In this post:

- Company Overview

- Is Empower Legit?

- Is Empower Worth It?

- What Does Empower Offer?

- Empower Cash Advance Requirements

- How Much Does Empower Cost?

- How Does The Empower App Work?

- Who Is Empower Best For?

- Other Empower Cash Advance App Reviews From Customers

- How Does Empower Compare?

- Is There Customer Service?

- Is Empower Worth It?

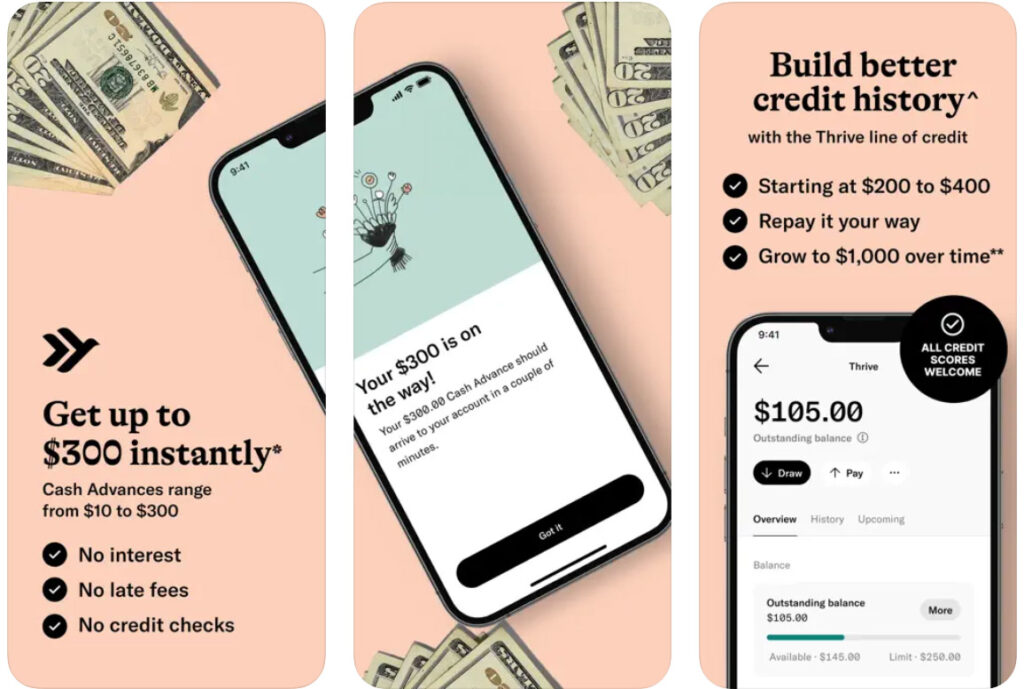

Empower is a popular cash advance app that lets new users borrow up to $300 instantly without a credit check. In addition to cash advances, the app offers a line of credit, debit card, and additional financial features.

In this Empower cash advance review, we'll dive into how the app works and look at the fees involved, then explore some alternatives you might want to consider before signing up.

Company Overview

Empower provides quick access to short-term loans for individuals. The company offers cash advances, debit cards, and lines of credit. Customers can apply online and receive funds quickly. Empower focuses on fast and convenient loan processing to meet urgent financial needs.

Pros

- Cash advances are typically deposited within one business day

- Freelancers and gig workers can qualify

- Includes 14-day free trial

Cons

- Starting cash advance limit can be as low as $10

- Requires monthly membership fee

- Must open an Empower debit card to get free instant deposits

Cash Advance Limits: up to $300 per pay period ($350 for returning customers)

Fees: $8 monthly subscription, $1-$8 Instant Delivery (or 3% for advances of $300+)

Credit Score Requirements: None

Is Empower Legit?

Yes, Empower is a legitimate company headquartered in San Francisco, CA. Since its launch in 2020, Empower has become one of the most popular cash advance apps on the market.

The app has a 4.7-star rating out of 172K on Google Play and a 4.8-star rating out of over 189K reviews on the Apple App Store.

Is Empower Worth It?

The Empower app can be helpful if you sometimes need quick cash before payday. Gig workers and freelancers can also get cash advances. If you open a debit card with them, you can get free instant deposits.

However, the $8 monthly subscription fee is high. The line of credit the app offers can't be used with cash advances, and its other features don't make the subscription worth the price.

