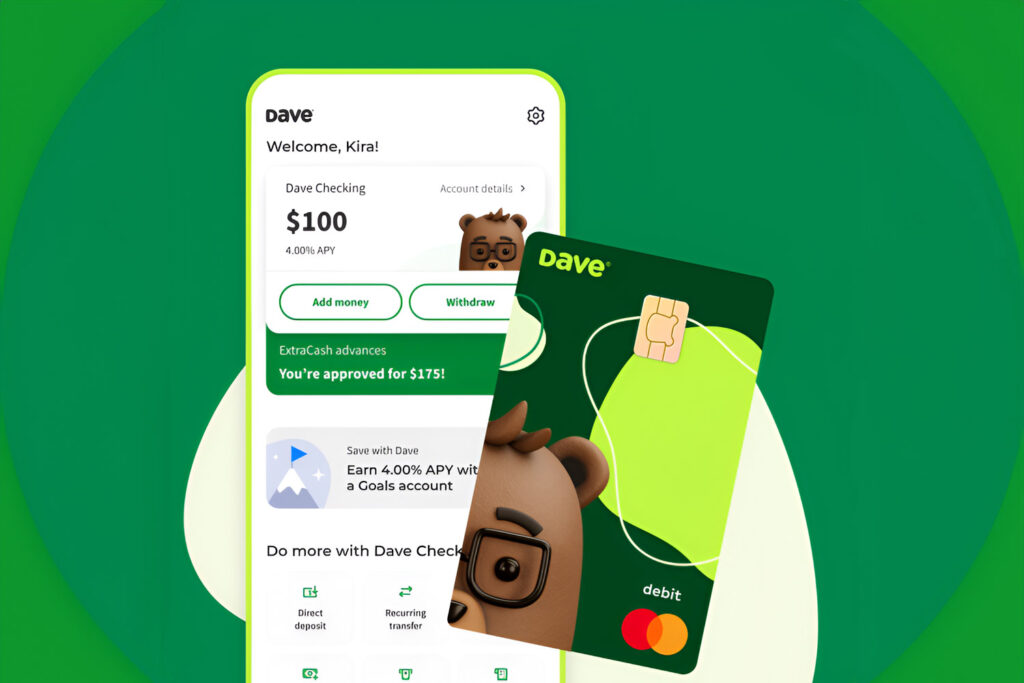

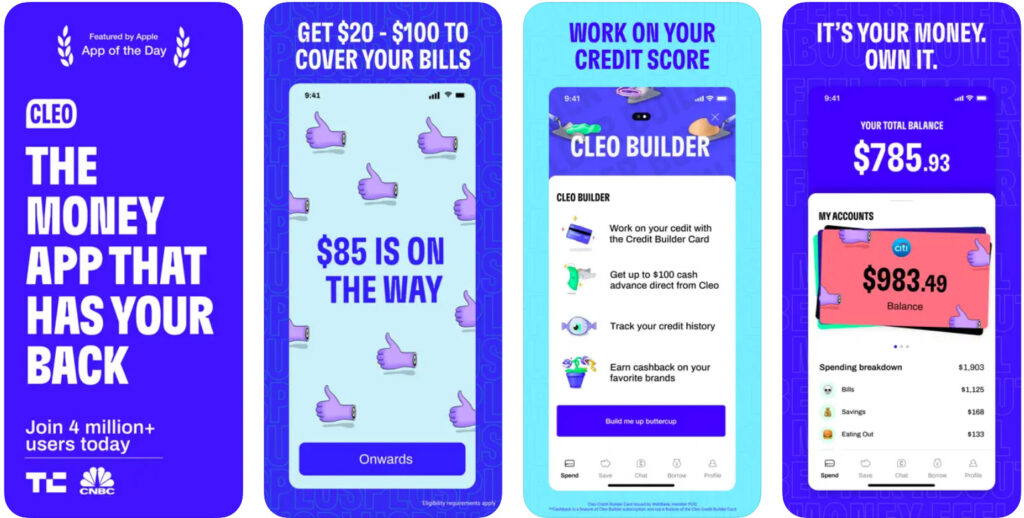

Cleo is a sarcastic AI assistant that helps you budget, save, and create good spending habits. It’s also a popular cash advance app. In this review, we're focusing on its cash advance feature, other perks, and how to decide if it’s worth it.

Cleo App: Overview

Cleo AI Ltd. is based in the United Kingdom, and was founded in 2019. Initially, the Cleo app was focused on serving EU customers. But later, the company expanded to the United States.

