Klover is a widely-used cash advance app that allows users to borrow up to $200 through its “boosts” feature. Ideal for short-term cash advances, Klover offers a convenient way to access quick cash without the hassle of payday loans.

However, users should know how it works and what the app offers before trying it. And that's why our Klover review is covering its features, fees, and how to decide if it's worth it.

Klover Overview

Klover is a financial app that offers interest-free, no-fee cash advances, along with a handful of other financial features like credit monitoring. The financial business has provided cash advances since its 2019 launch. In 2022, the company changed its name to Attain, but the app is still called Klover.

Pros

- No mandatory fees

- No credit check

- Does not charge interest

Cons

- Relatively small cash advance limits

- Very high express transfer fees

- Collects and uses personal data in exchange for services

Highlights

Cash Advance Limits: up to $200

Fees: No mandatory fees, Klover+ membership fee of up to $4.99, Express transfer fee of $1.99-$16.78

Credit Score Requirements: None

Is Klover Legit?

Klover is legit and is one of the top cash advance apps out there. The company is BBB-accredited with an A+ rating. It also has a 4.7-star rating out of over 183K reviews on the iOS app store and a 4.6-star rating out of 65K reviews on the Android app store.

This app is useful if you need some quick cash. But it's not a long-term financial solution or comprehensive budgeting app.

What Does Klover Offer?

Klover offers cash advances up to $200 through a points program where users earn points by completing various activities. The service charges no mandatory fees or interest, but there is a fee for instant deposits.

Get a cash advance with Klover today!

Cash Advance Boosts

Klover's cash advances are known as “boosts.” When a user signs up, they are typically given a $100 cash advance limit. This limit can be increased up to $200 by completing certain activities through the app's points program.

Cash Advance and Fees

| Cash Advance Limit | Fees |

|---|---|

| Up to $200 | Express transfer fee: $1.99-$16.78 |

| Klover+ membership: up to $4.99 |

Activities that can be performed in exchange for points typically require the user to give some form of data. Options include:

- Filling out a survey

- Watching a video ad (10-30 seconds long)

- Playing a game

- Spinning a wheel

- Scanning/emailing receipts

- Linking to a retail account (ex. Target, Walgreens)

- Signing up for offers from a partner

- Inviting friends to join

- Sharing location

- Linking debit card

- Connecting email account

For every 200 points earned, users can increase their cash advance limit by $5. Users can earn an unlimited number of points, and they never expire. However, you cannot transfer points over to another Klover member or account.

30+ Ways To Save Money Around The House.

No Interest Charges or Fees

Klover doesn’t charge any mandatory fees or interest on its cash advance boosts. However, it has pretty steep fees – from $1.99 up to $16.78 – if you pay for an instant cash deposit.

Klover calls this the “immediate debit” option, and it lets you receive a withdrawal in a few minutes up to 6 hours. Otherwise, you have to wait up to 3 business days, depending on your banking institution, for your advance to hit your account.

Klover+

Klover+ includes personalized financial tools, like credit monitoring, earning extra points, and the ability to create saving and budgeting goals. Klover+ members also unlock the option to cash points out for an Amazon gift card. To access these extra features, users must pay a monthly subscription fee of up to $4.99.

Daily Cash Giveaways

Klover gives out cash every day. Users can participate in daily sweepstakes to win up to $100. There is one winner of the $100 prize each day, and 5 winners who get $20.

Klover Cash Advance Requirements

| Requirement | Details |

|---|---|

| Age | 18+ |

| Citizenship | U.S. |

| Bank Account | Active checking account with good standing and a debit card |

| Direct Deposits | At least 3 in the last 60 days |

| Paychecks | Several with the same descriptions |

| Income | Weekly or bi-weekly paycheck required |

Unlike payday loans, Klover doesn't run a credit check to determine eligibility. Instead, they evaluate information from a user's linked bank account to decide whether or not to grant a cash advance.

Relative to the competition, Klover has pretty strict eligibility requirements. Users must receive a weekly or bi-weekly paycheck to qualify for a Klover cash advance; Klover does not accept self-employment, unemployment, or monthly/semi-monthly income.

To qualify for a Klover cash advance, an individual must also:

- Be 18 years old and a U.S. citizen

- Have an active checking account with good standing and a debit card

- Have received three direct deposits, at minimum, in the last 60 days

- Have several paychecks with the same descriptions

Is Klover Safe?

