In this post:

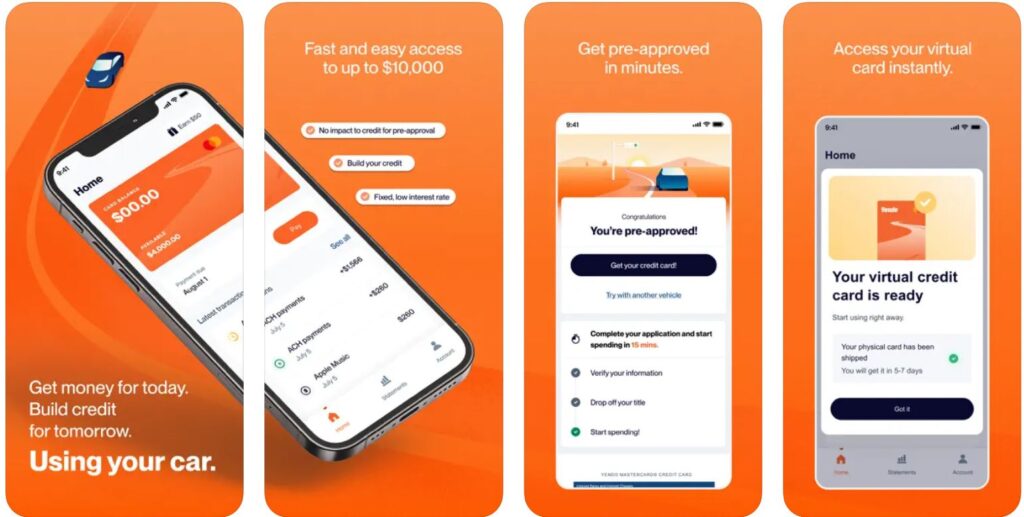

Yendo is a fintech company that launched in October of 2022 and is based in Dallas, Texas. The Yendo Credit Card works like a secured credit card, but you don’t have to put any money towards it upfront as a security deposit. Instead, the company will use the equity in your vehicle as collateral.

Yendo Overview

Yendo offers an affordable credit card for consumers who own or lease their car. Your credit limit is based on the year, make, model, mileage, and condition of your car, and only cars made in 1996 or later can be used.

Pros

- Includes fraud protection from Mastercard

- Good option for those who can’t qualify for a traditional credit card

- Fast approval process

- Some cardholders will see an improvement in their credit score

Cons

- If you default on your payments, you could lose your car

- High APRs if you don’t pay off your balance each month

- Your credit limit is restricted by the value of your car

Credit Check Required: No

Credit Limit: $450 to $10,000

Fees: $40 annual fee

Interest Rates: 29.88% APR, but there’s no interest charged if you pay your balance on time each month.

Cash Advance Limit: As much as $400 a day and up to 50% of your total credit limit

Related reading: How To Get a Personal Loan

Is Yendo Legit?

Yes, Yendo is a legitimate finance company. Since it’s only been in business for less than two years, it hasn’t established the track record that other credit card companies have. It currently has an average of 3.2 stars on Trustpilot and a B+ rating from the BBB. Even though the company has some unfavorable reviews, for many consumers it can be a good way to access credit that they couldn’t get through a personal lender or credit card company.

Is Yendo Worth It?

Yendo’s terms and conditions may not suit everyone, and if you struggle to make regular payments, you’ll risk losing your car. However, the Yendo Credit Card can be a good choice for those who can't get a non-secured line of credit or have a low credit score but own or lease a car. If you can pay off your balance monthly or meet minimum payments, Yendo might be a reasonable option.

Related reading: Apps Like MoneyLion

How Does Yendo Work?

