In this post:

- Possible Finance Overview

- Is Possible Finance Legit?

- What Does Possible Finance Offer?

- Possible Finance Loan Requirements

- How To Get Started With Possible Finance

- Who Is Possible Finance Best For?

- How Does Possible Finance Compare?

- Other Possible Finance Reviews From Customers

- Is There Customer Service?

- Are Possible Loans Worth It?

Possible Finance is an online consumer finance company that bills itself as an alternative to more traditional payday loans. There are two main products available, a standard loan and a credit card. Both options are offered to consumers without having to undergo a credit check, making this a good solution for those who need fast cash and can’t qualify for a loan through a traditional lender.

However, even though the process for getting one of these short-term loans is quick and easy, you’ll still need to familiarize yourself with the terms and conditions and evaluate your other options as well.

Related reading: How To Get a Personal Loan

Possible Finance Overview

Founded in 2017 by Tony Huang and Tyler Conant, Possible Finance was interested in revamping the way short-term installment loans were handled. Typically, if a consumer needed cash fast and couldn’t qualify for a traditional loan, their only option was a payday loan. These loans with historically high interest rates and almost always need to be paid back by the next paycheck. If the loan isn’t paid back, the interest and fees continue to compound, sinking the customer further into debt.

Pros

- Immediate cash available

- Loans made to consumers with low or no credit

- Borrowers have eight weeks to repay the loan

- No APRs or late fees

- Can improve your credit score in some cases

Cons

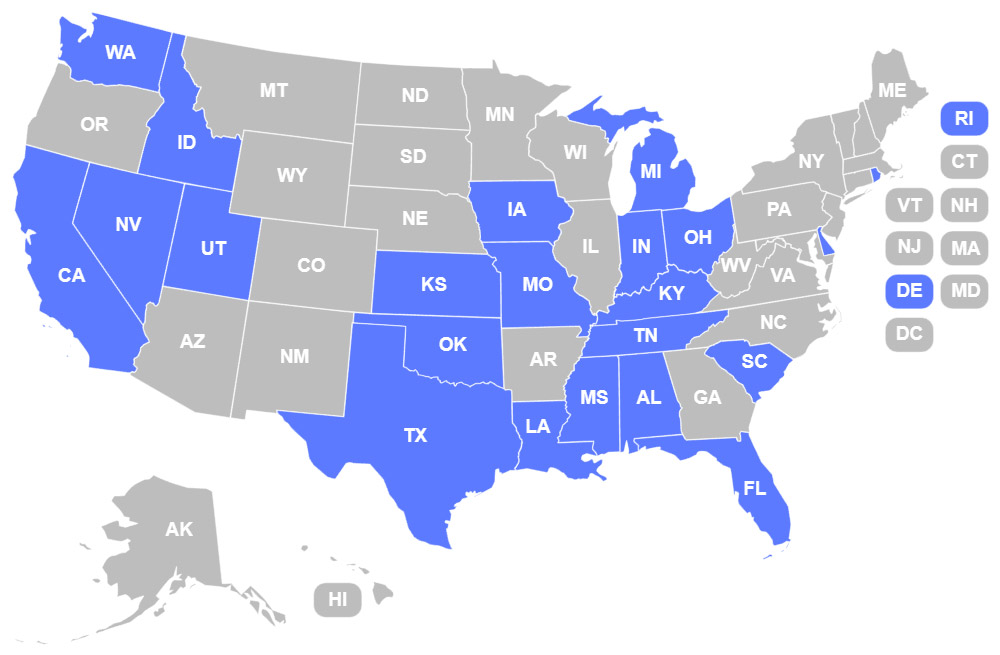

- Not available in all states

- High origination costs and monthly fees can add up

- Loan amount caps out at $500

- No live customer support

Highlights

Loan Limits: $500, though some states will have a lower maximum loan.

Fees: $8-$16 per month, plus variable origination fees depending on location.

Minimum Credit Score Requirement: None; bank statements required.

Availability: 22 states

Approximate APRs: None; Possible Finance does not charge an APR.

Possible Finance saw an opportunity to harness the power of technology to serve lower-income individuals as one of the best cash advance apps in the U.S. The company offers small loans without having to pay exorbitant fees.