Klover offers no-fee cash advances – but there's a catch. Instead of charging users a monthly subscription like Dave or using a tipping system like EarnIn, Klover makes money by using customer data. This might be cause for concern.

To use Klover, you have to grant them access to your data, including your bank account activity, app and phone usage details, and survey answers. Klover leverages insights from your data and shares it with its partners. Data is used for anonymous market research and targeted ads.

Klover assures that they do not share identifiable, personal information. Users must consent to having their data accessed and can withdraw their consent at any time by emailing customer support.

How Does Klover Work?

It’s easy to obtain a Klover cash advance. Here are the steps:

- Download the Klover app and sign up for an account. The Klover app can be downloaded for free on the Apple App or Google Play store. After downloading the app on your iPhone, iPad, or Android device, create an account with your email address. You will also need to provide your name, phone number, home address, birth date, and employer's name and address.

- Add your bank account and debit card information. Klover will use these details to review your activity and determine if you qualify for a cash advance. If eligible, the app will also link to your bank account in order to deposit and withdraw funds.

- Find out if you're eligible for a Klover cash advance. After evaluating your bank account activity, Klover will notify you of the decision. If you qualify, they will also give you a cash advance limit. Most users start with a limit of $100. Optionally, you can earn points to increase your limit amount.

- Request an advance. Choose the amount of money you want to borrow and request a withdrawal. You can also opt to pay an extra tip or express fee to get your cash instantly. Standard transfers take 3 business days.

- Repay your Klover loan. Klover automatically withdraws funds in the amount of your advance on your settlement date. Eligibility-based cash advances are repaid when your next paycheck hits your bank account. Points-based advances are settled seven days after they are requested.

Who Is Klover Best For?

Klover is best for beginners, and for employed individuals with a regular paycheck who need a small amount of cash for an unexpected or emergency expense. The app is a better option than predatory payday loans or high-interest debt because it provides no-fee, interest-free cash advances.

However, Klover is not a solution for ongoing financial issues or those without traditional employment. Klover does not give cash advances to self-employed individuals, those on unemployment, or workers who only get paid once or twice a month.

Klover is also unsuitable if you need a large cash advance. It has a much lower cash advance limit than Klover alternatives like EarnIn and Dave. If you need cash quickly, you might also want to look elsewhere since Klover has very high instant advance fees.

If you have concerns about data privacy, Klover is also not a great option. While they don't share personally identifiable information, Klover does use and share anonymous data – including bank account activity – with its trusted partners.

How Does Klover Compare?

