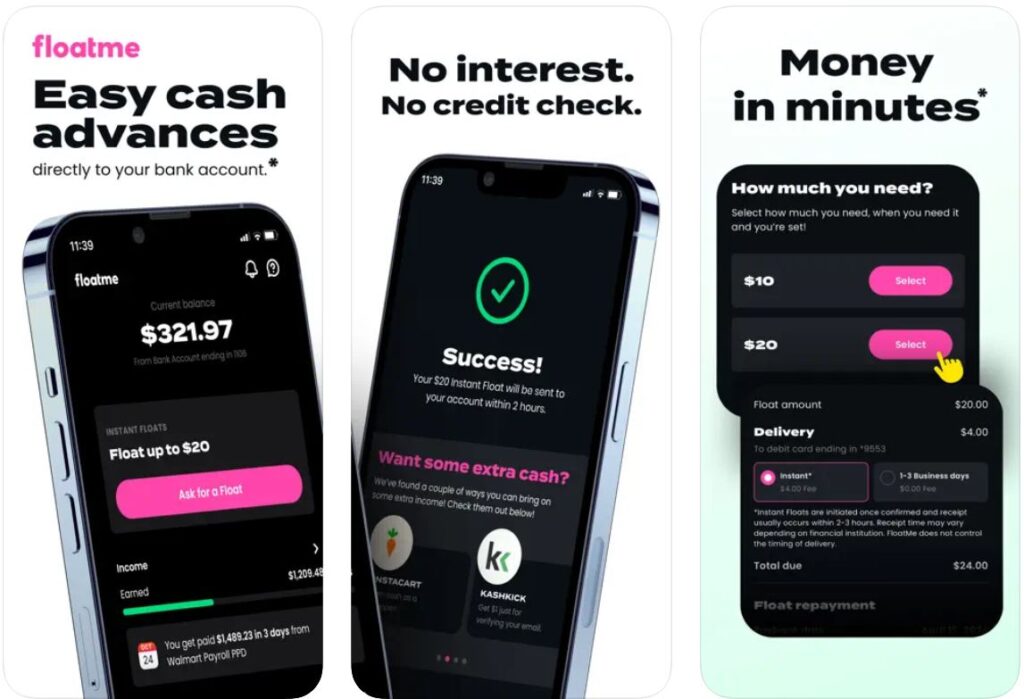

FloatMe is a cash advance app that lets new members borrow money before payday. While it may be convenient for fast cash, FloatMe's low limits and membership fees are significant drawbacks. In this FloatMe app review, we'll cover everything you need to know to help you decide if it's the right choice for you.

Looking for some great FloatMe alternatives? Checkout:

- EarnIn: Borrow up to $750 against an upcoming paycheck without paying expensive membership fees!

FloatMe: App Overview

Launched in 2019, FloatMe provides cash advances to help people manage expenses between paychecks. The company provides its services through a membership model which costs $3.99 per month. FloatMe has over 7 million downloads, helping users avoid overdraft fees and build emergency savings.

Pros

- No credit check

- Does not charge interest

- Includes automatic savings and overdraft alert feature

- Has a 7-day free trial

Cons

- Membership fee required

- Relatively high costs

- Low cash advance limit

- No repayment date flexibility

Cash Advance Limits: up to $100 (new members are significantly limited)

Cost: $3.99 monthly membership, $3-$7 Instant Float fees

Credit Score Requirements: None

Is FloatMe Legit?

Yes, FloatMe is a legitimate finance app that provides cash advances. The company has secured $49 million in funding from venture capital firms.

With over 7 million downloads, FloatMe has become a popular cash advance apps on the market. The app has a 4.7 out of 5 rating out of over 76K reviews on the iOS app store and a 4.4 out of 5 rating across 46K reviews on the Android app store.

Legal Trouble

That said, FloatMe landed itself in hot water this year with the FTC for making baseless claims and false promises. The FTC's complaint alleged that the app's advertised “free $50 cash advances” were deceptive, since the majority of users are approved for a much lower limit at first and have to pay membership fees, along with express transfer fees.

In January 2024, FloatMe settled the claim and paid $3 million in customer refunds. Since then, the company has become much more transparent about its fees and changed several of its policies, including its membership pricing system.

33 Real Ways To Save More Money At Home.

How Does FloatMe Work?

The FloatMe app lets users borrow from $10 to $100 against an upcoming paycheck. There is no credit check required and no interest or late fees charged.

Along with payday advances, which the app refers to as “floats,” FloatMe offers overdraft alerts, personal finance management services, and an automatic savings tool called Stash, designed to help users save up for their specific goals or an emergency fund. However, the app's main focus is on cash advances.

To request a FloatMe cash advance, follow these steps:

- Download and sign up for the app. The FloatMe app is available on Google Play and the Apple App Store. After downloading, create an account and sign up for a membership. You must pay for a $3.99 monthly subscription to access cash advances.

- Verify your employment. FloatMe only provides cash advances to employed individuals. You will need to provide your employment details and prove your income. You will also need to show that your paychecks are directly deposited into a checking account and that you have received at least three consecutive payments.

- Link your bank account. You will need to do this so that the app can deposit and withdraw funds. FloatMe uses Plaid to securely connect to your bank account.

- Check your eligibility for a FloatMe cash advance. The app will review your bank account activity to determine if you qualify for a cash advance. Initially, your cash advance limit will only be $10-$20. But, you can increase this up to $100 over time as you make consistent, timely repayments.

- Request a FloatMe cash advance. It can take up to 3 business days for funds to arrive. Members can choose to pay an additional fee of $3-$7 for faster delivery.

- Repay your FloatMe cash advance. The app will automatically deduct the advance amount from your bank account on your next payday. FloatMe does not offer repayment extensions, but it also does not report to the major credit bureaus. So, late repayments will not impact your credit score.

Who Is FloatMe Best For?

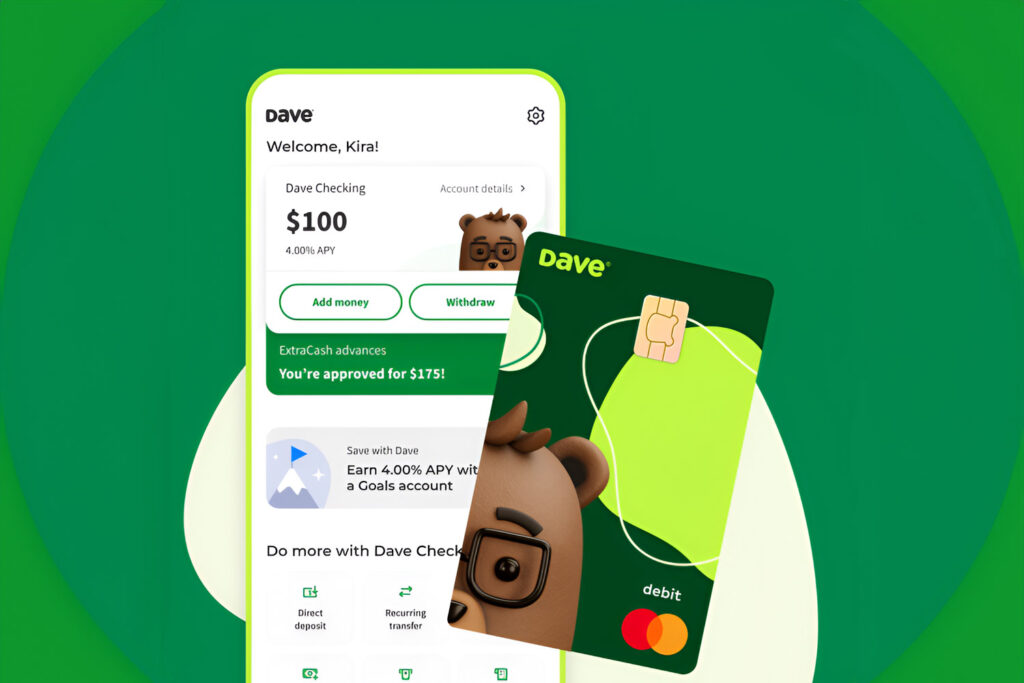

The FloatMe app is best for employed individuals with a regular income who need a small cash boost to avoid overdraft fees or get through a tight spot. However, its cash advance limit is quite low, so if you need a larger payday advance, apps like EarnIn, Cleo, or Dave are better options.

Additionally, FloatMe is not designed for habitual use. It is not a solution for ongoing financial issues, and we do not recommend relying on it instead of income.

FloatMe also isn't suitable for everyone. Self-employed individuals and gig workers will not qualify for the app's cash advances. People on government benefits also are not eligible for a FloatMe cash advance.

FloatMe Cash Advance Requirements

Like most cash advance apps, FloatMe does not run your credit to determine eligibility. Instead, they review your bank account history and balance to decide if you're eligible for a FloatMe cash advance.

To qualify, you will need to meet the following FloatMe requirements:

- Have a positive bank account balance

- Have a debit card linked to an active checking account

- Receive direct deposits (their system must detect at least two consecutive payments)

- Earn at least $150 each pay period

FloatMe only approves employed individuals who receive W-2 tax forms. Self-employment, freelance work, gig work, and government benefits do not count as acceptable forms of income. If you don't qualify, you may want to try a different service. For example, Yendo gives cash advances and a credit line based on the value of your car.

How Much Does FloatMe Cost?

FloatMe has one membership tier, which costs $3.99 per month. This includes access to cash advances and FloatMe's other features. There is a 7-day free trial period.

An Instant Float costs between $3-$7, depending on the amount of the advance. Here is the complete pricing structure for express delivery:

| Feature | Cost/Fee |

|---|---|

| Standard Cash Advance Limit | Up to $50 |

| Membership Fee | $3.99/month |

| $10 Instant Float | $3 |

| $20 Instant Float | $4 |

| $30-$50 Instant Float | $5 |

| $75 Instant Float | $6 |

| $100 Instant Float | $7 |

There are no interest charges or late fees. Unlike other cash advance apps like EarnIn, FloatMe also does not have an optional tipping system.

After you request a FloatMe cash advance, the funds will be delivered to your account within 3 business days for free. Or, you can pay a few extra dollars for an “Instant Float,” which takes less than 8 minutes.

Other FloatMe App Reviews From Customers

While FloatMe has positive reviews on the iOS and Android app stores, its few other online reviews aren't as favorable. The app has a 2.2 out of 5-star rating on Trustpilot, and a 3.17 out of 5-star rating on Better Business Bureau.

Trustpilot: 2.2/5

BBB: 3.2/5

Satisfied customers mention that the small advance was sufficient to help tide them over until their next paycheck.

However, several users noted that their initial borrowing limit never went up from around $20.

Negative reviews also mention trouble reaching customer service and canceling memberships. Some customers also express concerns about the membership fee and report that cash advances sometimes lead to overdraft fees.

Is There Customer Service?

FloatMe does not have a customer service phone number or email. The only way to reach a customer service agent is by submitting a request through this online form.

There is also an FAQ page on the FloatMe website.

Is FloatMe Worth It?

Ultimately, we don't recommend this service. FloatMe does make it easy to get some quick cash – but the costs are high compared to the small loan amount.

The app's low advance limit and mandatory membership fee are significant downsides. Some of the best cash advance apps like EarnIn and Dave offer much larger cash advances for little to no cost.

While the $3.99 monthly subscription isn't very expensive, it's only worthwhile if you can be approved for loans in the $50-$100 range. The paid membership includes a few additional useful features, but these alone are unlikely to justify the cost, especially since other apps offer more robust financial features and better pricing.

How long do you have to pay FloatMe back?

When you take out a FloatMe cash advance, you will be given a repayment date. Typically, it will be scheduled for your next payday or just after you receive your next paycheck.

Funds will automatically be deducted from your bank account on your due date. You can also manually repay your advance early through the app.

At this time, FloatMe does not allow for any repayment date extensions.

Is the FloatMe app safe?

Yes, FloatMe keeps your information safe using bank-level encryption. They also use the well-known, secure Plaid platform to link to your bank account.

However, the app has had some issues in the past with the FTC over deceptive marketing promises and false claims. Earlier this year, they resolved the claim and have since taken steps to be more transparent with customers.

Does the FloatMe app impact my credit score?

No, FloatMe does not require a credit check, and they do not report any activity to the three major credit bureaus. So, if you fail to make a repayment on time, your credit score will not take a hit. You will just be unable to take out another cash advance until you pay it back.