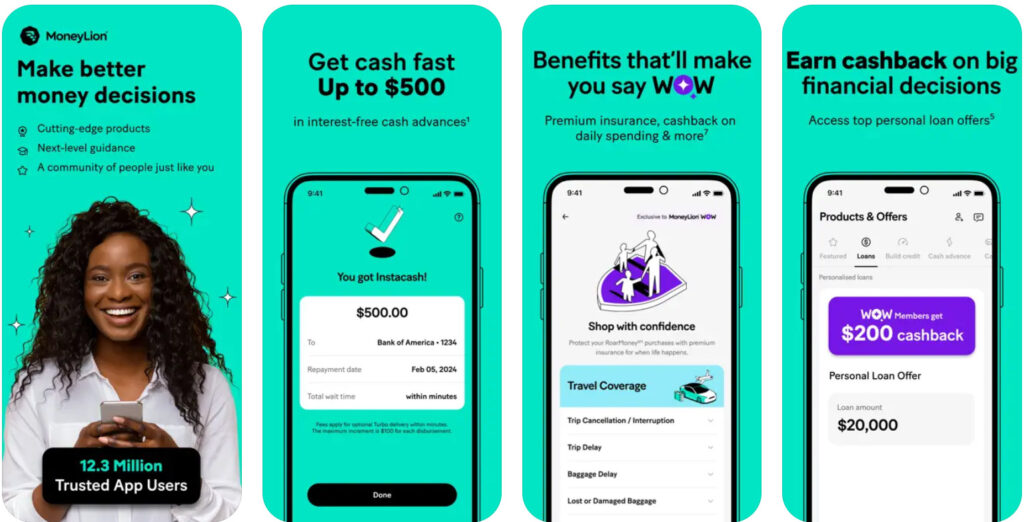

MoneyLion is an app that provides a wide range of financial services, but it is particularly well-known for its Instacash cash advance feature. In this review, we'll focus on the requirements for receiving a cash advance, plus MoneyLion's other features to help you decide if the app is right for you.

MoneyLion: Overview

MoneyLion is a legitimate financial technology company that has been offering cash advances since 2018. It is headquartered in New York City and partnered with FDIC-insured MetaBank to provide banking services.

Pros

- Tons of banking and investing features

- Customers can increase cash advance limit up to $1,000

- Has a credit-building tool

Cons

- Best for existing MoneyLion customers

- Instant cash advance fees can be high depending on amount

Highlights

Cash Advance Limits: up to $500 (or $1000 with a MoneyRoar account)

Other Features: Banking and investing

Fees: Optional tips, Fast-Advance Fee of $0.49 – $8.99, Optional Credit Builder membership of $19.99/mo.

Credit Score Requirements: None

Is MoneyLion Legit?

Yes, MoneyLion is a legit company. The MoneyLion app is one of the best cash advance apps on the market. The app has a 4.7-star rating out of over 127K reviews on the iOS app store and a 4.5-star rating out of 119K reviews on the Android app store.

MoneyLion InstaCash Cash Advance

MoneyLion is well-known for its InstaCash feature that lets qualifying users receive cash advances up to $500. There are no mandatory fees or interest charged, and MoneyLion does not perform a credit check.

| Feature | Details |

|---|---|

| Cash Advance Limit | Up to $500 ($1000 with MoneyRoar) |

| Fees | Optional tips, Fast-Advance Fee of $0.49 – $8.99 |

| Turbo Delivery Fee | 1.5% of the advance amount |

| Credit Builder Membership | $19.99 per month |

So, how does MoneyLion Instacash work?

With Instacash, users can request a cash advance in the amount of up to 30% of their regular direct deposit each pay cycle. So, for instance, if you get an $800 bi-weekly paycheck, you can apply for a cash advance of up to $240.

The maximum cash advance limit is $500 unless you have a MoneyLion MoneyRoar account or sign up for Credit Builder Plus. Both of these let you increase your limit up to $1000.

While it's not necessary to have a MoneyLion bank account to use InstaCash, members with a MoneyLion MoneyRoar account can also get discounts on same-day transfer fees.

MoneyLion cash advances must be paid back by the settlement date, which is usually a user's next payday. However, if MoneyLion has trouble determining your payday, the repayment date might be set to the second Friday after you borrowed the cash advance.

After you settle your balance with MoneyLion, you can take out another cash advance, so long as you remain eligible.

MoneyLion Instacash Requirements & Fees

Please explain the eligibility requirements, potential fees, and how you can increase your limit to $1,000 potentially.

Eligibility Requirements

| Requirement | Details |

|---|---|

| Income Source | Regular income, including government benefits and pensions |

| Bank Account | Checking account in your name, at least 60 days old, with minimum three recurring direct deposits from the same source |

| Good Standing | Must be in good standing with MoneyLion |

Like most cash advance apps, MoneyLion does not perform a credit check to determine eligibility. Instead, it uses your connected bank account to decide if you're eligible and how much to approve you for. MoneyLion also must verify your identity before you can apply for a cash advance.

To qualify for a MoneyLion cash advance, you must have:

- A regular source of income

- A checking account in your name that’s at least 60 days old with a minimum of three recurring (weekly, bi-weekly, semi-monthly, or monthly) direct deposits from the same source

- Good standing with MoneyLion

Along with payroll deposits, MoneyLion considers government benefits and pension payments as acceptable forms of income. However, MoneyLion does not accept transfers, ATM deposits, cash deposits, money transfer service deposits, or a single paycheck from a new employer.

If approved, you'll first be allowed to take out at least $25. But, if MoneyLion detects recurring deposits in your connected bank account, you will be approved for between $50 and $500. To get up to $1,000, you can switch deposits to a MoneyLion RoarMoney account or purchase a Credit Builder Plus monthly subscription.

MoneyLion does not charge any mandatory fees for cash advances, but there is an optional tipping system. Cash advances are also interest-free.

There are no fees for standard delivery, which takes 1-5 business days. But, if you want cash instantly, you can choose to pay for Turbo Delivery. Turbo Delivery costs an additional fee of 1.5% on the amount being transferred. So, between $0.49 to $8.99 based on the amount of the advance.

Other MoneyLion Products & Features

What is MoneyLion?

MoneyLion is a robust all-in-one financial app. Along with Instacash cash advances, the MoneyLion app has lots of other features, including a digital RoarMoney bank account, a credit building membership, various types of loans, managed investing services, and an online savings account marketplace.

| Product/Feature | Details |

|---|---|

| RoarMoney Banking Account | Digital bank account, FDIC-insured, $1/month fee, no minimum balance or overdraft fees, 55,000+ free ATMs |

| Credit Builder Plus | $19.99/month, credit monitoring, 5.99%-29.99% APR credit-builder loan |

| Personal Loans | Up to $50,000 |

| Payday Advance Loans | Available |

| MoneyLion WOW | $9.99/month, $500 cashback, purchase protection, black metal debit card |

| Investing Tools | Managed investment tools, auto-investments, round-ups |

| Savings Account Marketplace | Compare FDIC-insured high-yield savings accounts from partners, APY rates around 4-6% |

30+ Real Ways To Save Money At Home.

RoarMoney Banking Account

RoarMoney is a digital bank account offered by MoneyLion. The bank account is FDIC-insured and includes both a virtual card and a physical Mastercard.

There is a low $1 per month account fee, but no minimum balance or overdraft fees. Members can withdraw cash for free from over 55,000 ATMs but must pay an additional withdrawal fee from out-of-network ATMs.

A RoarMoney banking account also includes many benefits, such as cash-back rewards on eligible purchases, early direct deposits up to 2 days early, weekly spend reports, customizable alerts, and more. RoarMoney members can also increase their InstaCash cash advance limit up to $100 and get a $1 discount on Turbo Transfers.

MoneyLion Credit Builder Plus

For $19.99 per month, MoneyLion members can sign up for a Credit Builder Plus membership. Features of the membership include credit monitoring and eligibility for a 5.99%-29.99% APR credit-builder loan.

Credit Builder Plus members can also have the $1 per month account fee for MoneyLion banking and investment accounts waived. Just like with RoarMoney, those with a Credit Builder Plus subscription can also access higher Instacash cash advance maximums, up to $1,000.

MoneyLion Loans

MoneyLion recommends various kinds of loans, tailored to your goals and financial history.

Types of MoneyLion loans include:

- Personal loans – up to $50,000

- Credit-builder loans

- Payday advance loans

MoneyLion WOW

MoneyLion WOW is a membership that lets members earn up to $500 cashback on everyday spending, loans, credit-building tools, income increases, insurance purchases, and more. It also includes purchase protection for trips and exclusive access to a variety of features like active investing, weekly giveaways, and discounts.

It costs $9.99 per month to join the MoneyLion WOW club. Members also get a unique black metal debit card and fees waived for MoneyLion investing and banking accounts. Additionally, MoneyLion WOW members can get up to $5 rebates on their first Instacash Turbo Fee, and then every 10th after that.

Investing Tools

MoneyLion offers fully managed investment tools that allow you to start investing with as little as $1. You can set up auto-investments to automatically add funds to your investment account over time.

You can also turn on a “round-ups” feature that invests spare change from debit and credit card purchases.

Savings Account

MoneyLion does not offer savings accounts themselves, but it does provide an online marketplace to compare FDIC-insured high-yield savings accounts from its partners. Most savings accounts have zero monthly fees and APY rates around 4-6%.

The Best Budgeting Apps To Save Money.

Is MoneyLion Safe?

MoneyLion is a safe and trustworthy app. The company uses encryption and top-level security measures to keep its users' money and data safe.

The MoneyLion app also sends transaction alerts and gives users the ability to lock stolen or lost cards. Additionally, MoneyLion checking accounts and debit cards are FDIC-insured.

That said, it's worth mentioning that the Consumer Financial Protection Bureau sued MoneyLion for predatory behavior in 2022. The CFPB alleged that MoneyLion offered credit-builder loans to military members and dependents at an APR over 36%, which went against the Military Lending Act.

The bureau also accused MoneyLion of not allowing users to cancel and stop paying membership fees at any time. But, MoneyLion has denied all of these claims.

Who Is MoneyLion Instacash Best For?

MoneyLion Instacash is best suited for financially responsible individuals with a regular paycheck who occasionally need a small amount of extra cash to tide them over during emergencies or to cover unexpected bills. It offers a quick and convenient way to access funds without the hassle of a traditional payday loan or taking out high-interest debt.

However, the MoneyLion app isn’t designed for those lacking consistent income or seeking a solution for ongoing money issues. If you don't have a reliable paycheck or are already drowning in debt, we don't recommend that you use this app.

In addition to Instacash, MoneyLion has some other great financial products – especially the RoarMoney banking account, which lets you increase your maximum cash advance limit from $500 up to $1,000!

If you're already a MoneyLion customer, this is probably the best cash advance app for you. But, if you're not in the market for a new banking service, apps like EarnIn and Cleo might offer better options.

Other MoneyLion Reviews From Customers

Overall, MoneyLion has glowing customer reviews online. MoneyLion has a 4.4 out of 5 star rating on Trustpilot out of over 27K reviews, and a 4.62 out of 5 star rating on Better Business Bureau out of over 2.7K reviews.

| Platform | Rating | Number of Reviews |

|---|---|---|

| Apple App Store | 4.7/5 stars | 127,000+ |

| Google Play | 4.5/5 stars | 119,000+ |

| Trustpilot | 4.4/5 stars | 27,000+ |

| BBB | 4.6/5 stars | 2,700+ |

Many customers like how easy and convenient MoneyLion Instacash is. A few reviewers also praise the app's credit-building feature, noting how MoneyLion helped them significantly increase their credit score in just a few months.

Most users report being satisfied with MoneyLion customer support, as well. However, a few customers expressed disappointment with interactions involving unhelpful customer service agents.

Some critical reviews also mention that their MoneyLion cash advance limit decreased over time, reducing the amount they were able to borrow compared to before.

Is There Customer Service?

MoneyLion has 24/7 customer service. You can contact MoneyLion customer service by phone, email, or in-app live chat. MoneyLion's phone number is (516) 916-5466, and it typically only takes a few minutes to connect with a customer service agent. Emails are normally answered within one day.

There is also a useful Help page on MoneyLion's website with answers to FAQs and solutions for common issues.

Is MoneyLion Worth It?

In tough times or when emergencies strike and you find yourself needing some fast cash, MoneyLion Instacash is definitely worth it – especially if you already use other MoneyLion services. An interest-free MoneyLion cash advance is a superior option to predatory payday loans or taking on costly debt.

The MoneyLion app also has lots of other perks, including a digital banking account and cash-back membership. Overall, MoneyLion is a highly-praised financial app that is well worth considering.

That said, if you don't have a MoneyLion account already, you might want to check out other cash advance apps like EarnIn and Dave before signing up for one.

EarnIn lets you borrow up to $750 each pay period, which is a much larger advance than MoneyLion's $500 – unless you have a MoneyRoar account to increase this limit up to $1,000. Dave has much more flexible repayment terms, plus a suite of additional financial features.

Does MoneyLion impact my credit score?

No, MoneyLion Instacash will not impact your credit score. Just like most other cash advance apps, MoneyLion does not report payment activity to any of the major credit bureaus. So, if for some reason, you fail to make a repayment on time, your credit score will remain unaffected.

How long does it take to get money from MoneyLion?

It can take 1-5 business days to receive your MoneyLion cash advance with a free, standard transfer. You can also opt to pay an extra small Turbo Delivery fee to get funds within minutes.