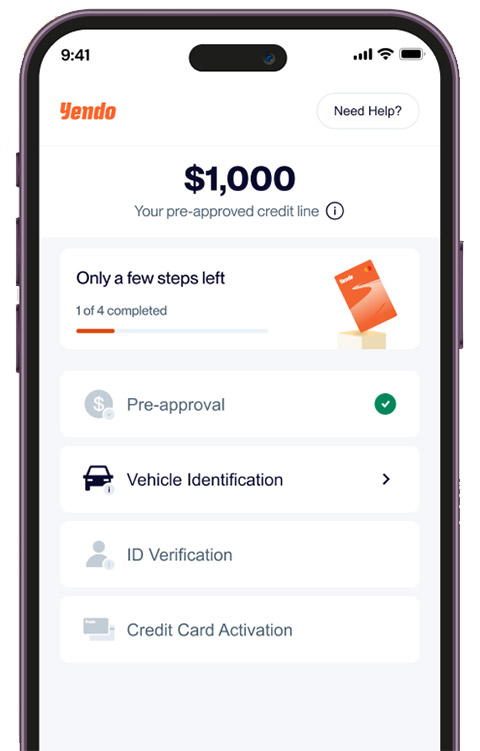

To apply, enter personal information on Yendo’s website by clicking on the orange “get started” button. You’ll be asked to include either your Social Security number or your taxpayer identification number (TIN), a current email address, and a copy of your government-issued ID.

You must also prove that you either own your vehicle or are leasing it. During the pre-approval process, you won’t have to undergo a credit check but if you decide to move forward, Yendo will perform a hard credit check which can cause your score to drop.

Once you’re pre-approved, download the Yendo app on your smartphone to validate your vehicle by uploading pictures of the car and the title. Once you’re fully approved, you’ll have to send your title to Yendo via FedEx.

After Yendo receives confirmation that your title is on its way, you’ll receive a virtual card, and in 7 to 10 days you’ll get your physical card in the mail. However, until the title is actually received, you’ll only have access to 40% of your approved limit, not to exceed $1,500.

When you receive your first monthly statement, you have 25 days to make your minimum payment which has to be either $50 or 1% of their balance, whichever is greater. Once you’ve paid your balance down to $0, you have to make a formal request to Yendo to have the title sent back to you. If you choose not to do this, your line of credit will stay active.

Yendo Credit Card Requirements

Yendo lists several eligibility requirements, but other rules are more vague. For example, the terms state you must “have an income that can support your monthly obligations,” but there are no listed income requirements. Presumably, you’ll need to prove that you have a steady income source and show that you’ll be able to meet your regular expenses and any payments that a new credit card would bring.

Also, although you won’t have to undergo a credit check in the pre-approval process, the company will perform a hard credit check once you proceed with the official application but it doesn’t say what kind of score they’re looking for.

Related reading: Is Wayfair Legit?

In addition, you must meet the following criteria:

