33 Proven Ways To Save Money At Home

For frugal homeowners, there are plenty of ways to save money at home. From cutting down on your grocery bill to finding ways to be more energy-efficient; it’s possible to reduce your monthly spending with just a bit of effort.

The Homeowner team has compiled over 30 tips to save money around the house. Use one or several of these ideas to slash your spending and get your finances back on track.

Want some fast money-saving wins? Checkout:

- EarnIn: Borrow up to $750 against an upcoming paycheck!

- Capital One Shopping: Automatically apply available coupon codes at 30,000+ online stores to save money.

How To Save Money At Home

1. Create A Household Budget

The first step to saving money at home is to create a traditional budget for your household. After all, if you don’t know where your money is going each month, it’s impossible to know how to save.

Thankfully, there are plenty of budgeting apps you can use that do all the hard work for you.

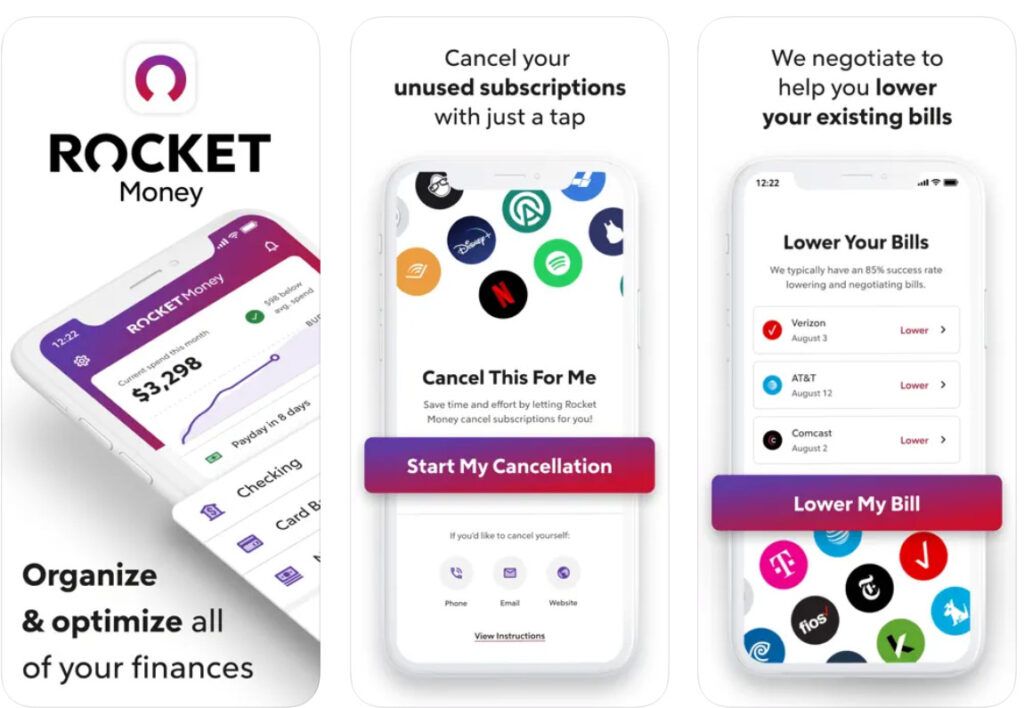

At Homeowner, we like using Rocket Money the most. It’s an all-in-one budgeting app that helps you cancel expensive subscriptions and track your spending across different categories.

Rocket Money has a free plan to try out the app. It also has a Premium Plan that helps you negotiate lower monthly bills to save even more.

Start saving with Rocket Money!

2. Use Coupons To Save On Home Essentials

Using coupons is another simple-yet-effective way to spend less money each year. And you can use coupons to save on groceries, cleaning supplies, and other home essentials every single month.

