A personal loan can help you cover a financial emergency or give you some extra cash to use when you need it while you pay it back over time. Still, personal loans are meant to help temporarily, not become a long-term financial crutch. Knowing how to use them wisely is a must.

There are also several different types of personal loans to consider when shopping around for one. Some are better for specific financial situations, like if you have bad or no credit, so it’s a good idea to understand their differences to find the right one for your needs.

13 Types of Personal Loans

The following types of personal loans are the most common. Consider the pros and cons of each as you determine whether a personal loan is right for your situation.

- Unsecured Personal Loans

- Secured Personal Loans

- Fixed-Rate Loans

- Variable-Rate Loans

- Cash Advance Loans

- Installment Loans

- Buy Now Pay Later (BNPL) Loans

- Debt Consolidation Loans

- Co-Signed Loans

- Personal Lines of Credit

- Payday Loans

- Pawn Shop Loans

- Title Loans

What Is a Personal Loan?

A personal loan gives you an upfront payment while requiring you to make installment payments over time until you pay off the loan. Of course, those payments come with interest, so you’ll end up paying more for your loan than you originally received. However, that lump sum can help you cover a big purchase that you might not have otherwise been able to, like a room renovation or a car repair.

Personal loans are available for a wide range of uses, like paying for medical expenses, consolidating other debts, taking a vacation, or planning a wedding, but they aren’t available for everything. For example, some banks won’t let you take out a personal loan to pay for a vehicle and will direct you to an auto loan instead. You also can’t generally use a personal loan in place of a business loan, home loan, or student loan.

When you apply for a personal loan, your lender may restrict what you can and can’t use your loan for. Pay attention to these requirements before applying, as there may be a better loan option from that lender that suits your situation.

Before jumping into a personal loan search, continue reading this guide to learn more about each type of personal loan, what it’s best for, and when to avoid it.

Guide to Personal Loans

There are many types of personal loans designed to meet different financial needs. Each one offers unique benefits and terms. Let's explore these different types of personal loans in more detail.

| Loan Type | Best For | When to Avoid | Interest Rate | Collateral Required |

|---|---|---|---|---|

| Unsecured Personal Loan | People with good credit scores | If you want the lowest interest rate possible | Higher | No |

| Secured Personal Loan | Borrowers with bad/no credit | If you're uncomfortable using collateral | Lower | Yes |

| Fixed-Rate Loan | Predictable monthly payment | When interest rates are high | Fixed | No |

| Variable-Rate Loan | Lower initial interest rates | If you want steady monthly payments | Variable | No |

| Cash Advance Loan | Urgent cash needs | If you have alternatives | High | No |

| Installment Loan | Managing large purchases over time | If you can't make extra payments | Varies | No |

| BNPL Loan | Smaller online purchases | If unsure about on-time payments | Often 0% | No |

| Debt Consolidation Loan | Refinancing multiple debts | If the new rate is higher than current debts | Lower | No |

| Co-Signed Loan | People with bad/no credit | If there's a chance of default | Varies | No |

| Personal Line of Credit | Emergency cash | If high fees are charged | Varies | No |

| Payday Loan | Quick cash until payday | If you can't repay on next paycheck | Very High | No |

| Pawn Shop Loan | Quick cash, no credit check | If you don't want to risk losing collateral | Very High | Yes |

| Title Loan | Emergency cash, can't qualify for others | If you need a larger, long-term loan | Very High | Yes |

1. Unsecured Personal Loans

Best For: People with credit scores above 680 and solid credit histories

When to Avoid: You want the lowest interest rate possible

An unsecured personal loan doesn’t require any type of collateral to back the loan. Collateral is something of value you promise to your lender if you stop making payments on your loan, putting it into default. Because an unsecured personal loan requires no collateral, a lender usually wants a borrower to have an excellent credit score and credit history, denoting that the borrower is less likely to default on their loan.

Typically, lenders look for credit scores in the upper 600s, at minimum, to qualify for an unsecured personal loan. But credit history is just as important. Lenders want to see that you pay your bills on time, don’t have too many unnecessary accounts open – especially not several new accounts opened recently – and aren’t carrying high balances month to month on your accounts.

A point to consider: Unsecured personal loans usually have higher interest rates than secured personal loans, so they’re not the best option if you’re looking to reduce your interest costs over the life of your loan.