Cleo AI Ltd. is based in the United Kingdom, and was founded in 2016. Initially, the Cleo app was focused on serving UK customers. But later, the company expanded to the United States.

Pros

- No interest or credit checks

- Accepts freelancers and gig workers

- Includes money-management features

Cons

- Small cash advance limit

- Monthly subscription required

- There is an extra fee for same-day transfers

Highlights

Cash Advance Limits: $20 to $250

Fees: $5.99/mo – $14.99/mo, additional fee for 24-hour disbursement

Other Features: Budgeting, saving, credit building, credit scoring

Credit Score Requirements: None

Is Cleo Legit?

Cleo is legit and has over 4 million members worldwide. It's also one of the most popular cash advance apps on the market. The app has a 4.4-star rating out of over 66K reviews on Google Play and a 4.7-star rating out of over 2K reviews on the Apple App Store.

Apps like Cleo aren't a long-term solution for paying your bills. But the app can help you learn how to budget and borrow cash if you're in a pinch.

Cleo Cash Advances

Cleo offers up to $250 in cash advances, including for people with low credit and gig workers. There is no credit check required, and Cleo never charges interest.

However, first-time users can only borrow between $20-$100, based on their eligibility. Over time, users can increase their cash advance limit as they pay back advances on time and receive higher, consistent deposits in their bank accounts.

| Criteria | Details |

|---|---|

| Cash Advance Limit | $20-$250 |

| First-time Borrower Limit | $20-$100 |

| Settlement Date Range | Up to 14 days, with a 14-day extension |

| Transfer Time | Up to 4 days (standard), same day (express) |

Qualifying members can also boost their Cleo salary advance limit up to $250 by signing up for a Cleo Direct Deposit account. This requires a Cleo Builder subscription.

It can take up to four days for a Cleo cash advance to hit your bank account. If you need cash instantly, there is an optional express fee of $3.99 to get your funds the same day.

A Cleo loan must be paid back on a settlement date scheduled up to 14 days after taking out an advance. There is also an option to request a repayment extension for an additional 14 days.

How Much Does Cleo Cost?

The Cleo app is free to download and includes budgeting and saving features like Cleo Wallet, a personalized budget, and notifications to help users stay on track with their budget.

| Plan | Monthly Fee | Features |

|---|---|---|

| Cleo Plus | $5.99 | Cash advances, credit scoring, cashback, personalized saving goals |

| Cleo Grow | $2.99 | High-yield savings account (4.11% APY) |

| Cleo Credit Builder | $14.99 | Secured Visa credit card, credit building, all features of Cleo Plus |

| Same-day Transfer | Varies | Express cash advance |

However, to get a Cleo cash advance, users must sign up for Cleo Plus, which costs $5.99 per month. Cleo Credit Builder subscribers also get access to cash advances. This more expensive plan costs $14.99 per month.

There's also the Cleo Grow plan, for $2.99 per month, but this is just for a savings account. Cleo Grow does not include cash advances.

Standard cash advance transfers take up to 4 days to be deposited, but there is an option express transfer fee to get cash instantly.

Is Cleo Worth It?

If you need a bit of extra cash to help cover some unexpected expenses until payday and want to avoid a credit or employment check, Cleo offers an appealing solution. Using Cleo to get a cash advance can help you steer clear of a costly payday loan or crippling debt.

Unlike most cash advance apps, Cleo doesn't require employment verification. So, if you're a freelancer or gig worker, Cleo might be your best bet to get a quick influx of cash, up to $250. Cleo AI's snarky attitude is a fun gimmick that also boosts the app's appeal.

However, Cleo requires users to pay fees of at least $5.99 per month to access cash advances, plus extra express fees for same-day funds. This is pretty steep, considering that similar apps like EarnIn don't have any mandatory fees and offer much larger cash advances.

Before you sign up for Cleo, be sure to check out the competition to see if you could qualify for a less expensive cash advance with a higher limit.

The Best Budgeting Apps To Save Money.

Who Is Cleo Best For?

Cleo is best suited for individuals with a steady income who, from time to time, might need a small amount of cash to tide them over until payday. It's an especially good solution for gig workers and freelancers who might not qualify for a cash advance from other apps.

A Cleo cash advance is a far better alternative to predatory payday loans or high-interest debt. Plus, its humor and AI helper can be appealing if you’re new to budgeting or want to get roasted.

However, the Cleo app is not intended to be a long-term solution for financial problems or those lacking regular earnings. Cleo offers the same cash advance limit as Dave, and the instant advance fees are lower than the fees charged by EarnIn.

