EarnIn is one of the best cash advance apps that lets employees collect earned income before payday. The app is known for its $750 paycheck advance. Even though the app is free to use with no mandatory fees or interest rates, it's important to know how it all works before signing up.

Our EarnIn review is sharing how this app works, its fees, and how to ultimately decide if it's worth using.

EarnIn Overview

In 2013, the business was founded under the name Activehours in Palo Alto, California. The app was launched in 2014 and has provided employed Americans with access to earned wages ever since.

Pros

- Zero mandatory fees or interest charges

- Large cash advances

- Offers same-day funding (for an extra fee)

- Does not require credit check

Cons

- Needs access to your bank account

- May require location access or employment verification

- Not all forms of income supported

Highlights

Cash Advance Limits: $100 per day,$750 per pay period

Fees: Optional tip between $0-$13, optional express transfer fee of $3.99

Credit Score Requirements: None

Is EarnIn Legit?

EarnIn is legit and is one of the most popular cash advance apps on the market, with over 380,000 5-star reviews between the iOS and Google Play app stores. Overall, it's rated 4.7/5 stars on the iOS App Store, and 4.6/5 stars on Google Play.

The company is also BBB-accredited with an A rating. And we like that it has such a high advance limit of $750, whereas many competitors only let you borrow $250 to $500.

Ultimately, EarnIn can help you save more money if you're in a pinch since you can avoid expensive alternatives like payday loans. But this app isn't a long-term financial solution, so keep this in mind.

What Does EarnIn Offer?

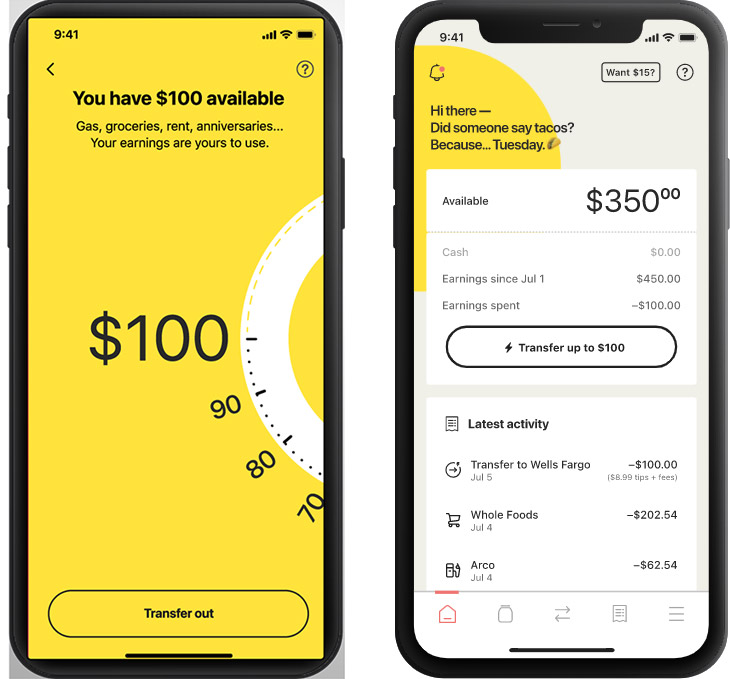

EarnIn was designed as a way to let employees access their earned wages before their scheduled payday. The app links to the user's bank account and tracks how many hours they've worked. It does this by using timesheets, checking their work email for job-related information, or using GPS to confirm they were at work. Once it has this information, it gives the user a cash advance within 1-2 business days.

So, how much does EarnIn charge?

One of the best things about EarnIn is that it can be used entirely free. The EarnIn app offers paycheck advances with no required fees, as well as balance shield and credit monitoring features.

Cash Advance Withdrawals

EarnIn allows employed consumers to withdraw $50-$750 each pay period as a cash advance on their upcoming paycheck. On the user's next payday, the amount withdrawn is automatically re-paid.

| Feature | Details |

|---|---|

| Daily Cash Advance Limit | $100 per day |

| Pay Period Limit | $750 per pay period |

| Optional Tip | $0 – $13 |

| Express Transfer Fee | $3.99 |

After signing up, every user is given a Pay Period Max that limits how much money they can withdraw within a given pay period. The Pay Period Max will be set somewhere between $50-$750 and increases over time as users repay cash advances on time.

There is also a “Boost” feature that lets a user temporarily increase their max by $50 for one pay period. To receive a “Boost” on their Pay Period Max, a user must share their account code with another EarnIn app user and ask them to vouch for them. If they do, then the one-time max increase will be approved.

EarnIn also has a Daily Max, or daily transfer limit, of $100. The Daily Max is the same for every user and cannot be increased.

No Interest Charges Or Fees

EarnIn doesn't charge any mandatory fees, and you don't have to pay interest. Instead, the free-to-download app makes money using a “Pay What’s Fair” pricing model, with optional tips ranging from $0-$13.

If you want cash instantly, you have to pay a small transaction fee of $3.99 for its Lightning Speed deposit. Standard speed for withdrawals is 1-2 business days, but Lightning Speed allows you to get your money in just a few minutes.