2. Secured Personal Loans

Best For: Borrowers with bad or no credit

When to Avoid: You’re not comfortable using collateral to back your loan

In contrast to unsecured personal loans, secured personal loans require some form of collateral. Your lender may request specific collateral, like a vehicle or a savings account, or you may have some options. Either way, your collateral needs to be valuable enough for the lender to feel comfortable granting your loan.

Secured personal loans are mostly for people with fair, bad, or no credit. Because these borrowers may not qualify for a traditional unsecured loan based on their credit, a secured loan allows them to qualify with their collateral. The good news is that if you continue to pay your secured loan without defaulting, your collateral remains safe and you will maintain 100% ownership of it after paying off your loan.

Lenders are often willing to provide lower interest rates for secured loans because of your collateral, which can help you pay less over time.

3. Fixed-Rate Loans

Best For: Having a predictable monthly payment

When to Avoid: When interest rates are at their highest

A fixed-rate personal loan maintains the same interest rate throughout the loan term. So, the initial interest rate you agree on – say, 12% – will remain your interest rate until you pay off the loan. Because the interest rate doesn’t change, your monthly payment also stays the same for the entire loan term, making your payments predictable every month.

The downside to that is that interest rates naturally change throughout the year, and sometimes even as frequently as month by month, depending on the bank. Perhaps you get your loan when the interest rate is 12%. In six months, your bank might lower the interest rate for someone with a similar credit history to 10% based on the market interest rate. Your loan will still have an interest rate of 12%. On the other hand, if interest rates happen to rise through your loan term, you have a better deal by paying just 12% when the market rate might be closer to 15%.

4. Variable-Rate Loans

Best For: When fixed interest rates are high

When to Avoid: You want a steady monthly payment throughout the life of your loan

A variable-rate personal loan is less common than a fixed-rate personal loan, but some lenders offer them. Unlike a fixed-rate personal loan, a variable-rate personal loan has an interest rate that can change throughout your loan term. However, most lenders lock in a rate for you for a period of time before the rate can begin changing. Usually, the rate locks for at least one year, but some lenders lock your rate for longer, depending on your loan length. Starting rates for variable-rate loans are usually lower than those for fixed-rate loans.

Once your interest rate starts to move, it could do so monthly, depending on the terms of your loan. The rate can go up or down based on the market rate, but either way, your monthly payment can change, making it more challenging to plan your payments. The good news is that most lenders set a cap for your interest rate, meaning it can’t go any higher than that rate, even if market rates skyrocket.

5. Cash Advance Loans

Best For: When you urgently need cash for an unexpected situation

When to Avoid: You have an alternative available, like an emergency fund or borrowing from family