Cleo Cash Advance Requirements

Cleo does its best to make cash advances widely accessible. Unlike many other cash advance apps, Cleo provides cash advances to people without traditional employment, such as freelancers and gig workers, as well as individuals with poor credit.

To qualify for a Cleo cash advance, you must meet the following eligibility requirements:

- Must be at least 18 years old

- Must have a bank account compatible with Plaid

- Must provide state of residence

With most cash advance apps, users have to provide proof of employment and a regular paycheck in order to qualify. Cleo does not require this. Instead, the app uses a complex algorithm that reviews a user's bank account activity to determine eligibility.

The algorithm takes into account numerous factors, including a user's income, borrowing patterns, and spending habits. To find out if you qualify for Cleo, you must link your bank account and sign up for a Cleo Plus or Cleo Credit Builder membership.

To ensure you have the best chance at qualifying for a Cleo cash advance, be sure to:

- Link all of your bank accounts, even if you do not receive income in all of them

- Inform Cleo about all of your income, where it comes from, and which account it is deposited into

- Not to make too many cash withdrawals

- Pay your Cleo monthly subscription on time

- Use Cleo's budgeting tools to prevent negative or zero balances

Other Cleo Features & Plans

Cleo offers both free and paid services. With the free service, users can chat with AI to get financial advice and take advantage of useful budgeting features. There are also 3 subscription-based service tiers that offer additional rewards and benefits.

| Feature | Free Service | Cleo Plus ($5.99/mo) | Cleo Grow ($2.99/mo) | Cleo Credit Builder ($14.99/mo) |

|---|---|---|---|---|

| Budgeting Tools | Yes | Yes | Yes | Yes |

| Saving Tools | Yes (limited) | Yes | Yes (high-yield savings) | Yes |

| Credit Scoring | No | Yes | No | Yes |

| Cash Advances | No | Yes | No | Yes |

| Secured Visa Card | No | No | No | Yes |

| Cash Back | No | Yes | No | Yes |

Budgeting Tools – Free

The Cleo app has free budgeting and saving tools, available to anyone who downloads the app. Only Cleo Credit Builder subscribers can pay their bills through Cleo, but unpaid members can still connect a bank account to share bills and income with the app. This allows Cleo to create a personalized budget and send reminders to help users stay on course.

Cleo also has a free Cleo Wallet feature that helps users save. The app uses your budget to determine an amount to automatically put aside into a virtual “wallet.” Users can turn this autosave feature on or off at any time.

Keep in mind that the Cleo Wallet is not FDIC-insured. It also does not earn interest over time like a regular savings account.

We also prefer budgeting apps like Rocket Money and YNAB to Cleo. However, neither of these alternatives let you borrow money.

Cleo Plus – $5.99/mo.

Along with free budgeting features, Cleo Plus includes cash advances (for users who meet the eligibility requirements), credit scoring, cash back at select stores, personalized saving goals, and round-ups. The cost is $5.99 per month.

With Cleo Plus, you can:

- Apply for an advance to cover expenses until payday with no credit check or APR

- Get cash back at participating stores

- See what's affecting your credit score

Cleo Grow – $2.99/mo.

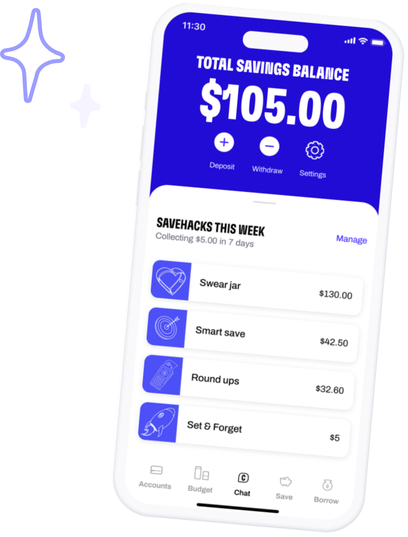

Cleo Grow is the app's newest subscription tier. For $2.99 per month, users get a high-yield (4.11% APY) savings account.

The Cleo savings account is FDIC-insured and provided through their banking partner, Thread Bank. It comes with a Savings Goal feature, which lets users set a target amount and a deadline for their savings.

Cleo's high-yield savings account also includes four automated savings tools, powered by AI: Set & Forget, Smart Save, the Swear Jar, and Roundups.

With Set & Forget, users can schedule automatic weekly contributions to their savings. Smart Save analyzes a member's finances and customizes savings accordingly.

The Swear Jar penalizes users for shopping at stores they set as “guilty pleasures.” Each time a user spends money at one of these stores, Cleo transfers a predetermined amount from spending into savings.