- Be at least 18 years old

- Have a Social Security Number or TIN

- Have a valid email address and own a smartphone

- Own or lease a car that was made after 1996

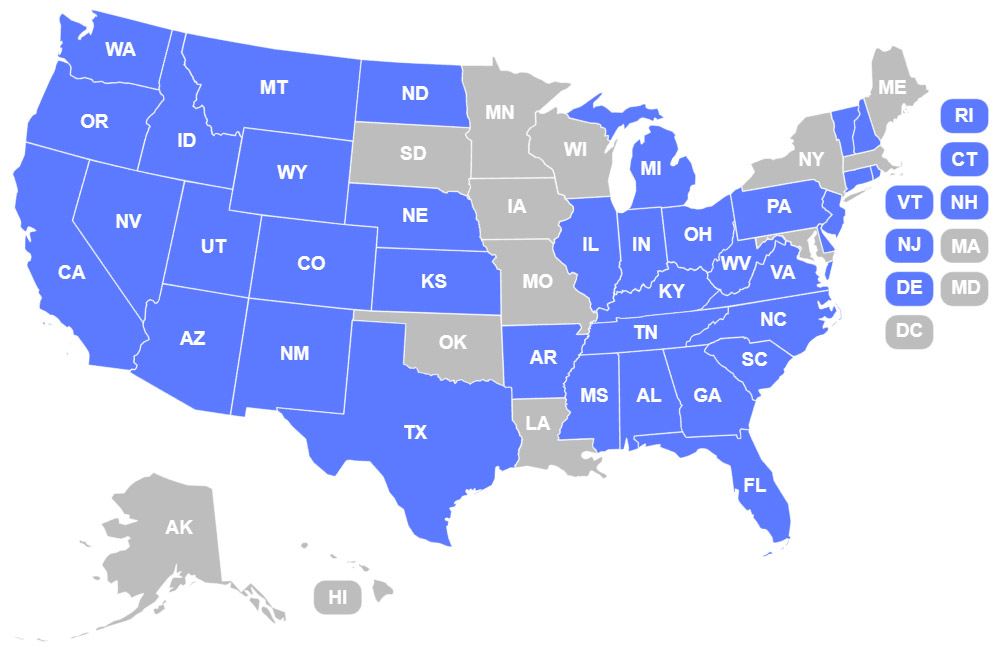

- Live in one of the following 37 states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Michigan, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, or Wyoming.

Yendo Locations Map

Yendo Fees

There’s a non-refundable $40 annual fee for the credit card. If you choose to use your Yendo Credit Card in an ATM for a cash advance, you’ll incur a 3% fee and this may be on top of any fees imposed by the ATM.

Other Yendo Features

In addition to being an affordable credit card option, Yendo also offers other benefits for cardholders. Because Yendo reports your payments to all three of the major credit bureaus – Equifax, Experian, and TransUnion – you can improve your credit history by using the card. However, this won’t be the case for everyone. If you’re concerned about how this may affect your score you can request your free report from AnnualCreditReport.com or contact the company for more information.

Yendo also allows you to keep your line of credit open even after you pay off your purchases in full, but the company will retain the lien on your title during this time. Yendo also offers auto refinancing and is one of the best cash advance apps, allowing you to withdraw up to $400 a day from ATM machines.

Related reading: Apps That Loan You Money Instantly Without a Job

Is Yendo a Title Loan?

No, Yendo is not a title loan. Though they function similarly, the services differ in a few ways. Both title loans and Yendo use the value of your vehicle as collateral, and they both allow borrowers with lower credit to qualify for a loan (or a credit card in Yendo’s case).

However, title loans often come with extremely high interest rates, as much as 100% to 300% APR. Plus, they are typically due in full within 30 days and you must have full ownership of the car. With Yendo, the APR is set at 29.88%, you’ll be able to pay your balance off in lower payments each month, and consumers who own or lease their cars can apply.

What Happens If You Don’t Pay Yendo Back?

If you’re unable to make your minimum payment, you should reach out to Yendo to work on a plan before your account becomes past due. Per Yendo’s website, the company will work with cardholders who miss a payment and it says that repossession would only be their final option after exhausting all other possibilities.

Since it does have a legal lien on your car, Yendo does have the right to eventually take your car to recoup its losses. If you carry a balance on your card and are not making regular payments, your card will be locked until it’s brought back to a $0 balance.

Other Yendo Credit Card Reviews

On average, customers report mixed feelings when it comes to their experiences with Yendo. So far, Trustpilot has only accumulated 28 reviews from consumers, so when reading comments, it’s important to keep in mind this is only a small representation and you should take the time to research the company for yourself.

How To Contact Yendo

Reach out to Yendo via email at [email protected] or call them at (888) 532-0770. The customer service team is available from 8:00 AM to 6:00 PM CST Monday through Friday, and 9:00 AM to 4:00 PM on Saturday.

Is Yendo Worth Paying For?

Yendo’s terms and conditions aren’t going to be ideal for all consumers. That said, the Yendo Credit Card can be a great option for someone who’s unable to obtain a non-secured line of credit, or who may have a low credit score but still owns or leases their car and can use its value to their advantage.

If you’re able to pay off your balance each month or at least meet the minimum payments, you’ll likely find Yendo to be a reasonable option. On the other hand, if you aren’t confident in your ability to make regular payments on your purchases, you’ll be stuck with a high APR and could ultimately risk losing your car.