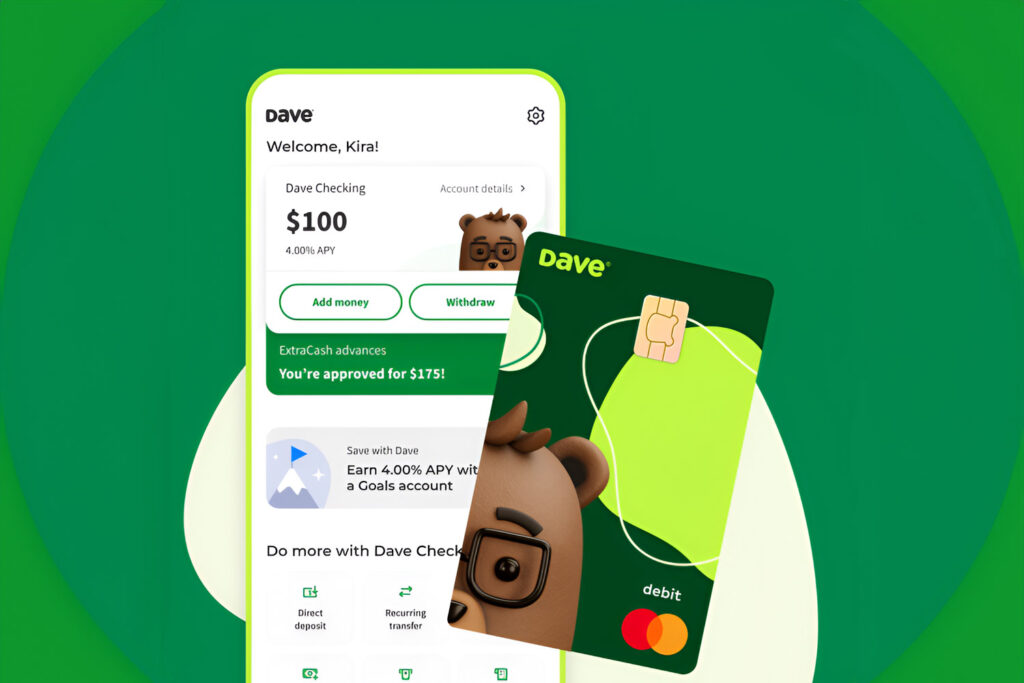

Cash advance loans let you get an advance on your paycheck before payday hits. Once you get paid, you pay back the loan with interest. Most of the best cash advance apps let you do this, but you may have brick-and-mortar cash advance loan services in your area. Many cash advance services don’t require credit checks.

There’s also another way to get a cash advance, which is borrowing against your available credit card limit. Say, for example, you have a credit card with a $5,000 available limit. You can request a cash advance of up to $5,000 – although some credit cards won’t let you borrow the full amount you have available – to borrow that money as cash. You can complete the transaction at your bank or via an ATM.

It sounds good in theory if you need quick cash, but cash advance loans generally come with high fees and higher interest rates compared to regular credit card purchases. Expect to pay a cash advance fee of up to 5% of the amount you borrowed. If you took a cash advance for your full $5,000, you’d pay $250 just in fees. And, while you might have a 19.99% interest rate for regular purchases, your cash advance interest rate might be closer to 29.99%.

It’s best to avoid any type of cash advance loan if you can help it, as they can get you stuck in a cycle of debt that can be difficult to climb out of.

6. Installment Loans

Best For: Borrowers who can pay more than their minimum payment each month

When to Avoid: You don’t have extra padding in your monthly budget to make loan payments

An installment loan pays you a lump sum to cover a purchase, and you pay that loan through a set of installments. Depending on the loan terms, you might pay weekly, bi-weekly, or monthly, but monthly installment loans are most common, especially for loan amounts of $1,000 or more.

Typical installment loans charge interest, so you’ll wind up paying more than you originally borrowed by the time you pay off the loan. However, you can reduce the amount of interest you pay by paying more than your agreed-upon payment each month or by choosing a shorter loan term. Of course, that means you need more space in your budget each month.

Defaulting on an installment loan is never a good idea, as it can lead to expensive late fees, additional interest charges, and negative marks on your credit report. So, only opt for installment loans if you know for sure you have enough extra cash flow to make payments on time each month.

7. Buy Now Pay Later (BNPL) Loans

Best For: Smaller online purchases

When to Avoid: You’re not sure if you can make on-time payments each month

A buy now, pay later loan is a form of installment loan that gives you money upfront to cover something you want to buy and lets you pay for it later in installments. You may have seen buy now, pay later loans when shopping online, as many online retailers use services like Affirm or Klarna to help people pay for larger purchases in smaller increments over time.

For example, say you need to purchase $400 in back-to-school clothes but only have about $100 to pay right now. If the retailer uses a BNPL service, you can cover the full $400 now and pay it over time according to an installment schedule – maybe four biweekly payments of $100, for example. Many of these BNPL services only require a soft credit check for smaller purchases, which doesn’t affect your credit score, and they often come with 0% interest unless you have a big purchase to cover.

The downside is that fees can be hefty if you miss a payment, so it’s important to understand your full payment schedule and make sure you can adhere to it before accepting a BNPL offer.

8. Debt Consolidation Loans

Best For: Refinancing multiple debt payments into one monthly payment

When to Avoid: The interest rate for a loan is higher than the average interest rate of the debts you want the loan to cover

Debt consolidation is the process of grouping debts together to make one monthly payment instead of several. A debt consolidation loan is a common way to do that.

Let’s say you have five credit cards with balances totaling $8,000. Right now, you make five separate payments each month to pay off those cards, each of which has not-so-great interest rates. Instead, you could take out a debt consolidation loan for $8,000, use the money to pay off all card balances, and then continue making one monthly payment to pay off the loan.

Debt consolidation loans should have a lower interest rate than the average rate of your other debts. Otherwise, you’re only moving money around instead of tackling your debt quicker and reducing the amount you pay.

9. Co-Signed Loans

Best For: People with no credit or bad credit

When to Avoid: There’s any chance you’d default on your loan

A co-signed loan requires another person to sign for a personal loan with you. If a lender recommends having a co-signer, it’s usually because you have either no or too little credit history, or your credit history isn’t as solid as the lender would like to see. Some lenders may also require a co-signer if your income is too low to qualify for a loan.