The Roundups feature works similarly to Acorns. It automatically rounds up purchases to the nearest dollar and transfers the extra amount to savings.

30+ Amazing Ways To Save Money Around The Home.

Cleo Credit Builder – $14.99/mo.

Cleo Credit Builder costs $14.99 per month. It is the highest-tier subscription offered by Cleo and includes all of the features from Cleo Plus, along with a no-interest, secured Visa credit card. The card is intended to help beginners build credit without incurring debt.

Cleo does not require a credit check to be approved for a Credit Builder card, but they do report payments to the three major credit bureaus. Over time, as long as you make payments on time, this can help improve your credit score.

After applying for a Cleo Credit Builder card, members provide an upfront security deposit. The amount of money added to the security deposit becomes their credit limit and can be used towards their balance at the end of the month. So, it's nearly impossible to miss a payment.

Cash for a security deposit can be transferred from another account or through direct deposits. Users who set up direct deposits with Cleo can get their paycheck up to 2 days early and access higher cash advance limits.

The card can be used anywhere Visa is accepted. Any expenses are covered either through autopay or a user's security deposit balance. Cleo Credit Builder subscribers also get priority customer support.

How Does Cleo Work?

Cleo AI is the app's most unique selling point. It's aimed at making it feel like you're texting a friend about your finances, not dealing with a boring bot.

Users can ask Cleo AI about financial habits and transactions to get sound, but brutally honest, advice. Some examples of questions you can ask Cleo about include:

- What do I spend the most money on?

- Am I overpaying for my utilities?

- When's payday?

- Should I order Doordash?

- Should I cancel my TV streaming services?

- Can I call in sick at work today?

Cleo will respond in a conversational, sassy tone. If it detects problematic financial habits, the app will “roast” you, which can be quite hilarious and entertaining. Alternatively, if you need some encouragement, you can ask Cleo to “hype” you with witty positive reinforcement.

To chat with Cleo AI and use the service's free budgeting tools, first download the app. It's available for free on the Apple App or Google Play store.

Then, sign up and connect your bank account. Linking your bank account allows Cleo to review your activity, spending habits, and saving data to give you personalized financial advice, as well as a custom budget.

The free app includes budgeting and saving features, including Cleo Wallet. But, if you want to borrow money with Cleo, you'll need to follow these extra steps:

- Sign up for a paid Cleo subscription. Choose Cleo Plus or Cleo Credit Builder. Both of these monthly subscription tiers give you access to cash advances, but Cleo Credit Builder also includes a secured credit card.

- Find out if you're approved for a Cleo cash advance. In the chat section, type either “spot me”, “cash advance”, or “salary advance.” Cleo AI will respond letting you know if you're eligible for a cash advance, and if so, what your limit is.

- Request an advance and choose a settlement date. If you're approved for a Cleo salary advance, you will need to select an amount to borrow and repayment term between 3-28 days. You will receive your advance within 4 days; or, you can pay an express fee to get it that same day.

- Request an advance. Choose the amount of money you want to borrow and request a withdrawal. You can also opt to pay an extra tip or express fee to get your cash instantly. Standard transfers take 3 business days.

- Pay back your Cleo loan. Cleo will automatically withdraw funds from your bank account on your repayment date to settle your balance. As advances get paid back on time, your limit will increase.

Other Cleo App Reviews From Customers

| Platform | Rating | Number of Reviews |

|---|---|---|

| Google Play | 4.4/5 | 66K+ |

| Apple App Store | 4.7/5 | 2K+ |

| Trustpilot | 3.8/5 | 3K+ |

| Better Business Bureau | 1/5 | 10 |

Cleo has a 3.8-star rating on Trustpilot, out of over 3K reviews. They also have a 1-star rating on Better Business Bureau based on 10 customer reviews.

Satisfied customers praise the app for its quick process, ease of use, and credit-building services. Negative reviews mention trouble reaching customer service and excessively high fees.

Cleo Customer Service

Cleo offers customer service through the app. This is the fastest way to get help. On average, replies take 6 minutes.

Users can also send an email to [email protected] to reach Cleo customer support.

Does Cleo hurt my credit score?

No. Unless you sign up for Cleo Credit Builder, the Cleo app does not report your payment activity to any major credit bureaus. So, if you fail to repay your cash advance on time, your credit score will remain unaffected. However, you will not be able to take out another Cleo loan until your balance is settled.

How long does it take to get money from Cleo?

It takes up to 4 business days to receive a Cleo cash advance with a free, standard transfer. Express transfers are available for an extra $3.99 fee to get your money instantly.