This new system exists entirely online and does away with the old business model of high APRs and late fees, and instead charges a flat monthly rate along with an origination fee. Possible Finance also gives consumers two months to repay their loans.

Is Possible Finance Legit?

Possible Finance is a legit and has earned 4.5 stars on Trustpilot from over 1,000 individual reviews. Not everyone will need Possible’s services, but those who would normally rely on a payday loan company to get them through a short–term financial issue may find they’re able to get the money they need with much lower associated fees.

However, if you can qualify for a personal loan through a traditional lending institution or borrow money from a friend or family member, you can avoid paying Possible’s high fees. It’s also not an ideal choice for someone who has to borrow a substantial amount of money, since Possible’s lending caps are typically around $500, though this will vary by borrower and by state.

Is a Possible Loan Worth It?

Possible Finance offers low requirements for short-term loans. This can help if you need quick cash and have limited options. If you use the service rarely and repay your loan quickly, it might be a good choice for you.

Possible Finance’s low requirements for short-term loans can help in urgent financial situations. But remember that the loan isn't cost-free. You need to consider the origination fees paid to the lender and the monthly service fee charged by Possible.

Possible Finance Locations

Possible Finance operates in the following states: Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nevada, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, and Washington.

What Does Possible Finance Offer?

Possible Finance offers two main consumer products, a standard loan and a credit card. The service you choose will depend on your needs and your qualifications.

Possible Loan

The Possible Loan is the original and most popular service offered and provides short-term loans to consumers. One of the biggest draws for customers is that, unlike other loans, you don’t have to undergo a hard credit check meaning you can get a loan with little or no credit.

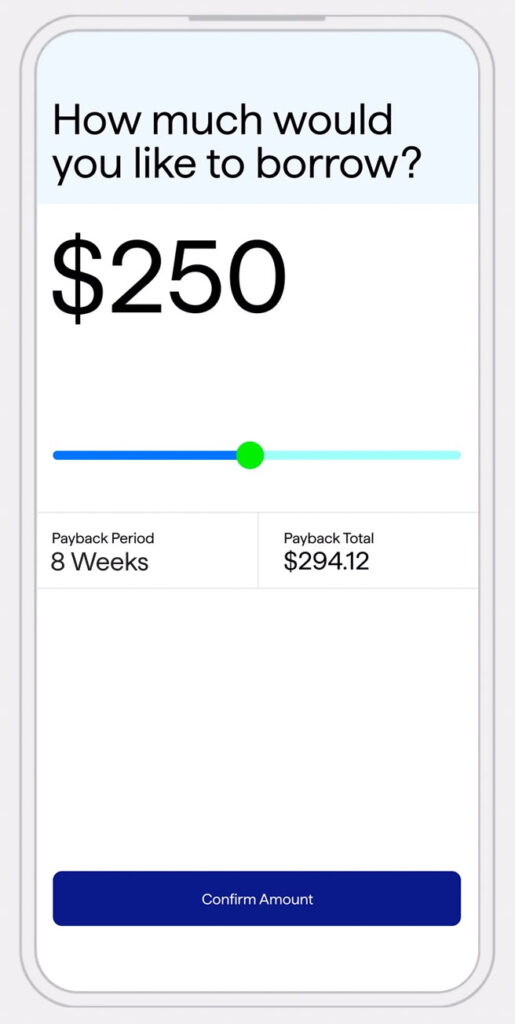

Instead, Possible Finance looks at your bank account history to check that you have a steady cash flow and have maintained a positive balance. Many states have a maximum loan amount of $500, but others will have their own limits. For example, California will only lend up to $250.

These loans have no APRs, but you will have to pay a monthly fee of $8 or $16 – plus each state has its own origination fees. These fees must be paid upfront or they can be deducted from your loan amount.

For instance, Rhode Island charges $10 for every $100 loaned, while Delaware, Missouri, and Nevada all charge $25 for every $100. In other states like Florida, Indiana, Iowa, Louisiana, Michigan, Ohio, Oklahoma, and Texas your origination fees are based on a percentage instead of a flat rate.