Your co-signer takes on the responsibility of a loan right behind you. Their credit and income can help you qualify, but if you stop making payments, the co-signer becomes responsible for paying the loan. That leaves them with a lot of financial risk, so be 100% sure you can continue paying for your loan before signing.

10. Personal Lines of Credit

Best For: Having emergency cash to use when you need it

When to Avoid: Your bank charges high maintenance or transaction fees for a line of credit

A personal line of credit is similar to a credit card in that it gives you an amount of cash you can borrow when you need it. This differs from a traditional personal loan, which pays you all the money upfront. With a personal line of credit, you have more control over when and how much you borrow, so you’ll never need to pay for more than you need.

To illustrate, say you open a personal line of credit for $10,000. You have an unexpected medical expense come up, so you borrow $1,000. Three months later, you borrow $500 to fix your car. You pay off both expenses in six months and don’t need to borrow anything from your line of credit for another year.

If you had a $10,000 loan, you’d be paying principal plus interest that entire time for the full loan amount, but with a line of credit, you only pay for principal plus interest on the amount you borrow when you borrow it.

With that said, beware of fees. Some banks charge monthly or annual maintenance fees or transaction fees for personal lines of credit. Although maintenance fees are usually minimal, transaction fees can sometimes be expensive, especially when charged as a percent of what you borrow.

11. Payday Loans

Best For: Quick cash to hold you over until payday

When to Avoid: You won’t have enough cash on your upcoming paycheck to pay off the loan plus interest

A payday loan gives you cash before your payday from work, but you’ll need to pay it back when you get paid. Since the loan is based on how much you earn from a paycheck, they’re generally geared toward lower-income individuals and are, therefore, usually not more than $1,000.

Payday loans also come with high fees, sometimes for as much as $30 for every $100 borrowed. If you borrow just $500 at this rate, you’ll pay $150 in fees – 30% of what you borrowed.

For this reason, some states ban payday loans altogether.

12. Pawn Shop Loans

Best For: Quick cash with no credit check

When to Avoid: You don’t want the chance of losing a valuable collateral item

If you have something of value, you can take it to a pawn shop to offer as collateral for a loan instead of pawning it, with no credit check needed. Once you pay off the loan plus interest, the pawn shop gives you back your item.

These loans might seem like an easy financial fix, but pawn shops often charge incredibly high interest rates for this service, sometimes as much as 25% to 30% monthly interest. Plus, if you fail to pay your loan, you lose your collateral to the pawn shop.

13. Title Loans

Best For: Emergency situations when you can’t qualify for a traditional loan

When to Avoid: You need a larger loan for a longer period of time

Title loans are short-term loans that require you to place your vehicle as collateral to qualify for a loan. Therefore, you won’t be able to borrow more than what your car’s worth, and they usually stay under 50% of its value.

Like a pawn shop loan, title loans often come with high interest rates, and you stand to lose your car if you can’t pay your loan on time.

How To Choose the Right Personal Loan

You have a lot of options when it comes to personal loans, but which one is right for you? In most cases, it’s best to steer clear of short-term, high-interest loans, like title, payday, and pawn shop loans. Instead, consider installment loans or a personal line of credit, either of which offers more manageable interest rates and more cash to cover big expenses.

Remember: Your options vary by lender. Some only have fixed-rate loans, while others might have several types of personal loans, like secured loans, variable-rate loans, and debt consolidation loans. Take advantage of the free online quotes that many lenders offer so you can compare your options side-by-side.

Where can I get a personal loan?

Check with your bank or credit union to learn more about its personal loan options. Online lenders, like Lightstream and Rocket Loans, also offer personal loans.

Which type of personal loan is easiest to qualify for?

A secured loan is generally the easiest to qualify for because it’s backed by collateral. Therefore, you won’t need as strong of a credit history to qualify as you might for an unsecured loan.

Which type of personal loan is most common?

Most personal loans are fixed-rate loans, meaning that they maintain the same interest rate throughout the life of the loan.

What’s the difference between a payday loan and a cash advance loan?

Although similar, payday loans often come with higher fees than cash advance loans. Many cash advance apps require small fees for an advance or allow users to donate a percent of their cash advance.

Does applying for a personal loan hurt my credit?

Most lenders require only a soft credit pull, which won’t harm your credit, to give you a personal loan quote. However, once you apply for a personal loan, you’ll likely have a hard credit check, which could ding your credit score by a few points.