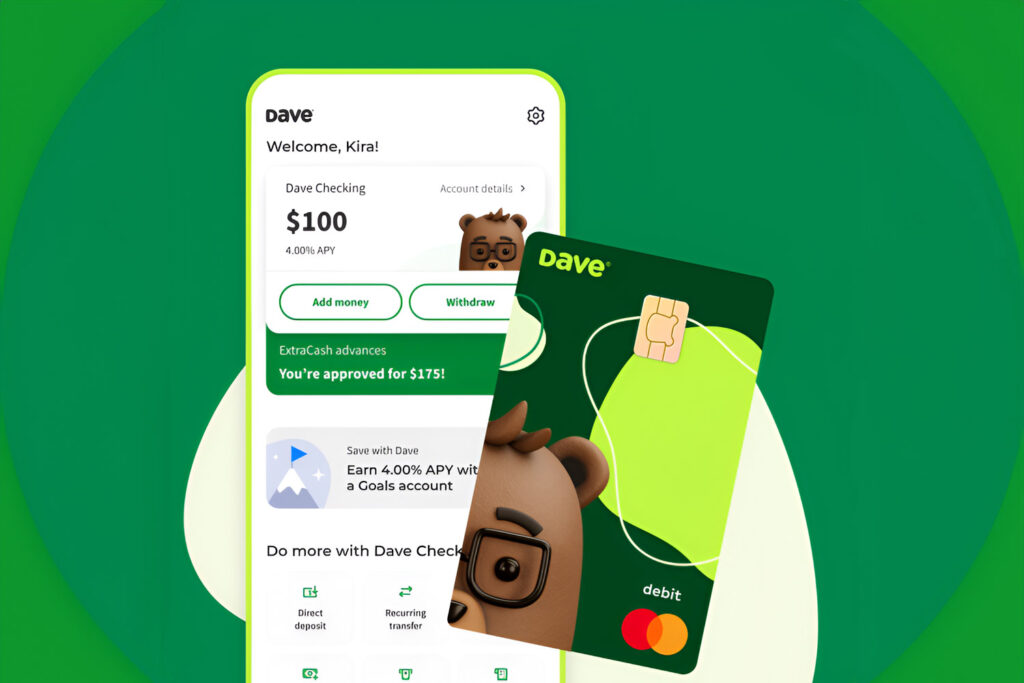

Klover offers smaller cash advances with a longer deposit time and has both an instant cash fee and a monthly membership fee. While its fees and advance amounts differ from competitors like EarnIn and Dave, it provides a similar range of services but with different cost structures.

| Cash Advance App | Advance Amount | Deposit Time | Instant Cash Fee | Other Fees |

|---|---|---|---|---|

| EarnIn | $100 to $750 | 1 – 3 days | $3.99 – $4.99 | No |

| Dave | Up to $500 | 1 – 3 days | $3 – $25 | $1 monthly membership |

| Chime | Up to $500 | 1 – 3 days | $2 | No |

| Klover | $5 to $200 | 3 days | $1.50 – $20.78 | $3.99 monthly Klover+ fee |

| Brigit | $50 to $250 | 1 – 3 days | $0.99 – $3.99 | $8.99 or $14.99 monthly membership |

| Empower | $10 to $250 | Instant | $1 – $8 | $8 monthly membership |

| MoneyLion | Up to $1,000 | 1 – 5 days | $0.49 – $8.99 | No |

Other Klover App Reviews from Customers

Klover has a 1.14-star rating on Better Business Bureau based on 7 customer reviews. Complaints from customers center around unauthorized charges and high instant transfer fees.

Klover Customer Service

Klover offers customer support 24 hours a day, 5 days a week – Monday through Friday. Members can contact the Klover customer team by submitting a request in-app or sending an email to [email protected]. Live chat is also available in the Klover app from 9:30 AM to 5 PM CT, Monday through Friday.

Users must include the email address and phone number associated with their Klover account in their request or email. After sending an email or support request, Klover agents will do their best to respond within 1-2 business days.

Additionally, you can find answers to frequently asked questions and solutions to many common issues with the app on Klover's Help page.

Is Klover Worth It?

Overall, Klover is worth it if you need a modest boost to cover an unplanned expenditure and are not concerned about the app's data collection and usage practices. Compared to exploitative payday loans and high-interest debt, Klover offers a significantly better way to borrow small amounts of money.

Klover is unique in that it lets you perform certain activities to increase your cash advance limit. So, regardless of your initial approval amount, you can earn up to the maximum $225 advance through some additional effort.

That said, Klover isn't necessarily the best choice for payday advances. Klover has some substantial drawbacks when compared to other popular cash advance apps.

Despite offering no-interest, fee-free cash advances, its express transfer fees are significantly higher than those of competitors. Klover's limit of up to $225 is relatively low – and, it's even lower if you don't participate in the points program. Apps like Dave and EarnIn provide larger cash advances and charge less for instant access to funds.

Get your cash advance from Klover today!

Will Klover overdraft my account?

Klover states that its system is designed to avoid overdrafts or leaving you with a zero balance. If your bank account lacks sufficient funds to settle your balance on your repayment date, then the Klover app will attempt to withdraw however much is available, and continue taking partial withdrawals until the debt is settled.

That said, Klover's terms and services say that the company does not claim responsibility for any overdraft fees incurred and will not issue a refund.

Does Klover impact my credit score?

No, Klover does not impact your credit score. The app does not require a credit check when you sign up and does not report your activity to any of the major credit or collection agencies. So, if for some reason, you do not pay back a Klover loan, your credit score will remain unaffected.

However, Klover also won't just let an outstanding balance slide. The company might suspend your account until you settle your balance. If something happens and you cannot make a repayment by the due date, Klover allows you to request an extension three times a year for up to 28 days. To do this, you must already have a history of paying your advances back on time with the company and make your extension request by contacting customer service at least two business days before your settlement date.

How long does it take to get money from Klover?

A Klover cash advance takes 3 days to deposit into your bank account with its free, standard transfer option. Users can also opt to have funds deposited instantly (which takes anywhere from a few minutes to 6 hours) by paying an extra “immediate debt” fee. This express fee can cost anywhere from $1.99 to $16.78, based on the amount of the advance requested.