Here are some of our favorite couponing resources to check out:

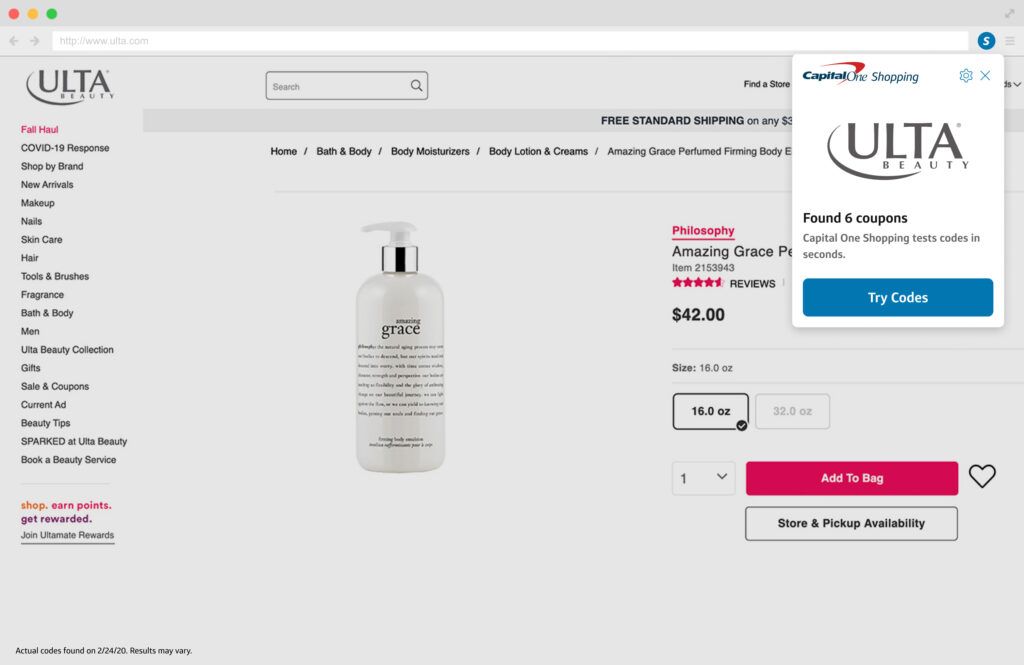

- Capital One Shopping: This free extension automatically applies available coupon codes at 30,000+ stores to help you save money on autopilot.

- Fetch: Earn free gift cards for taking photos of your grocery receipts.

- P&G Good Everyday: Get exclusive coupons and rebates for brands like Tide, Pampers, Febreze, Gillette, and dozens of other household names.

With this simple reward app stack, saving $25 to $100+ per month is pretty realistic. And you can stack this idea with a cash-back rewards card to double-dip on savings.

Start saving money with Capital One Shopping!

Note: Capital One Shopping compensates us when you sign up with the provided links.

3. Share Your Opinion To Get Free Gift Cards

Want an easy way to save extra money at home?

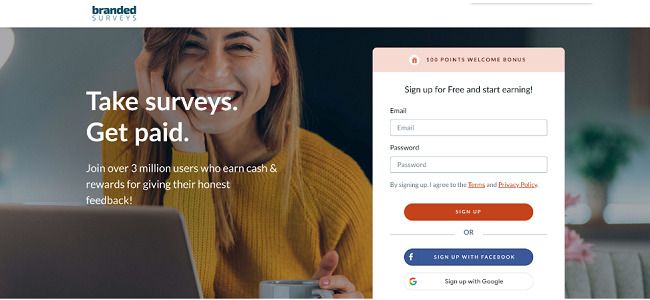

Then try earning free gift cards and cash every month with Branded Surveys!

This leading survey site pays you for sharing your honest opinion. All you have to do is sign up with your email and then begin answering surveys in your spare time to earn.

Surveys cover all kinds of topics, like food, music, entertainment, sports, and more. And you earn after every single survey you complete.

As for rewards, you can cash out with tons of gift cards to companies like Amazon, Home Depot, Target, and Walmart. PayPal cash is also an option too if you prefer cash.

There’s also a nice sign up bonus to get you started. So it’s the perfect time to try out Branded Surveys!

4. Cover Rent & Emergency Expenses By Getting Paid Early

Have bills coming up like rent? Or, maybe you’re dealing with an emergency expense?

The last thing you want is to use your credit card or an expensive loan to cover these bills. This is how people fall into cycles of debt; certainly not good if you’re trying to save more money.

If money is a bit tight, you can use cash advance apps to borrow money against an upcoming paycheck. And the top apps let you do so without paying expensive membership fees or even paying any interest.

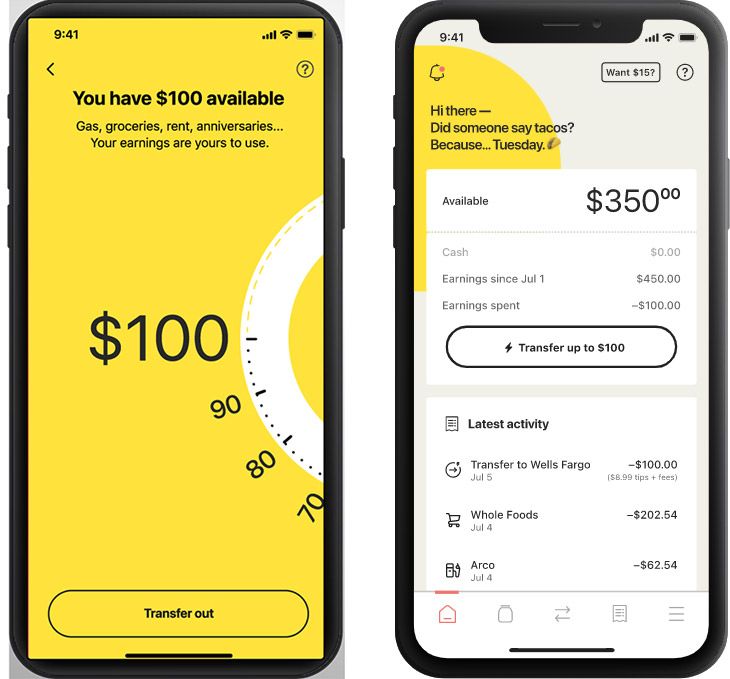

EarnIn and Dave are two of our favorites. They let you borrow up to $750 and $500 in a given pay period respectively. And they’re awesome tools to access the money you worked hard for much faster.

At Homeowner, we like apps like EarnIn the most since it lets you borrow $100 per day and up to $750 in a given pay period. You don’t pay interest, and there’s no credit check either.

You have to have regular payments coming in from a job or income stream for EarnIn to grant you a cash advance. But as long as you pay EarnIn back, you won’t get hit with steep interest fees.

5. Lower Your Water Heater Temperature

Most water heaters come with a factory temperature setting that’s higher than you actually need. So, take a minute and lower your water heater temperature by a few degrees to reduce your energy bills.

6. Earn Free Gift Cards When You Buy Groceries

If you want to save money on groceries each month, this home saving hack is for you.

A company called InboxDollars is paying people for taking photos of their shopping receipts. Seriously; you can get paid for buying everyday products and groceries and then snapping a photo of your receipt.

InboxDollars also pays you to complete surveys, watch videos, play games, and shop online. And it’s one of the most popular rewards programs out there.

New members also get a $5 sign up bonus, which we love. And you can cash out to PayPal or with gift cards to companies like Amazon and Walmart too!

10+ Proven Ways To Make Money From Home.

7. Protect Major Appliances With A Home Warranty Plan

A lot of homeowners don’t know this, but you can use a home warranty plan to protect your major and minor appliances and home systems from expensive repairs.

Emergencies happen all the time. Your water heater could go bust, or a pipe could burst. But the last thing you want is to be on the hook for thousands of dollars in repair.

Companies like Choice Home Warranty can help provide peace of mind and prevent you from getting gouged by repairs. It lets you cover both major and minor appliances and home systems. And with 2+ million customers across the country, it’s one of the leading providers.

Choice Home Warranty is also giving away a free month right now to new customers. So, consider protecting your home and your bank account.

Get a free month from Choice Home Warranty!

8. Upgrade Your Old Windows

Did you know that old, drafty windows are one of the main culprits for not saving energy around the home?

That’s right: poorly insulated windows ramp up your energy bill year-round. But these days, you can find energy-efficient windows for a fraction of what they used to cost. And this is also an excellent tip to help increase the resale value of your home.

Search for energy-efficient window deals in your area!

9. Stop Wasting Money On Car Insurance

Has it been a while since you’ve shopped around for car insurance?

If the answer is ‘yes’ then you’re probably wasting money. But you don’t have to keep overpaying for auto insurance if you can spare a couple of minutes.

That’s because this free toolhelps you find the cheapest auto insurance plans you qualify for. It compares the latest deals from nationwide and local providers, and all you need to do is enter your Zip code and a bit of information to get started.

Some homeowners are saving $500+ per year on their car insurance policies. So, take a couple of minutes and stop getting gouged by your insurance company.

Also: remember to keep up with car maintenance too. Regularly changing your oil, keeping up with tire pressure, and general maintenance goes a long way in keeping your vehicle in good shape!

Save $500+ per year on auto insurance!

10. Try Cord-Cutting To Save Money

We’re huge fans of cable TV and having an awesome home entertainment plan. But if you’re trying to save more money at home, cutting the cord for your cable bill is a smart move.

And this doesn’t mean you have to give up on watching your favorite shows and movies. In fact, some of the best TV streaming services out there are incredibly affordable or even have free plans if you’re willing to watch some ads.

11. Wash Clothes Using Cold Water

Like your water heater, you can save money at home by washing clothing with cold water more often. According to GE Appliances, cold water is fine for most clothing items, and you can go as low as 60 degrees with many detergents.

Pro Tip: Lower your monthly energy costs and explore the benefits of solar energy with Energy Bill Saver! Just enter your Zip code to check your eligibility for solar tax credits and bonus savings.

12. Stop Overpaying For Homeowner’s Insurance

Homeowners insurance is a must have. But far too many homeowners spend too much on their premium.

If it’s been a while since you’ve shopped around, we suggest using a website called Lemonade to find cheaper insurance policies.

Lemonade lets you use its super simple online tool to find the cheapest homeowners insurance possible. All it takes is two minutes, and you can ensure you’re not wasting money each month on expensive premiums.

Pro Tip: You can also use Lemonade to find incredibly affordable renters insurance, pet insurance, term life insurance, and other coverage options!

13. Repair Your Roof

Have you been putting off that roof repair for the last couple of seasons?

We hear you. Repairing your roof is an upfront expense. But a neglected roof can lead to all sorts of problems, including mold, water damage, and even unwanted pests like raccoons or termites.

And repairing your roof might not be as pricey as you think. Working with the right roof repair company can be both affordable and speedy.

You can also search for a free roof repair quote and compare prices in minutes. And if you’re planning on selling your home in the next few years, it’s a great time to invest in some home repairs.

Get a free roof repair quote in one minute!

14. Program Your Thermostat

Programming your thermostat is another easy home saving hack. Make sure your home isn’t pumping out AC or heat when you’re not home.

According to Energy.gov, this simple trick can help you save as much as 10% your energy bill every single year.

Find the best programmable thermostat deals!

15. Insulate Your Home

Insulating your home is another effective money-saver homeowners need to know. Both your attic and crawl spaces can be great starting points. The same goes for your basement. The more energy-efficient you can make your home, the more your wallet will thank you.

16. Stop Using Disposable Products

Single-use plastics and disposable products are a massive waste of money. This includes common culprits like plastic straws, plastic water bottles, paper plates, and plastic cutlery.

Cut these items from your shopping list ASAP to easily save more money each year.

17. Get Paid To Use Less Energy

Reducing your energy usage is one of the best ways to save money around the house. But did you know you can also earn money by dialing back your energy bill?

That’s right: certain energy companies out there actually pay homeowners for not using energy. That’s because it’s cheaper for them to pay their customers instead of straining the power grid.

You can use the free Energy Linker toolto see if an energy company in your area offers this incentive program.

18. Keep Your Fridge & Freezer Full

This money saver is simple, but it works. Keep your fridge and freezer as full as possible (without wasting food.) Having less empty space helps keep temperatures down and more money in your wallet.

19. Change Furnace Filters Regularly

Regularly changing your furnace filter every three months or so can help your home become more energy efficient. According to Del-Air and The Environmental Protection Agency, this can save you as much as 15% per month on your energy bill.

20. Cut Your Phone Bill In Half

Like your car insurance policy, phone plans are another common area most homeowners spend too much money on.

But if you’re tired of giving big telecom companies too much money, we have great news. A company called Mint Mobileis offering competitive wireless plans for as little as $15 per month.

That’s right: you can get unlimited wireless plans for only $15 a month. This includes high-speed data, unlimited talk and text, and nationwide coverage too.

Mint Mobile helps people save money by bundling plans. So you can shop for different bundles that have enough data to suit your needs.

Start saving money and switch to Mint Mobile!

21. Use Energy-Efficient Lightbulbs

According to EnergyStar.gov, energy-efficient lightbulbs use up to 90% less energy than regular bulbs. And the top lightbulbs can save $55 in energy usage in their lifetime and last up to 15 times longer.

22. Use Energy-Efficient Appliances

If it’s been years since you’ve upgraded some of your major appliances, it could be time to make a change.

Appliances have been getting more energy-efficient as time goes on. And for major appliances like your fridge, dishwasher, and laundry machine, differences in energy usage can really make a difference for your energy bill.

Check out our guide on the best smart home devices as well for some eco-friendly inspo!

23. Use Energy-Intense Appliances During Non-Peak Hours

In many cities, off-peak energy times run from 7pm to 7am throughout the week and all-day during the weekends. So, get in the habit of saving energy-intensive chores like laundry or using the dishwasher for off-peak times when energy is cheaper.

24. Rent Out A Spare Room

If you have a spare room or finished basement, you can make money with your home by renting out a spare room.

Platforms like Airbnb and VRBO make it easy to find short-term renters. And if you live in a touristy area, you can likely find a steady stream of renters throughout the month.

Even one or two nights a week can yield $1,000+ in your pocket per month. In some cases, you might be able to cover your entire mortgage cost with short-term tenants.

25. Use Ceiling Fans & Ditch AC

Have ceiling fans in your house? Why not use them?

Try saving more money by keeping your AC off and using your ceiling fans instead. You can also open up the windows in your house to create more air flow without spending a penny.

26. Share What’s In Your Fridge To Earn Gift Cards

Want free gift cards to companies like Amazon, Target, and Starbucks? Then the NCP Mobile app belongs on your smartphone.

The app pays you share information about the products you buy every week. All you have to do is download the free app and then take photos of the products in your fridge and shopping cart.

NCP asks you some simple questions and you earn points for each survey you complete. You then cash out for free gift cards that you can use to treat yourself or cover various expenses.

27. Repurpose Old Furniture

Think twice before you ditch your furniture for an expensive upgrade. Oftentimes, repurposing the furniture you already have with a fresh coat of paint or stain is enough to give your home a facelift without spending a fortune.

28. Keep Up With Home Maintenance

One of the best ways to reduce your home expenses is to keep up with regular maintenance.

This is true for your appliances and also general home maintenance like your windows and doors, gutters, roof, sump pump, and other home systems.

29. Make Your Own DIY Cleaners

Want a clean home saving hack? Stop buying cleaning products and make your own instead.

Here’s an example: a lot of surface and mirror cleaners can cost $5 to $6 and are packed with chemicals. But you can make a cheaper DIY cleaner by just mixing dish soap and vinegar.

30. Install A Clothes Line

Installing a clothes line is a simple way to save more money at home by cutting down your dryer time. And if you live somewhere with warm weather year-around, this tip is even more effective.

31. Start A Vegetable & Herb Garden

This home saving hack is for the green thumbs. You can start a small vegetable and herb garden at home to reduce your grocery spending. Even a small backyard space is enough room to begin growing some of your own food.

32. Make Coffee At Home (& Other Meals!)

Getting coffee everyday or eating out can be a nice treat. But it’s also an expensive habit to have everyday.

Making food at home can easily slash your food budget by 50% or more. And plenty of cheap meal ideas are still full of flavor and don’t take long to prepare. So, invest in some meal prep containers, get a few recipes, and start a new healthy habit that also saves money!

33. Deal With High-Interest Debt

Figuring out how to save more money is an excellent goal. But if you’re spending all your savings tackling high-interest debt payments, it can feel impossible to get ahead.

This is where working with a qualified debt relief company can be a lifesaver.

These companies help people consolidate high-interest debts like credit card bills and personal loans into a single loan. This means you only have one monthly payment to worry about. And the interest rate is lower, so you can save thousands of dollars in the long run.

ClearOne Advantage and National Debt Relief are two leading companies you can work with if you have at least $15,000 in high-interest debt.

Both companies are helping people become completely debt-free in as little as 24 months. And you can get started with a free consultation just by filling out a bit of information.

Final Thoughts

There you have it: over 30 effective ways to save money at home that you can implement today to get your budget back on track.

Of course, you can take this money-saving mission even further. Trying a no-spend challenge for a week or two is a perfect example. Or you can use a budgeting app like Rocket Money or YNAB to stop overspending each month.

The main point is to take action so you start moving in the right direction.

Happy saving!

Want more awesome guides? Checkout: