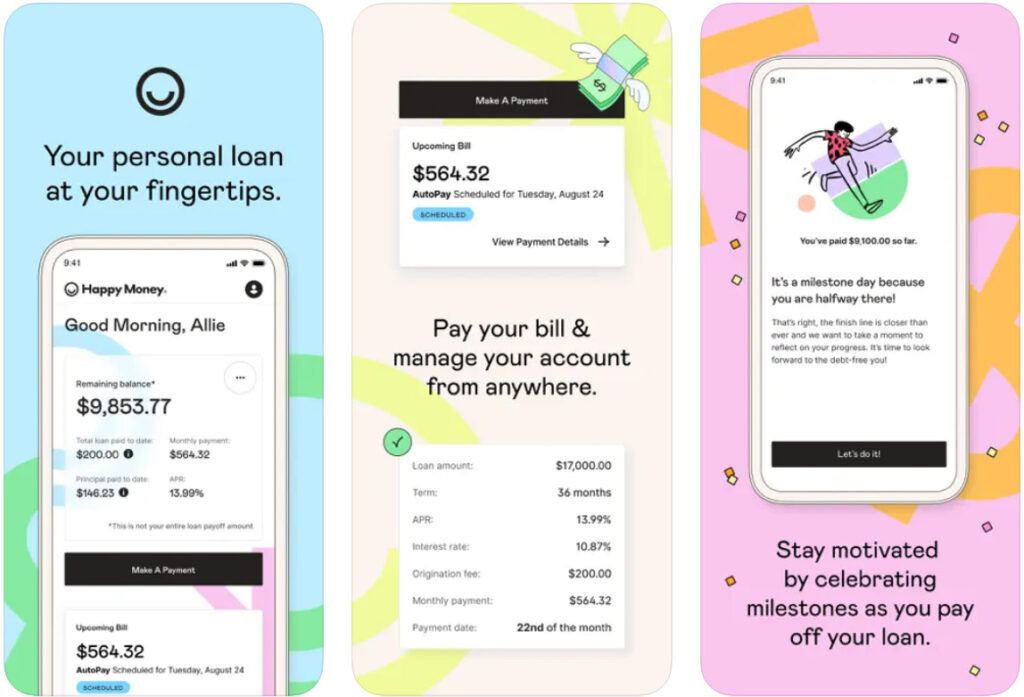

3. Happy Money

Happy Money provides personal loans for paying off credit card debt while striving to simplify the loan application process for borrowers. Founded in 2009, Happy Money works with credit unions and lending partners to give borrowers agreeable interest rates and loan terms.

👍

Pros

- Simple online prequalification process

- Flexible loan terms of 2-5 years

- Maximum fixed rates of 17.99%

👎

Cons

- Only available for debt consolidation

- Typically requires a minimum credit score of 640

- Origination fee may be more than 5% for some loans

Highlights

Best For: Credit card consolidation or refinancing

Loan Amounts: $5,000-$40,000

Estimated APR: 11.72%-17.99%

Loan Terms: 2-5 years

BBB Rating: A+

Why We Like Happy Money

Happy Money’s clean and easy-to-navigate website makes the process of understanding the kind of loans it offers and prequalifying and applying for loans simple. Happy Money also provides multiple loan options, allowing you to choose the terms that make the most sense for you. Its credit card consolidation personal loans also have among the best potential interest rates, maxing out at 17.99%, which is significantly lower than the max of 30% or more than many lenders charge.

Who Is Happy Money Best For?

If you have credit card balances that you’d like to refinance or consolidate, Happy Money could be for you. The Payoff Loan from Happy Money gives you up to $40,000 to pay off credit card debt. Even at the highest APR of 17.99%, Happy Money loans offer lower interest rates than many credit cards, which could help you pay down your debt faster and pay less interest while paying just one monthly payment.

However, you’ll need decent credit to get approval for a Happy Money loan, as the company usually requires a credit score of at least 640.

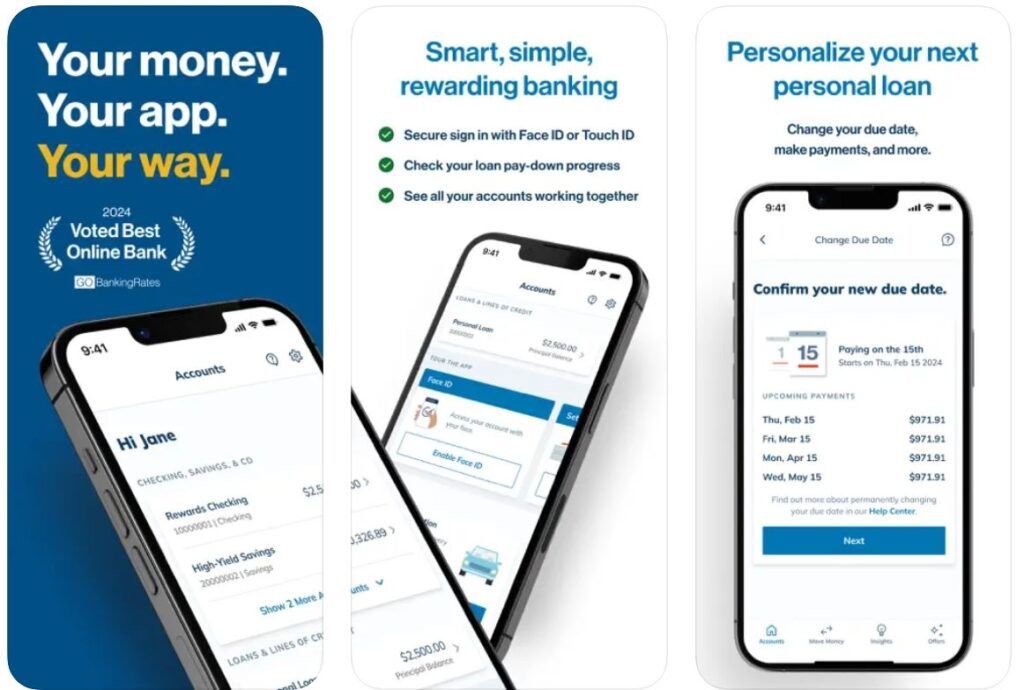

4. SoFi

SoFi was founded in 2011 by students in Stanford’s business school to help other college students and graduates fund their education. Now, SoFi offers multiple financial products, including student loans, mortgages, personal loans, and banking accounts.

👍

Pros

- Personalized loan options for various borrowing needs

- No origination or prepayment fees

- Loan terms up to 7 years

👎

Cons

- Minimum loan of $5,000

- Typically prefers borrowers in the good to excellent credit score range

- Borrowers can’t choose their payment date

Highlights

Best For: Large purchases, like home repairs or weddings

Loan Amounts: $5,000-$100,000

Estimated APR: 8.99%-29.49%

Loan Terms: 2-7 years

BBB Rating: A+

Why We Like SoFi

SoFi has an excellent reputation in the financial industry, making it a trusted player when it comes to personal loans. SoFi also offers some of the highest personal loan amounts for creditworthy borrowers, with up to $100,000 allowed.

You can check your rate on SoFi’s website to get your estimated loan terms and interest rate. SoFi doesn’t charge fees for late payments, loan origination, or paying early, and you can get an interest discount of 0.25% when you choose autopay for your monthly loan payments.

Who Is SoFi Best For?

SoFi personal loans are best for borrowers who need to cover a large purchase, like an upcoming wedding or home repair, with borrowing options of up to $100,000. However, amounts over $20,000 are usually reserved for borrowers with high incomes and exceptional credit.

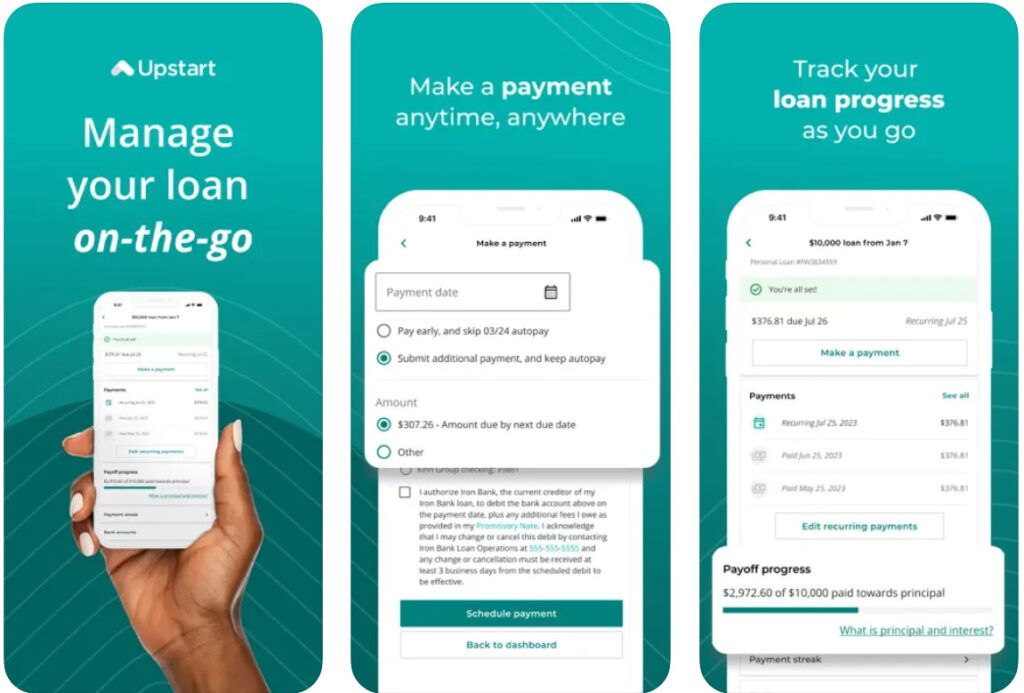

5. Upstart

Upstart entered the financial technology scene in 2012, boasting an AI-powered system that analyzes each applicant’s creditworthiness and borrowing power to accurately suggest the best loan options.

👍

Pros

- Next-day funds available

- Checking a rate takes just a few minutes

- Simple application process with little to no paperwork needed

👎

Cons

- Requires a minimum annual income of $12,000

- Minimum loan amounts vary by state

- Some loans have origination fees of up to 12%

Highlights

Best For: Borrowers with low credit scores or little credit history

Loan Amounts: $1,000-$50,000

Estimated APR: 7.80%-35.99%

Loan Terms: 3-5 years

BBB Rating: A+

Why We Like Upstart

Upstart’s AI approval system streamlines the process of personal loan approvals while making it easier for its partnered banks and credit unions to offer better interest rates and approve more applicants. You can get approval decisions from Upstart immediately and, if denied, receive a thorough explanation so you’ll know what to improve for future approvals.

Who Is Upstart Best For?

Because Upstart uses an AI-driven system to approve and underwrite loans, it checks your full financial profile rather than make decisions based solely on your credit score or credit history. Therefore, if you have little to no credit or bad credit, you could still get approved for a loan if your income and other factors satisfy the system.

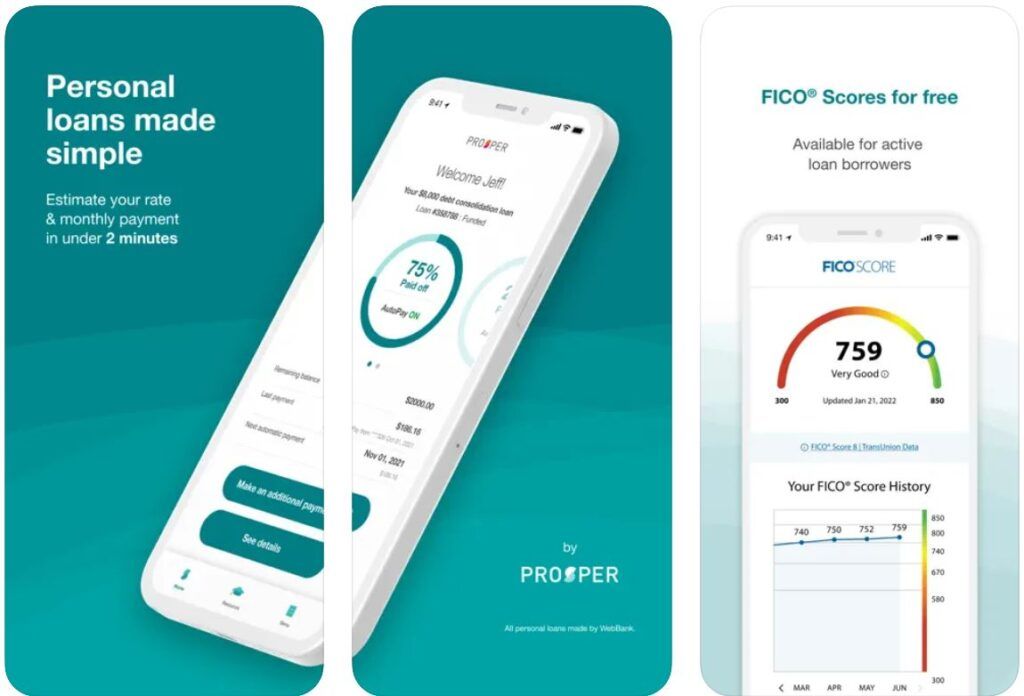

6. Prosper

Prosper is the original peer-to-peer online lending platform, established in 2005. More than one million loans have been delivered through Prosper since its start, with about 4,000 new loans given weekly.

👍

Pros

- Simple online application process

- Loans can be funded in as little as one business day

- Mobile app for easy account management

👎

Cons

- Origination fees of up to 9.99% are possible

- No auto-pay discount

- Can be difficult to qualify for lower interest rates

Highlights

Best For: Borrowing a smaller loan

Loan Amounts: $2,000-$50,000

Estimated APR: 8.99%-35.99%

Loan Terms: 2-5 years

BBB Rating: A-

Why We Like Prosper

As the first online peer-to-peer lending service, Prosper has made a name for itself in the loan industry and is one of the most recommended services of its kind. Its easy application process speaks for itself, requiring just a few minutes of your time to check your rate, accept an offer, and apply for a loan. In most cases, funds can be directly deposited into your account by the next business day.

Some Prosper loans can have origination fees of up to 9.99%, but many of them fall within the 1% to 3% range. With loan amounts from $2,000 to $50,000, Prosper caters to a wide range of borrowing needs, funding personal loans for numerous purposes, like medical bills, home improvements, or large purchases.

Who Is Prosper Best For?

Because Prosper offers loans for just $2,000, it can be a good option if you’re looking for smaller loans for car repairs, minor home upgrades, etc. Also, if you plan to pay off your loan from Prosper early, you won’t get stuck with any prepayment fees.

7. LightStream

LightStream was established in 2012 to provide fast and uncomplicated loan financing for various purposes, from auto purchases to swimming pool installations. Every time a customer gets a loan funded, LightStream plants a tree through its partner, American Forests.

👍

Pros

- $100 borrower satisfaction guarantee

- High loan amounts and long loan terms are available

- Convenient web and mobile applications

👎

Cons

- Minimum loan of $5,000 required

- Borrowers can’t prequalify

- Not all loans qualify for max loan amounts or loan terms

Highlights

Best For: Large-purchase borrowers who need long loan terms

Loan Amounts: $5,000-$100,000

Estimated APR: 7.59%-25.99%

Loan Terms: 2-20 years

BBB Rating: A

Why We Like LightStream

LightStream is committed to making the borrowing experience as quick and easy as possible, so much so that it offers a satisfaction guarantee. If you don’t enjoy your application and funding experience, LightStream will pay you $100.

LightStream also offers a 0.10% APR discount if you are approved for an identical loan from a competing lender with a better rate than your LightStream offer. This applies to unsecured loans only.

Who Is LightStream Best For?

Try LightStream if you need to borrow more than $50,000 and want several loan options to choose from. After checking your rate based on the type of loan and amount you want to borrow, LightStream provides multiple options with flexible loan terms, various interest rates, and a range of monthly payments, so you can decide which loan is right for you.

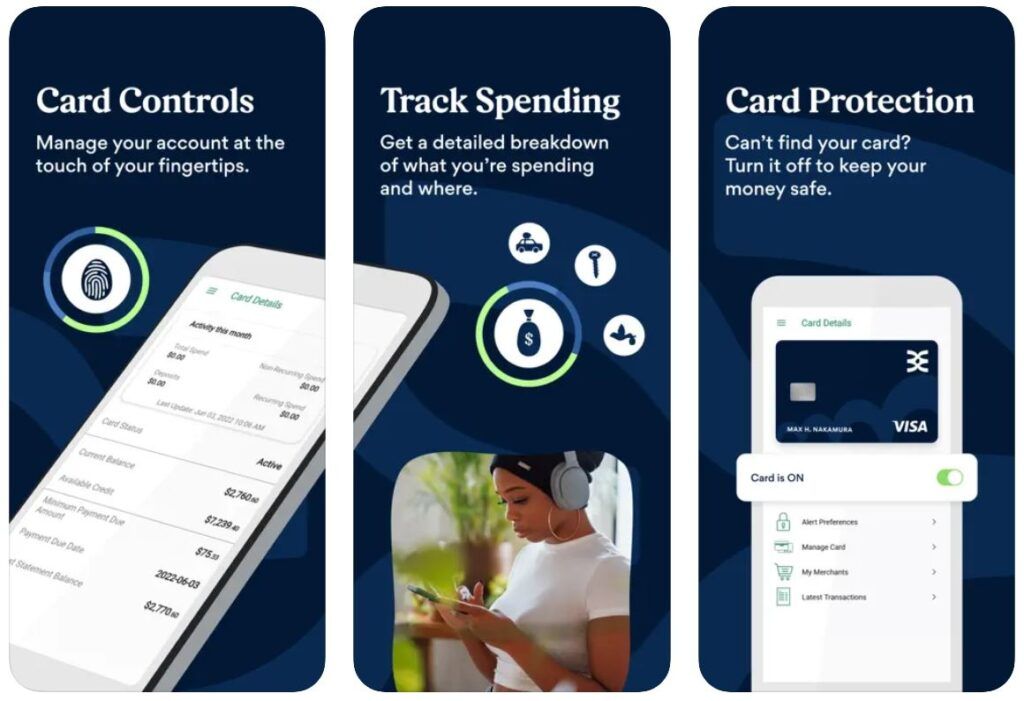

8. Discover Personal Loans

Discover is a financial services company founded in 1985. In addition to personal loans, Discover provides student loans, home loans, credit cards, and online banking services.

👍

Pros

- Low maximum APR of 24.99%

- Loan terms of up to 84 months

- No origination fees

👎

Cons

- Minimum credit score of 660 needed

- Requires a minimum household income of $25,000

- Doesn’t allow co-signers

Highlights

Best For: Long loan terms

Loan Amounts: $2,500-$40,000

Estimated APR: 7.99%-24.99%

Loan Terms: 36-84 months

BBB Rating: A+

Why We Like Discover Personal Loans

Discover has some of the best potential APRs in the industry, maxing out at 24.99% for borrowers with lower-than-average credit. Its online calculator makes it easy to see what you might qualify for based on your credit score, loan amount, and loan term. In many cases, Discover sends funds for approved loans by the next business day as a direct deposit. Once you’re funded, you can manage your account conveniently online and change your payment date to one that suits your budgeting needs.

Who Is Discover Personal Loans Best For?

A Discover personal loan doesn’t have any origination, prepayment, or application fees, so it’s a good option for you if you want to avoid paying extra for your loan. Also, with terms of up to 84 months, you’ll get more time to pay off bigger loans for things like home improvements or debt consolidation.

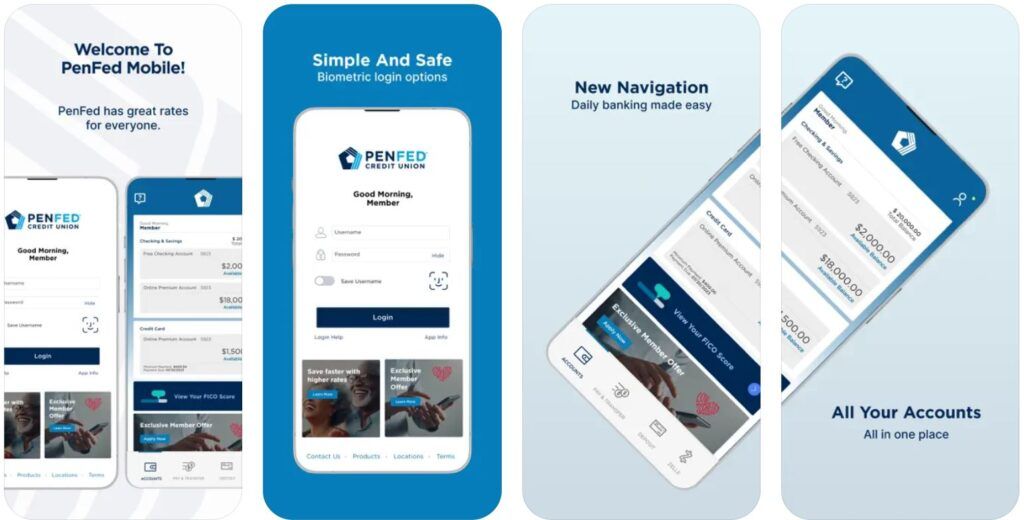

9. PenFed

Pentagon Federal Credit Union, better known as PenFed, has been serving members since 1935. Over the years, PenFed has helped nearly 3 million members manage their finances through credit cards, banking accounts, auto loans, mortgages, personal loans, and other financial products.

👍

Pros

- Next-day funding available

- Prequalification available

- No origination, balance transfer, or prepayment fees

👎

Cons

- Must be a member to get a personal loan

- Bad credit typically doesn’t qualify

- No autopay discount

Highlights

Best For: Borrowers considering switching to a credit union

Loan Amounts: $600-$50,000

Estimated APR: 8.99%-17.99%

Loan Terms: 12-60 months

BBB Rating: A+

Why We Like PenFed

PenFed makes it easy to check your potential loan rates by filling out a quick online form with information about the loan terms you want. Within seconds, discover your estimated loan interest rate and payments so you can decide if you’d like to apply. The prequalification process is only a soft credit check, so it won’t affect your credit score.

With terms between 12 and 60 months, you can get the time you need to pay off a loan of up to $50,000. Although there’s no autopay discount, PenFed doesn’t charge fees for originating your loan or paying it off early.

Who Is PenFed Best For?

Credit unions usually offer perks for members, like discounts on financial products or lower-than-average interest rates, and PenFed is no exception. Although you’ll typically need excellent credit around 760 or higher to qualify for a PenFed loan, you’ll have access to flexible terms and budget-friendly interest rates that can be more difficult to find with other banks and lenders.

Some of PenFed’s member benefits include financial hardship assistance and discounts on phone service, auto insurance, and car rentals.

How To Choose the Right Personal Loan Lender

A personal loan can help you afford large purchases, but you’ll also need to remember that its payments add to your monthly bills. It’s important to find a loan that fits your budget from a lender that’s easy to work with.

Here are a few things to ask yourself when choosing the best personal loan lender:

- Do they charge late fees and if so, how much?

- Can you adjust your payment date?

- Can you manage your account entirely online?

- Does the lender offer several contact options if you need support?

- Does the lender have mostly positive reviews from real customers?

- How strict are the lender’s approval requirements?

- Does the lender have loan terms that work for you?

- Can you prequalify on the lender’s website before applying?

Also, consider any additional benefits a lender might provide that could help you pay less for your loan, like a discount for choosing autopay or a bonus if you open another account through the company, like a savings account.

Is it better to go through a bank or lender for a personal loan?

Online lenders often make the process of applying for a loan simple and quick using an online prequalification and application process. But, if you have a solid credit history and an established relationship with a bank, you might get better interest rates and loan terms by applying through your bank.

Where is the easiest place to get a personal loan?

A bank or credit union you already have an account with is often the best place to start your personal loan search. If you don’t qualify through your own financial institution, consider applying with an online lender, some of which may have looser requirements for borrowers.

What’s the minimum credit score for a personal loan?

Credit score requirements vary by lender. However, most lenders want to see good credit scores around 660 or higher. Secured loans, which require collateral to guarantee your loan, and cosigned loans can be easier to get with lower credit.

Is a credit union better than a bank for a personal loan?

Credit unions sometimes offer more affordable loans than banks, as they tend to provide lower interest rates and more favorable loan terms. However, you’ll usually need to be a member to apply for a loan from a credit union.