There are also no late fees and loans must be paid back in four installment payments over eight weeks with at least a seven-day window before your first payment is due. You can choose to pay back your loan earlier with no penalty, and there’s also an option for a 29-day grace period to defer and adjust your payments.

Possible Card

The Possible Card offers consumers either a $400 or $800 credit limit without having to undergo a credit or security check. The company charges an $8 or $16 monthly fee which you owe whether or not you carry a balance on the card. Because the card relies on monthly fees instead of interest rates or late payment fees, more people will be able to qualify since there’s no need for a credit check. However, you will still need to submit personal financial information when you apply to confirm you have a regular cash flow of at least $1,000 a month for the last three months.

This card may also allow individuals to build their credit by making regular payments against their purchases since Possible Finance reports payments to TransUnion. That said, this credit reporting is more likely to benefit those with no credit history at all or very low scores. In some cases, those who already have a good credit score have actually seen it fall.

Customers have two options to pay off the balance of their card, either through an auto-pay system in full or over four installments, or with the “Pay Over Time” feature where you can carry a balance on your card. With the latter option, your card will be locked to any new purchases until the balance is paid off.

Possible Finance Loan Requirements

Even though Possible Finance doesn’t rely on traditional credit checks, that doesn’t mean there are no requirements to qualify, and this can vary from customer to customer and from state to state.

The most important factor is your bank account activity, and here Possible is looking for a steady income of at least $750 a month for loans and $1,000 a month for the Possible Card. Typically, you need to show at least two to three months of steady income. You also need to demonstrate a consistently positive account balance and avoid risk factors like returned check fees and non-sufficient funds (NSF) fees.

There are no hard credit checks, so there’s no minimum credit score you must have and even people with no credit history can qualify for a Possible loan. The lender may perform a soft credit check which will not affect your score.

How To Get Started With Possible Finance

The entire application, loan disbursement, and repayment process happens entirely online through the Possible Finance app, and most people will receive an immediate answer once they apply.

Steps To Sign Up With Possible Finance:

- Download the Possible Finance app for Google Play or the App Store.

- Sign up for a membership by entering a few personal details about yourself including an ID or driver's license number and your social security number.

- Input financial details that may include your bank account number, employment information, or proof of recent direct deposits.

- Once you’ve submitted this information, most people will receive an immediate decision, but you may have to wait up to one day to get a reply if a lender needs more time.

- If your application is approved, review your loan offer to see if you want to move forward with it. If you were denied, you’ll be provided with a reason for the denial and advised that you can reapply after 72 hours.

- If you accept the terms, you have three days to e-sign the loan documents before they expire and the money will be dispersed either to your bank account or directly to your debit card. In most cases, you’ll see the money deposited in your account within one or two business days.

- After about a week, you will begin paying back your loan in four installments over the next two months.

Who Is Possible Finance Best For?

Possible Finance loans and cards aren’t right for everyone, but they can be a good short-term solution for those who need the service and can’t qualify for assistance elsewhere. If you are able to qualify for other funding sources, you’ll probably be better off using an alternative.

However, there are some circumstances where a Possible Finance loan may be your only real option. For those who only need a small sum of money and have a steady income, but no real credit history or a very low credit score, a Possible cash advance could be a decent temporary fix.

Related reading: Apps That Loan You Money Instantly Without a Job

How Does Possible Finance Compare?

The table below shows how Possible Finance compares to many of the best cash advance apps.

| Company | Loan Amount | Fees & Costs | Deposit Speed |

|---|---|---|---|

| Possible Finance | Up to $500 | $15-$20 per $100 borrowed | 1-3 business days |

| EarnIn | Up to $750 per pay period | Optional tips up to $13, $3.99-$4.99 Fast-Advance fee | 1-3 business days |