If you have a regular job with consistent paychecks, some of the best cash advance apps like EarnIn or Dave might be better. They offer higher limits at lower or no cost. Keep reading to learn more.

What Does Empower Offer?

Along with cash advances, the Empower app offers a credit line feature known as Empower Thrive, a debit card, automatic savings, and credit monitoring.

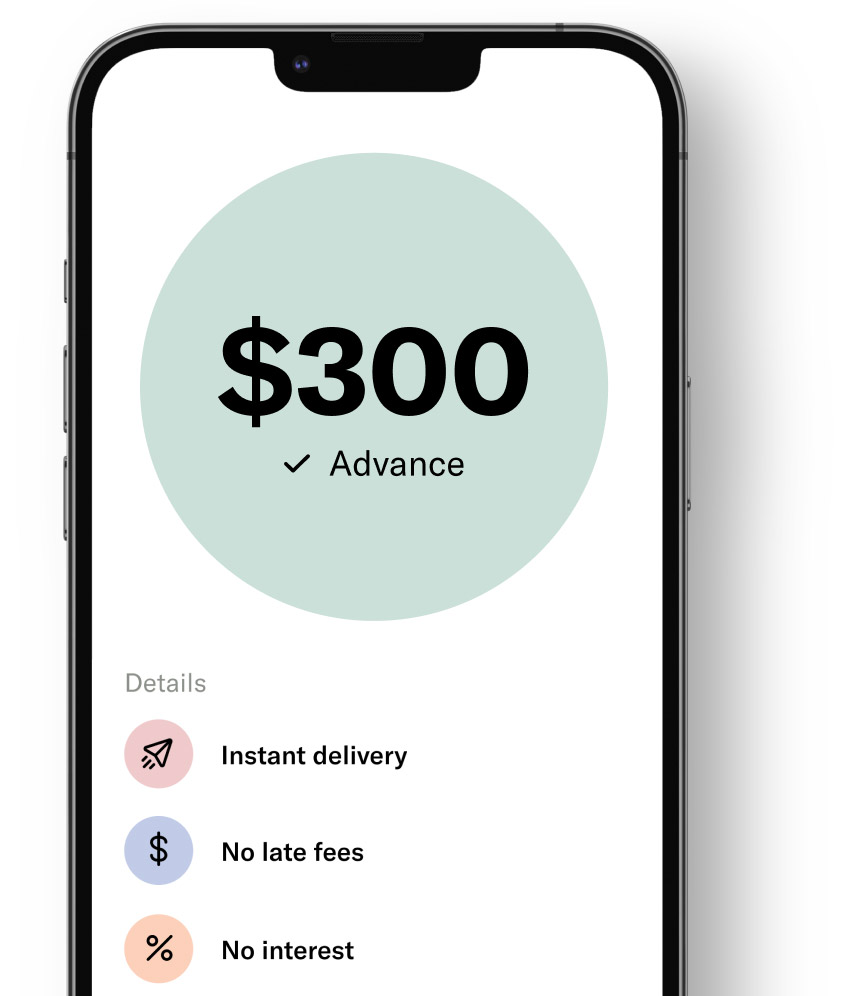

Empower Cash Advance

Empower is best known for its cash advances. New users can borrow between $10-$300 as an advance on their next paycheck, with the average amount being $145. Returning customers can boost their limit up to $350. There is no interest charged nor credit check required.

| User Status | Cash Advance Limit | Instant Delivery Fee |

|---|---|---|

| New User | $10 – $300 | $1 – $8 or 3% for $300+ |

| Returning Customer | Up to $350 | $1 – $8 or 3% for $300+ |

When you request an Empower cash advance, the money can be deposited into your bank account or your Empower debit card, if you sign up for one. Deposits to your Empower debit card are instant and free of charge.

Transfers to external checking accounts are also free, but they may not be instant. The Empower website states most ACH deposits take less than one business day but can take up to five days, depending on your bank.

To ensure an instant deposit directly to your bank account, you can choose to pay an extra $1-$8 express transfer fee. Instant delivery occurs within 15 minutes for 98% of cash advances. Rarely, instant cash advances can take one or two hours to hit your account.

On your repayment date, which is your next payday, the borrowed amount will be automatically debited to your bank account or Empower debit card account, depending on the method you chose when you requested the Empower cash advance.

There are no late fees if you fail to make a repayment on time. However, there is potential for an overdraft to occur if Empower tries to take out the repayment and you don't have sufficient funds.

Empower Thrive

Empower Thrive is a line of credit that starts between $200-$400, with the potential to increase up to $1,000 over time. There is no minimum credit score to qualify.

| Credit Line Amount | APR | Late Fees | Credit Reporting |

|---|---|---|---|

| $200 – $1,000 | 0% if paid before payday, 35.99% otherwise | Yes | Yes |

If you pay off the Empower loan amount prior to your next payday, the APR is 0%. However, if you carry a balance or split payments, the APR is approximately 35.99%, varying by state law. There are also late fees for missed payments.

Unlike Empower cash advances, your payments are reported to the three major credit bureaus: Equifax, Experian, and TransUnion. This can help build your credit score over time – but missed or late payments can also negatively impact your credit.

It's important to note that users who open a Thrive account are not eligible for cash advances while the line of credit is open. If you apply for Empower Thrive, a soft inquiry will be performed on your credit history, which will not affect your score.

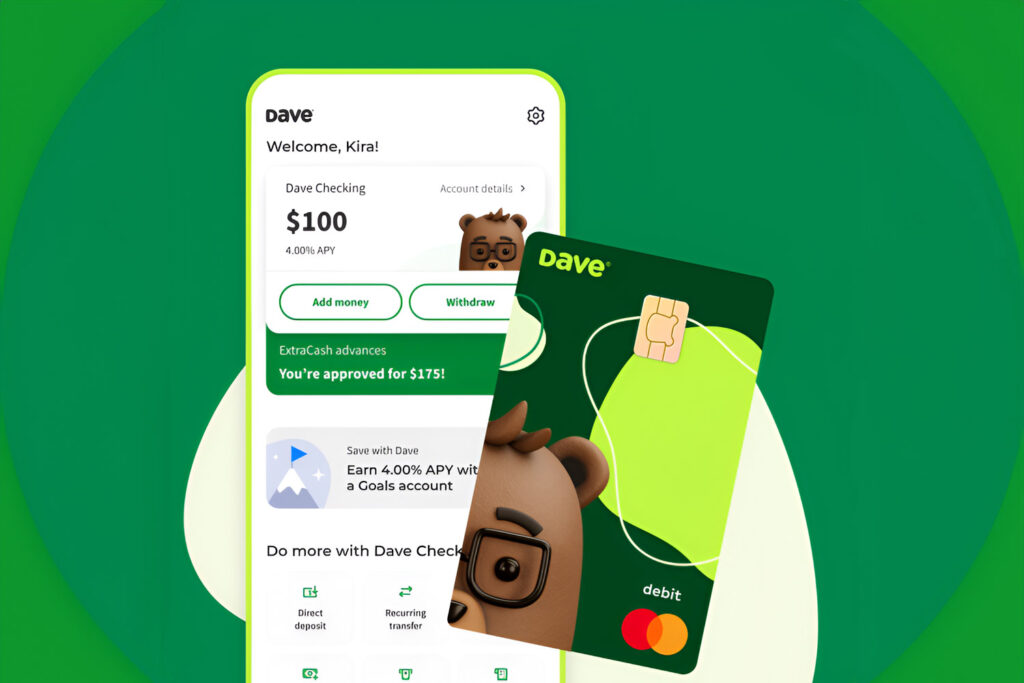

Empower Card

The Empower Card is a debit card that allows you to deposit funds from both paychecks and cash advances. The card earns 0.01% APY, and there is no minimum balance requirement to open an account.

If you deposit your paychecks directly to the Empower debit card, you can receive your earnings up to two days early. Additionally, you can earn cash-back rewards of up to 10% on purchases made with the card.

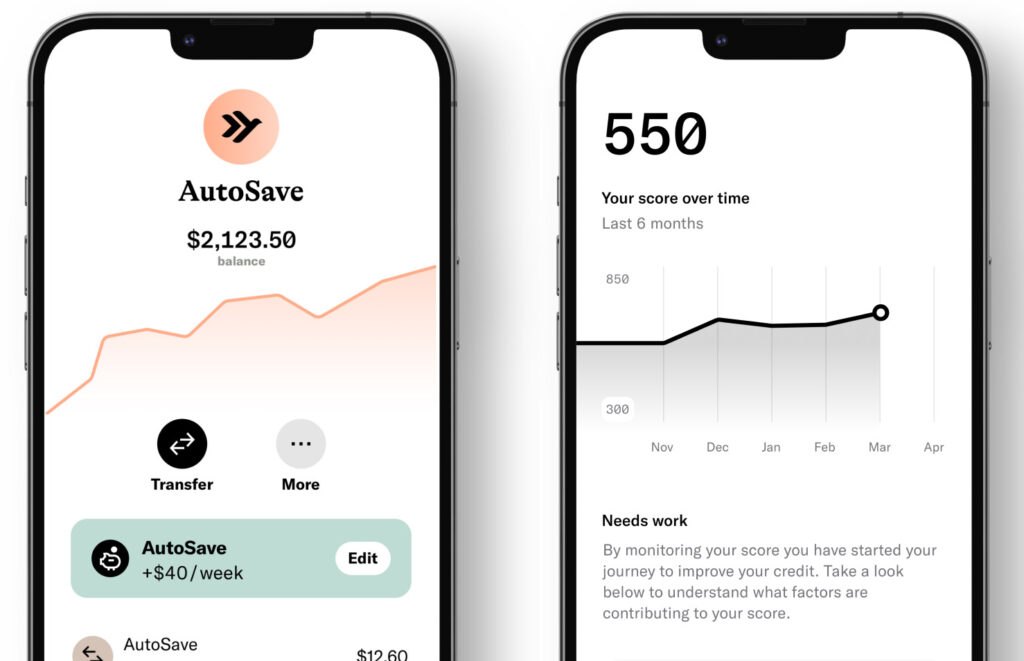

AutoSave & Credit Monitoring

Empower offers an automatic savings feature through its partner bank, NBKC. With the Empower Automatic Savings feature, you can set a weekly savings goal, and the app will monitor your balance, setting aside funds when it detects you can afford to save. The money saved in this account can be used to repay your cash advances.

The app also includes a credit monitoring tool to help you keep track of your credit score and a budgeting feature to monitor your spending.

Empower Cash Advance Requirements

Like many other cash advance apps, Empower does not run your credit to determine eligibility. Instead, Empower analyzes your bank account activity to determine if you qualify for a cash advance and how much to approve you for.

Eligibility requirements:

- Must be 18 years old

- Must live in the United States (not available in Connecticut)

- Must have a Social Security number

- Must have a bank account at least 30 days old

Compared to other cash advance apps, Empower has loose eligibility requirements. There is no proof of employment required. Gig workers and freelancers can qualify for an Empower cash advance.

If you do not qualify for an Empower cash advance, the app will provide factors to help you become eligible in the future.

How Much Does Empower Cost?

Empower charges an $8 per month subscription to access its cash advance and other features. The app offers a 14-day free trial, after which you will be charged monthly unless you cancel. There are no interest charges or late fees associated with cash advances.

Instant ACH transfers to an external bank account cost an extra fee. Instant delivery fees vary based on the amount of the advance, as follows:

| Cash Advance Amount | Instant Delivery Fee |

|---|---|

| $0 – $10 | $1 |

| $10.01 – $49.99 | $2 |

| $50.00 – $74.99 | $3 |

| $75.00 – $99.99 | $4 |

| $100.00 – $149.99 | $5 |

| $150.00 – $199.99 | $6 |

| $200.00 – $249.99 | $7 |

| $250.00 – $299.99 | $8 |

| $300+ | 3% of the advance amount |

For Empower Thrive, there may be late fees if you fail to make a repayment in time. Instant Delivery charges can also apply.

How Does The Empower App Work?

It's easy to get started with Empower. To request an Empower cash advance, follow these steps:

- Download the Empower app. The Empower app can be downloaded for free from the Apple App or Google Play store.

- Sign up for an account. Before your account is approved, you will need to answer identity verification questions. You will also need to prove your residence by providing a document utility bill, lease agreement, or pay stub. You might need to submit additional details or documents, such as your driver's license, passport, and state or military ID card. If this is the case, then it can take up to three days for Empower to manually review your information and approve your account.

- Connect your bank account. Empower will use your bank account activity to determine whether or not to approve you for a cash advance and give you a cash advance limit. The app uses Plaid to securely link to your bank account.

- Request an Empower cash advance. If you qualify, you can request an Empower cash advance from the app up to your approved limit. There are several options for receiving your cash advance. You can choose to have your cash advance deposited to your linked bank account for free, which takes one to five business days. Or, you can pay an extra instant delivery fee for guaranteed same-day funding. Alternatively, you can open an Empower debit card to get free instant transfers.

- Pay back your Empower cash advance. On your next payday, the full amount of the advance you borrowed will be automatically withdrawn from the account where the cash advance was deposited. If you need more time to repay, Empower offers the option to extend your repayment date.

Who Is Empower Best For?

Empower is best suited for people with regular income who need some extra cash to help cover unexpected bills or emergency expenses. It offers a much better solution to taking out high-interest debt or an exploitative payday loan.

The Empower app is an especially great option for gig workers, freelancers, and self-employed individuals. Other cash advance apps like Dave or EarnIn offer higher cash advances without the $8 monthly subscription, but they require proof of employment and do not accept gig or freelance work as valid forms of income.

That said, it's important to note that Empower is not designed as a long-term fix for financial problems. Cash advances can be helpful in a pinch, but if you consistently spend more than you earn, they are not a sustainable solution.

Other Empower Cash Advance App Reviews From Customers

| Platform | Rating | Number of Reviews |

|---|---|---|

| Google Play Store | 4.7 stars | 172K |

| Apple App Store | 4.8 stars | 189K |

| Better Business Bureau (BBB) | B rating | Not specified |

| Trustpilot | 1.9 stars | 26 |

Empower has an overall B rating on the Better Business Bureau and a less-than-positive 1.9-star rating out of 26 reviews on Trustpilot.

Satisfied users praise the process of getting an Empower cash advance for being easy and straightforward. Negative reviews center around low cash advance limits, overdrafts, and trouble canceling their monthly subscription.

How Does Empower Compare?

The table below shows how Empower compares to the best cash advance apps.

| Company | Loan Amount | Fees & Costs | Deposit Speed |

|---|---|---|---|

| Empower | Up to $300 per pay period ($350 for returning customers) | $8 monthly subscription, $1-$8 Instant Delivery (or 3% for advances of $300+) | 1-5 business days |

| Possible Finance | Up to $500 | $15-$20 per $100 borrowed | 1-3 business days |

| EarnIn | Up to $750 per pay period | Optional tips up to $13, $3.99-$4.99 Fast-Advance fee | 1-3 business days |

| Dave | Up to $500 per pay period | $1 monthly membership, $3-$25 Fast Advance, Optional tips | 1-3 business days |

| Cleo | Up to $250 | $5.99-$14.99 monthly subscription, $3.99 Fast Advance | 3-4 business days |

| Brigit | Up to $250 | $8.99 or $14.99 monthly subscription, $0.99-$3.99 Fast Advance | 1-3 business days |

| MoneyLion | Up to $500 per pay period (up to $1,000 with MoneyRoar account) | Optional tips, $0.49-$8.99 Fast Advance, Optional $19.99 monthly Credit Builder membership | 1-5 business days |

| Albert | Up to $250 per pay period | $14.99 monthly subscription, $4.99 Fast Advance | 2-3 business days |

Is There Customer Service?

Empower offers customer service via phone, email, and live chat in the app. Their phone number is (888) 943-8967 and email address is [email protected].

You can reach an Empower customer service agent over the phone between the hours of 6 AM and 3 PM PST on Monday through Friday. Email support is 24/7.

Is Empower Worth It?

The Empower app might be worth it if you occasionally need a quick cash boost to hold you over until payday. Unlike many of its competitors, Empower allows gig workers and freelancers to qualify for cash advances. Plus, the app offers free instant deposits if you open a debit card with them.

However, the $8 monthly subscription is a bit steep. The Empower app's line of credit might be useful, but it can't be used in conjunction with cash advances. And, the app's other features are not unique enough to justify the subscription cost.

Overall, if you are employed with a regular paycheck, you will probably be better off with top cash advance apps like EarnIn or Dave, which offer higher limits for little to no cost.

How long do you have to pay Empower back?

You have until your next payday to repay an Empower cash advance. If you need more time, you can contact Empower customer support to get a repayment date extension. Requests must be made by noon PT one business day before your scheduled due date.

Is the Empower app safe?

Yes, the Empower app is safe and secure. Data on its website and app uses end-to-end encryption to ensure it stays protected. You can further protect your account by using multi-factor authentication.

The app is also partnered with NBKC, an FDIC member bank, to provide its digital banking services. This means that money in your Empower account is FDIC-insured up to $250,000.