Balance Shield

Balance Shield is a feature that lets users get alerts when their bank balance drops below a certain amount. Users can set the amount anywhere between $0-$500.

In addition to alerts, Balance Shield also allows members to receive automatic transfers up to $100 whenever their bank balance falls below their set amount. The transfer amount counts towards Daily and Pay Period maxes.

By default, automatic transfers are sent for free through standard speed (1-2) business days, but they can be sent via Lightning Speed for an extra $3.99 fee. At any time, users can turn Balance Shield features on or off.

The Best Budgeting Apps To Use.

Credit Monitoring

EarnIn app users can opt-in for free credit monitoring services.

At any time, users who choose to take advantage of this feature can check and monitor their credit score right from the EarnIn app. Scores are updated every month.

EarnIn Eligibility & Requirements

Not everyone is eligible to use EarnIn. The financial services company only provides paycheck advances to consumers with consistent, provable income from a regular source of employment.

To qualify, a user must meet the following requirements:

- Be employed

- Be at least 18 years old with a U.S. checking account

- Have a regular direct deposit pay schedule (weekly, bi-weekly, semi-monthly, monthly)

- Have either a fixed work location or an email address given by an employer

- At least 50% of your direct deposit must be sent to a checking account (EarnIn cannot send withdrawals to savings accounts)

- Live in the United States

- Own a valid U.S. cell phone number

It's important to note that even if you receive a monthly check, some types of income, like government assistance, do not qualify. These include Supplemental Security Income, unemployment wages, disability pay, and veteran's benefits.

How Does EarnIn Work?

EarnIn works by connecting with your bank and using your employment details to deliver paycheck advances right to your checking account. You'll need a regular paycheck, checking account, and mobile device.

| Feature | Details |

|---|---|

| Cash Advance | $50-$750 per pay period; repaid on next payday |

| Boost Feature | Temporarily increase max by $50 for one pay period with a referral |

| Balance Shield | Alerts and automatic transfers up to $100 when bank balance drops below set amount |

| Credit Monitoring | Free credit score checks and monitoring; scores updated monthly |

If you want to get started with EarnIn, here are the steps to follow:

- Download the EarnIn app and sign up for an account. The EarnIn app is free to download from the Apple or Google Play store. It only takes a few minutes to sign up, but EarnIn might take 2-3 days to verify the information you provide.

- Link your bank account and add your employment information. This will allow EarnIn to deposit withdrawals to your checking account, withdraw EarnIn loan repayments, and learn your pay schedule.

- Add your wages to the EarnIn app. You can do this in one of three ways: providing your employer-given work email address, uploading an electronic timesheet, or allowing EarnIn to track your work hours through their GPS-enabled Automagic EarnIngs feature.

- Request a paycheck advance. From the EarnIn app, click on the “Cash Out” button to withdraw earned wages early. Your withdrawal amount will be restricted based on the Daily and Pay Period maxes. However much money you take out will be automatically paid back through a deduction from your bank account on the day you receive your paycheck.

Who Is EarnIn Best For?

EarnIn is ideal for people with a paycheck who just need a bit of extra cash to cover emergencies or unexpected bills. It’s a better option than exploitative payday loans or high-interest debt.

However, the EarnIn app isn’t a long-term financial fix for money issues. It's unsuitable for individuals without a steady income or those seeking a strategy for managing their cash flow.

Although EarnIn offers a safe way to get fast cash during an emergency, consumers should avoid depending on it for ongoing financial needs.

Other EarnIn App Reviews From Customers

EarnIn has a 2.0-star rating on Trustpilot out of 43 reviews, and a 2.1-star rating on Better Business Bureau based on 233 customer reviews.

| Platform | Number of 5-star reviews | Overall Rating |

|---|---|---|

| iOS App Store | Over 380,000 | 4.7/5 stars |

| Google Play Store | Over 380,000 | 4.6/5 stars |

| Trustpilot | 43 reviews | 2.0/5 stars |

| BBB | 233 reviews | 2.1/5 stars |

Many EarnIn users are satisfied with how easy the app is to use. Some customers have praised customer service for being helpful and fast to respond. However, other users report dissatisfaction with slow, unresponsive customer service.

Negative EarnIn review comments also frequently highlight problems with the app connecting to bank accounts, noting that bank accounts often need to be re-connected periodically. Additionally, some customers report that withdrawing a cash advance through EarnIn is tedious and plagued with glitches.

EarnIn Customer Service

EarnIn offers 24/7 customer service through a chat feature on the app. You can chat with the EarnIn Care team in-app at any time. Your chats are saved and never get disconnected, so you can reply whenever it's convenient for you.

There is no EarnIn phone number you can call or a listed email address. Users can also log in to their EarnIn account online to contact customer support through the website.

Additionally, EarnIn has a useful Help Center on the website full of answers to frequently asked questions and solutions to common issues with the app.

How Does EarnIn Compare?

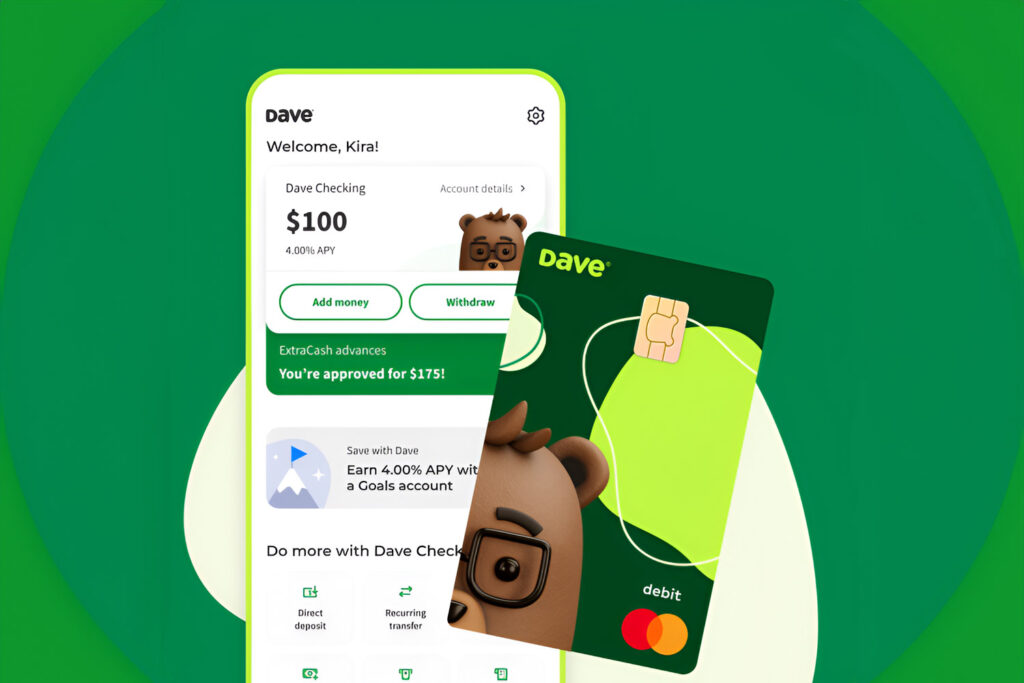

EarnIn's only other low-cost competitor is Dave, which costs $1 per month and only lets you borrow up to $500 per pay period. So, if you're looking for a truly free cash advance app, EarnIn may be your best bet. But, this all depends on the Pay Period Max that EarnIn gives you.

| Feature | EarnIn | Dave |

|---|---|---|

| Monthly Cost | Free | $1 per month |

| Max Cash Advance | $750 per pay period | $500 per pay period |

| Mandatory Fees | None | $1 per month |

| Interest Charges | None | None |

| Eligibility Requirement | Employed with direct deposit | Employed with direct deposit |

There are other options out there too. We also like solutions like Cleo and Brigit. However, EarnIn really stands out from the competition due to its high $750 limit per pay period.

Is EarnIn Worth It?

If, like many Americans, you're living paycheck-to-paycheck and find yourself needing an occasional boost to hold you over until your next payday, EarnIn is certainly worth it. You can borrow up to $750 each pay period, and the EarnIn loan is automatically paid back as soon as your direct deposit hits your bank account.

EarnIn is a great payday loan alternative. Unlike predatory payday loans or credit cards with sky-high interest rates, an EarnIn loan has no mandatory or hidden fees. You can contribute an amount that fits your budget, and their express transfer fees are very cheap. Still, use of the app should be limited to rare emergencies.

On the downside, you are required to track your wages through the company and provide proof of income before you can receive an EarnIn cash advance. While this may seem inconvenient, it is a reasonable measure so that the company can verify it will be reimbursed before issuing what is essentially an interest-free loan.

Get started with EarnIn today!

Is EarnIn Safe?

Yes, EarnIn is a safe and dependable app owned by a reputable, trustworthy company. While it's wise to be cautious about giving any app your bank account and employment details, EarnIn requires this access to be able to deposit and withdraw funds. The company employs the latest bank-level security measures to protect your data and promises not to sell your personal information.

Will EarnIn Overdraft My Account?

EarnIn is not an overdraft protection service. So, there are some instances where it's possible for the company to overdraft your bank account. You can take advantage of EarnIn's Balance Shield features to prevent this by allowing alerts and automatic transfers when your bank account balance gets too low.

If an EarnIn repayment withdrawal does ever result in a bank overdraft fee, you can take a screenshot and send it to the company. Under specific conditions, EarnIn will cover the amount of the fee.

Does EarnIn Impact My Credit Score?

No, EarnIn will not impact your credit score in any way. The EarnIn app does not require a soft or hard credit check when you sign up.

EarnIn also refrains from disclosing your payment activity to any of the three major credit bureaus: Equifax, Experian, and TransUnion. So, even if, for some reason, you fail to repay an EarnIn loan on time, your credit score will not be affected.