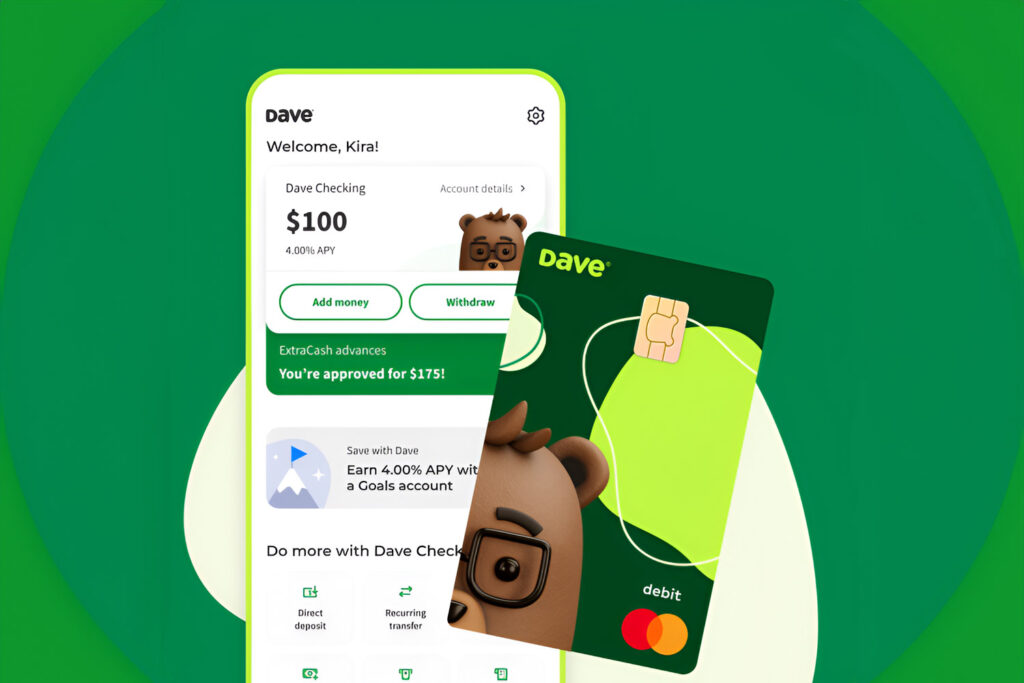

| Dave | Up to $500 per pay period | $1 monthly membership, $3-$25 Fast Advance, Optional tips | 1-3 business days |

| Chime | Up to $500 per pay period | $2 Fast Advance | 1-3 business days |

| Cleo | Up to $250 | $5.99-$14.99 monthly subscription, $3.99 Fast Advance | 3-4 business days |

| Brigit | Up to $250 | $8.99 or $14.99 monthly subscription, $0.99-$3.99 Fast Advance | 1-3 business days |

| MoneyLion | Up to $500 per pay period (up to $1,000 with MoneyRoar account) | Optional tips, $0.49-$8.99 Fast Advance, Optional $19.99 monthly Credit Builder membership | 1-5 business days |

| Albert | Up to $250 per pay period | $14.99 monthly subscription, $4.99 Fast Advance | 2-3 business days |

| Beem | Up to $1,000 per pay period | $2.47-$12.97 monthly subscription, $1-$4 Fast Advance | 1-5 business days |

| Branch | Up to 50% of wages | Optional tips, $2.99 to $4.99 Fast Advance | Instant to digital wallet, up to 3 business days to bank account |

Other Possible Finance Reviews From Customers

Possible Finance has a B rating from the Better Business Bureau (BBB), and the majority of its customer reviews are positive, garnering 4.44 out of 5 stars out of 331 reviews. It also gets thousands of positive reviews from both Google Play and the App Store.

| Platform | Rating (stars) | Number of Reviews |

|---|---|---|

| Google Play | 4.5 | 51K+ |

| App Store | 4.8 | 106K+ |

| BBB | 4.4 | 331 |

| Trustpilot | 4.5 | 1,000+ |

Is There Customer Service?

When you need help with your Possible loans, there is a customer service team available, but you can’t contact them by phone or speak with anyone. Instead, you have to email your questions and concerns directly to the company or use the chat feature through the app.

Are Possible Loans Worth It?

Possible Finance has fairly low requirements to qualify for a short-term loan, and for those who are in a pinch and can’t access quick cash elsewhere, it can be a valuable tool. If you use this service infrequently and are sure to pay off your loan as quickly as possible, it can be worth it to many cash-strapped consumers.

On the other hand, even though there are no late fees or APRs, the loan you’ll receive is far from free when you factor in the origination fees paid to the lender and the monthly service fee that Possible Finance charges.

Continue reading: